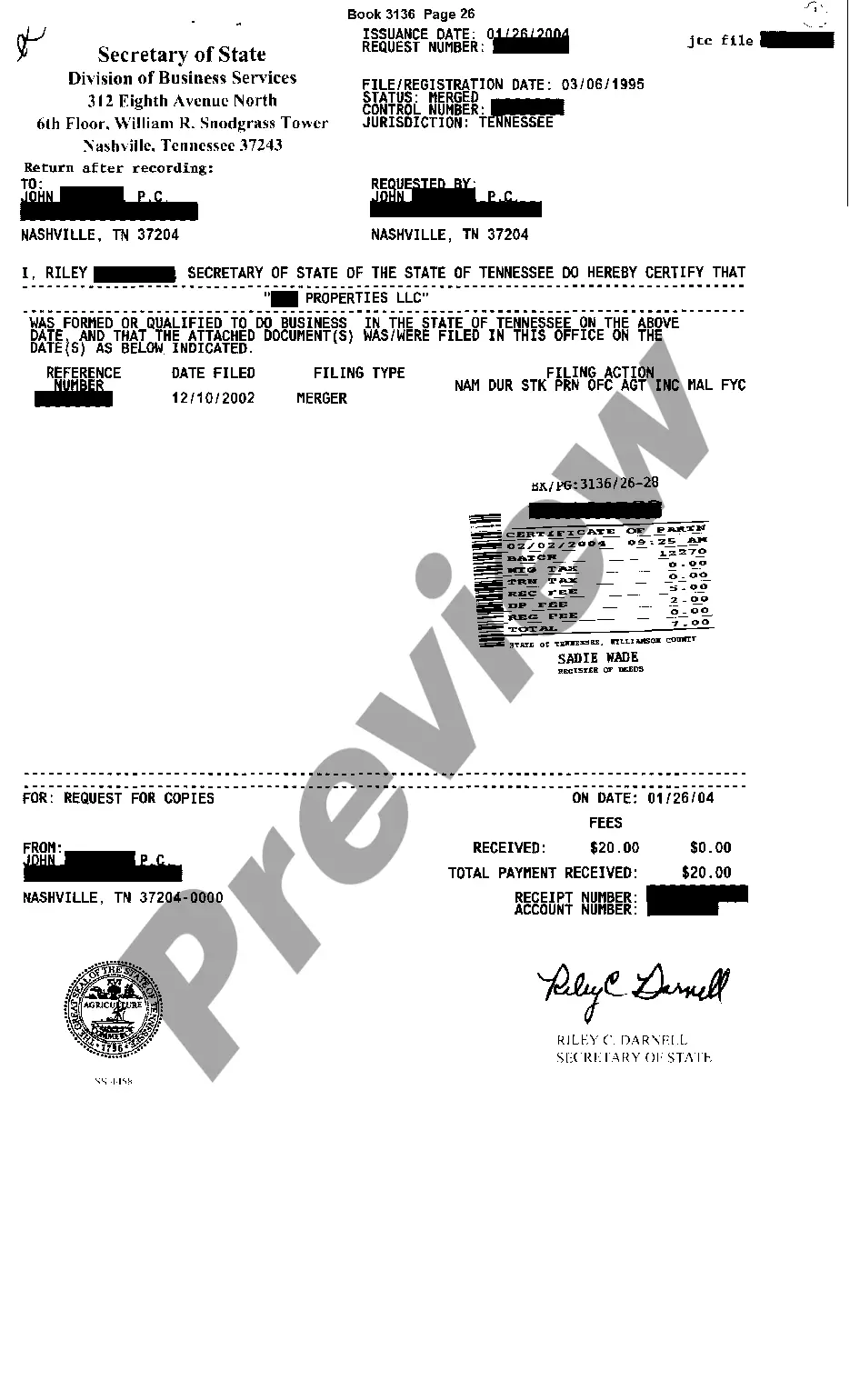

The dissolution package contains all forms to dissolve a LLC or PLLC in Connecticut, step by step instructions, addresses, transmittal letters, and other information.

Connecticut Dissolution Package to Dissolve Limited Liability Company LLC

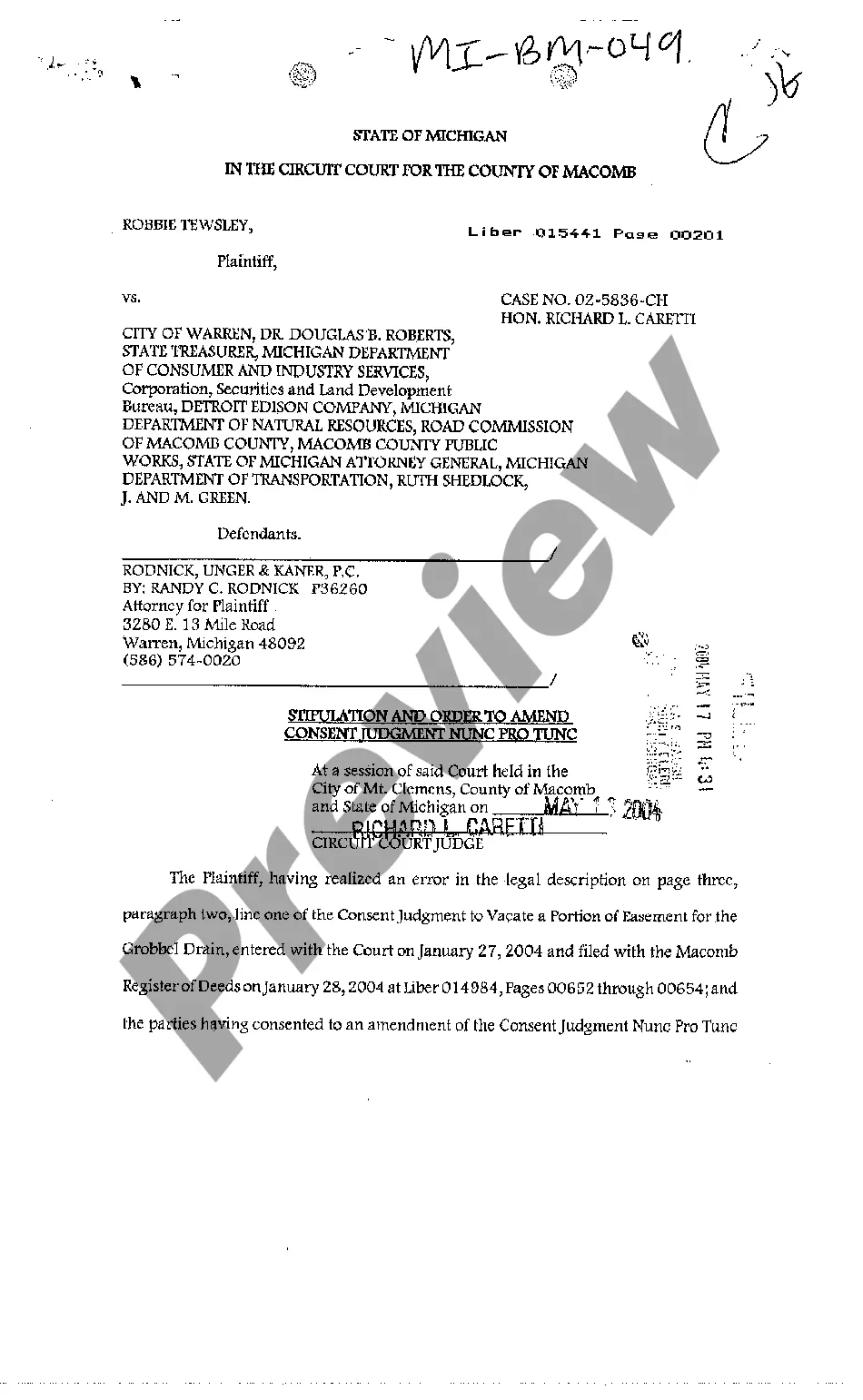

Description Dissolve Llc In Ct

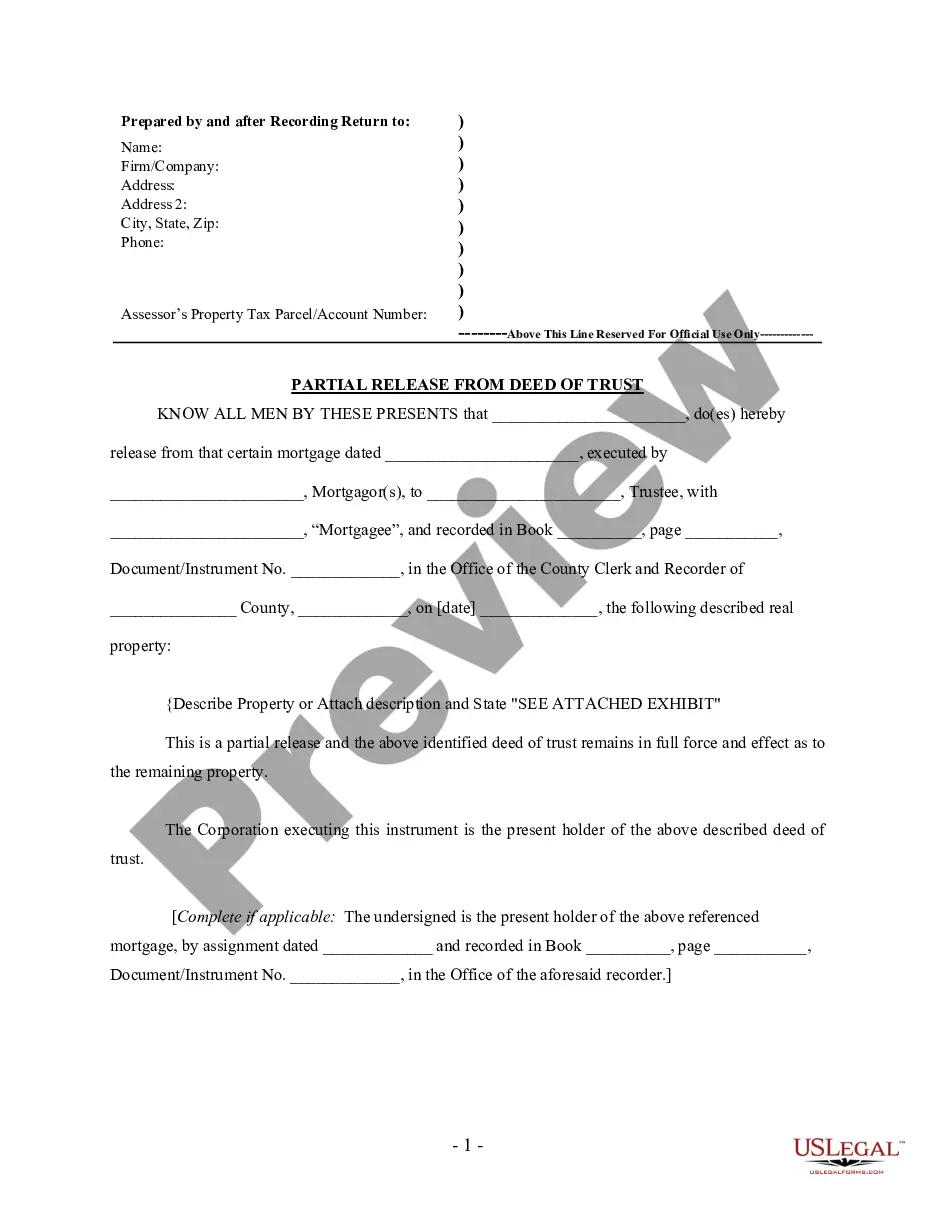

How to fill out Except As Otherwise Provided?

The more paperwork you need to prepare - the more anxious you are. You can find thousands of Connecticut Dissolution Package to Dissolve Limited Liability Company LLC templates on the internet, nevertheless, you don't know which ones to rely on. Eliminate the hassle to make finding samples easier using US Legal Forms. Get accurately drafted forms that are written to satisfy state specifications.

If you currently have a US Legal Forms subscribing, log in to your account, and you'll find the Download option on the Connecticut Dissolution Package to Dissolve Limited Liability Company LLC’s webpage.

If you’ve never applied our website earlier, complete the signing up procedure using these instructions:

- Make sure the Connecticut Dissolution Package to Dissolve Limited Liability Company LLC is valid in the state you live.

- Double-check your option by studying the description or by using the Preview function if they’re provided for the selected file.

- Click on Buy Now to get started on the sign up procedure and select a rates program that suits your preferences.

- Insert the asked for details to make your profile and pay for your order with the PayPal or credit card.

- Choose a practical file formatting and have your copy.

Find every template you download in the My Forms menu. Simply go there to fill in new duplicate of the Connecticut Dissolution Package to Dissolve Limited Liability Company LLC. Even when having professionally drafted web templates, it is still vital that you think about requesting the local attorney to double-check filled in form to be sure that your document is correctly filled in. Do much more for less with US Legal Forms!

Ct Llc Form popularity

Ct Company Llc Other Form Names

How To Close Llc In Ct FAQ

Dissolving an LLC can have various tax implications, including the need to report any gains or losses on your final tax return. Additionally, personal liability may arise if corporate formalities were not adhered to. A Connecticut Dissolution Package to Dissolve Limited Liability Company LLC can help clarify these consequences and ensure you fulfill all tax requirements.

Once your LLC is dissolved, you should notify creditors, settle remaining debts, and distribute any assets. It's also crucial to keep records of the dissolution for your personal files and tax records. Using a Connecticut Dissolution Package to Dissolve Limited Liability Company LLC can assist you in managing these post-dissolution tasks effectively.

Yes, you must notify the IRS when you close your LLC. This includes filing your final tax return and marking it as such. A Connecticut Dissolution Package to Dissolve Limited Liability Company LLC will provide guidance on these vital steps, ensuring you meet your tax obligations upon dissolution.

Dissolving an LLC can be straightforward if you follow the correct procedures. The process typically involves filing the necessary paperwork and paying any fees. With a Connecticut Dissolution Package to Dissolve Limited Liability Company LLC, you gain access to resources that can assist you in navigating the process with ease.

To dissolve a Limited Liability Partnership (LLP) in Connecticut, file a Statement of Withdrawal with the Connecticut Secretary of State. Make sure to clear all financial obligations and notify all partners of the decision. Using a Connecticut Dissolution Package to Dissolve Limited Liability Company LLC can help streamline these steps and ensure all legal requirements are met.

Before dissolving your LLC, review your operating agreement and state regulations to ensure compliance. You should also settle any outstanding debts and obligations to prepare for the dissolution. Consider using a Connecticut Dissolution Package to Dissolve Limited Liability Company LLC to simplify this process and guide you through the necessary steps.

To get your LLC undissolved, start by contacting the state’s Secretary of State office to obtain the necessary reinstatement forms. You will need to provide information about your LLC, along with any outstanding fees. The Connecticut Dissolution Package to Dissolve Limited Liability Company LLC can assist you in navigating this process and help you gather all required documentation, making reinstatement straightforward.

The process to dissolve an LLC varies by state, but in Connecticut, it generally takes a few weeks after filing the necessary documents. This timeline can be affected by how quickly the state processes your request. To ensure a smooth and timely dissolution, utilizing the Connecticut Dissolution Package to Dissolve Limited Liability Company LLC is advisable, as it provides the required forms and guidance.

If you never dissolve your LLC, it remains legally active, even if it is not conducting business. This can lead to ongoing tax obligations and legal liabilities. Not addressing the dissolution can also incur additional fees, making it essential to consider a Connecticut Dissolution Package to Dissolve Limited Liability Company LLC to manage these responsibilities effectively.

To undissolve an LLC, you typically need to file specific paperwork with the state where your LLC was formed. This process involves submitting a reinstatement application along with any outstanding fees. Using the Connecticut Dissolution Package to Dissolve Limited Liability Company LLC can simplify this process, guiding you through the necessary steps and ensuring compliance with state regulations.