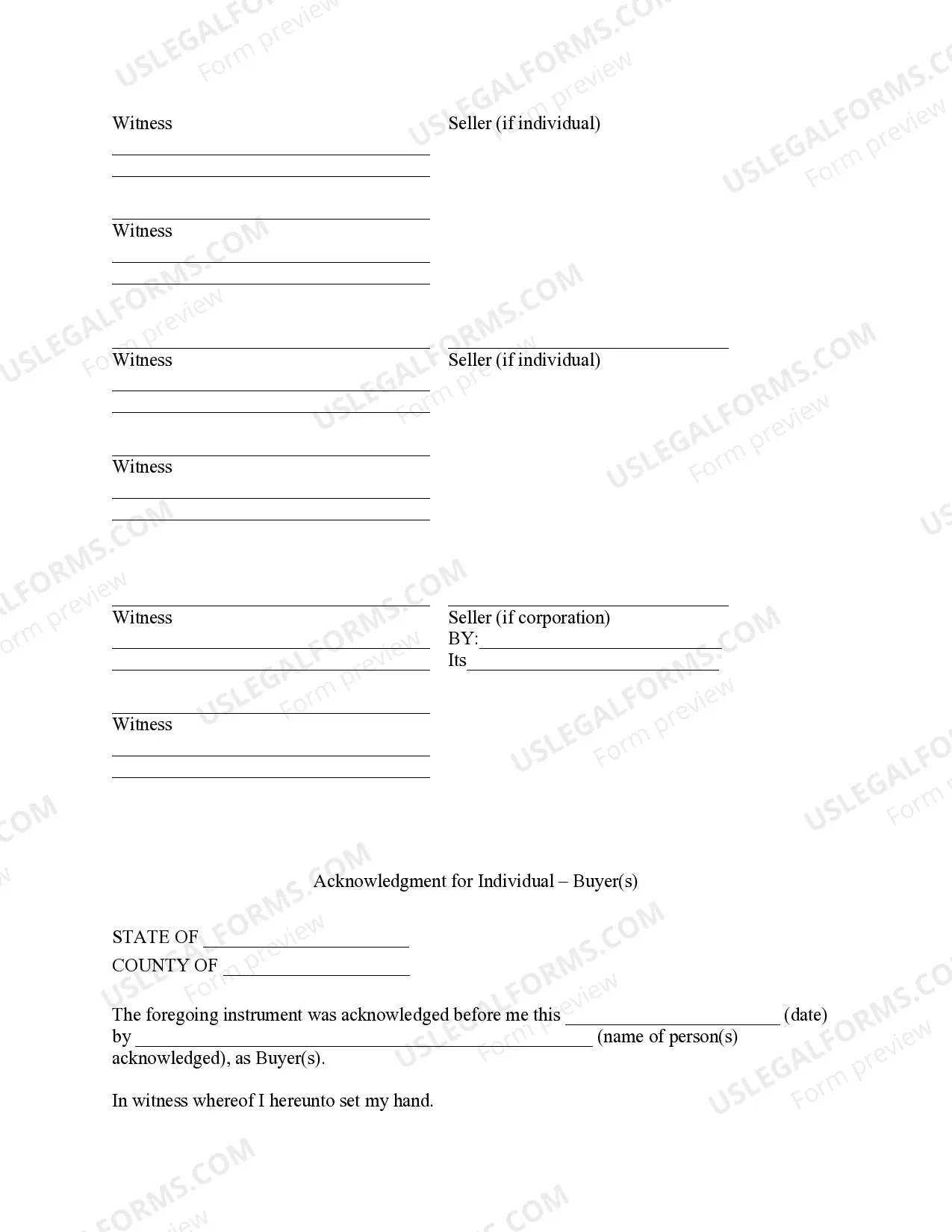

This is a contract whereby the buyer agrees to purchase all timber as designated for removal by the seller. Seller will also grant the buyer the right of ingress and egress to remove the timber from seller's land.

Connecticut Forest Products Timber Sale Contract

Description

How to fill out Connecticut Forest Products Timber Sale Contract?

The greater the number of documents you are required to create - the more anxious you become.

You can discover a vast array of Connecticut Forest Products Timber Sale Contract templates online, but you are uncertain which ones are reliable.

Eliminate the frustration of identifying samples with US Legal Forms to make the process much easier.

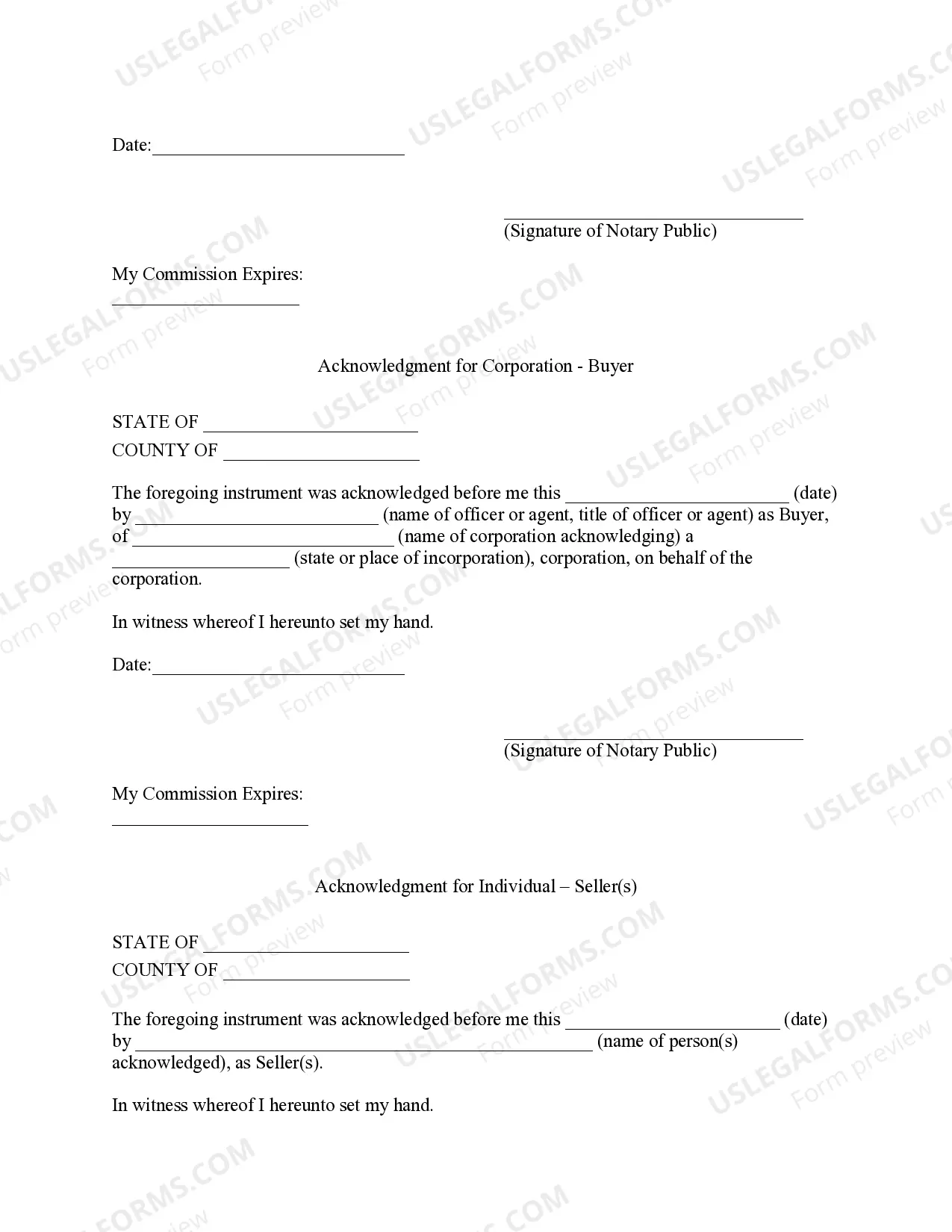

Provide the required information to create your profile and complete your payment using PayPal or a credit card. Select a convenient file format and obtain your template. Access all samples acquired in the My documents section. Just visit there to generate a new version of your Connecticut Forest Products Timber Sale Contract. Even when using well-structured templates, it is still advisable to consult your local attorney to verify that your document is properly completed. Achieve more for less with US Legal Forms!

- If you currently have a subscription with US Legal Forms, Log In to your account, and you will see the Download option on the page for the Connecticut Forest Products Timber Sale Contract.

- If you have not previously used our platform, follow these steps to sign up.

- Verify that the Connecticut Forest Products Timber Sale Contract is applicable in your state.

- Double-check your choice by reviewing the description or by utilizing the Preview feature if available for the selected document.

- Click Buy Now to initiate the registration process and choose a pricing plan that fits your needs.

Form popularity

FAQ

You absolutely can sell timber from your land, provided you own it. This process involves assessing the value of your timber and having a plan for the harvest and sale. A Connecticut Forest Products Timber Sale Contract can assist in structuring the sale, ensuring both parties abide by the agreed terms.

Yes, you can cut and sell timber from your own land, but you must follow local laws and regulations. It’s essential to have a basic understanding of the timber market in Connecticut. Utilizing a Connecticut Forest Products Timber Sale Contract can provide legal protection and ensure you follow the necessary procedures to sell your timber securely.

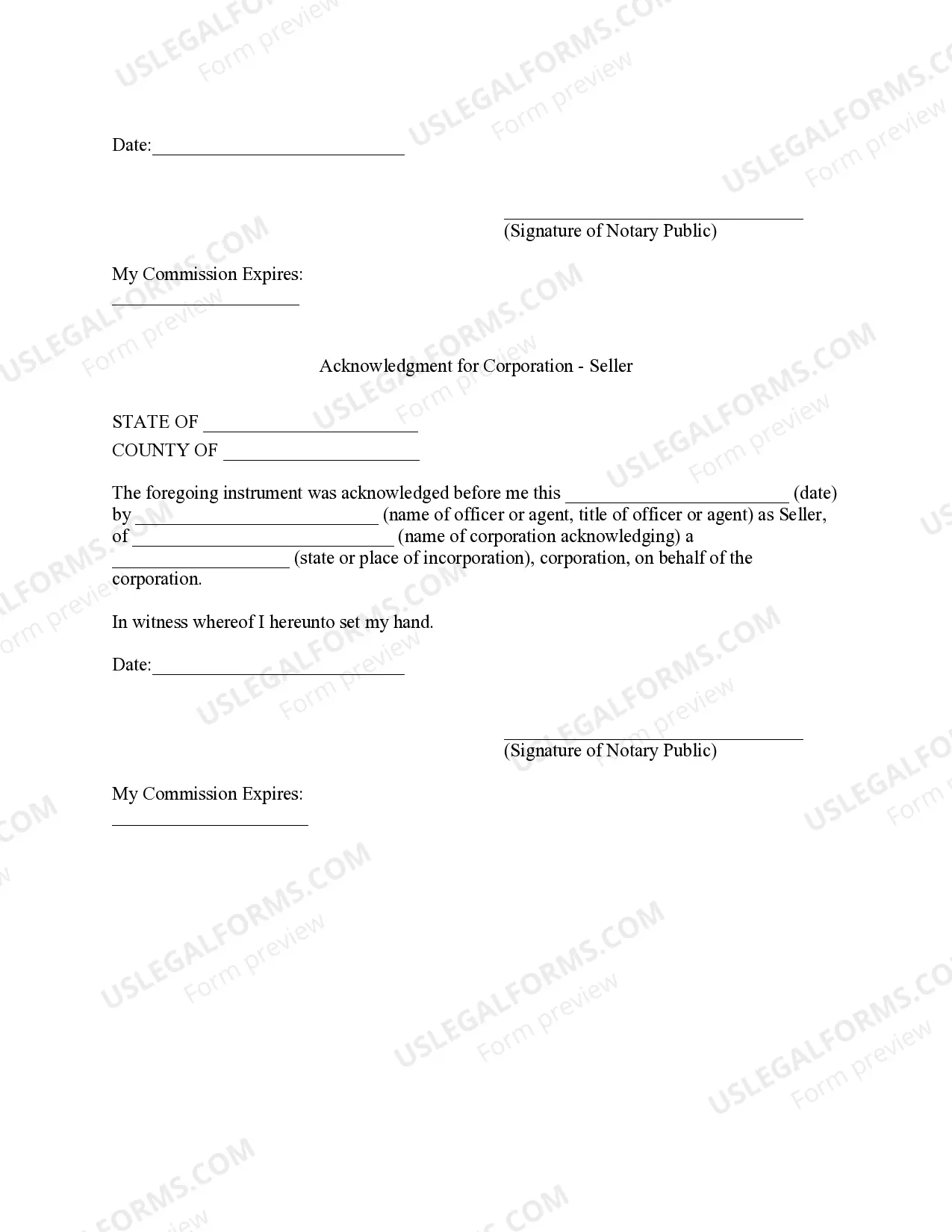

When you sell timber, you must report the sale on your tax return, as it is considered capital gains. Ensure you keep detailed records of your timber sale, including the amount received and expenses incurred. A Connecticut Forest Products Timber Sale Contract simplifes this process, helping you document the sale and potentially maximizing your tax benefits.

A logging contract outlines the terms and responsibilities involved in timber sales. When you use a Connecticut Forest Products Timber Sale Contract, it details key elements like payment structures, logging timeline, and the types of timber involved. Both parties sign the contract, ensuring clarity and mutual agreement. This formal agreement helps protect your interests and simplifies the transaction process.

Yes, the sale of timber is generally considered taxable income under U.S. tax law. When you engage in a timber sale using a Connecticut Forest Products Timber Sale Contract, you must report the proceeds on your tax return. It's important to keep detailed financial records to support any deductions you may claim. Consulting a tax professional can help you navigate this aspect efficiently.

To sell timber in Connecticut effectively, you typically need a minimum of 10 acres of forested land. This acreage allows you to meet the conditions outlined in the Connecticut Forest Products Timber Sale Contract. However, smaller parcels may also be sold depending on specific circumstances, making it essential to consult with an expert. They can help you determine the best approach based on your property.

When reporting timber sales on your tax return, you should use the Connecticut Forest Products Timber Sale Contract as a guide. This contract outlines the income received from the sale, which you need to declare. Additionally, you may be able to deduct certain expenses related to the timber sale, such as land improvement costs. Keeping thorough records ensures you comply with IRS regulations.

Selling timber on your property involves several steps, starting with assessing your timber's value. Then, creating a plan and understanding legal requirements, such as a Connecticut Forest Products Timber Sale Contract, is essential. Platforms like uslegalforms can guide you through the process, ensuring compliance and maximizing your financial return.

Yes, cutting down a tree in a national forest typically requires a permit. This regulation helps protect the forest ecosystem while ensuring sustainable practices. Thus, it's important to look into the specifics of a Connecticut Forest Products Timber Sale Contract to avoid potential legal issues.

Reporting timber sales on your taxes involves a few straightforward steps. You should keep careful records of your sale, including the Connecticut Forest Products Timber Sale Contract. This documentation allows you to report the income appropriately and claim any deductions related to management costs, helping you maximize your tax benefits.