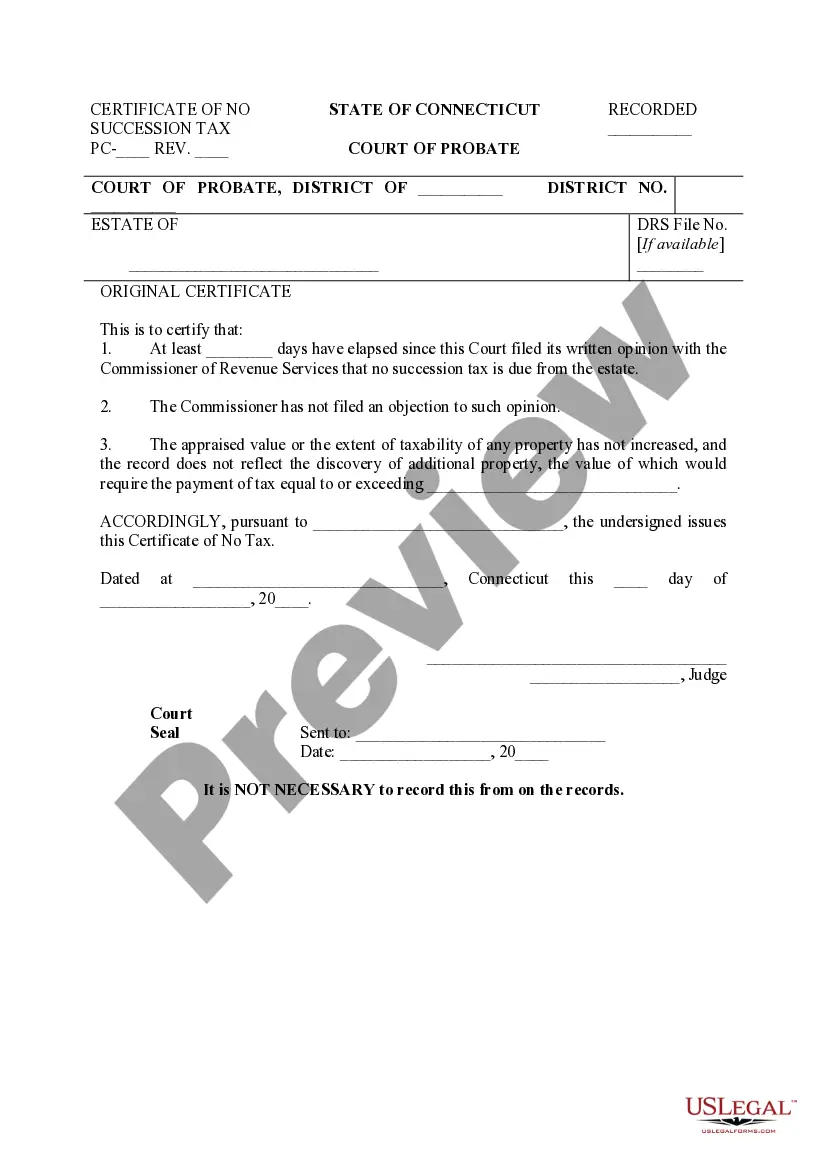

Connecticut Certificate of No Succession Tax

Description

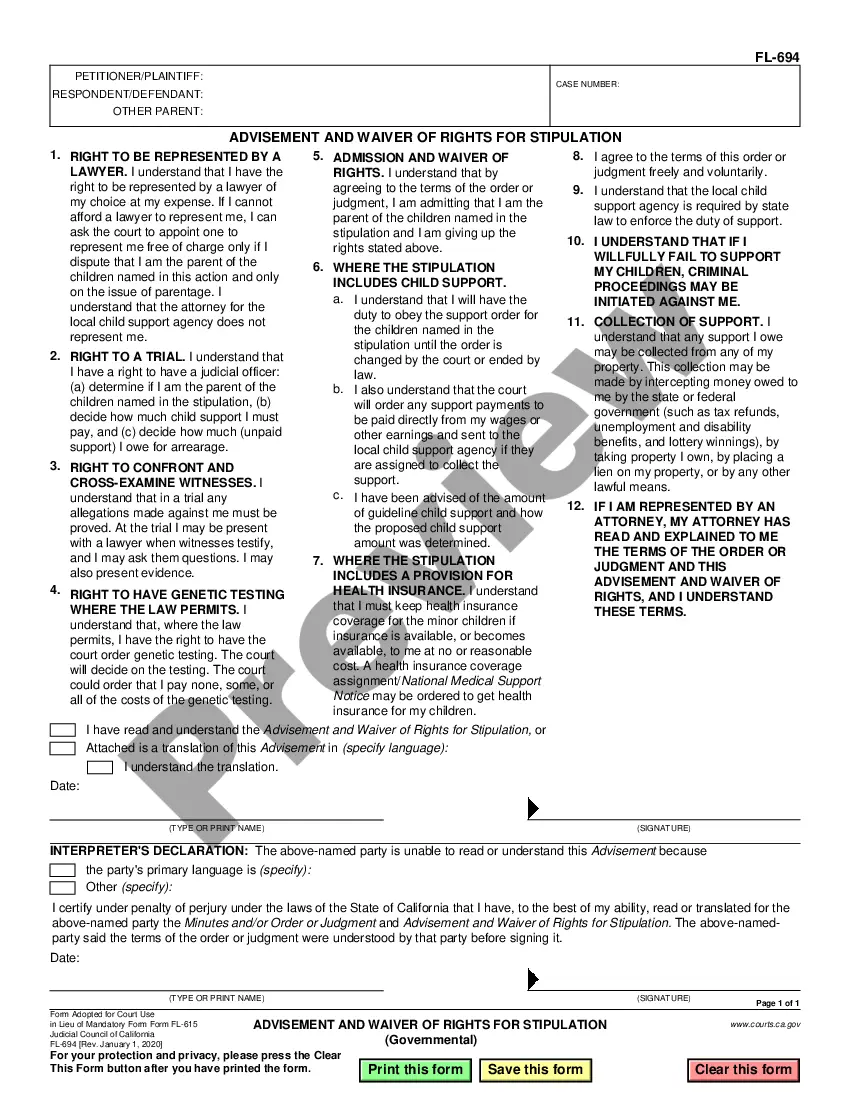

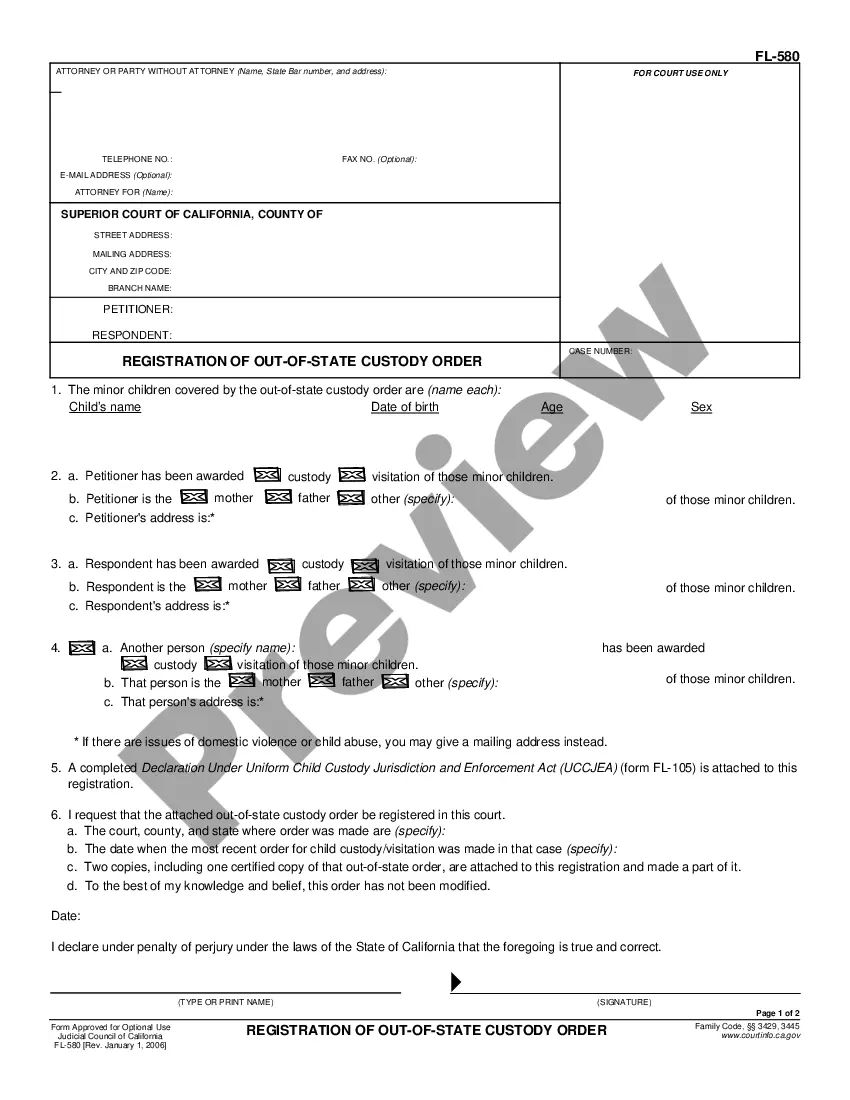

How to fill out Connecticut Certificate Of No Succession Tax?

Utilize US Legal Forms to secure a printable Connecticut Certificate of No Succession Tax.

Our court-accepted forms are written and frequently revised by experienced attorneys.

Ours is the most extensive library of forms available online, offering economical and precise templates for clients, lawyers, and small to medium-sized businesses.

Click Buy Now if it is the document you require. Set up your account and pay through PayPal or with a credit/debit card. Download the form to your device and feel free to use it multiple times. Use the search function if you're looking for another document template. US Legal Forms provides thousands of legal and tax templates as well as packages for both business and personal use, including the Connecticut Certificate of No Succession Tax. Over three million users have successfully utilized our platform. Choose your subscription option and access premium forms in just a few clicks.

- The templates are categorized by state and some can be viewed prior to downloading.

- To obtain samples, users need a subscription and must Log In to their account.

- Click Download beside any template you desire and locate it in My documents.

- For users without a subscription, follow these steps to swiftly locate and download the Connecticut Certificate of No Succession Tax.

- Confirm that you have the correct template relevant to the needed state.

- Examine the form by reading the description and utilizing the Preview feature.

Form popularity

FAQ

Gift and Estate Taxes in Other States As it shows, the exemptions range from $1 million in Massachusetts and Oregon to $5.85 million in New York. Connecticut's $5.1 million exemption for 2020 puts it 9th among the 13 jurisdictions.

The Connecticut estate tax exemption will be $5,100,000 in 2020, $7,100,000 in 2021, $9,100,000 in 2022, and it will match the federal exemption amount on January 1, 2023. The tax rate on estates or gifts in excess of the Connecticut exemption ranges from 7.8% to 12%.

Estates larger than $7.1 million pay a Connecticut estate tax rate of 10.8%-12%, compared to the current federal rate of 40%. Connecticut caps the estate tax, so estates of the super-rich will pay a maximum of $15 million.

The exemption level is indexed for inflation reaching $11.4 million in 2019 and $11.58 million in 2020 (and twice those amounts for married couples). The 40 percent top tax rate remains in place.

While estate tax is assessed to the estate of the person giving a gift or leaving assets to heirs, an inheritance tax is assessed on the person who inherits the assets. There is no estate tax on the federal level, but a few states have an inheritance tax that you may have to pay.

In Connecticut, the right of survivorship comes when you own property in joint tenancy. Property owned in joint tenancy automatically passes to the surviving owners when one owner dies. No probate is necessary.

Estate taxes are paid out of the estate, off the top, before any money is distributed to heirs.The IRS generally doesn't consider inheritances to be taxable income, so you likely won't have to pay federal income tax on any inheritance you receive.

Connecticut Inheritance Tax There is no inheritance tax in Connecticut.