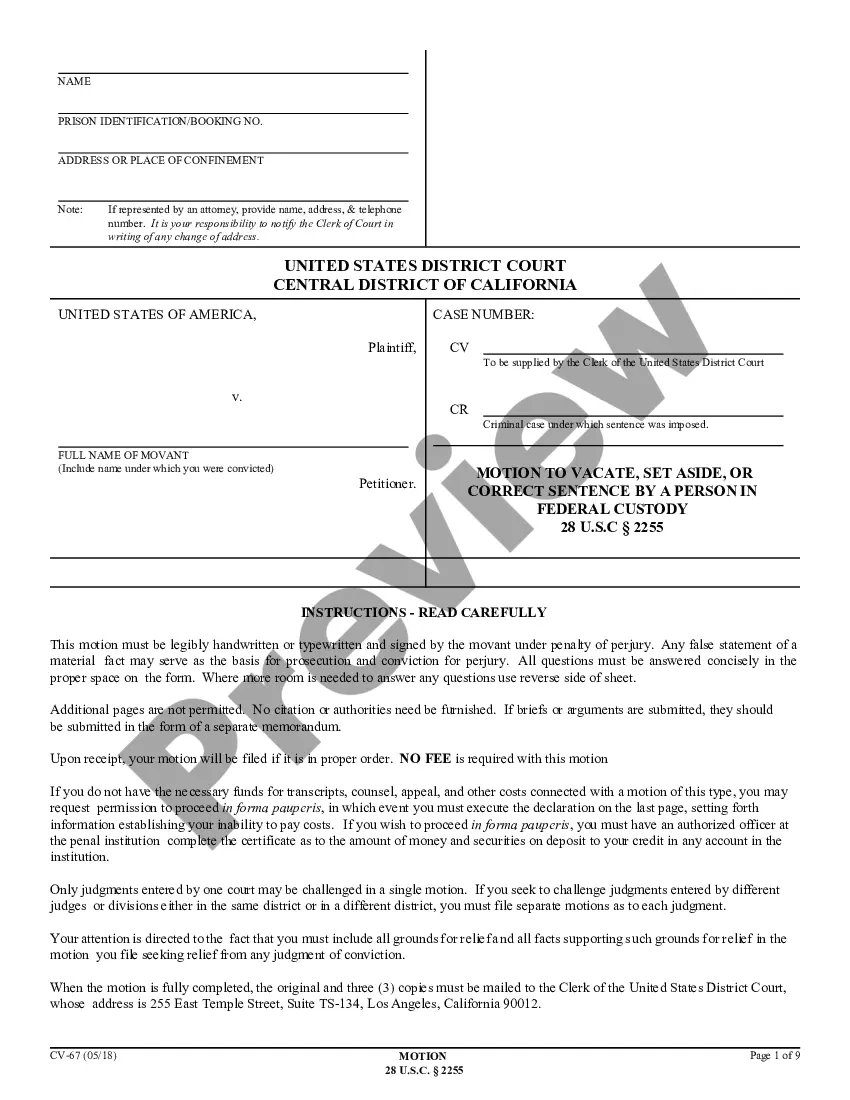

A motion is a written request to the court to take a certain action. The court will either grant or deny the motion in accordance with law and court rules. This document, a Motion Information Form, is a model motion requesting the named action from the court (or a general motion form). Adapt to fit your facts and circumstances. Available for download now in standard format(s).

Connecticut Motion Information Form

Description What Is Cp575 Form

How to fill out Connecticut Motion Information Form?

The greater number of papers you have to create - the more anxious you get. You can get thousands of Connecticut Motion Information Form templates on the web, but you don't know which ones to rely on. Remove the hassle to make finding samples far more convenient using US Legal Forms. Get expertly drafted forms that are composed to satisfy state requirements.

If you already have a US Legal Forms subscribing, log in to the profile, and you'll find the Download option on the Connecticut Motion Information Form’s web page.

If you have never tried our platform earlier, finish the signing up process using these guidelines:

- Make sure the Connecticut Motion Information Form is valid in your state.

- Re-check your choice by reading the description or by using the Preview function if they are available for the selected record.

- Click on Buy Now to begin the registration procedure and select a rates program that meets your preferences.

- Provide the asked for details to create your profile and pay for the order with the PayPal or bank card.

- Pick a prefered document formatting and take your copy.

Find every document you obtain in the My Forms menu. Simply go there to produce a new version of the Connecticut Motion Information Form. Even when using professionally drafted web templates, it’s still essential that you think about requesting the local legal professional to double-check filled in sample to make certain that your document is correctly filled out. Do more for less with US Legal Forms!

Form popularity

FAQ

If you got your EIN Number online, you can download the CP 575 online. If you got your EIN Number by mail or fax, the IRS will mail you a CP 575 (it's mailed to the address you listed on 4a and 4b of Form SS-4; takes 4-6 weeks to arrive)

How to Do an EIN Lookup Online. The Securities and Exchange Commission EDGAR online Forms and Filings (SEC) database offers an EIN search tool for publicly held companies. If the company you're looking for is registered under the SEC, you can look up the EIN.

To obtain tax forms and publications, including those referenced in this notice, visit our Web site at www.irs.gov. If you do not have access to the Internet, call 1-800-829-3676 (TTY/TDD 1-800-829-4059) or visit your local IRS office. IMPORTANT REMINDERS: Keep a copy of this notice in your permanent records.

If you have lost your EIN Verification Letter from the Department of Treasury, you can request a new one. To do so, call the IRS Business & Specialty Tax Line toll free at 1-800-829-4933 between the hours of 7am and 7pm in your local time zone.

The IRS Form CP 575 is an Internal Revenue Service (IRS) generated letter you receive from the IRS granting your Employer Identification Number (EIN). A copy of your CP 575 may be required by the Medicare contractor to verify the provider or supplier's legal business name and EIN.

If you have lost your EIN Verification Letter from the Department of Treasury, you can request a new one. To do so, call the IRS Business & Specialty Tax Line toll free at 1-800-829-4933 between the hours of 7am and 7pm in your local time zone. Request a 147c letter when you speak with an agent on the phone.

To request a 147c letter from the IRS, contact the IRS Business and Specialty Tax line at 1-800-829-4933.

Find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced EIN. Your previously filed return should be notated with your EIN. Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at 800-829-4933.

The only way to get an EIN Verification Letter (147C) is to call the IRS at 1-800-829-4933. For security reasons, the IRS will never send anything by email.