A Connecticut Release of Mortgage or Lien is a legal document that releases a lien or mortgage on a property in the state of Connecticut. This document is typically used when a mortgage has been paid in full or when a lien on a property has been released. There are two types of Connecticut Release of Mortgage or Lien: the Release of Mortgage and the Release of Lien. The Release of Mortgage is used when a borrower has paid off their mortgage and the lien is released. The Release of Lien is used when a lien on a property has been released, such as when the lien holder has been paid the amount owed. Both documents are required to be filed with the Connecticut Secretary of the State.

Connecticut Release of Mortgage Or Lien

Description

How to fill out Connecticut Release Of Mortgage Or Lien?

How much duration and resources do you typically utilize in creating official documentation.

There’s a superior method to obtain such forms than employing legal professionals or wasting hours searching the internet for an appropriate template. US Legal Forms is the foremost online repository that offers expertly crafted and verified state-specific legal forms for any intention, such as the Connecticut Release of Mortgage Or Lien.

Another advantage of our library is that you can retrieve previously acquired documents that you securely store in your profile under the My documents tab. Access them at any time and recompile your paperwork as frequently as you require.

Conserve time and energy managing official documents with US Legal Forms, one of the most dependable online solutions. Join us today!

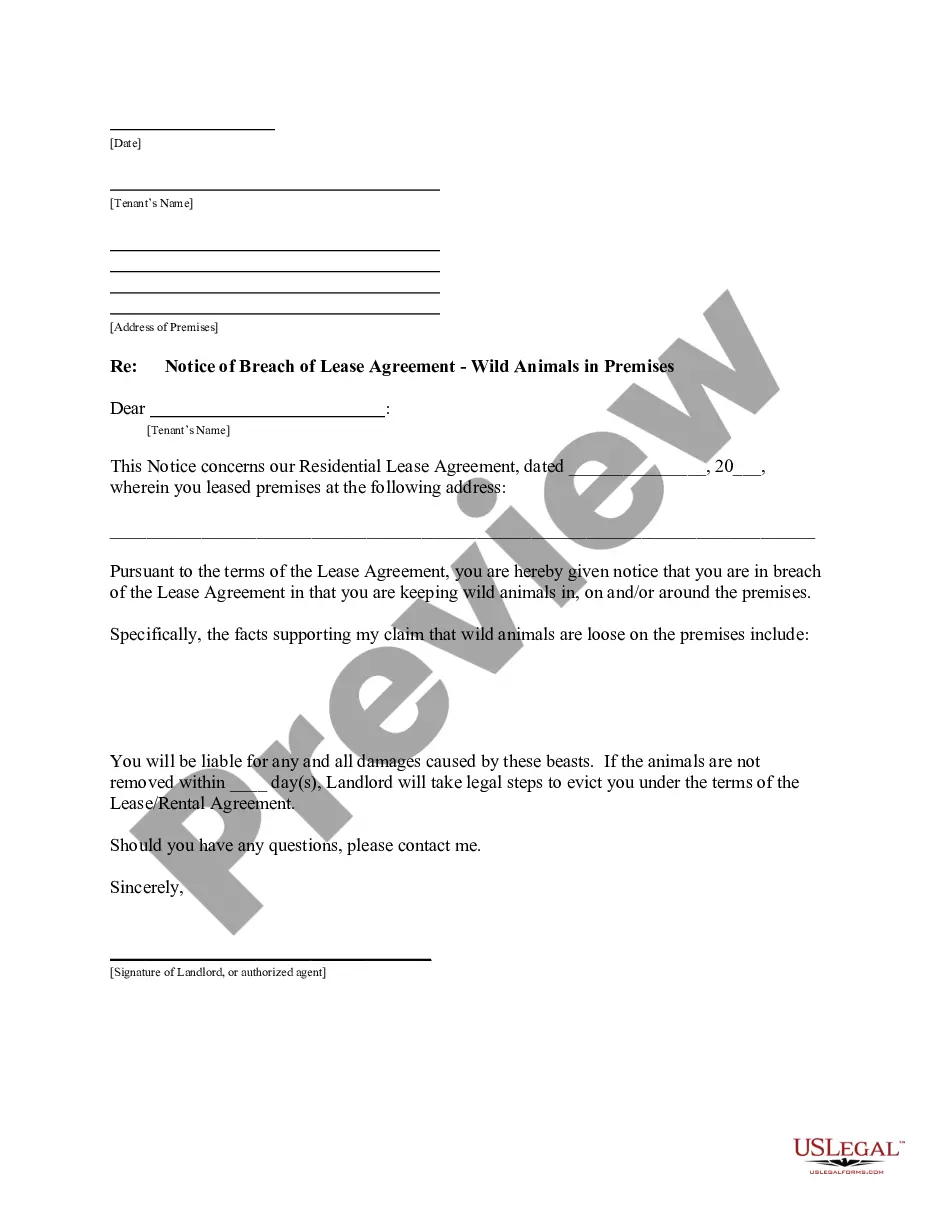

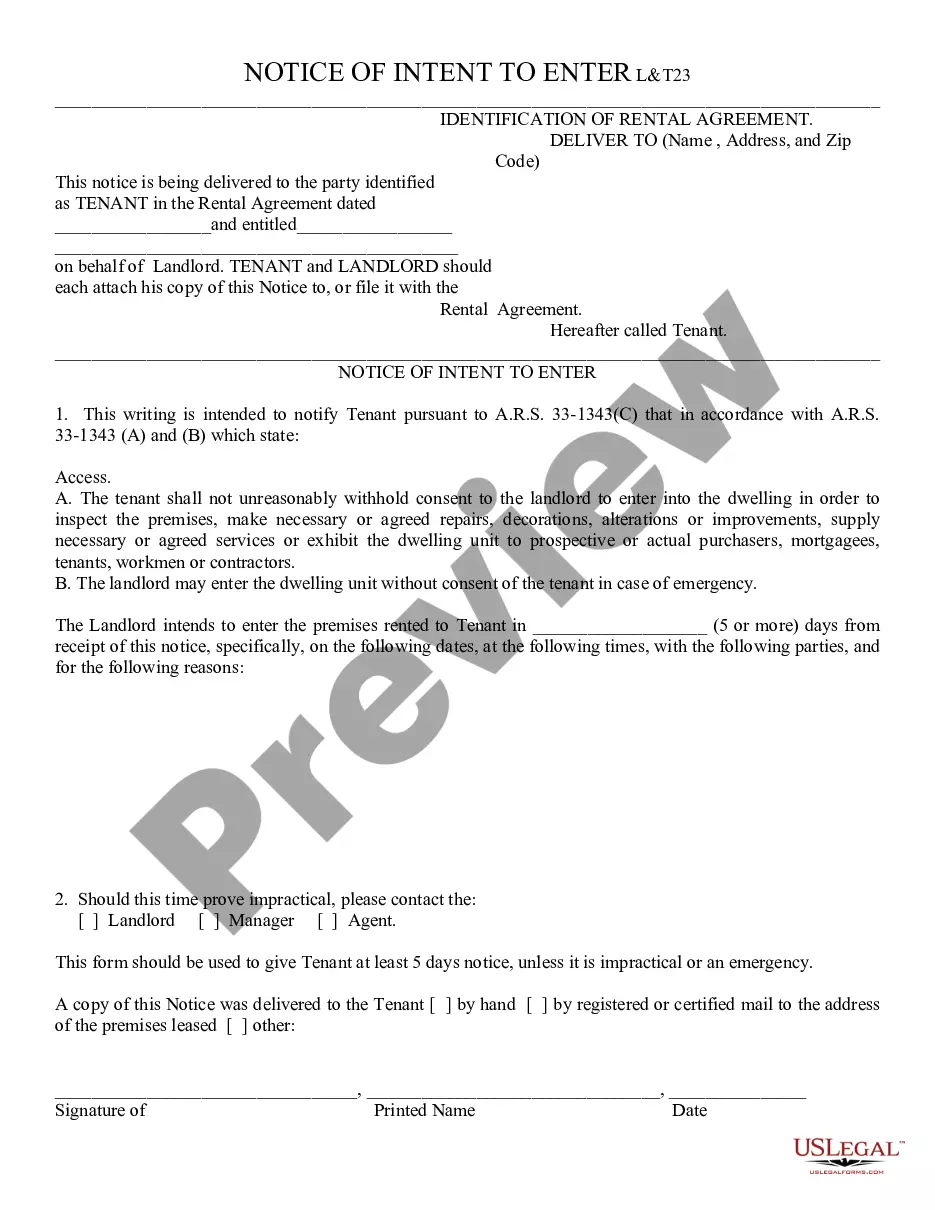

- Review the form content to ensure it complies with your state regulations. To do this, consult the form description or utilize the Preview option.

- If your legal template does not meet your requirements, find another one using the search tab at the top of the site.

- If you are already registered with our service, Log In and download the Connecticut Release of Mortgage Or Lien. If not, proceed to the next steps.

- Click Buy now once you identify the appropriate blank. Select the subscription plan that best fits you to unlock our full library’s offerings.

- Create an account and pay for your subscription. You can conduct a transaction with your credit card or via PayPal - our service is completely trustworthy for that.

- Download your Connecticut Release of Mortgage Or Lien onto your device and fill it out on a printed form or electronically.

Form popularity

FAQ

Connecticut General Statutes 49 8 addresses the implications of a failure to release a mortgage or lien within a specified timeframe. This statute is vital for those seeking a Connecticut Release of Mortgage Or Lien, as it provides property owners with the right to enforce the release, ensuring they can clear their title promptly. Using platforms like uslegalforms can simplify this process and provide necessary legal guidance.

CT General Statute 31 49 involves employment practices and workplace protections under Connecticut law. While this statute may not relate directly to a Connecticut Release of Mortgage Or Lien, understanding the broader legal environment is valuable for property owners, especially when considering the impact of employment situations on property finances or liens.

Connecticut General Statutes Section 4a 60 pertains to the procurement process of state contracts, emphasizing fair practices. Although it is not directly connected to a Connecticut Release of Mortgage Or Lien, it highlights the state's commitment to equitable dealings, which can impact various legal processes, including those related to property titles and mortgages.

The Connecticut General Statutes address interference with an officer under specific provisions, which can lead to legal consequences. While these statutes are not directly related to a Connecticut Release of Mortgage Or Lien, knowing your rights and responsibilities is essential if you face legal issues regarding property transactions. A comprehensive understanding can help you navigate these matters effectively.

Section 49 2 of the Connecticut General Statutes outlines the process for a Connecticut Release of Mortgage Or Lien. Specifically, it details the actions required to formally discharge a mortgage or lien on a property once the underlying obligation has been satisfied. Understanding this section is crucial for property owners looking to clear their titles.

In Connecticut, a lien can be placed under specific conditions, such as an unpaid debt or a legal obligation. The debt must be verifiable, and the proper legal channels must be followed when filing. Understanding these conditions is vital for anyone looking to execute a Connecticut Release of Mortgage Or Lien effectively.

Completing a lien release involves filling out a lien release form that details the property and the original lien. Ensure that all required parties sign the document to validate the release. Afterward, file this form with the town clerk's office so that the Connecticut Release of Mortgage Or Lien is officially recognized.

Filing a lien on a property in Connecticut requires filling out the appropriate forms and submitting them to the town clerk's office in your local area. Be sure to include all pertinent information regarding the property and the obligation. If you need assistance, consider using services like uslegalforms, which can guide you through the Connecticut Release of Mortgage Or Lien process.

To release a lien in Connecticut, you must complete a lien release form and file it with the town clerk where the lien was originally recorded. It's important to ensure that all relevant parties have signed the release, verifying that the obligation has been satisfied. By following these steps, you can effectively initiate the Connecticut Release of Mortgage Or Lien process.

In Connecticut, you generally have one year from the time the debt was incurred to file a lien. This timeline is critical as waiting too long can result in losing your right to claim on the property. Thus, if you're considering a Connecticut Release of Mortgage Or Lien, act promptly to secure your interests.