Connecticut Fiduciary's Probate Certificate

Description Pc 450

How to fill out Ct Fiduciary Certificate?

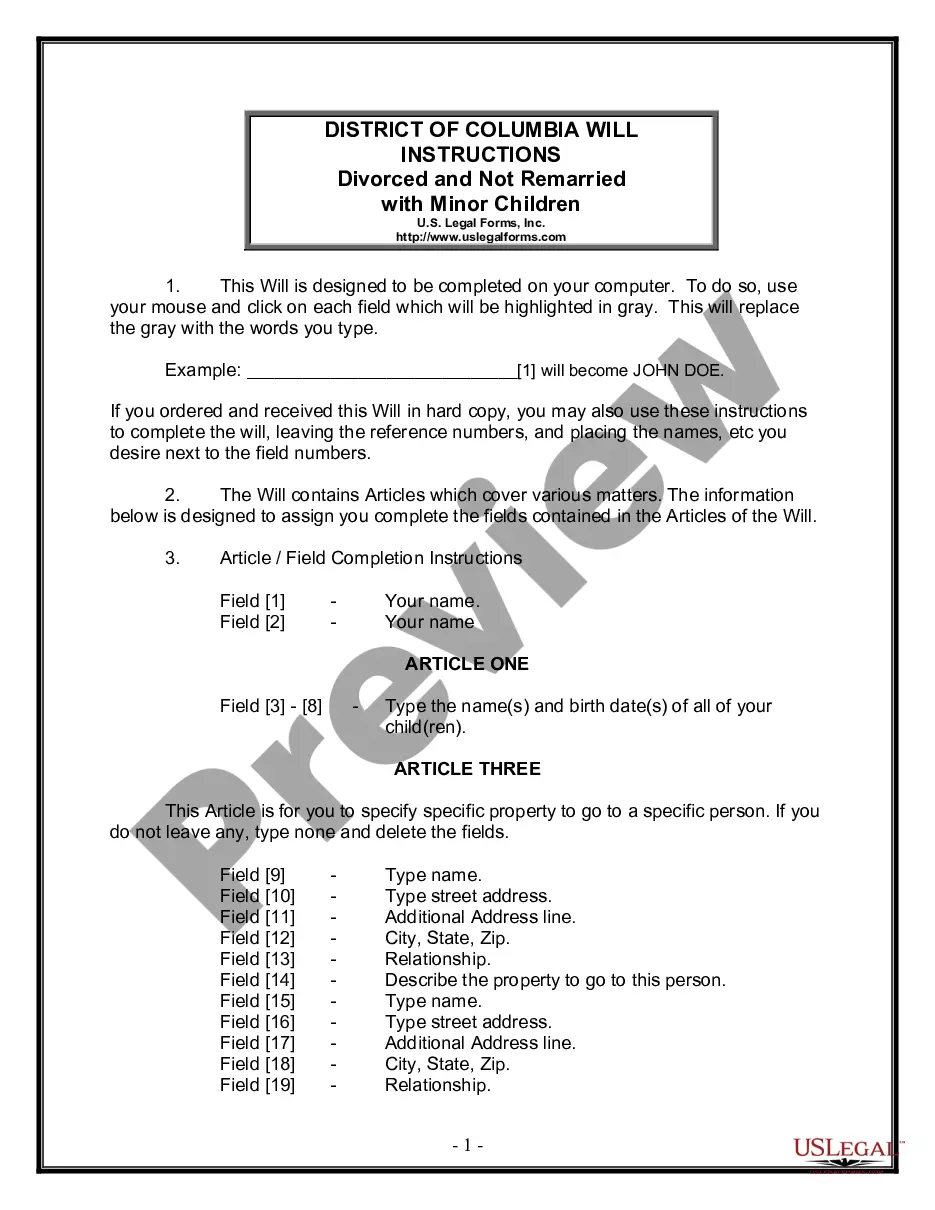

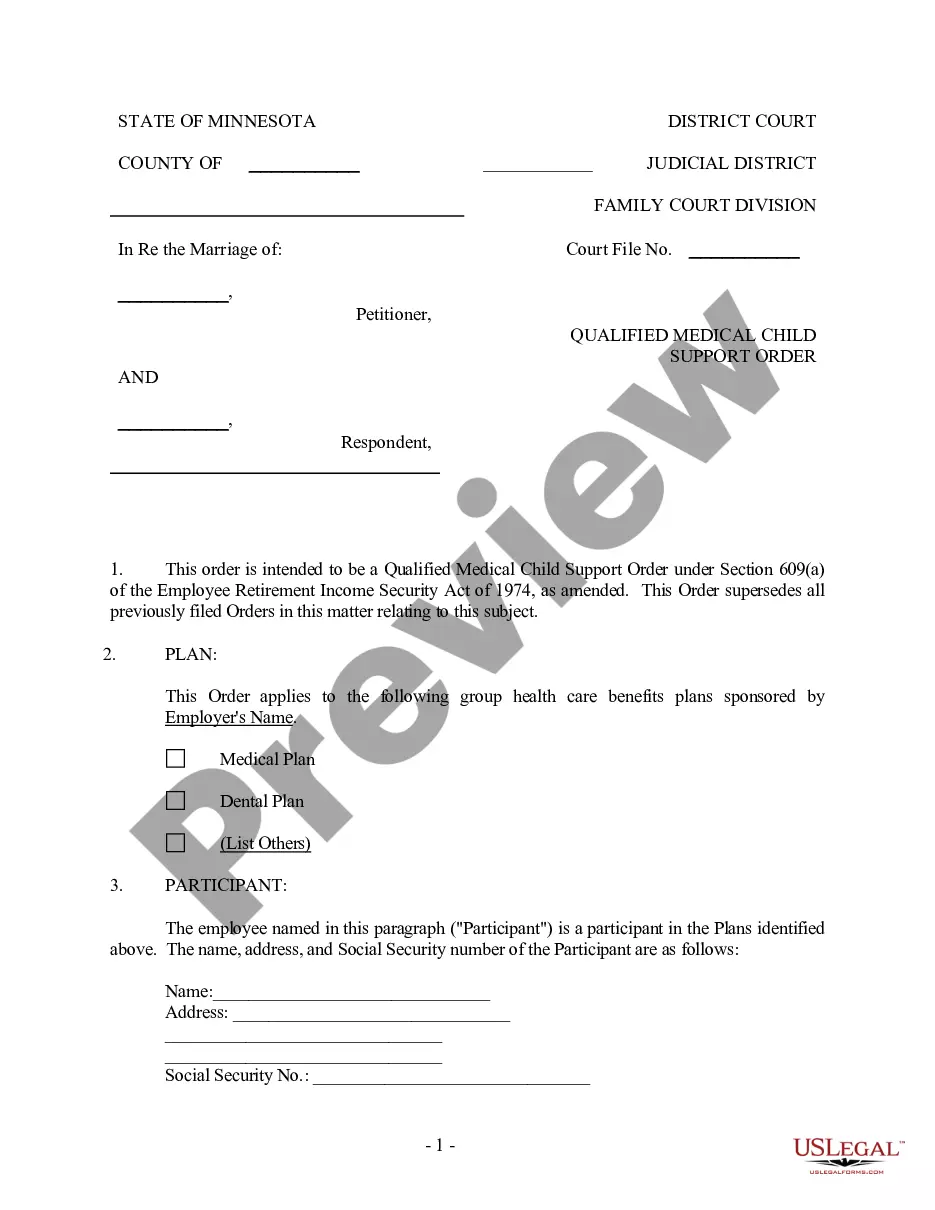

Use US Legal Forms to obtain a printable Connecticut Fiduciary's Probate Certificate. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most comprehensive Forms library on the internet and offers cost-effective and accurate templates for customers and lawyers, and SMBs. The templates are grouped into state-based categories and a few of them might be previewed prior to being downloaded.

To download templates, users must have a subscription and to log in to their account. Press Download next to any form you need and find it in My Forms.

For those who do not have a subscription, follow the following guidelines to easily find and download Connecticut Fiduciary's Probate Certificate:

- Check out to ensure that you get the right template in relation to the state it’s needed in.

- Review the form by looking through the description and using the Preview feature.

- Click Buy Now if it’s the template you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it many times.

- Use the Search engine if you want to find another document template.

US Legal Forms offers a large number of legal and tax samples and packages for business and personal needs, including Connecticut Fiduciary's Probate Certificate. More than three million users already have utilized our platform successfully. Choose your subscription plan and have high-quality forms in just a few clicks.

Pc 450 Fiduciary's Probate Certificate Form popularity

What Is A Pc 450 Probate Form In Ct Other Form Names

What Is A Fiduciary Certificate FAQ

The new probate fees are $5,615 plus 0.5 percent of the decedent's gross estate exceeding $2 million. (Under Connecticut and federal law, the decedent's gross estate is calculated before taking marital, charitable or other deductions into account.)

In Connecticut, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Connecticut has a simplified and expedited probate process for settling small decedent's estates. The entire process can be completed within 30 days, instead of six months or longer as is normally required for the regular probate process.

The new probate fees are $5,615 plus 0.5 percent of the decedent's gross estate exceeding $2 million. (Under Connecticut and federal law, the decedent's gross estate is calculated before taking marital, charitable or other deductions into account.)

The new probate fees are $5,615 plus 0.5 percent of the decedent's gross estate exceeding $2 million. (Under Connecticut and federal law, the decedent's gross estate is calculated before taking marital, charitable or other deductions into account.)

Probate if there is a Will They can also choose who should benefit from their Estate after their death these are their Beneficiaries. Therefore if there is a Will, it's the Executors who must apply to the Probate Registry for a Grant of Probate. On average this takes between three and six months to be issued.

If no will exists, the property is divided according to Connecticut law. The Probate Courts ensure that any debt owed by the deceased person, funeral expenses and taxes are paid before the remaining assets are distributed. Often a family member or friend is responsible for settling the affairs of the estate.

As part of estate administration duties, Connecticut requires the personal representative to file a certificate of devise, descent, or distribution describing each devise or distribution of real property, to be recorded within a month, in the land records of each town where the property is situated (Conn. Gen. Stat.

In Connecticut, the probate courts have sole jurisdiction over the appointment of conservators. A person filing an application for conservatorship must apply to the probate court in the probate district where the respondent (the person alleged to be incapable) resides at the time the application is filed.