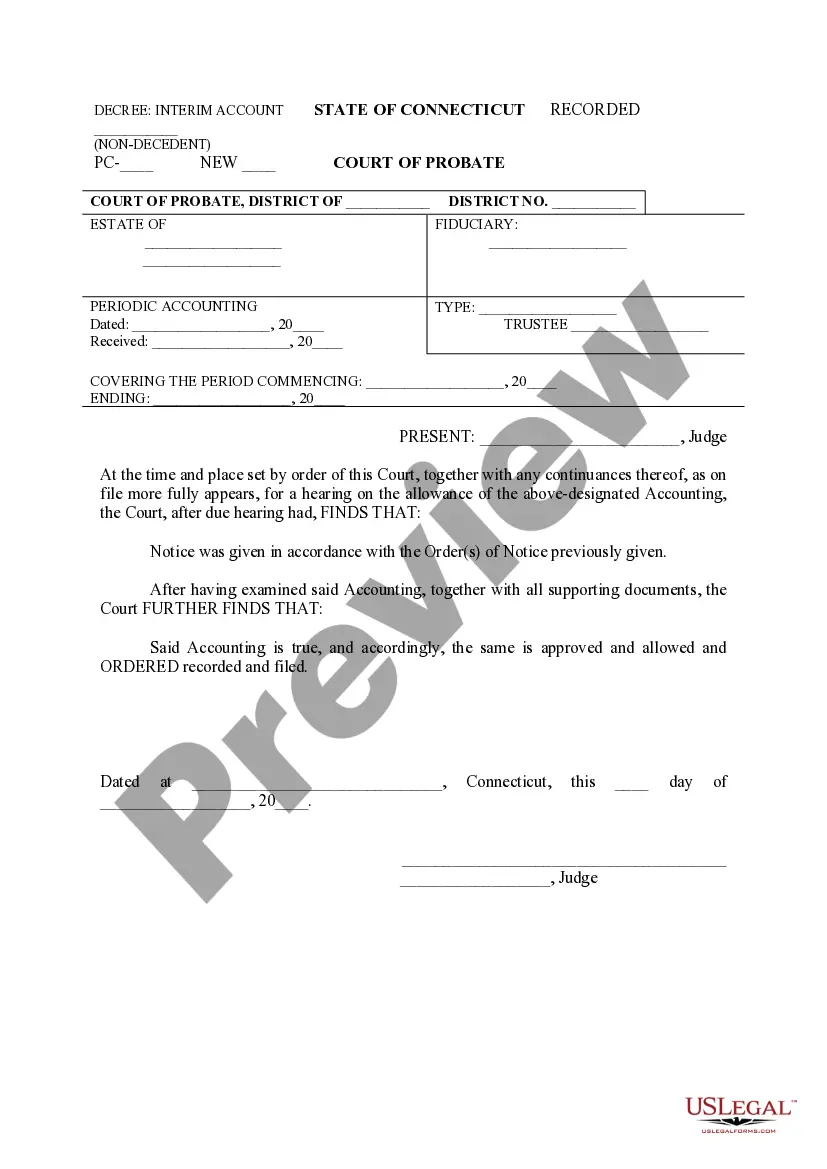

Connecticut Interim Account (Non-Decedent)

Description

How to fill out Connecticut Interim Account (Non-Decedent)?

Utilize US Legal Forms to obtain a printable Connecticut Interim Account (Non-Decedent). Our court-acceptable forms are crafted and frequently updated by experienced attorneys.

Ours is the most extensive Forms catalog available online and offers reasonably priced and precise samples for clients, lawyers, and small to medium-sized businesses.

The templates are organized into state-specific categories, and several can be previewed prior to download.

Establish your account and make the payment via PayPal or credit card. Download the form onto your device and feel free to reuse it multiple times. Utilize the Search engine if you need to locate another document template. US Legal Forms provides a vast array of legal and tax samples and packages for both business and personal requirements, including Connecticut Interim Account (Non-Decedent). Over three million users have successfully used our platform. Choose your subscription plan and obtain high-quality forms in just a few clicks.

- To download templates, clients must have a subscription and sign in to their account.

- Select Download next to any form you require and locate it in My documents.

- For users without a subscription, follow the guidelines below to swiftly find and download Connecticut Interim Account (Non-Decedent).

- Ensure that you obtain the correct template for the state you need it in.

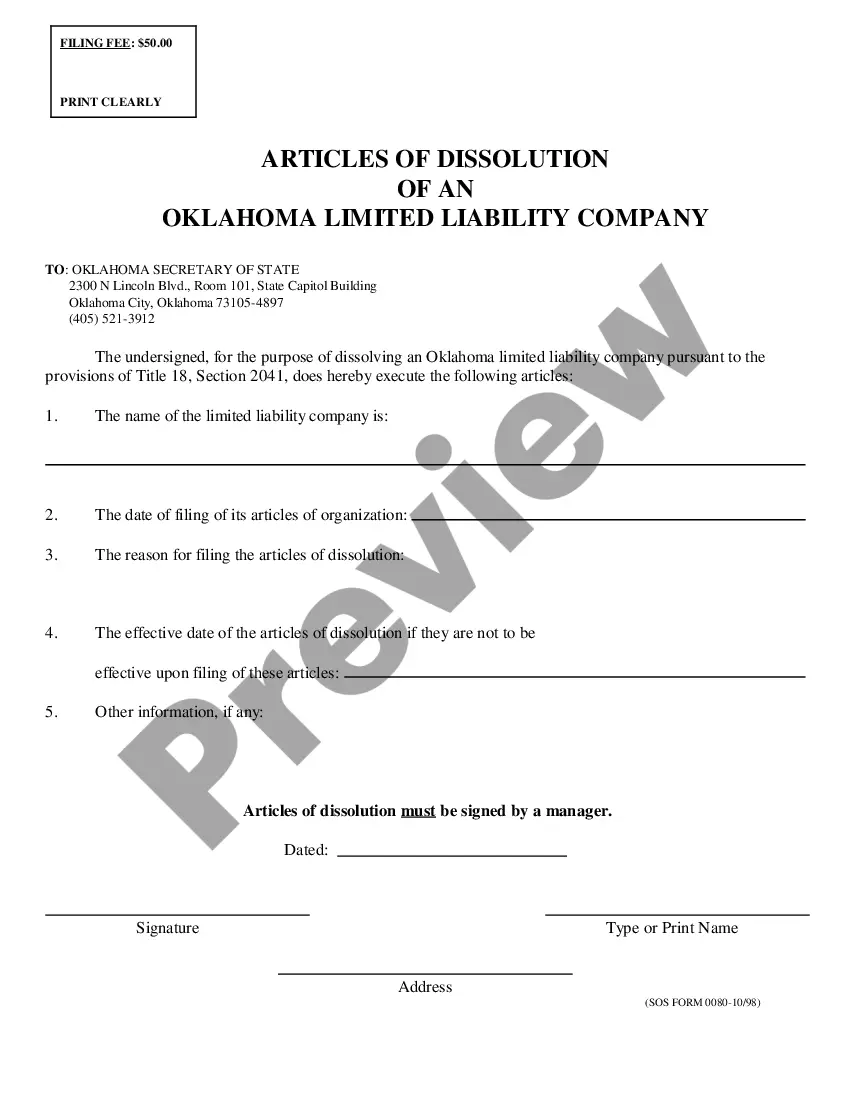

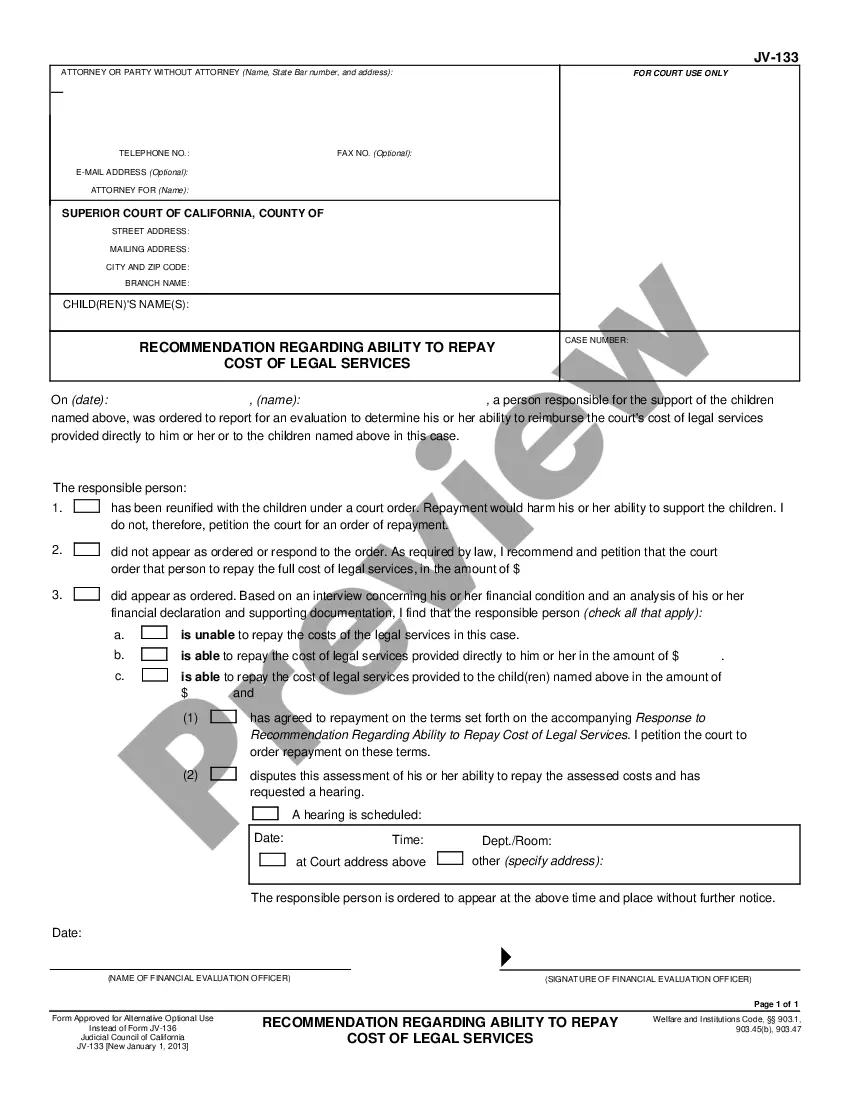

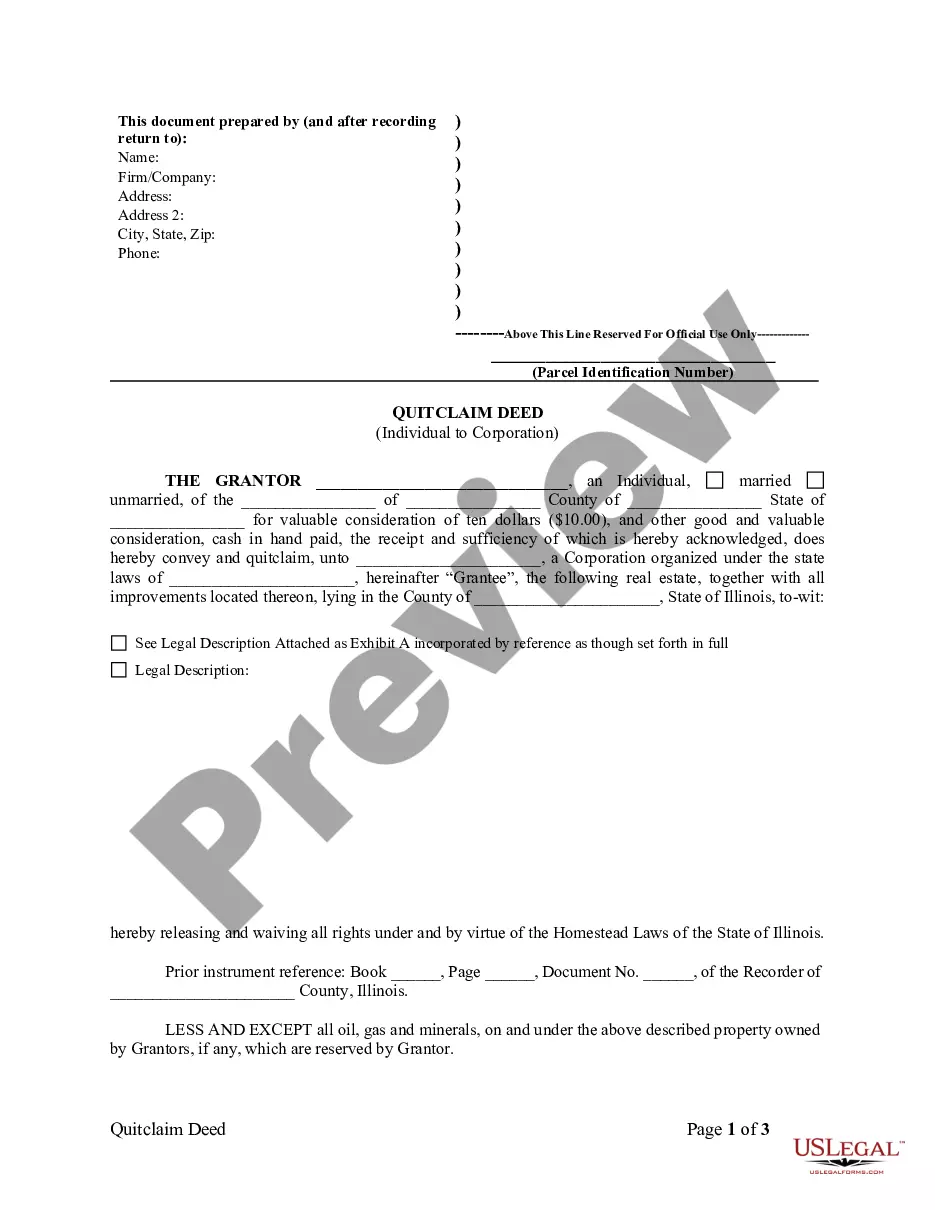

- Examine the document by browsing the description and using the Preview feature.

- Click Buy Now if it’s the template you are looking for.

Form popularity

FAQ

There is no requirement that a will or property go through probate, but if the decedent owned property that is not arranged specifically to avoid probate, there is no way for the beneficiaries to obtain legal ownership without it.

Retirement accountsIRAs or 401(k)s, for examplefor which a beneficiary was named. Life insurance proceeds (unless the estate is named as beneficiary, which is rare) Property held in a living trust. Funds in a payable-on-death (POD) bank account.

If Probate is needed but you don't apply for it, the beneficiaries won't be able to receive their inheritance. Instead the deceased person's assets will be frozen and held in a state of limbo. No one will have the legal authority to access, sell or transfer them.

If an estate is not properly probated and closed in a timely manner, there may be a number of consequences that can jeopardize the estate: The statute of limitations for creditors' claims is extended. Assets may lose value or be lost altogether. The state may claim the assets.

Typically, many of the assets in an estate don't need to go through probate. If the deceased person was married and owned most everything jointly, or did some planning to avoid probate, a probate court proceeding may not be necessary.Life insurance proceeds (unless the estate is named as beneficiary, which is rare)

When someone dies, you (as an executor or administrator of the estate) are not required by law to file probate documents. However, if you do not file probate documents, you will not be able to legally transfer title of any assets that exist in the decedent's name.

Updated December 16, 2020. Non-probate assets are property that doesn't need to go through the probate process after you die and will instead pass directly to your heirs. Owning non-probate property is one of the easiest ways to avoid the costly and time-consuming probate process.

Most of the deceased person's property has to go through probate.Additionally if it's a financial asset that names a beneficiary, such as with the bank account or a brokerage account, those assets do not go through probate either.

Non-probate assets include assets held as joint tenants with rights of survivorship, assets with a beneficiary designation, and assets held in the name of a trust or with a trust named as the beneficiary.Non-probate assets can be claimed by the beneficiaries without involvement of the probate court.