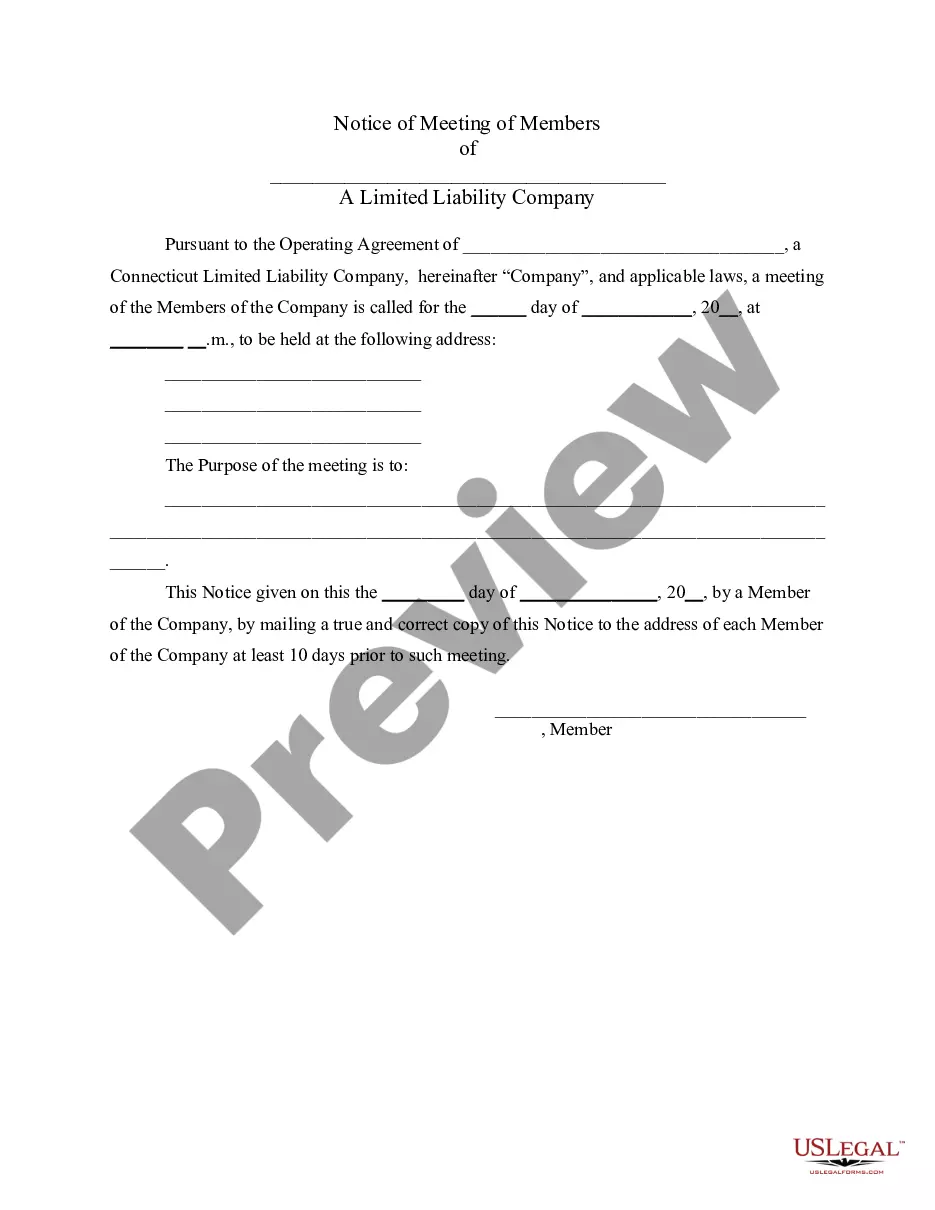

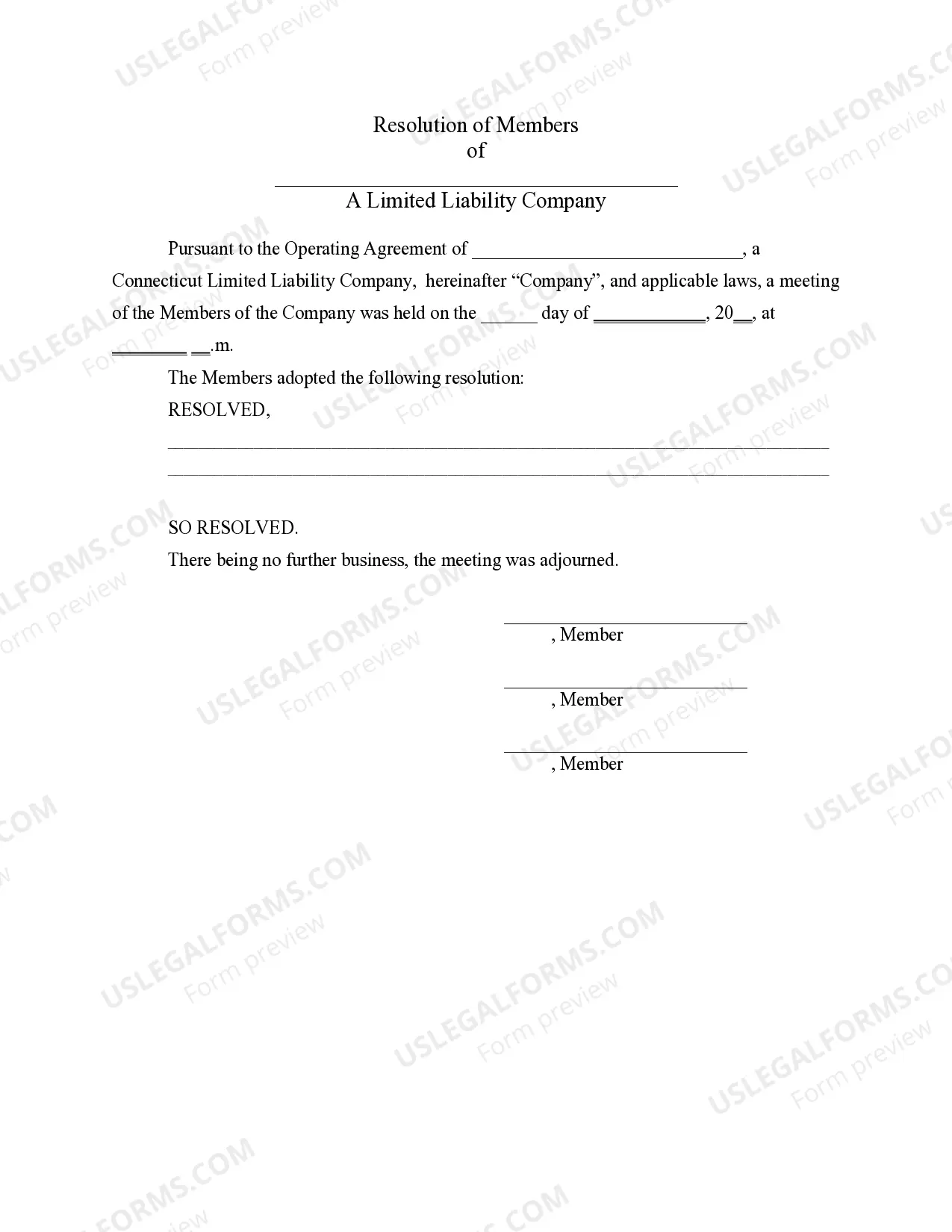

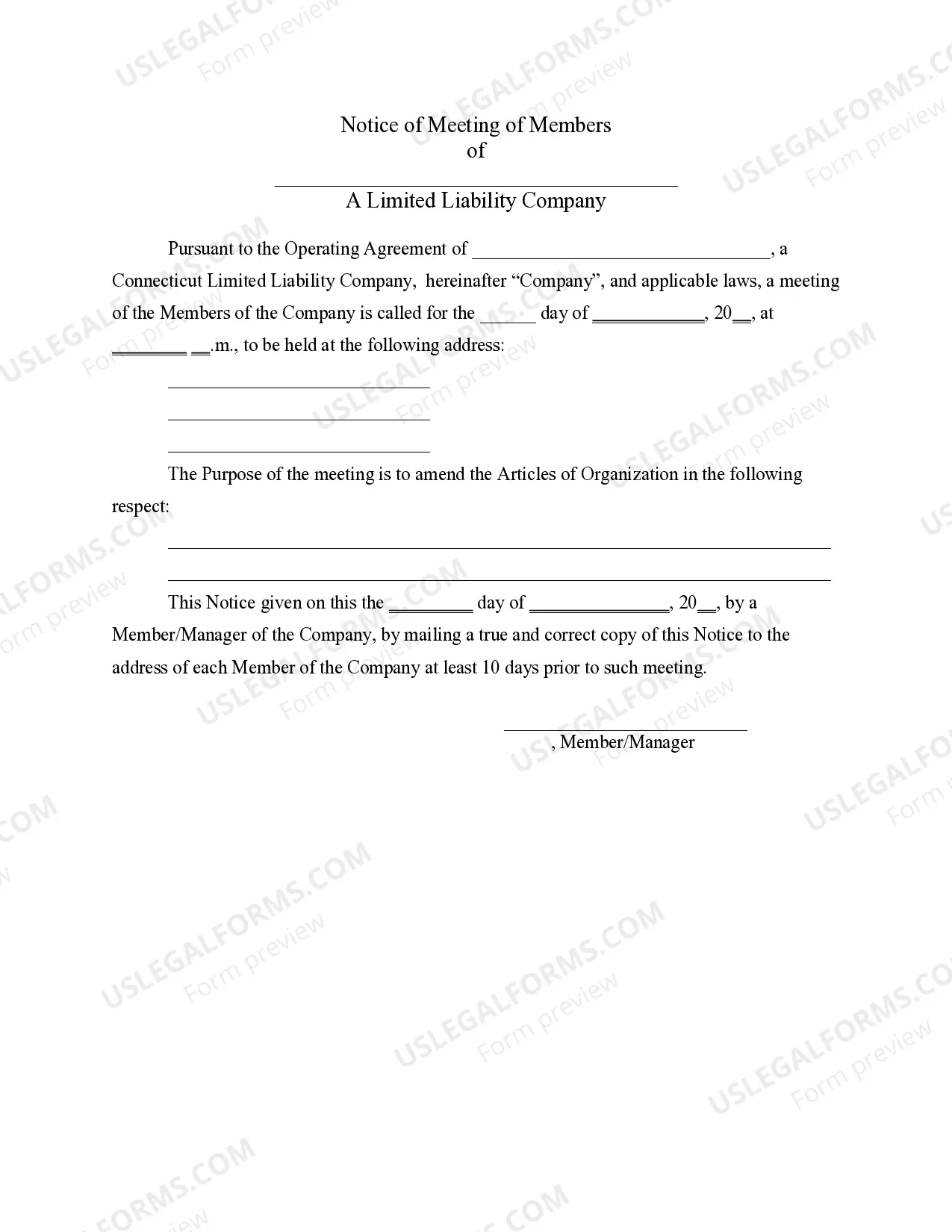

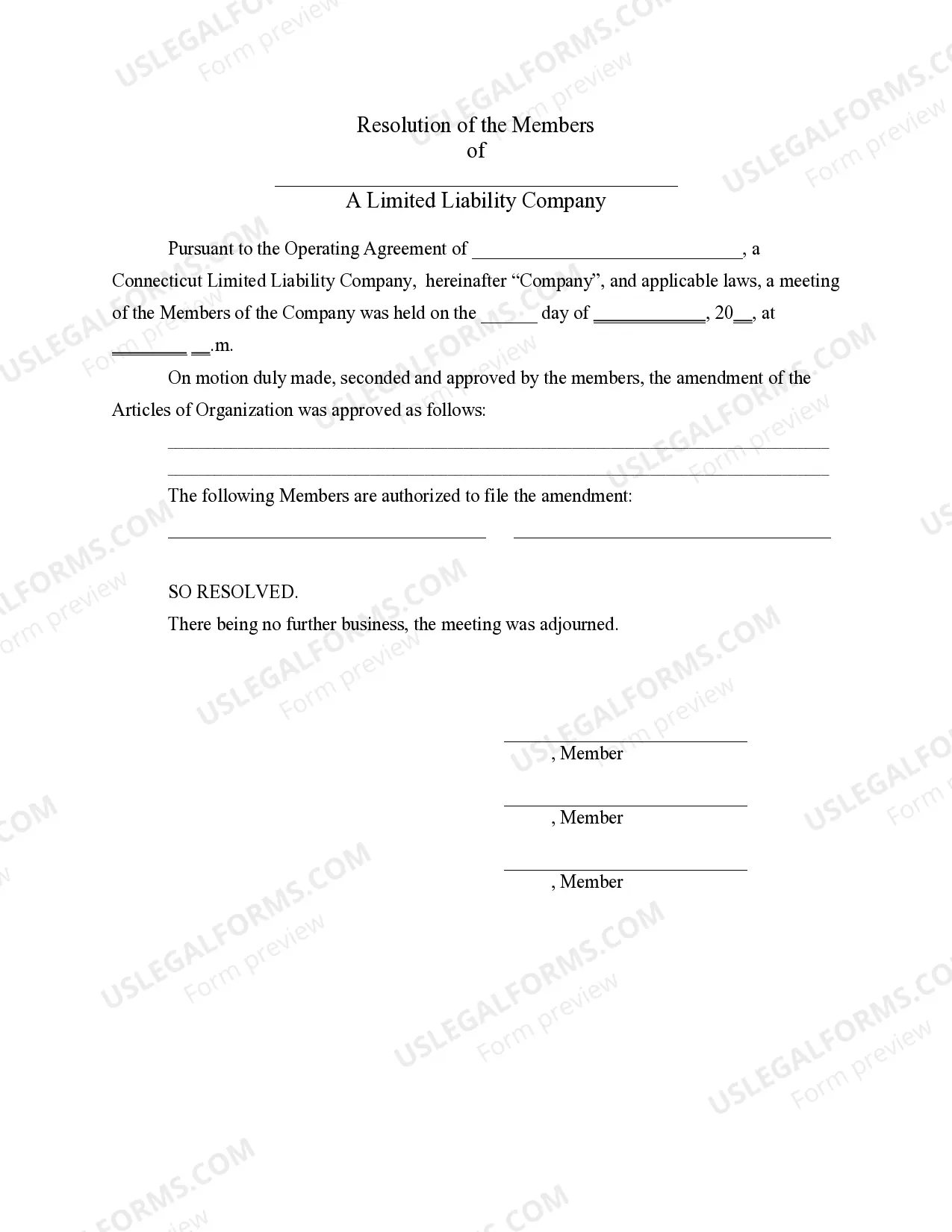

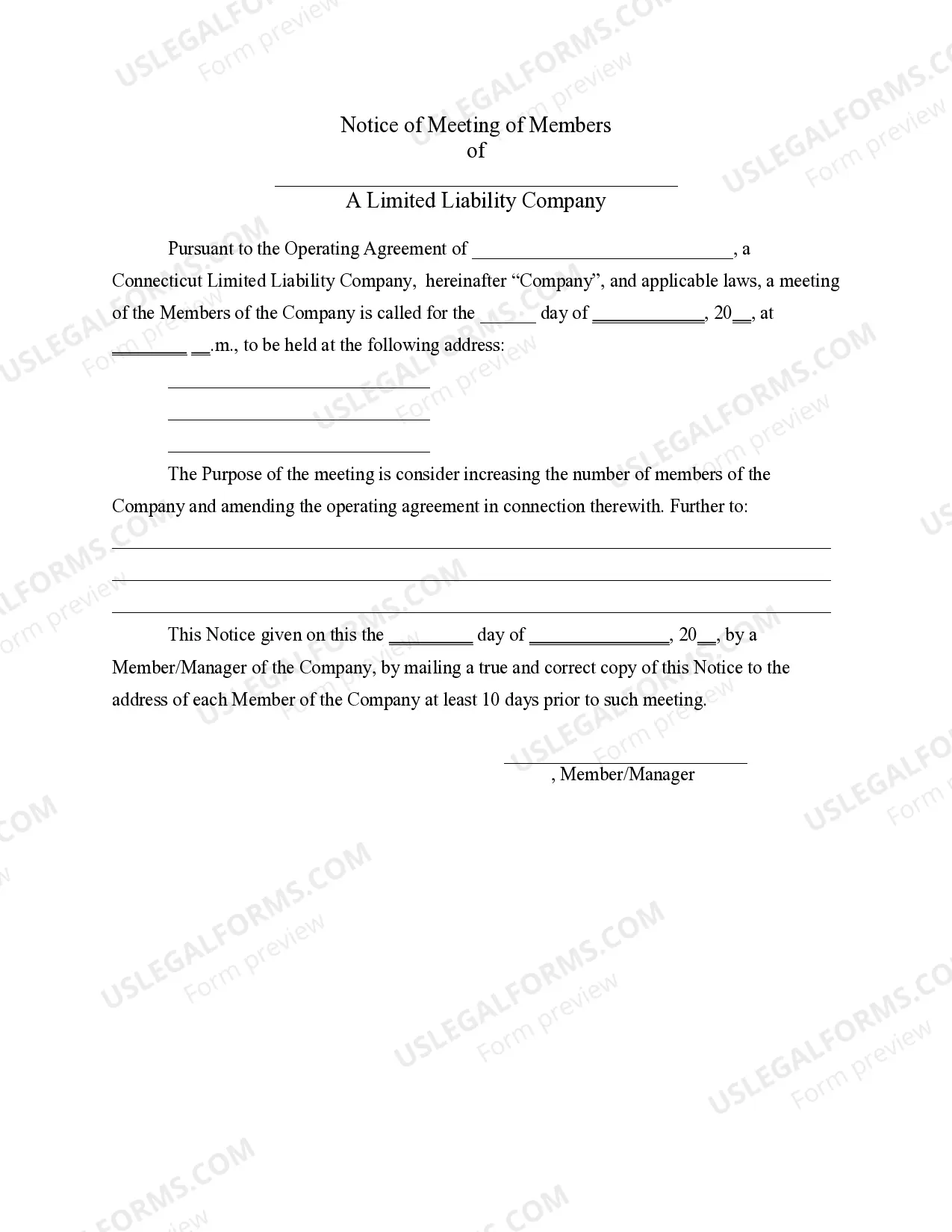

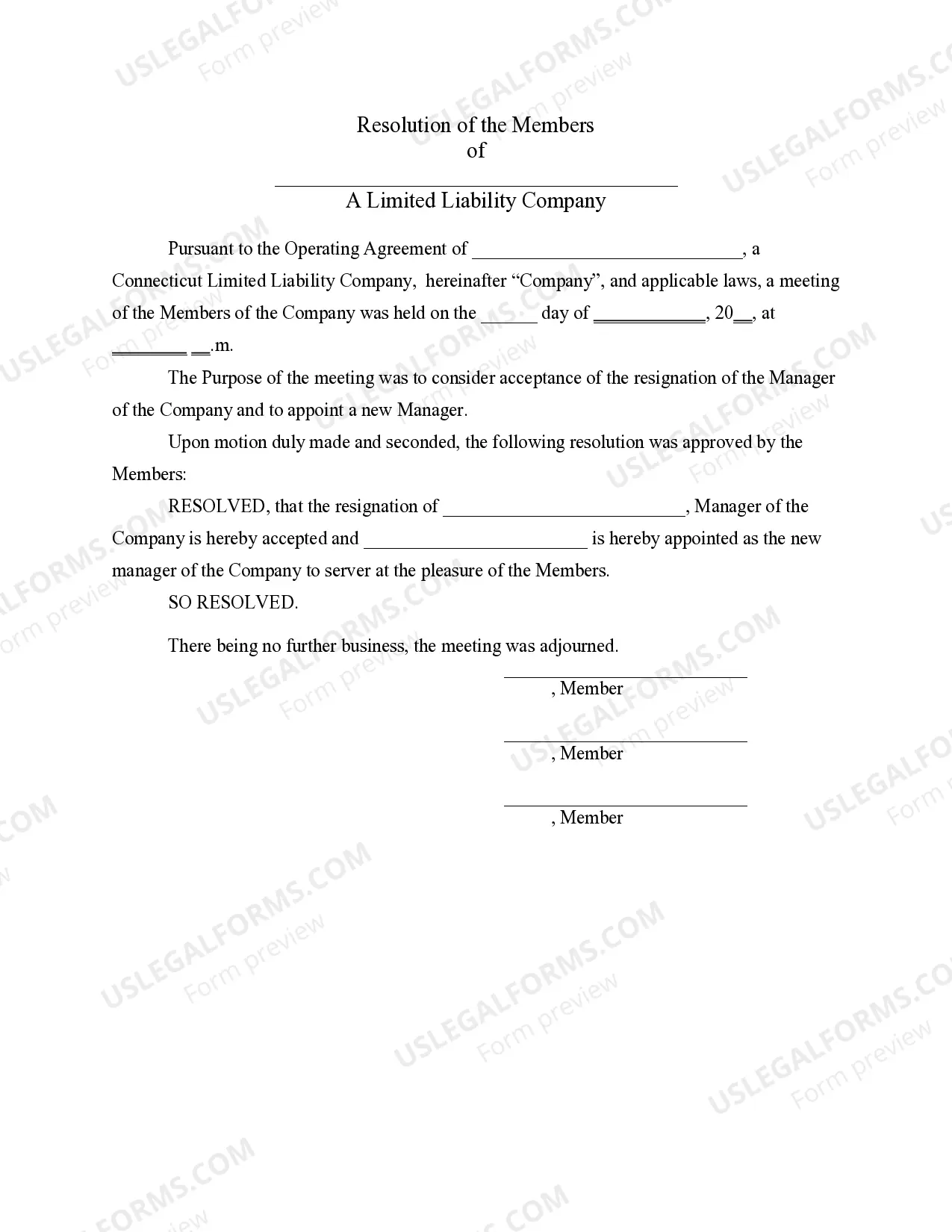

This LLC Notices, Resolutions and other Operations Forms Package contains over 15 forms for use in connection with the operation of a LLC, including the following: (1) Notice of Meeting for General Purpose, (2) Resolution of Meeting for General Purpose, (3) Notice of Meeting to Amend Articles of Organization, (4) Resolution to Amend Articles of Organization, (5) Notice of Meeting to Consider Dissolution, (6) Resolution Regarding Dissolution, (7) Notice to Admit New Members, (8) Resolution Concerning Admitting New Members, (9) Notice of Meeting Concerning Accepting Resignation of Manager, (10) Resolution Accepting Resignation of Manager, (11) Notice of Meeting to Remove Manager, (12) Resolution Concerning Removal of Manager, (13) Notice of Meeting to Consider Disbursements to Members, (14) Resolution Concerning Disbursements, (15) Assignment of Member Interest, (16) Demand for Indemnity by Member/Manager and (17) Application for Tax Identification Number.

Connecticut LLC Notices, Resolutions and other Operations Forms Package

Description

How to fill out Connecticut LLC Notices, Resolutions And Other Operations Forms Package?

The greater number of documents you should prepare - the more worried you feel. You can get thousands of Connecticut LLC Notices, Resolutions and other Operations Forms Package templates online, however, you don't know which of them to rely on. Eliminate the hassle to make getting exemplars easier using US Legal Forms. Get professionally drafted documents that are created to go with the state requirements.

If you have a US Legal Forms subscription, log in to the profile, and you'll see the Download option on the Connecticut LLC Notices, Resolutions and other Operations Forms Package’s web page.

If you’ve never applied our platform before, complete the signing up procedure using these guidelines:

- Make sure the Connecticut LLC Notices, Resolutions and other Operations Forms Package applies in your state.

- Double-check your selection by reading through the description or by using the Preview mode if they are available for the chosen file.

- Click on Buy Now to begin the signing up process and choose a costs plan that suits your requirements.

- Insert the asked for data to make your profile and pay for the order with the PayPal or credit card.

- Pick a convenient file type and obtain your sample.

Access every sample you download in the My Forms menu. Simply go there to prepare fresh version of your Connecticut LLC Notices, Resolutions and other Operations Forms Package. Even when preparing professionally drafted web templates, it’s still vital that you think about asking the local legal representative to re-check filled out sample to make sure that your document is accurately filled out. Do much more for less with US Legal Forms!

Form popularity

FAQ

Wyoming LLCs are the most affordable. Delaware is the best state to form an LLC in.

To start an LLC in Connecticut you will need to file a Certificate of Organization with the Connecticut Secretary of State, which costs $120. You can apply online, by mail, or in person. The Certificate of Organization is the legal document that officially creates your Connecticut limited liability company.

If money's tight, or you don't want to use a company formation service, we've got good news for you you can form an LLC yourself. Although you'll still need to pay your state filing fees (they're unavoidable!), you can save on the costs of having your LLC filed through a professional incorporation business.

Many LLC owners opt to file in their home state as a domestic LLC if they are physically located and transact most of their business within that state.If you decide to register your LLC in another state, but run your store in your home state, you will have to register and pay filing fees as a foreign LLC.

When you decide to start a limited liability company (LLC), you can choose to form your company in any state, regardless of where you are based. But in most circumstances, your home state is going to be your most-effective option.

In almost every situation, you'll want to form your LLC in your home state, but there are a few rare exceptions to the rule. by Brette Sember, J.D. When you decide to start a limited liability company (LLC), you can choose to form your company in any state, regardless of where you are based.

How much does it cost to form an LLC in Connecticut? The Connecticut Secretary of State charges a $120 fee to file the Articles of Organization. It will cost $60 to file a name reservation application, if you wish to reserve your LLC name prior to filing the Articles of Organization.

Choose a name for your LLC. File Articles of Organization. Choose a registered agent. Decide on member vs. manager management. Create an LLC operating agreement. Comply with other tax and regulatory requirements. File annual reports. Out of state LLC registration.

Your Connecticut LLC approval time can be as quick as 7-10 business days. However, if the state's office is backed up, approval time can take 3-5 weeks.