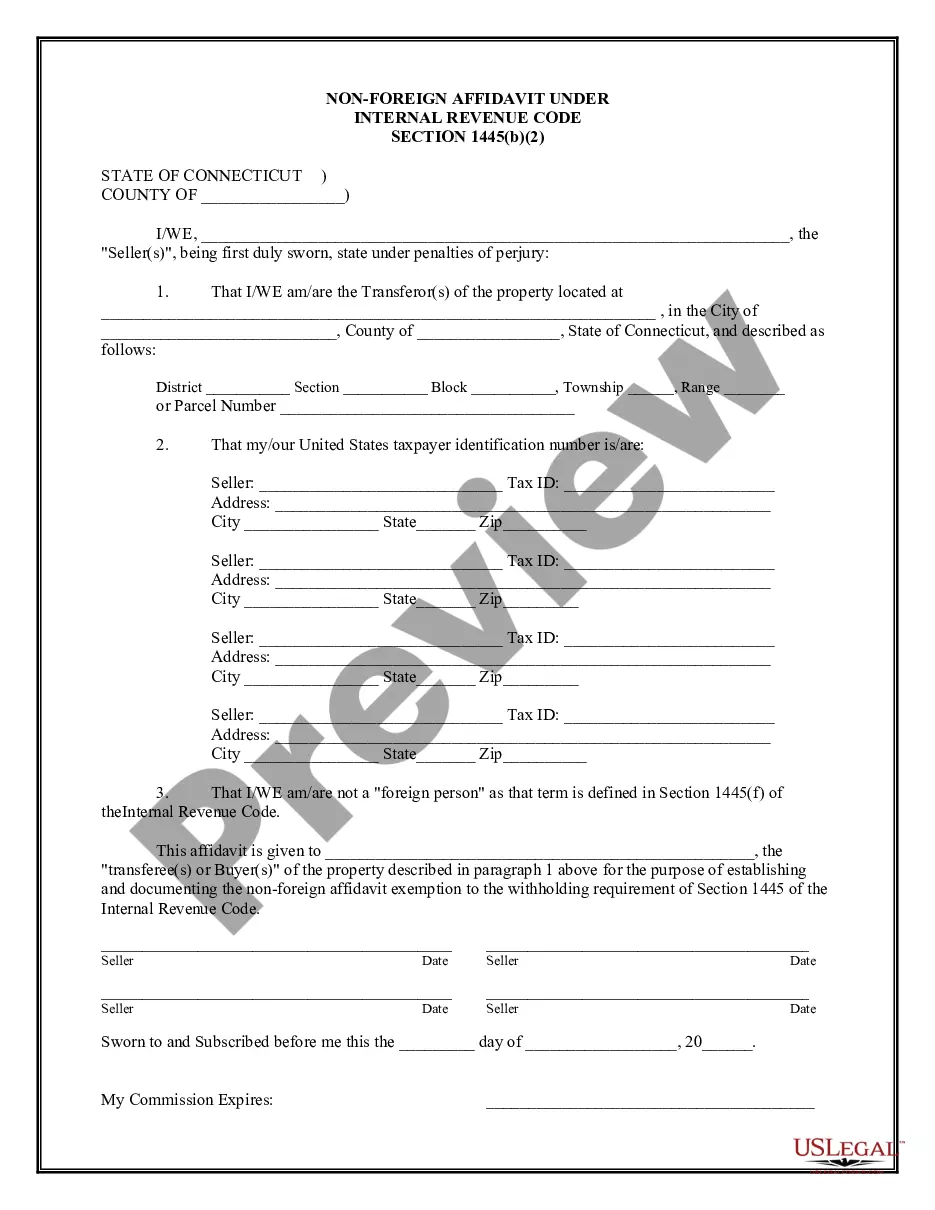

Connecticut Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Connecticut Non-Foreign Affidavit Under IRC 1445?

The greater number of documents you should create - the more stressed you become. You can find a huge number of Connecticut Non-Foreign Affidavit Under IRC 1445 blanks online, nevertheless, you don't know those to have confidence in. Get rid of the headache to make detecting exemplars far more convenient employing US Legal Forms. Get skillfully drafted documents that are published to meet state requirements.

If you already possess a US Legal Forms subscribing, log in to the account, and you'll find the Download option on the Connecticut Non-Foreign Affidavit Under IRC 1445’s web page.

If you’ve never used our service before, complete the registration procedure using these steps:

- Check if the Connecticut Non-Foreign Affidavit Under IRC 1445 applies in your state.

- Double-check your option by reading through the description or by using the Preview function if they are available for the chosen file.

- Click Buy Now to begin the signing up process and choose a rates plan that meets your expectations.

- Provide the asked for info to make your account and pay for the order with the PayPal or credit card.

- Select a hassle-free document type and get your duplicate.

Find each template you download in the My Forms menu. Simply go there to fill in new duplicate of your Connecticut Non-Foreign Affidavit Under IRC 1445. Even when using professionally drafted web templates, it’s still vital that you consider requesting the local attorney to re-check completed sample to make certain that your record is correctly completed. Do more for less with US Legal Forms!

Form popularity

FAQ

The IRS considers a foreign person to be any individual, corporation, partnership, trust, or estate that is not a U.S. citizen or resident alien. This definition can include non-U.S. entities involved in real estate transactions. To avoid the complications associated with FIRPTA assessments, sellers can utilize a Connecticut Non-Foreign Affidavit Under IRC 1445 to verify their status and ensure a smoother sale process.

The 1445 form is an essential document used to report the sale of U.S. real estate by foreign persons. It enables withholding agents to report the required withholding amounts to the IRS. Sellers can streamline this process by submitting a Connecticut Non-Foreign Affidavit Under IRC 1445, which helps clarify their non-foreign status and alleviates withholding obligations.

A FIRPTA statement typically confirms the seller's status as a non-foreign person, ensuring that the buyer is not required to withhold taxes from the sale proceeds. For example, a statement might include the seller's name, tax identification number, and a declaration of their non-foreign status under the guidelines of the Connecticut Non-Foreign Affidavit Under IRC 1445. This document serves to protect both the seller and buyer during the transaction.

IRS Notice 1445 addresses the withholding requirements for foreign sales of U.S. real estate. This notice outlines the necessary steps buyers must follow to comply with FIRPTA and protect themselves from potential tax liabilities. By utilizing a Connecticut Non-Foreign Affidavit Under IRC 1445, sellers can assert their non-foreign status, easing the burden of withholding during the sale.

If a seller is classified as a foreign person, the buyer must withhold a portion of the sale proceeds under the Foreign Investment in Real Property Tax Act (FIRPTA). This requirement stems from the need to ensure tax compliance for foreign entities selling real estate in the United States. To navigate this process efficiently, sellers can use a Connecticut Non-Foreign Affidavit Under IRC 1445 to confirm their non-foreign status and help avoid unnecessary withholding.

Yes, a FIRPTA affidavit often needs to be notarized to ensure its validity. Notarization adds a layer of authenticity to the document, especially in the context of the Connecticut Non-Foreign Affidavit Under IRC 1445. It's typically recommended to have a notary present at the signing to facilitate this process.

The seller of the property typically signs the FIRPTA certificate, affirming their status as a non-foreign person. This signature is a critical component of the Connecticut Non-Foreign Affidavit Under IRC 1445, and it adds credibility to the document. It's advisable to consult with a legal professional for proper procedures when executing this certificate.

A certificate that the seller is not a foreign person is a legal document, often part of a FIRPTA affidavit, confirming the seller's tax status. This certificate is key to the Connecticut Non-Foreign Affidavit Under IRC 1445, as it allows the buyer to avoid withholding federal tax on the proceeds of the sale. Alongside the affidavit, this ensures compliance with tax regulations.

A section 1445 affidavit is a document that certifies a seller is not a foreign person, thus exempting the buyer from withholding tax under FIRPTA. This is an essential aspect of the Connecticut Non-Foreign Affidavit Under IRC 1445, as it simplifies the sales process. Obtaining this affidavit helps protect both parties from unnecessary tax liabilities.

Form 8288 is usually prepared by the buyer or their representative, who is responsible for withholding tax on the sale of the property. In relation to the Connecticut Non-Foreign Affidavit Under IRC 1445, this form must be filed with the IRS to report the withholding. It's crucial to ensure that all necessary documents are in order to avoid possible penalties.