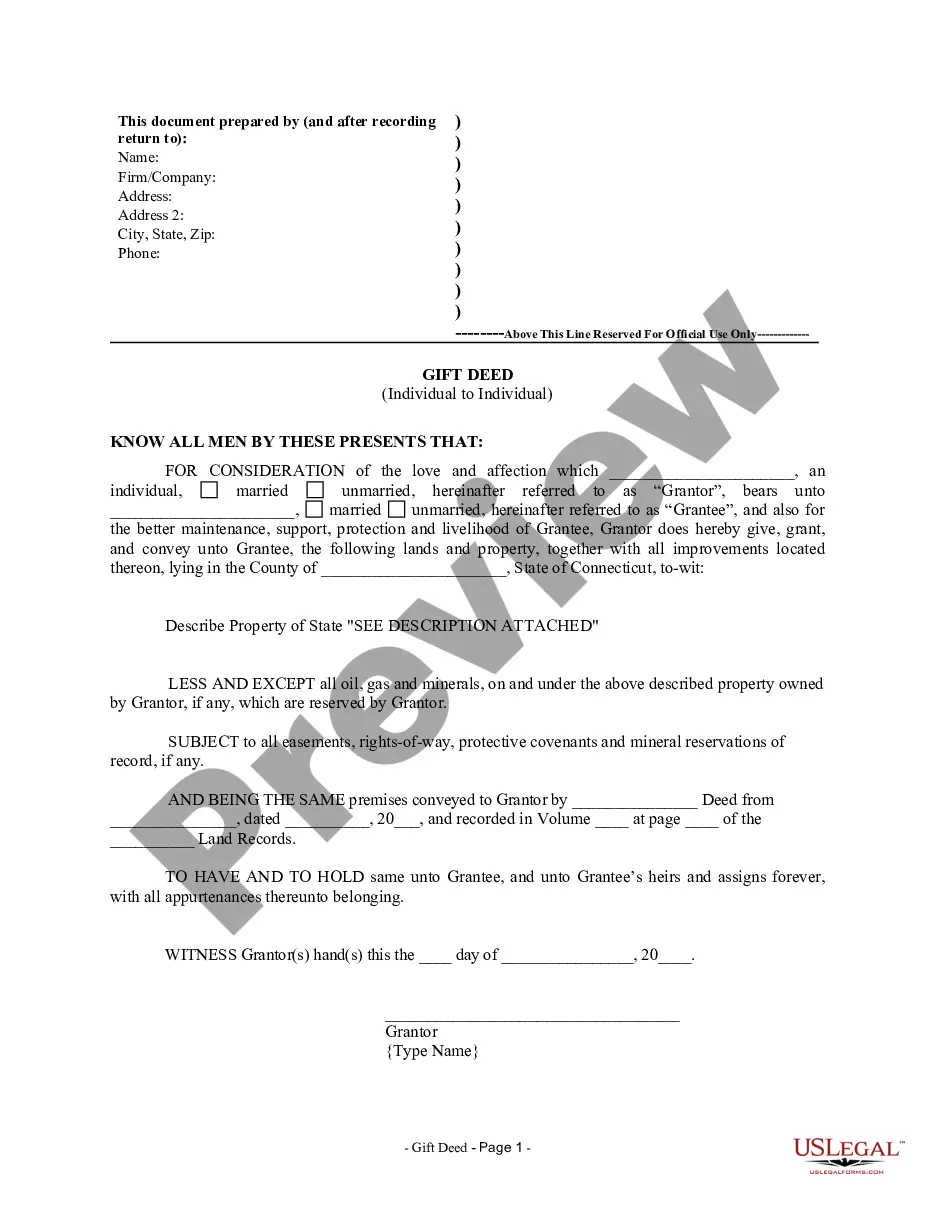

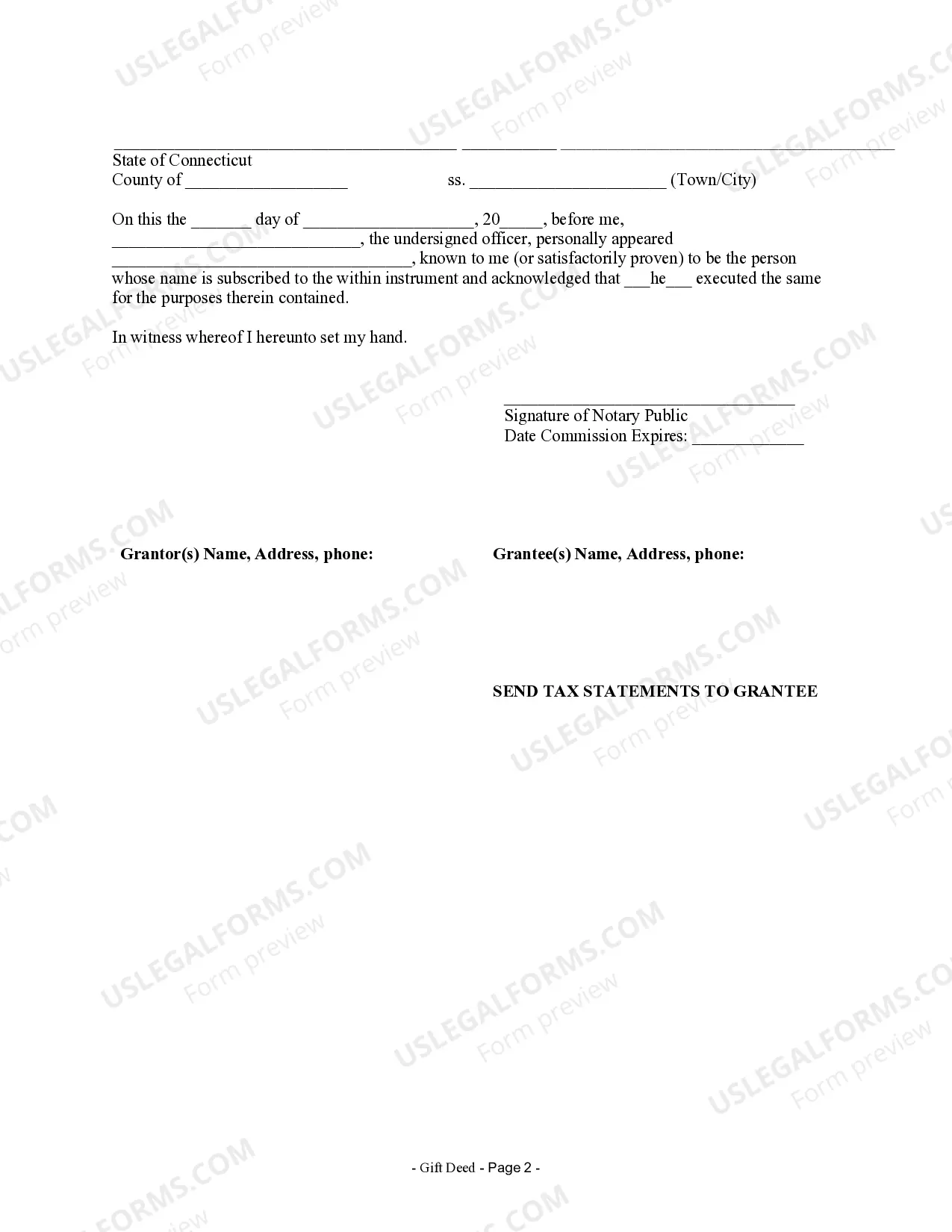

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Gift Deed - Connecticut - Individual to Individual, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CT-020-77

Connecticut Gift Deed for Individual to Individual

Description

How to fill out Connecticut Gift Deed For Individual To Individual?

The greater number of documents you need to produce - the more anxious you become.

You can find numerous Connecticut Gift Deed for Individual to Individual formats available online, but you may not be certain which ones to trust.

Eliminate the stress and simplify the process of finding templates with US Legal Forms.

Click Buy Now to initiate the subscription process and select a pricing plan that suits your needs.

- Obtain expertly crafted paperwork developed to comply with state regulations.

- If you are already subscribed to US Legal Forms, Log In to your account to see the Download button on the page for the Connecticut Gift Deed for Individual to Individual.

- For new users, complete the registration process by following these steps.

- Verify that the Connecticut Gift Deed for Individual to Individual is applicable in your state.

- Review your selection by checking the description or using the Preview mode if available for the chosen document.

Form popularity

FAQ

A Deed of Gift is a formal legal document used to give a gift of property or money to another person.The person who creates and executes a Deed of Gift to transfer money or property from himself to another person is called a Donor and the person receiving the gift is called the Donee.

It is possible to be named on the title deed of a home without being on the mortgage. However, doing so assumes risks of ownership because the title is not free and clear of liens and possible other encumbrances.If a mortgage exists, it's best to work with the lender to make sure everyone on the title is protected.

To add a co-owner, the bank would have to create a new home loan agreement, which must be registered after paying the due stamp duty and registration charges. The bank would also insist on making the co-owner a co-borrower in the home loan applicable.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.

Place and date on which the deed is to be executed. Relevant information regarding the donor and the donee, such as their names, address, relationship, date of birth and signatures. Complete details about the property. Two witnesses to bear testimony and their signatures.

Today's question is is it possible to deed real estate to someone without them knowing it? Strictly speaking, the answer is no. Because it does not meet the acceptance element of a valid deed transfer. Us lawyers must learn to speak in elements because it governs everything that we do.

Gift made by way of movable property is required to be made in stamp paper and stamped by the notary or court. Registration of gift deed is not required in case of transfer of moveable property.Gift of immovable property which is not registered is not a valid as per law and cannot pass any title to the donee.

It is executed during the life time of donor and transfer happens immediately whereas Will is applicable after death. Gift deed needs to be registered; only then it is effective. Registration renders it less liable to litigation. Transfer using gift deeds are tax free in the hands of donor and donee.