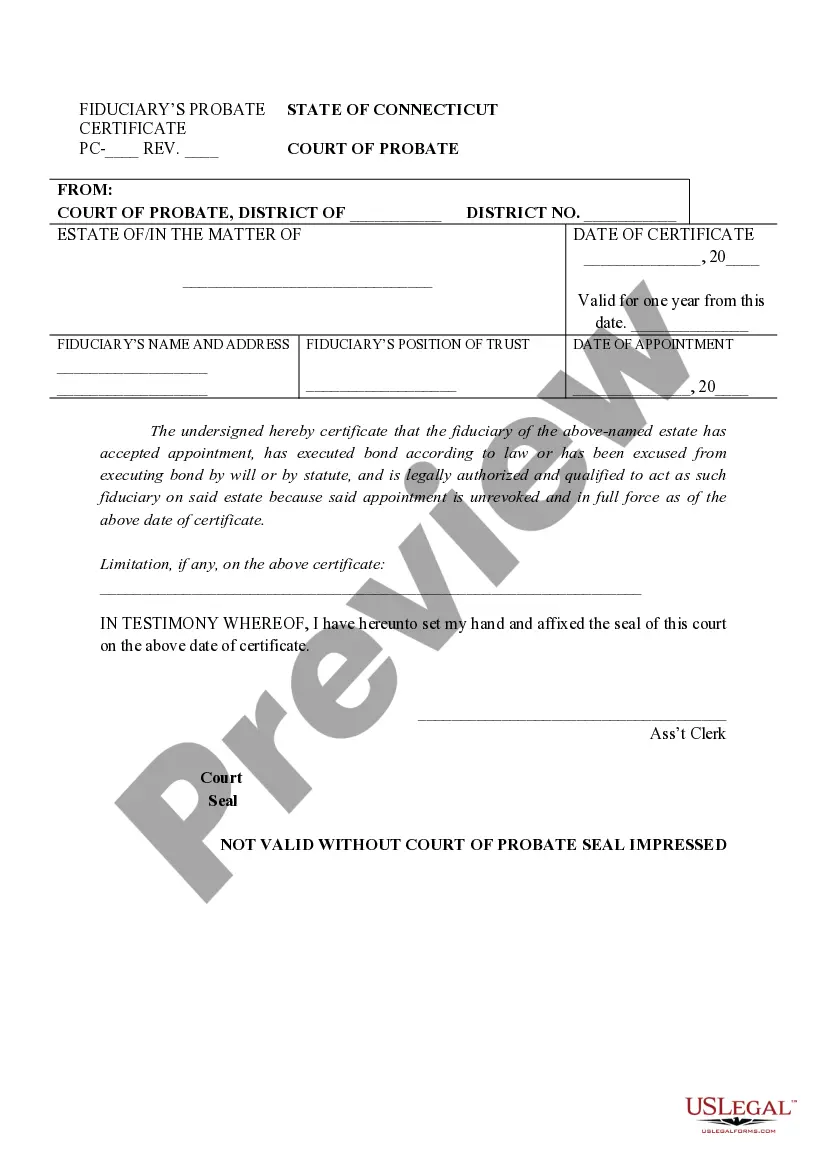

Connecticut Fiduciary's Probate Certificate

Description Pc 450

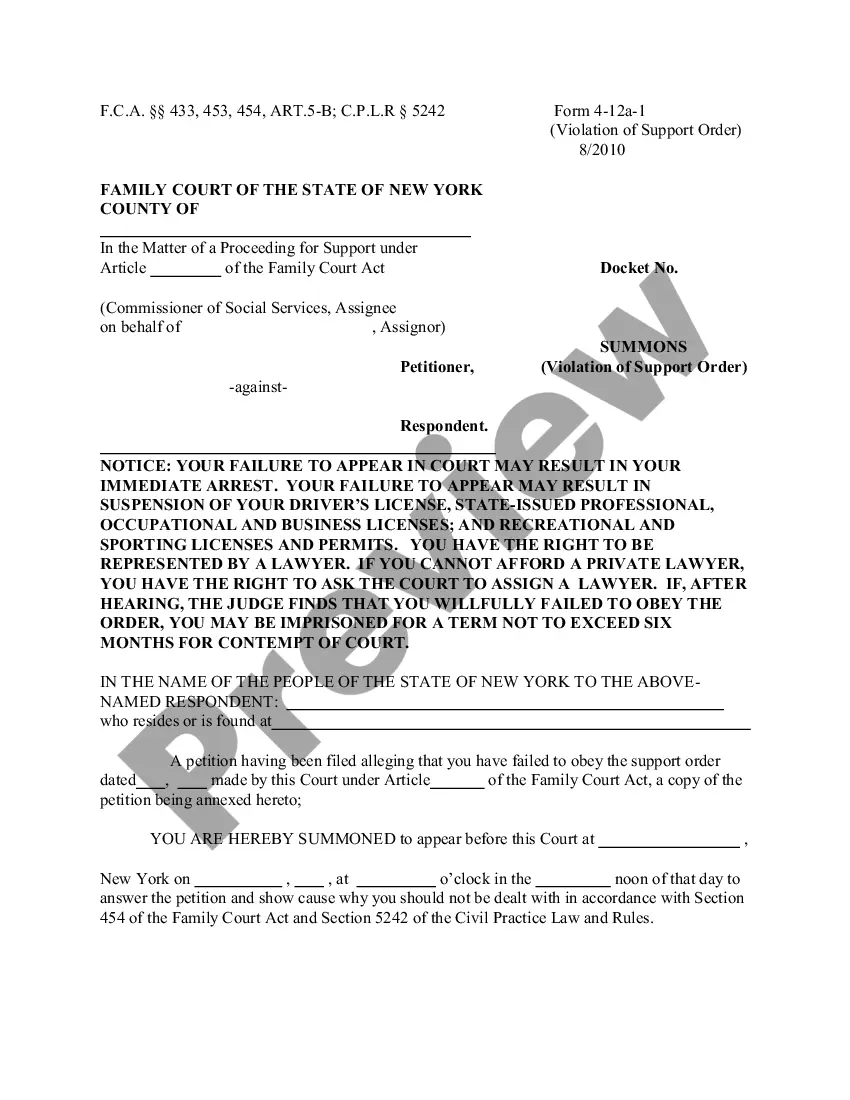

How to fill out Ct Fiduciary Certificate?

Utilize US Legal Forms to secure a printable Connecticut Fiduciary's Probate Certificate. Our court-accepted forms are crafted and frequently refreshed by qualified attorneys.

Ours is the most extensive library of forms available online, providing economical and precise templates for clients, attorneys, and small to medium-sized businesses.

The templates are organized into state-specific categories, and some can be previewed before downloading.

Create your account and complete payment via PayPal or credit card. Download the form onto your device and feel free to use it multiple times. Use the search feature if you wish to locate another document template. US Legal Forms provides a vast selection of legal and tax documents and packages tailored for both business and personal requirements, including the Connecticut Fiduciary's Probate Certificate. Over three million users have successfully made use of our platform. Select your subscription plan and acquire high-quality forms in just a few clicks.

- To obtain templates, users are required to have a subscription and to Log In to their profile.

- Click Download next to any form you require and find it in My documents.

- For those without a subscription, adhere to these steps to conveniently discover and download the Connecticut Fiduciary's Probate Certificate.

- Ensure that you select the correct template based on the relevant state.

- Examine the form by reviewing the description and utilizing the Preview option.

- Press Buy Now if it’s the form you require.

Pc 450 Fiduciary's Probate Certificate Form popularity

What Is A Pc 450 Probate Form In Ct Other Form Names

What Is A Fiduciary Certificate FAQ

The new probate fees are $5,615 plus 0.5 percent of the decedent's gross estate exceeding $2 million. (Under Connecticut and federal law, the decedent's gross estate is calculated before taking marital, charitable or other deductions into account.)

In Connecticut, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Connecticut has a simplified and expedited probate process for settling small decedent's estates. The entire process can be completed within 30 days, instead of six months or longer as is normally required for the regular probate process.

The new probate fees are $5,615 plus 0.5 percent of the decedent's gross estate exceeding $2 million. (Under Connecticut and federal law, the decedent's gross estate is calculated before taking marital, charitable or other deductions into account.)

The new probate fees are $5,615 plus 0.5 percent of the decedent's gross estate exceeding $2 million. (Under Connecticut and federal law, the decedent's gross estate is calculated before taking marital, charitable or other deductions into account.)

Probate if there is a Will They can also choose who should benefit from their Estate after their death these are their Beneficiaries. Therefore if there is a Will, it's the Executors who must apply to the Probate Registry for a Grant of Probate. On average this takes between three and six months to be issued.

If no will exists, the property is divided according to Connecticut law. The Probate Courts ensure that any debt owed by the deceased person, funeral expenses and taxes are paid before the remaining assets are distributed. Often a family member or friend is responsible for settling the affairs of the estate.

As part of estate administration duties, Connecticut requires the personal representative to file a certificate of devise, descent, or distribution describing each devise or distribution of real property, to be recorded within a month, in the land records of each town where the property is situated (Conn. Gen. Stat.

In Connecticut, the probate courts have sole jurisdiction over the appointment of conservators. A person filing an application for conservatorship must apply to the probate court in the probate district where the respondent (the person alleged to be incapable) resides at the time the application is filed.