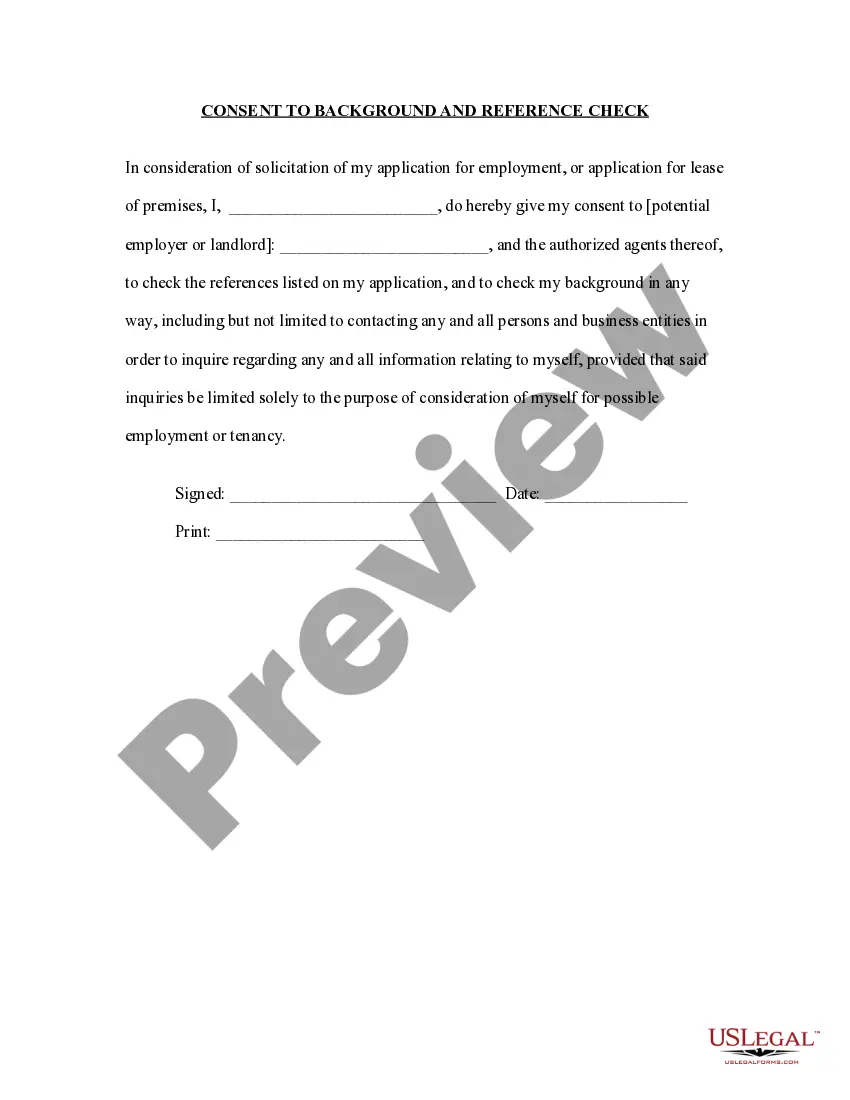

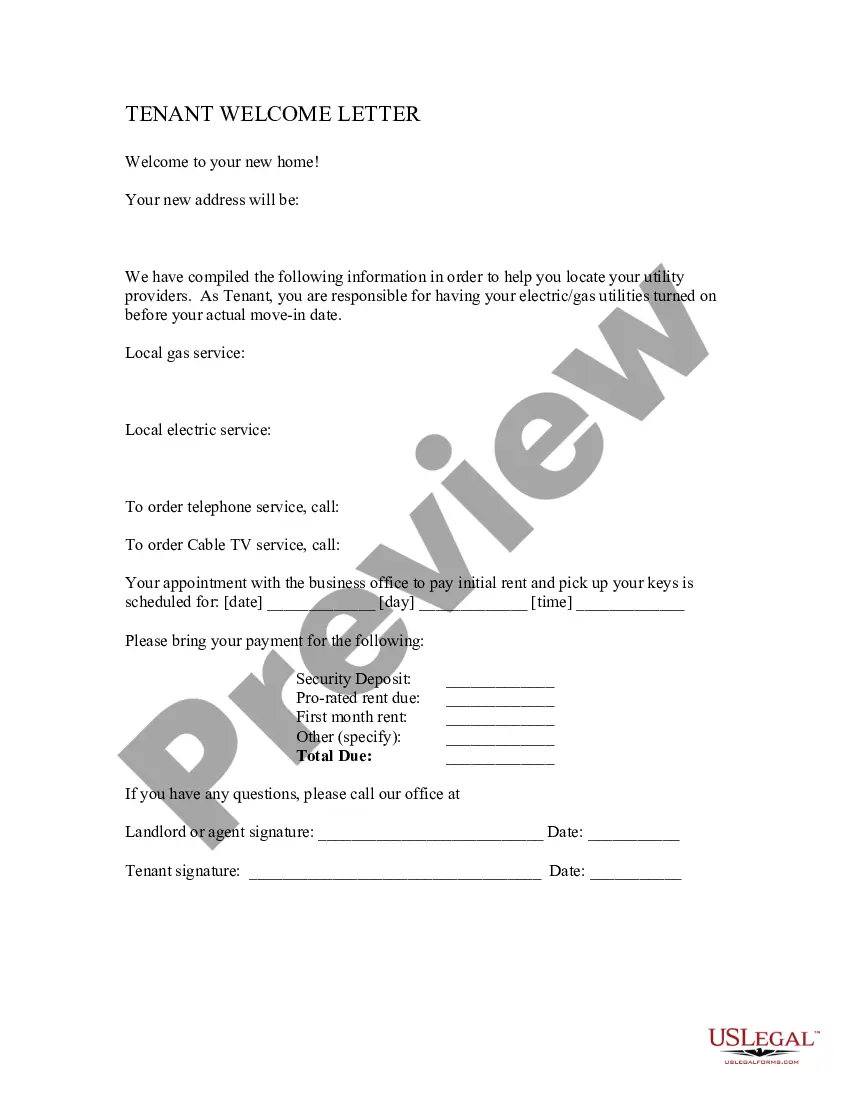

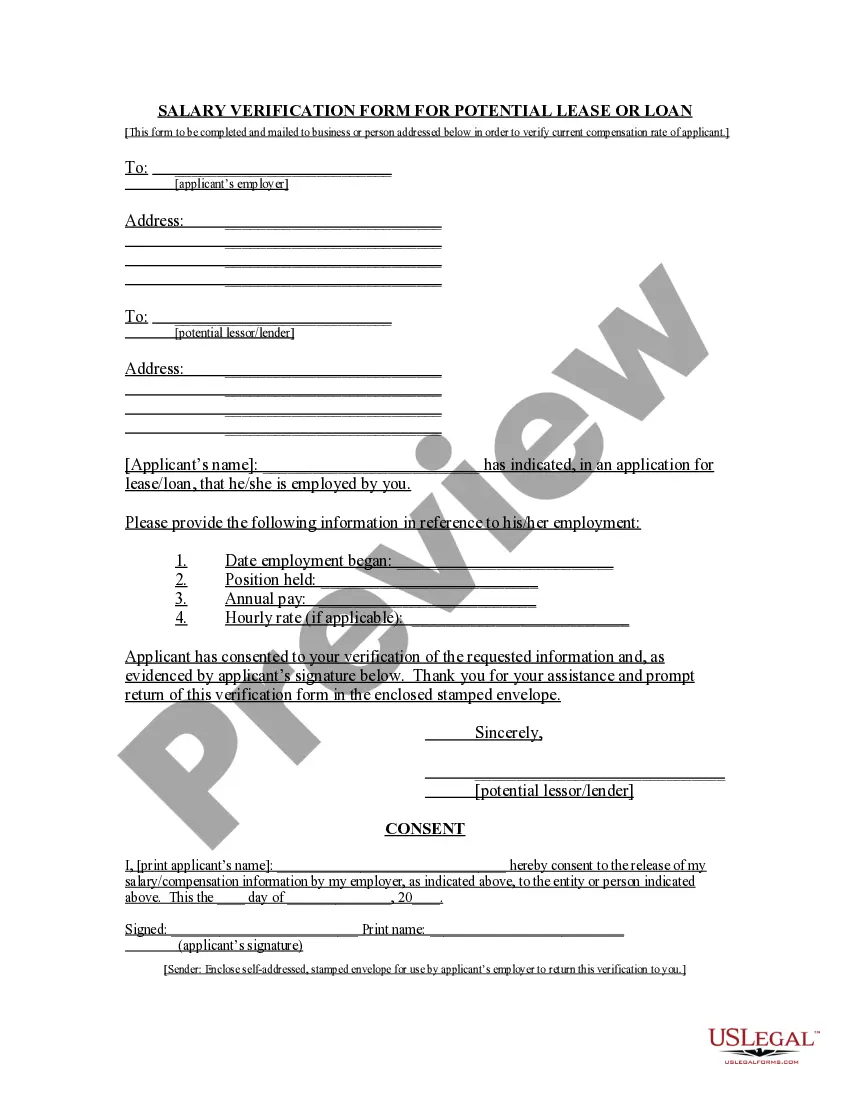

This Salary Verification form for Potential Lease is a form to be sent to a potential tenant's employer, in order for the Landlord to verify the lease applicant's income as reported on an application for lease (please see Form -827LT "Application for Residential Lease"). A Tenant Consent Form comes with the Salary Verification Form, and should also be sent to the employer.

Connecticut Salary Verification form for Potential Lease

Description

How to fill out Connecticut Salary Verification Form For Potential Lease?

The more paperwork you should make - the more anxious you are. You can get a huge number of Connecticut Salary Verification form for Potential Lease blanks on the web, nevertheless, you don't know those to have confidence in. Eliminate the headache to make getting samples more convenient with US Legal Forms. Get professionally drafted forms that are composed to meet state requirements.

If you already possess a US Legal Forms subscription, log in to your account, and you'll find the Download key on the Connecticut Salary Verification form for Potential Lease’s web page.

If you have never used our service before, finish the signing up process using these recommendations:

- Make sure the Connecticut Salary Verification form for Potential Lease applies in the state you live.

- Double-check your choice by reading the description or by using the Preview functionality if they’re available for the chosen record.

- Click Buy Now to start the signing up procedure and select a rates program that fits your expectations.

- Insert the asked for details to make your account and pay for your order with your PayPal or bank card.

- Pick a handy file format and take your copy.

Find each document you get in the My Forms menu. Simply go there to prepare fresh version of your Connecticut Salary Verification form for Potential Lease. Even when using professionally drafted web templates, it’s nevertheless essential that you consider asking the local lawyer to double-check filled out form to be sure that your record is correctly filled in. Do much more for less with US Legal Forms!

Form popularity

FAQ

(tie) Dabo Swinney, South Carolina $9.3 million. (tie) John Calipari, Kentucky $9.3 million. Nick Saban, Alabama $8.9 million. (tie) Jim Harbaugh, Michigan $7.5 million. (tie) Jimbo Fisher, Texas $7.5 million.

The average employee salary for the State of Connecticut in 2020 was $71,625. This is 16.2 percent higher than the national average for government employees and 26.6 percent higher than other states.

The term payroll taxes refers to FICA taxes, which is a combination of Social Security and Medicare taxes. These taxes are deducted from employee paychecks at a total flat rate of 7.65 percent that's split into the following percentages: Medicare taxes 1.45 percent. Social Security taxes 6.2 percent.

FICA Taxes - Who Pays What? Withhold half of the total (7.65% = 6.2% for Social Security plus 1.45% for Medicare) from the employee's paycheck. For the employee above, with $1,500 in weekly pay, the calculation is $1,500 x 7.65% (. 0765) for a total of $114.75.

Divide the sum of all assessed taxes by the employee's gross pay to determine the percentage of taxes deducted from a paycheck. Taxes can include FICA taxes (Medicare and Social Security), as well as federal and state withholding information found on a W-4.

Divide the sum of all assessed taxes by the employee's gross pay to determine the percentage of taxes deducted from a paycheck. Taxes can include FICA taxes (Medicare and Social Security), as well as federal and state withholding information found on a W-4.

What is the formula for salary calculation? Take Home Salary = Gross Salary - Income Tax - Employee's PF Contribution(PF) - Prof. Tax. Gross Salary = Cost to Company (CTC) - Employer's PF Contribution (EPF) - Gratuity.

Connecticut State Payroll Taxes It's a progressive income tax that ranges from 3% to 6.99%.

The average employee salary for the State of Connecticut in 2020 was $71,625. This is 16.2 percent higher than the national average for government employees and 26.6 percent higher than other states.