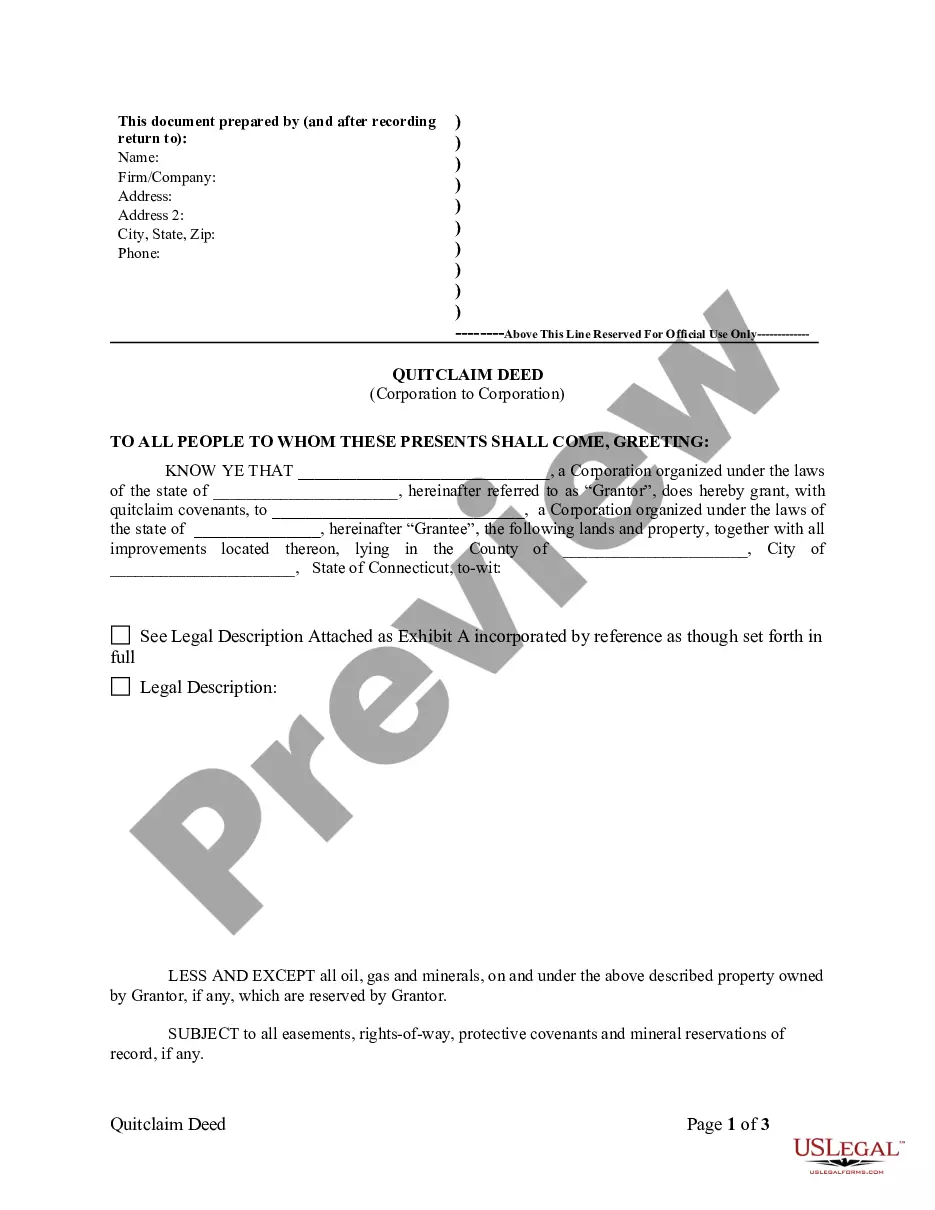

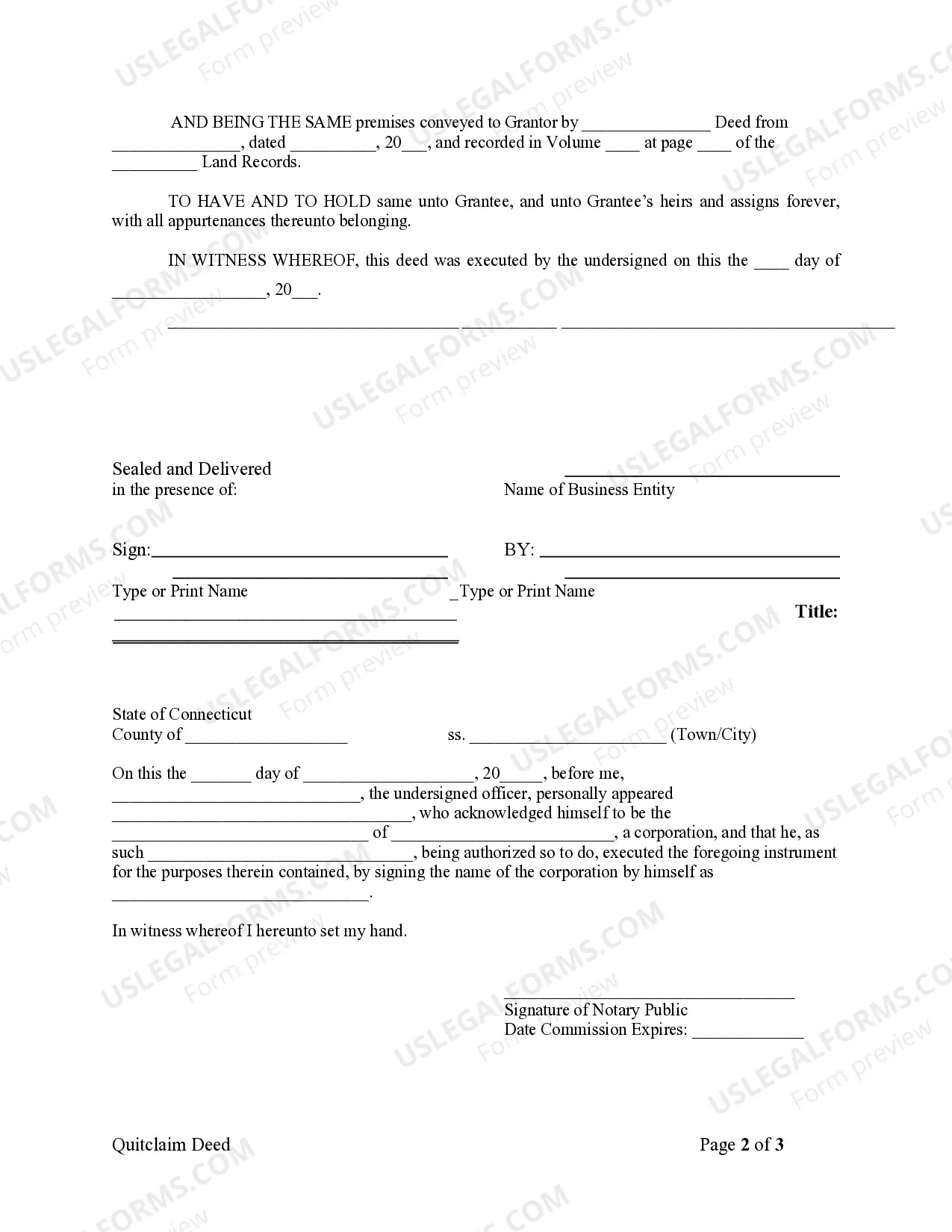

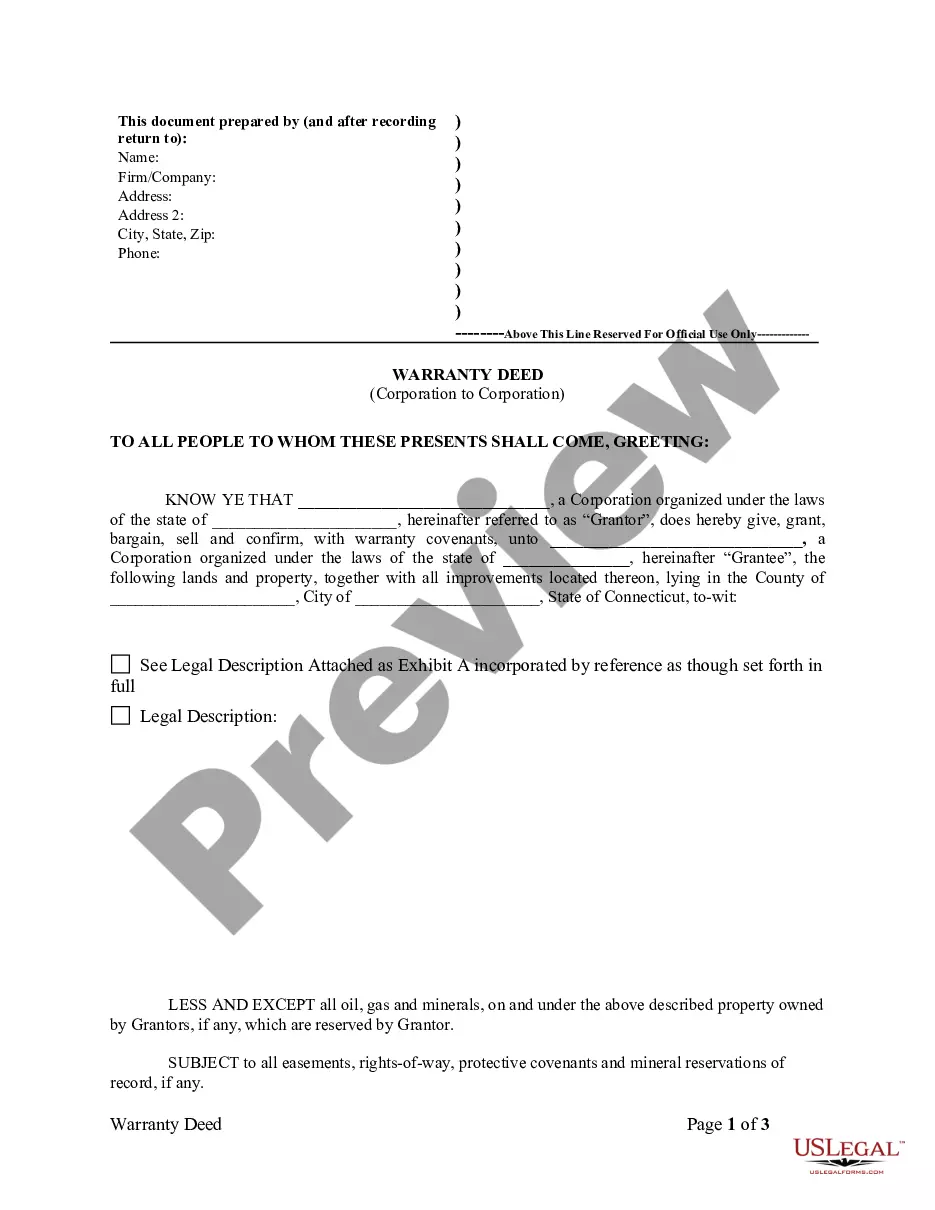

This Quitclaim Deed from Corporation to Corporation form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Connecticut Quitclaim Deed from Corporation to Corporation

Description

How to fill out Connecticut Quitclaim Deed From Corporation To Corporation?

The greater number of documents you should make - the more stressed you are. You can get thousands of Connecticut Quitclaim Deed from Corporation to Corporation templates on the web, nevertheless, you don't know which ones to have confidence in. Remove the headache to make detecting exemplars more straightforward with US Legal Forms. Get professionally drafted forms that are composed to go with the state specifications.

If you currently have a US Legal Forms subscription, log in to your profile, and you'll see the Download key on the Connecticut Quitclaim Deed from Corporation to Corporation’s web page.

If you’ve never tried our platform earlier, finish the registration procedure using these directions:

- Make sure the Connecticut Quitclaim Deed from Corporation to Corporation is valid in your state.

- Double-check your choice by reading through the description or by using the Preview function if they’re available for the chosen record.

- Click Buy Now to start the sign up process and select a rates program that fits your requirements.

- Insert the asked for information to make your profile and pay for your order with the PayPal or bank card.

- Choose a hassle-free file structure and take your copy.

Access every file you get in the My Forms menu. Simply go there to fill in new version of your Connecticut Quitclaim Deed from Corporation to Corporation. Even when having properly drafted web templates, it’s nevertheless essential that you consider asking the local attorney to double-check completed sample to make certain that your record is correctly filled in. Do much more for less with US Legal Forms!

Form popularity

FAQ

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.

Quitclaim Does Not Release Debts Signing a quitclaim deed and giving up all rights to the property doesn't release you from any financial obligations you may have. It only removes you from the title, not from the mortgage, and you are still responsible for making payments.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

A quit claim deed in Connecticut is a docuent that transfers property from one person to another.In a quit claim deed transaction, the only thing that a buyer is assured is that the seller is giving up his or her interest on the property and can no longer return at a later date to claim interest on the house or land.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.