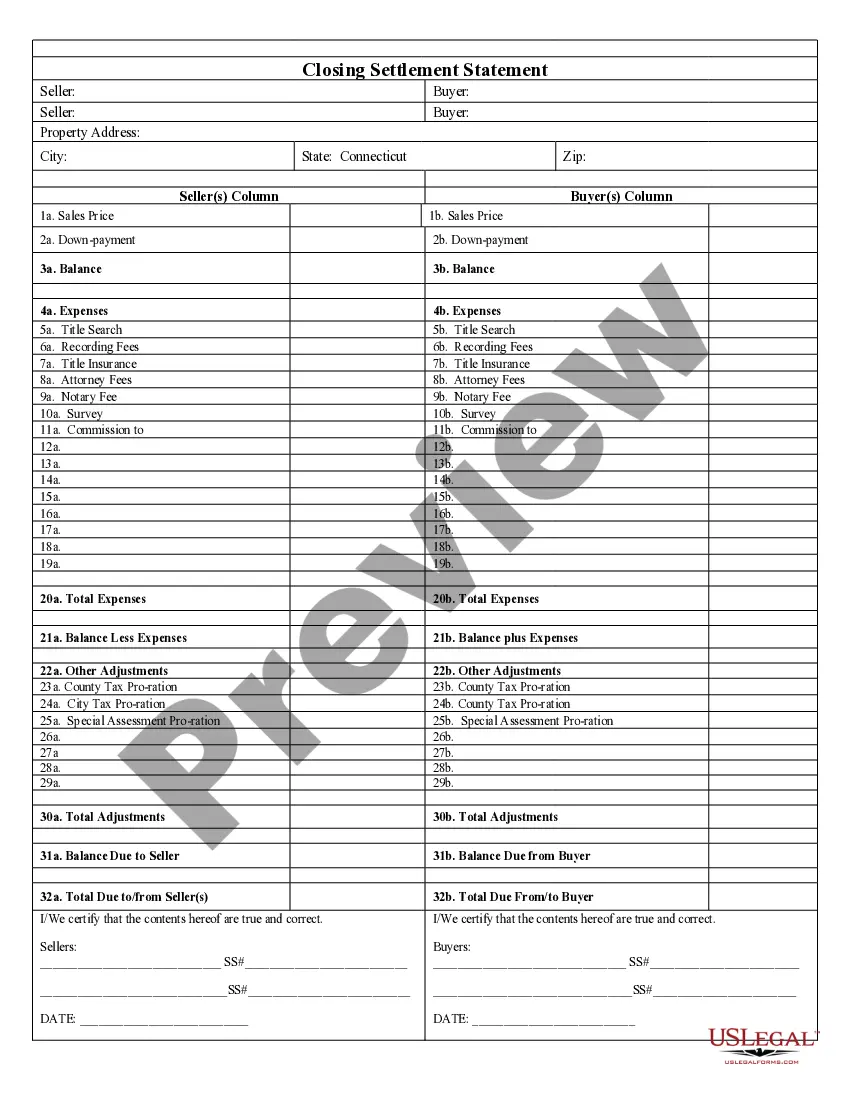

Connecticut Closing Statement

Description Connecticut Statement Uslegal

How to fill out Connecticut Closing Uslegal?

The more documents you have to make - the more anxious you become. You can get a huge number of Connecticut Closing Statement blanks online, still, you don't know those to have confidence in. Get rid of the headache and make detecting exemplars easier employing US Legal Forms. Get professionally drafted forms that are written to meet state requirements.

If you already possess a US Legal Forms subscription, log in to your account, and you'll find the Download button on the Connecticut Closing Statement’s page.

If you have never used our platform before, finish the sign up process with the following guidelines:

- Make sure the Connecticut Closing Statement is valid in your state.

- Double-check your option by reading through the description or by using the Preview functionality if they’re provided for the chosen record.

- Click on Buy Now to start the sign up procedure and choose a costs program that meets your requirements.

- Provide the asked for details to create your account and pay for your order with the PayPal or credit card.

- Select a hassle-free file format and have your sample.

Find every file you obtain in the My Forms menu. Simply go there to prepare fresh copy of the Connecticut Closing Statement. Even when preparing professionally drafted templates, it is still vital that you consider asking your local lawyer to twice-check filled in form to be sure that your record is correctly completed. Do much more for less with US Legal Forms!

Connecticut Closing Settlement Form Print Form popularity

Connecticut Statement File Other Form Names

31a 17b Adjustments FAQ

To obtain a copy of your Connecticut Closing Statement, you can contact the closing agent or attorney who handled your transaction. They are responsible for preparing and distributing this document to involved parties. If you used the US Legal Forms platform, you could also access your closing statement through your account. This service streamlines the process, making it easier for you to manage your real estate documents.

The Connecticut Closing Statement is typically provided to several parties involved in a real estate transaction. This includes the buyer, the seller, and their respective attorneys. Each party needs this document to understand the financial details of the transaction. If you work with a real estate agent or attorney, they will ensure you receive your copy of the Connecticut Closing Statement.

After selling a car, you must complete the transfer section of the title. Fill out the buyer's name, the sale date, and the sale amount. Both you and the buyer need to sign the document to validate the transfer. Completing this process correctly is vital for your Connecticut Closing Statement, ensuring everything is filed accurately.

To fill out a Connecticut registration and title application, start by entering the vehicle's information such as make, model, year, and identification number. You'll also need to provide personal information including your name and address. Don’t forget to check all requirements and fees associated with the application process, as these will be important for your Connecticut Closing Statement.

Closing costs refer to the charges and fees that are paid when a house purchase is finalized.Typically, the buyer's costs include mortgage insurance, homeowner's insurance, appraisal fees and property taxes, while the seller covers ownership transfer fees and pays a commission to their real estate agent.

Title fees (or attorney fees) Pre-paids and escrow (property taxes and homeowner's insurance) Mortgage insurance. Loan-related fees (lender fees) Property-related fees (may also be found in lender fees)

The general rule is that buyers should expect to spend anywhere from 2% to 5% of the purchase price of their home on closing costs. The median list price in Connecticut is $243,700. If you purchase a home for that amount, you should expect to spend anywhere from $4,874 to $12,185 in closing costs at a minimum.

File a final sales and use tax return (Form OS-114). Write the word "FINAL" prominently across the top of the return (OS-114); Fill out the back of the Sales and Use Tax Permit (blue card) with your last date of business, and enclose it with the final return; and.

The general rule is that buyers should expect to spend anywhere from 2% to 5% of the purchase price of their home on closing costs. The median list price in Connecticut is $243,700. If you purchase a home for that amount, you should expect to spend anywhere from $4,874 to $12,185 in closing costs at a minimum.

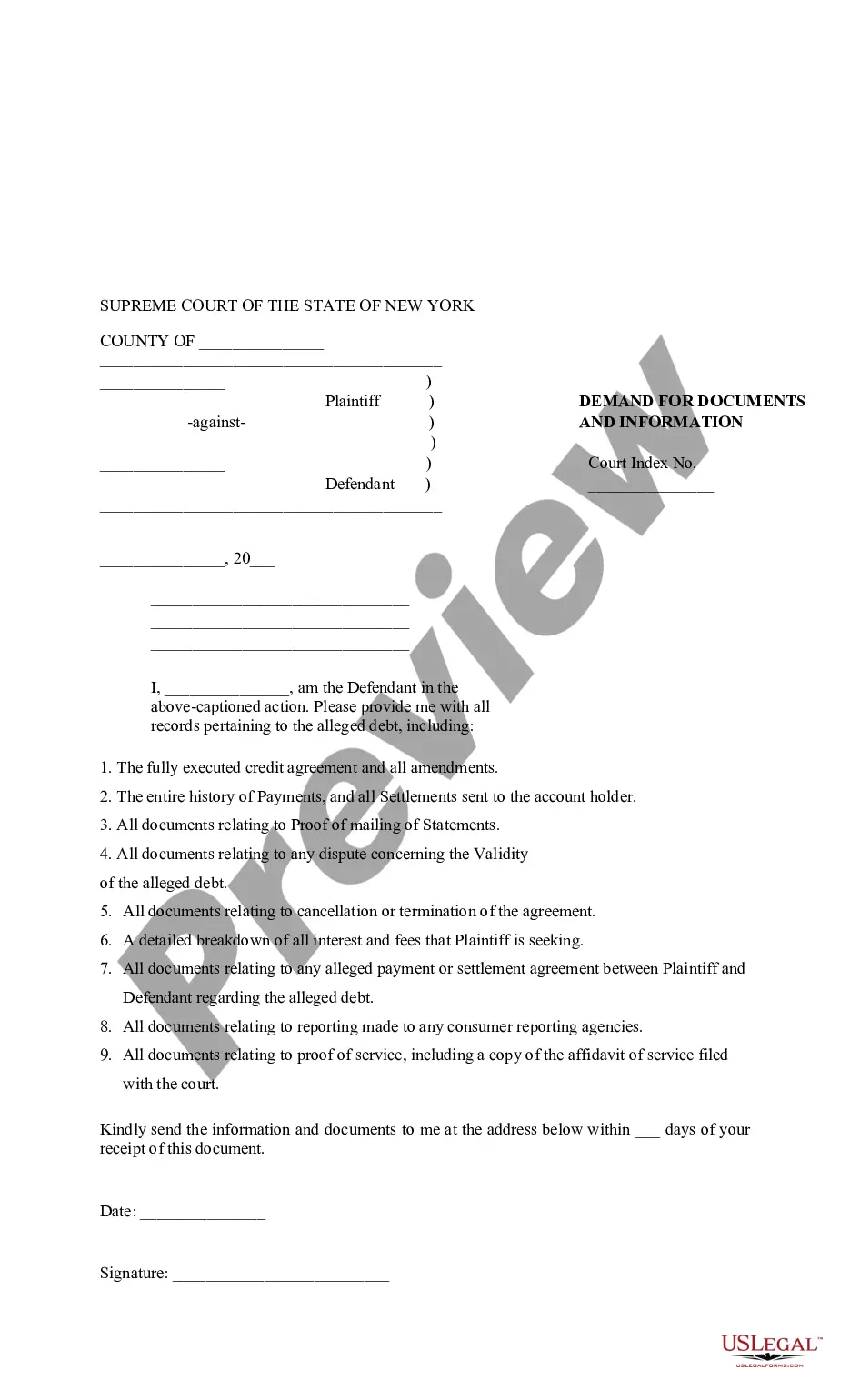

A closing statement is a document that records the details of a financial transaction. A home buyer who finances the purchase will receive a closing statement from the bank, while the home seller will receive one from the real estate agent who handled the sale.