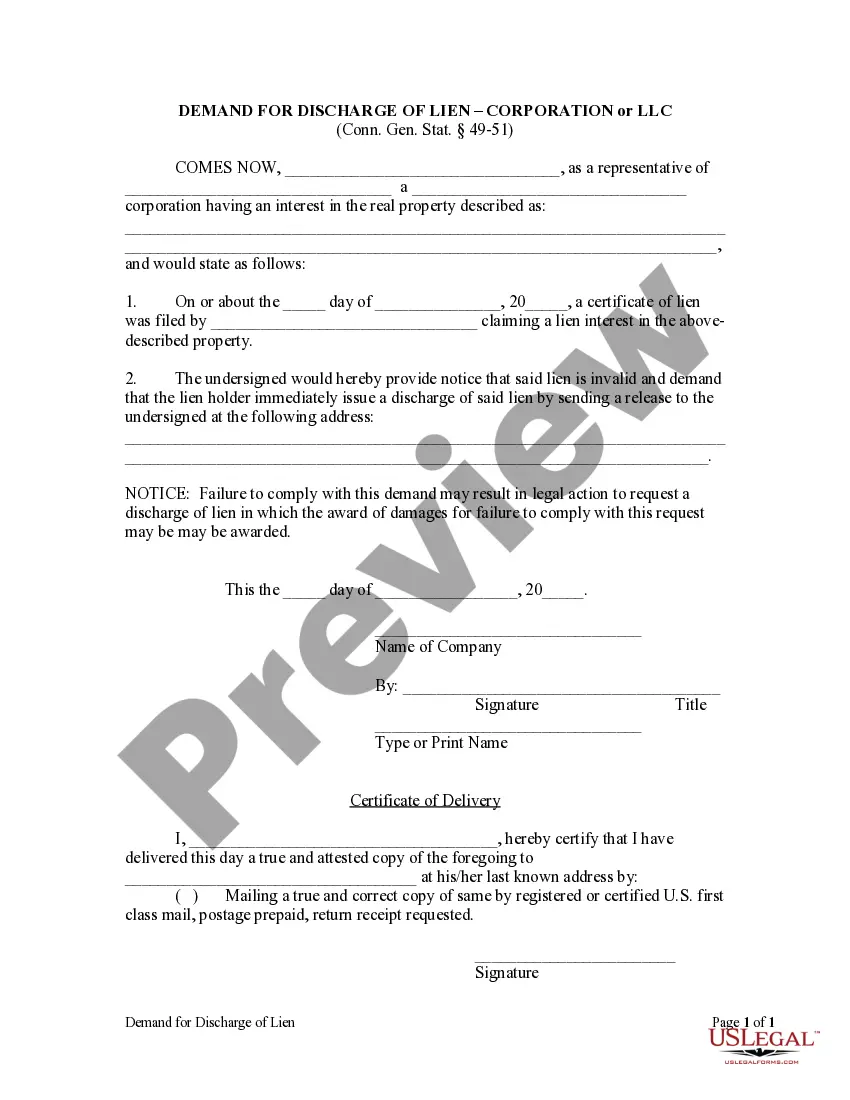

Any person having an interest in any real property described in a certificate of lien, when said lien is invalid but not discharged, may give written notice to the lienor sent to him at his last known address by registered mail or by certified mail. Upon receipt of such a demand for discharge, the lien holder is required to provide a release to the party requesting the discharge. If the lien is not discharged within thirty (30) days of receipt of the demand for discharge, the person with an interest in the property may apply to the Superior Court for a discharge, with the possibility that the Court may award the plaintiff party damages as a result of the lien holder's refusal to comply.

Connecticut Demand for Discharge by Corporation or LLC

Description Owner Corporation Paper

How to fill out Ct Limited Liability Company?

The larger quantity of documents you should produce - the more anxious you feel.

You can find thousands of Connecticut Demand for Discharge by Corporation or LLC forms available online, yet you remain uncertain about which ones to rely on.

Eliminate the stress to streamline acquiring templates by using US Legal Forms.

Access all templates you acquire in the My documents section. Simply navigate there to create a new version of the Connecticut Demand for Discharge by Corporation or LLC. Even when using well-prepared templates, it's still advisable to consult your local attorney to verify that your document is correctly completed. Achieve more for less with US Legal Forms!

- Ensure the Connecticut Demand for Discharge by Corporation or LLC is accepted in your state.

- Double-check your selection by reviewing the description or by utilizing the Preview feature if available for the chosen file.

- Press Buy Now to initiate the sign-up process and select a pricing plan that fits your needs.

- Fill in the required information to establish your account and settle your payment using PayPal or credit card.

- Select a suitable file format and download your copy.

Corporate Form Llc Form popularity

Connecticut Corporate Make Other Form Names

Notice Corporate Corporation FAQ

Hold a board of directors meeting and formally move to dissolve your corporation. Fill out and file the Certificate of Dissolution with the Connecticut Secretary of State. Fulfill all tax obligations with the state of Connecticut, as well as with the IRS.

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

File Articles of Dissolution with the state. Visit an online legal document creation service such as Legal Docs.com or Legal Zoom.com and write the LLC's Articles of Dissolution. These documents are necessary to legally separate each LLC member from the entity.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

How much does it cost to form an LLC in Connecticut? The Connecticut Secretary of State charges a $120 fee to file the Articles of Organization. It will cost $60 to file a name reservation application, if you wish to reserve your LLC name prior to filing the Articles of Organization.