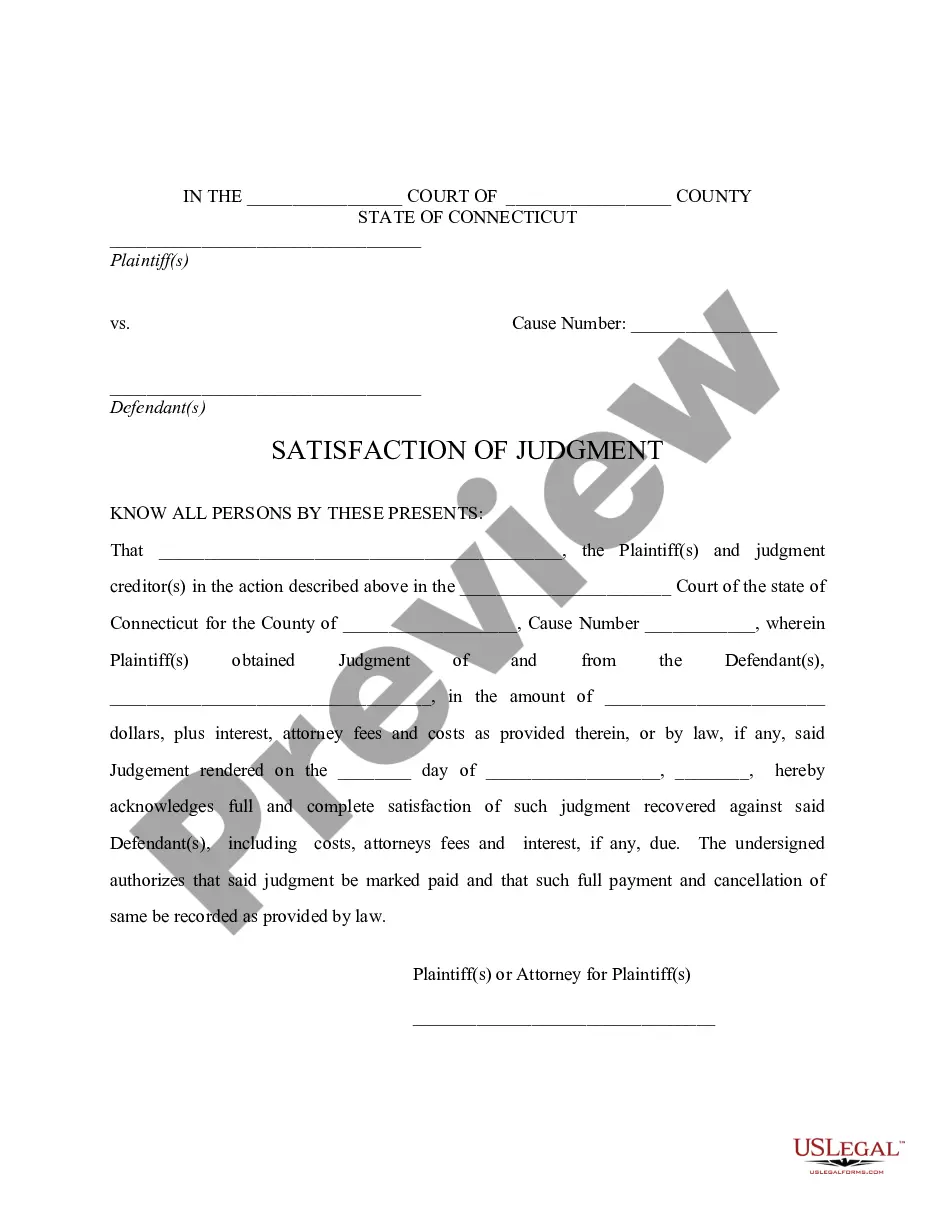

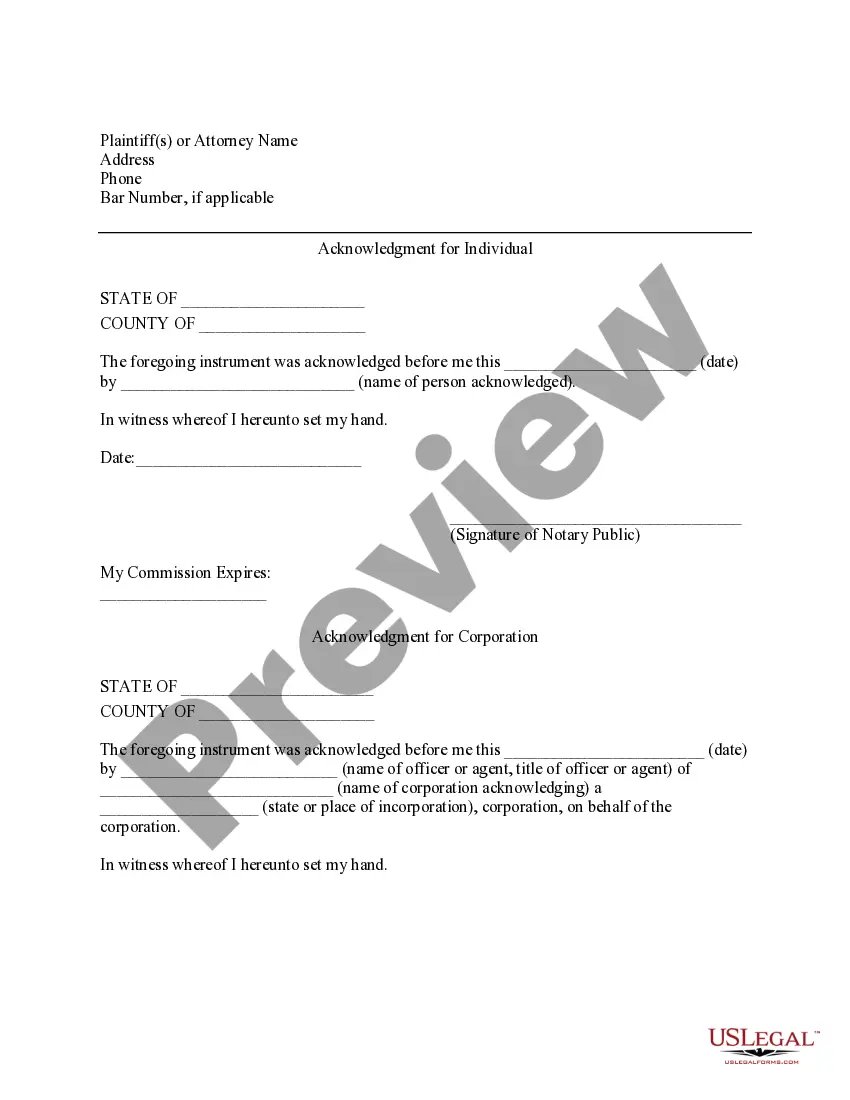

This is a satisfaction of judgment which indicates that a judgment has been paid in full, including all fees, costs and interest. It acknowledges full and complete satisfaction of the judgment and directs that the judgment be marked as paid in full.

Connecticut Satisfaction of Judgment

Description Ct Judgment File

How to fill out Satisfaction Of Judgment Form?

The more documents you have to make - the more stressed you become. You can get a huge number of Connecticut Satisfaction of Judgment templates online, still, you don't know which of them to trust. Get rid of the hassle to make getting exemplars less complicated using US Legal Forms. Get expertly drafted documents that are written to meet state requirements.

If you currently have a US Legal Forms subscribing, log in to your account, and you'll see the Download button on the Connecticut Satisfaction of Judgment’s web page.

If you have never used our service before, finish the signing up process with the following steps:

- Ensure the Connecticut Satisfaction of Judgment applies in the state you live.

- Double-check your decision by reading through the description or by using the Preview functionality if they are available for the selected document.

- Click Buy Now to begin the registration procedure and select a rates program that fits your needs.

- Insert the requested info to make your account and pay for the order with the PayPal or credit card.

- Choose a hassle-free document format and acquire your example.

Access every document you get in the My Forms menu. Simply go there to fill in new duplicate of your Connecticut Satisfaction of Judgment. Even when preparing professionally drafted templates, it is still important that you consider asking your local legal professional to twice-check filled in sample to make sure that your document is accurately filled out. Do more for less with US Legal Forms!

Connecticut Satisfaction Fill Form popularity

Ct Judgment Document Other Form Names

Ct Satisfaction FAQ

While a vacated judgment is typically the best-case scenario, the unfortunate truth is most legitimate judgments satisfied or not aren't going away anytime soon. In fact, judgments will generally remain on your credit report for seven years from the judgment date (the day the judgment was filed) before expiring.

How long does a judgment lien last in Connecticut? A judgment lien in Connecticut will remain attached to the debtor's property (even if the property changes hands) for 20 years (for liens on real estate) or five years (liens on personal property).

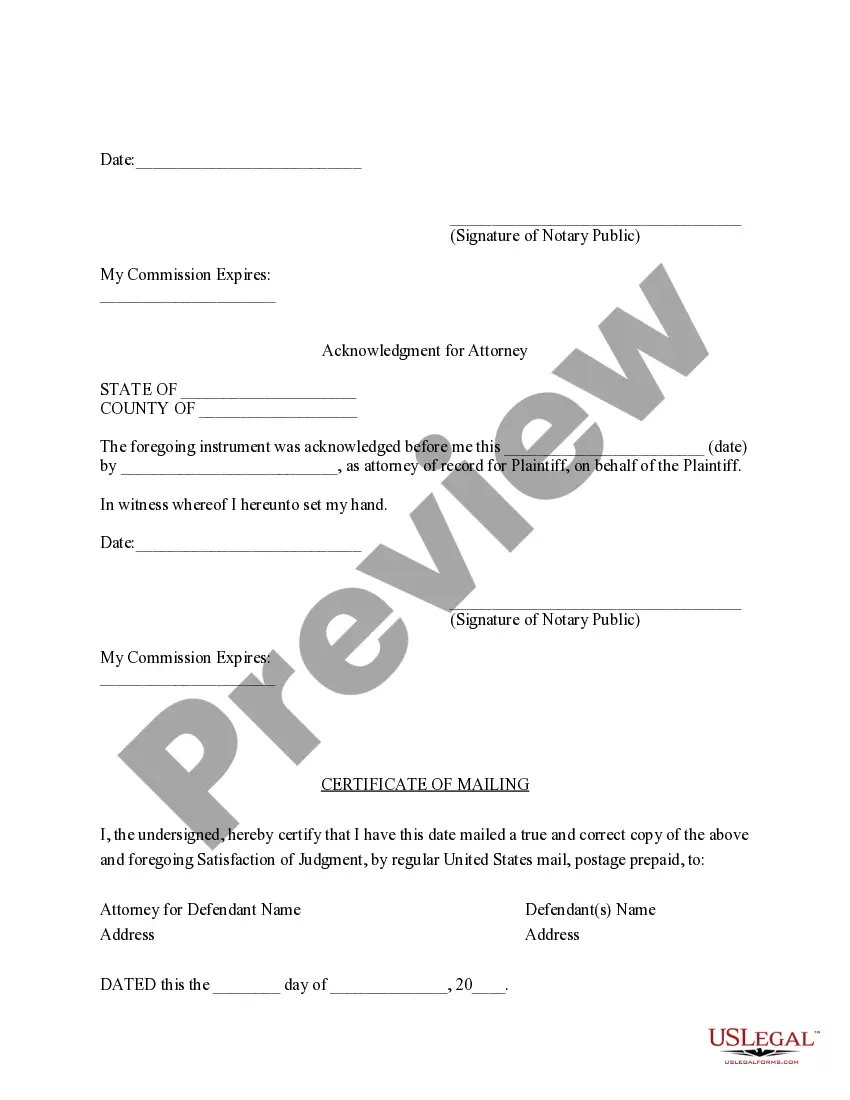

A Satisfaction of Judgment is a document signed by one party acknowledge receipt of the payment. The Satisfaction of Judgment is then filed with the court. This is beneficial to the paying party for multiple reasons. One, the court is put on notice that the debt has been satisfied.

If the judgment creditor does not immediately file an Acknowledgement of Satisfaction of Judgment (EJ-100) when the judgment is satisfied, the judgment debtor may make a formal written demand for the creditor to do so. The judgment creditor has 15 days after receiving the debtor's request to serve the acknowledgement.

A document signed by the party who is owed money under a court judgment (called the judgment creditor) stating that the full amount due on the judgment has been paid.

Once a judgment is paid, whether in installments or a lump sum, a judgment creditor (the person who won the case) must acknowledge that the judgment has been paid by filing a Satisfaction of Judgment form with the court clerk.

Judgments are no longer factored into credit scores, though they are still public record and can still impact your ability to qualify for credit or loans.You should pay legitimate judgments and dispute inaccurate judgments to ensure these do not affect your finances unduly.