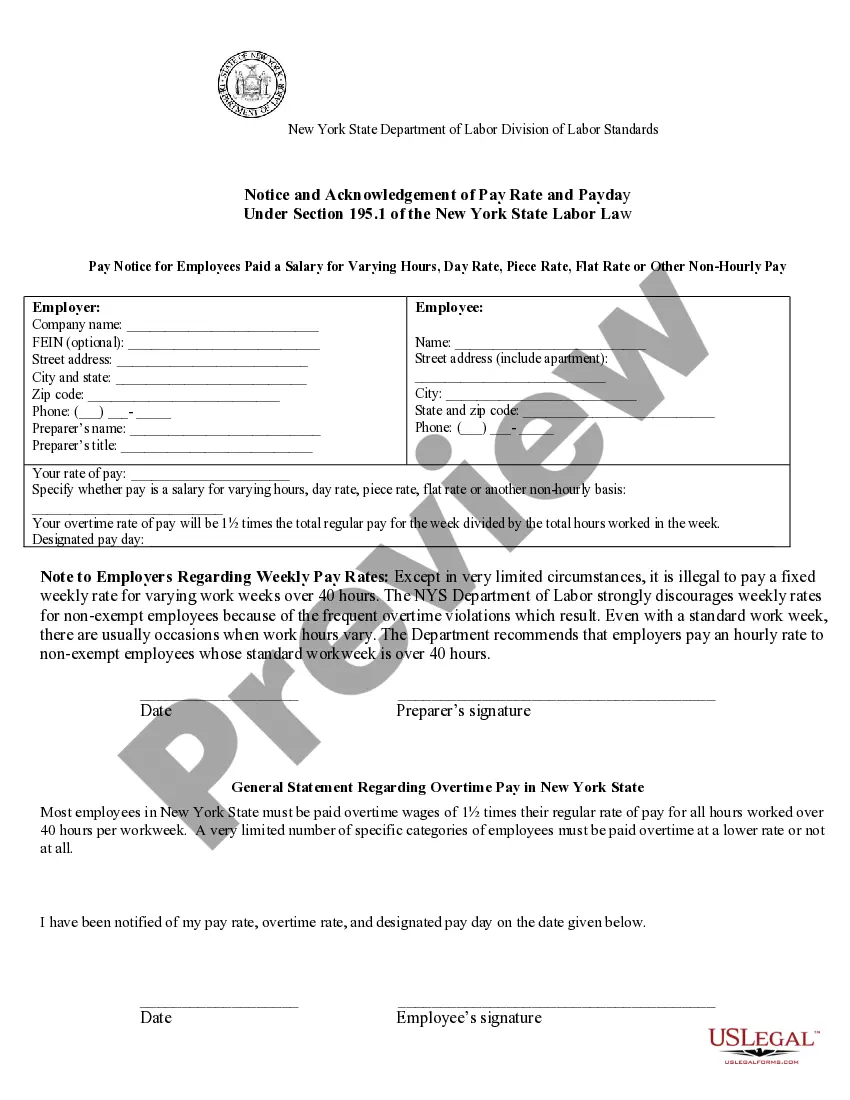

A Connecticut Certificate of Trust is a legal document that is used to prove the existence of an irrevocable trust. This document serves as proof that the trust is valid and can be used to prove the trustees' authority over the trust assets. It can also be used to open bank accounts in the name of the trust and to provide evidence that the trust is exempt from certain taxes. There are two types of Connecticut Certificate of Trust: a Connecticut Certificate of Trust for a Revocable Trust and a Connecticut Certificate of Trust for an Irrevocable Trust. The Certification of Trust is prepared by a lawyer and must be signed by the trustee and notarized.

Connecticut Certificate of Trust

Description

How to fill out Connecticut Certificate Of Trust?

Managing legal paperwork demands focus, precision, and utilizing properly crafted templates.

US Legal Forms has been assisting individuals nationwide with this for 25 years, so when you select your Connecticut Certificate of Trust form from our collection, you can be assured it complies with federal and state laws.

All documents are designed for multiple uses, including the Connecticut Certificate of Trust you see on this page. If you need them again, you can fill them out without additional payment—just access the My documents tab in your profile and complete your document whenever required. Try US Legal Forms and complete your business and personal documentation swiftly and in full legal compliance!

- Ensure to thoroughly review the form content and its alignment with general and legal standards by previewing it or reading its description.

- Look for an alternative official template if the previously accessed one does not suit your circumstances or state laws (the tab for that is in the upper corner of the page).

- Log in to your account and download the Connecticut Certificate of Trust in your chosen format. If it’s your first time using our service, click Buy now to proceed.

- Create an account, select your subscription option, and pay via credit card or PayPal.

- Select the format in which you wish to save your form and click Download. Print the document or use a professional PDF editor to submit it electronically.

Form popularity

FAQ

Certainly, you can make your own certificate of trust. It is crucial to include all required information clearly and accurately. For ease and accuracy, utilizing USLegalForms can provide access to professionally created templates, ensuring that your certificate complies with Connecticut’s legal standards.

To record a certificate of trust in Connecticut, file it with the appropriate local court or land records office, depending on the nature of the trust. The recording process helps establish the trust's validity and informs third parties of its existence. If you're unsure, consider using USLegalForms for comprehensive instructions and templates.

To form a trust in Connecticut, start by deciding on the type of trust that meets your needs. Then, draft a trust document that outlines the terms, names the trustee, and assigns beneficiaries. USLegalForms offers state-specific templates that can guide you through each step in establishing a trust effectively.

Yes, you can create your own certificate of trust. To do this, gather the essential details about the trust, including its name, date, and trustee information. Using USLegalForms allows you to access templates that can help you structure your certificate correctly and in line with Connecticut laws.

Typically, the trustee or legal counsel prepares the certification of trust. They will ensure the document contains the necessary information to confirm the trust's existence and authority. Using the services offered by USLegalForms can simplify this process, providing you with templates and guidance suited for Connecticut regulations.

In Connecticut, a certificate of trust does not necessarily need to be notarized. However, having it notarized can add a layer of authenticity and may be required by certain institutions. It is advisable to check with the specific entity requesting the certificate to ensure compliance with their requirements.

One of the biggest mistakes parents make when setting up a trust fund is failing to clearly outline the distribution terms and conditions. This lack of clarity can lead to confusion and potential conflicts among beneficiaries. Using resources like US Legal Forms can help you establish clear guidelines and ensure that your trust aligns with your family's needs and values.

A trust is a legal arrangement where one party holds property for the benefit of others, whereas a certification of trust is a document that summarizes the main facts about the trust. The certification provides essential details without revealing the entirety of the trust agreement, ensuring privacy. Understanding this distinction is crucial for effective trust management in Connecticut.

To acquire a certificate of legal existence in Connecticut, you must file the appropriate paperwork with the Connecticut Secretary of State's office. This document confirms that your trust or business entity is in good standing. For convenience, you can explore the resources offered by US Legal Forms to simplify the filing process.

To obtain your Connecticut Certificate of Trust, you typically need to draft the trust document with clear terms and then create the certificate based on that document. You may consider using the US Legal Forms platform to access templates and guidelines for creating your certificate. It is advisable to consult a legal expert to ensure your certificate adheres to state laws.