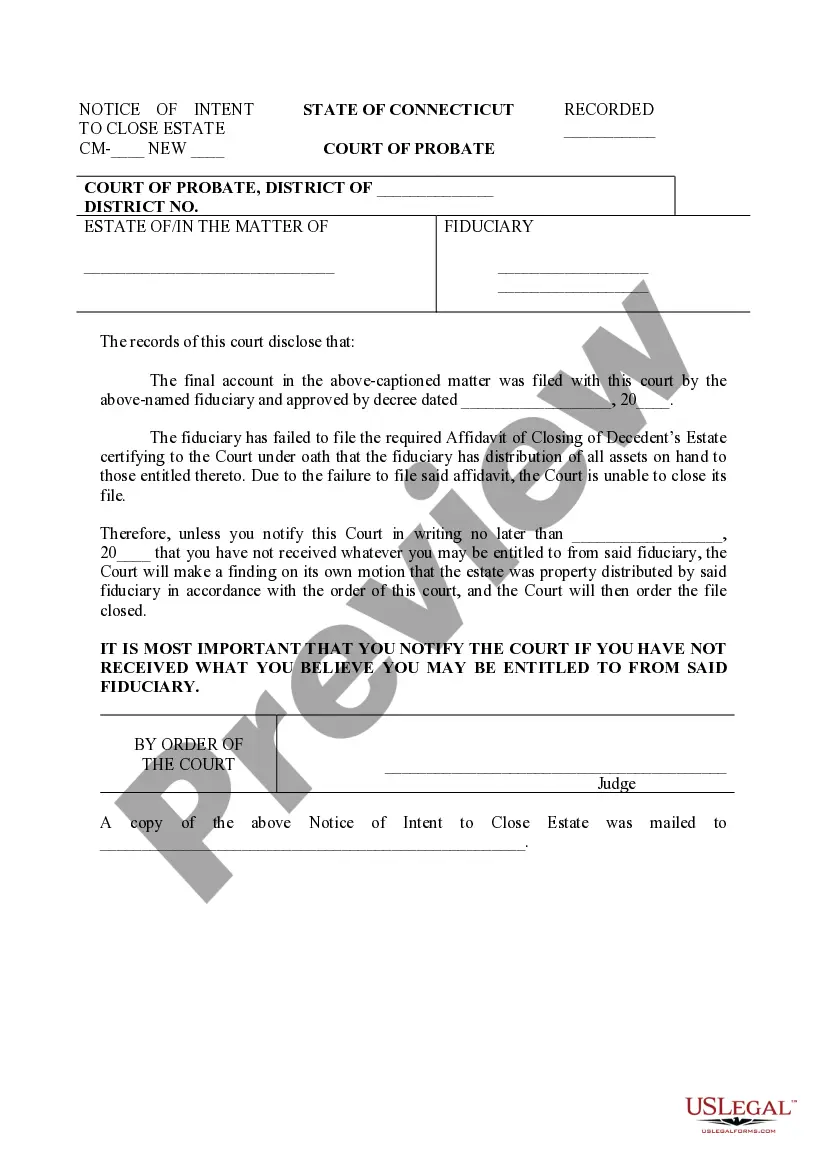

Connecticut Notice of Intent to Close Estate

Description

How to fill out Connecticut Notice Of Intent To Close Estate?

Utilize US Legal Forms to secure a printable Connecticut Notice of Intent to Conclude Estate.

Our court-acceptable forms are crafted and routinely refreshed by experienced attorneys.

Ours is the most comprehensive Forms library online and offers affordable and precise samples for clients, legal professionals, and small to medium-sized businesses.

Hit Buy Now if it’s the form you seek. Establish your account and make a payment through PayPal or by card|credit card. Download the template to your device and feel free to use it repeatedly. Employ the Search function if you need to locate another document template. US Legal Forms provides thousands of legal and tax templates and packages for business and personal requirements, including the Connecticut Notice of Intent to Conclude Estate. Over three million users have successfully used our platform. Choose your subscription plan and acquire high-quality documents in just a few clicks.

- Organized into state-specific categories, some templates may be viewed prior to downloading.

- To access samples, users must have a subscription and need to sign into their account.

- Click Download next to any template you wish to access and locate it in My documents.

- For users without a subscription, follow these steps to swiftly locate and download the Connecticut Notice of Intent to Conclude Estate.

- Ensure you select the correct form according to the state required.

- Examine the document by reviewing the description and utilizing the Preview feature.

Form popularity

FAQ

If an Executor breaches this duty, then they can be held personally financially liable for their mistakes, and the financial claim that is made against them can be substantial. In an extreme example of this, one Personal Representative failed to settle the Inheritance Tax bill before distributing the Estate.

Connecticut has a simplified and expedited probate process for settling small decedent's estates. The entire process can be completed within 30 days, instead of six months or longer as is normally required for the regular probate process.

An executor acts until the estate administration is completed or if they resign, die or are removed for cause.

If an estate is not properly probated and closed in a timely manner, there may be a number of consequences that can jeopardize the estate: The statute of limitations for creditors' claims is extended. Assets may lose value or be lost altogether. The state may claim the assets.

Generally, an executor has 12 months from the date of death to distribute the estate. This is known as 'the executor's year'. However, for various reasons the executor may have been delayed and has not distributed the estate within this time frame.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.

A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.