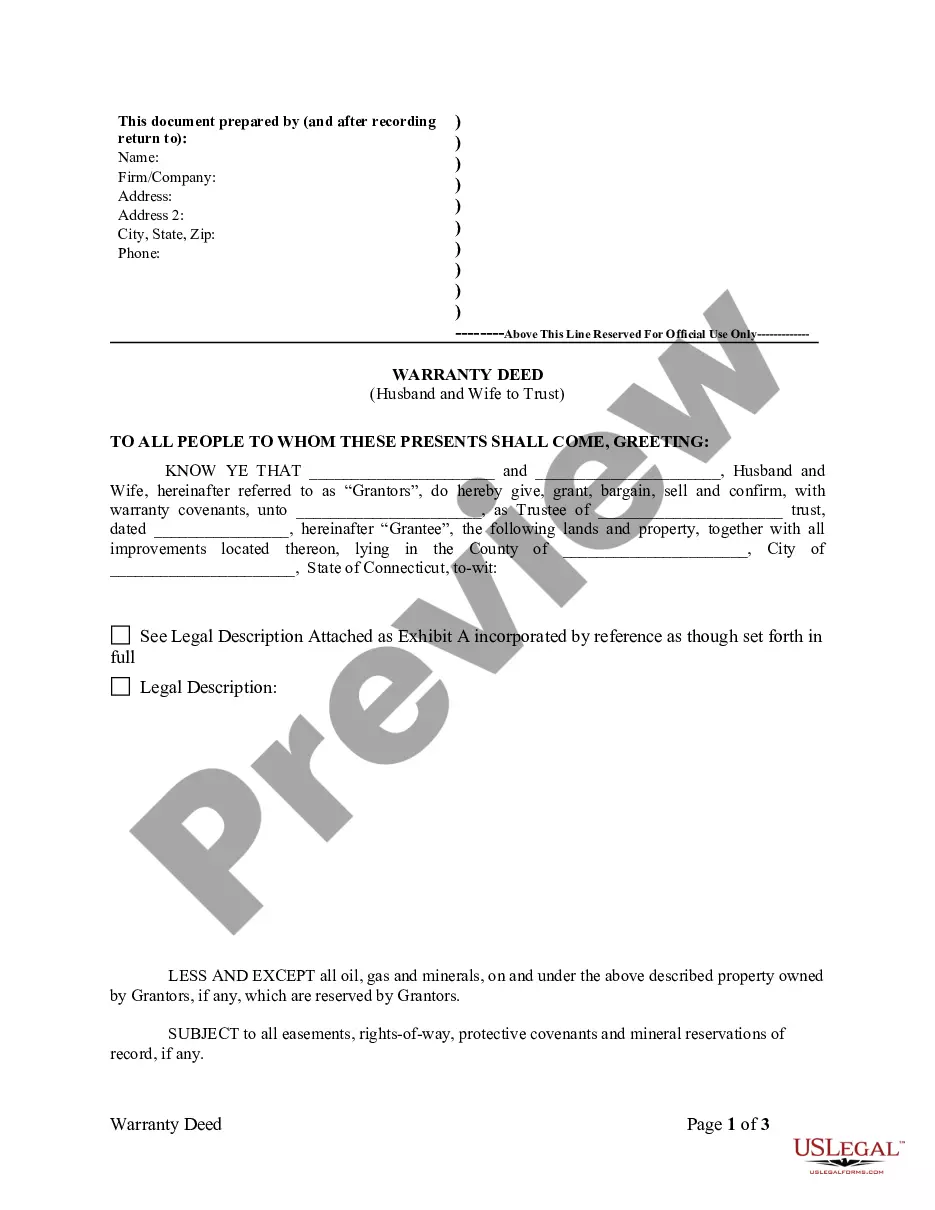

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Connecticut Warranty Deed from Husband and Wife to a Trust

Description

How to fill out Connecticut Warranty Deed From Husband And Wife To A Trust?

The greater quantity of documents you must generate - the more anxious you become.

You can find an extensive array of Connecticut Warranty Deed from Husband and Wife to a Trust templates online, however, you are uncertain which ones to rely on.

Eliminate the complications to make obtaining samples easier with US Legal Forms.

Input the required details to create your profile and complete the payment using PayPal or a credit card.

- If you possess a US Legal Forms membership, Log In to your account, and you will see the Download option on the Connecticut Warranty Deed from Husband and Wife to a Trust’s webpage.

- If you have never utilized our platform before, follow the sign-up procedure using these steps.

- Verify that the Connecticut Warranty Deed from Husband and Wife to a Trust is applicable in your jurisdiction.

- Double-check your choice by reading the description or by utilizing the Preview functionality if available for the chosen document.

- Click Buy Now to commence the registration process and choose a pricing plan that suits your preferences.

Form popularity

FAQ

Open a bank account in the name of the trust. Close out any bank accounts the grantor established for the trust and put the proceeds into the new trust bank account. Cash in any life insurance policies that name the trust as beneficiary and put the proceeds into the trust bank account.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

A trustee deed offers no such warranties about the title.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.