Connecticut Sales Agreement — Foreclosure is a contract between a lender and a borrower that allows a lender to foreclose on a borrower's property in the event of a default on a loan. This agreement outlines the terms and conditions that must be met in order for the foreclosure to take place. There are two types of Connecticut Sales Agreement — Foreclosure: Judicial Foreclosure and Non-Judicial Foreclosure. Judicial Foreclosure requires court intervention and is the most common type of foreclosure in Connecticut. Non-Judicial Foreclosure does not require court intervention and is used when the borrower does not have the right to a court hearing. In both cases, the lender must provide the borrower with a notice of foreclosure before proceeding with the foreclosure.

Connecticut Sales Agreement - Foreclosure

Description

How to fill out Connecticut Sales Agreement - Foreclosure?

Completing formal documentation can be quite a hassle if you lack ready-to-use editable templates. With the US Legal Forms digital library of official documents, you can be confident in the forms you discover, as all are aligned with federal and state regulations and are verified by our experts.

Thus, if you wish to obtain Connecticut Sales Agreement - Foreclosure, our platform is the ideal location to download it.

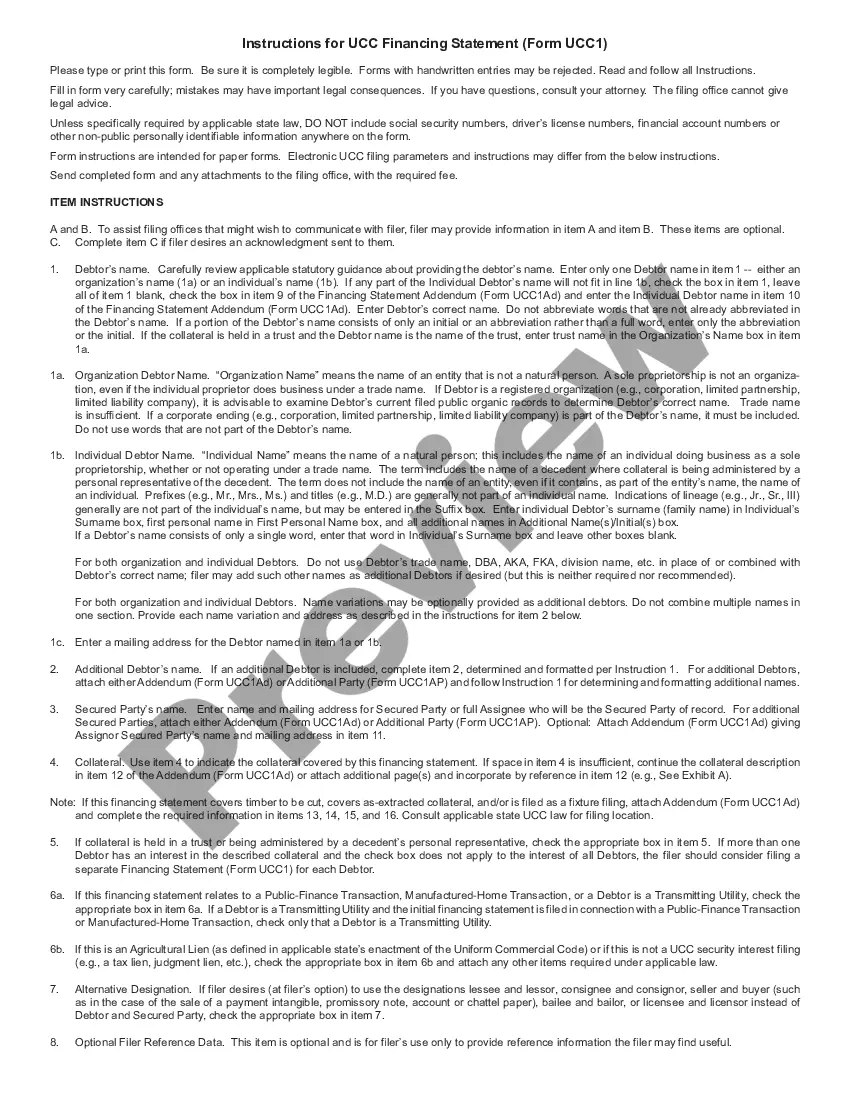

Here’s a quick guide for you: Document compliance verification. You should carefully examine the content of the form you desire and confirm whether it fits your requirements and complies with your state law. Previewing your document and checking its general overview will assist you in achieving that.

- Acquiring your Connecticut Sales Agreement - Foreclosure from our collection is as easy as ABC.

- Previously registered users with a valid membership simply need to Log In and click the Download button once they locate the correct template.

- Later on, if necessary, users can access the same document from the My documents section of their account.

- However, even if you are new to our service, signing up with a valid subscription will only take a few minutes.

Form popularity

FAQ

Redemption in foreclosure is the process through which a homeowner can reclaim their property by paying off the outstanding mortgage balance, along with any associated costs. In Connecticut, this process is available until the foreclosure sale takes place, generally lasting up to six months after the judgment. To effectively navigate redemption, utilize the Connecticut Sales Agreement - Foreclosure as a valuable resource to guide you.

After a foreclosure in Connecticut, you generally receive a court order granting you a specific timeframe to vacate the property. This period usually ranges from 30 to 90 days, depending on the circumstances. It is crucial to prepare for this transition, and utilizing documentation from the Connecticut Sales Agreement - Foreclosure can help streamline the process.

In Connecticut, the redemption period for foreclosure allows the homeowner to reclaim their property after a foreclosure judgment. Typically, this period lasts for six months, starting from the date of the judgment. However, if the property is sold at auction, the homeowner can redeem it up to the date of sale. To understand your options better, consider utilizing the Connecticut Sales Agreement - Foreclosure from USLegalForms.

Once a foreclosure sale is finalized in Connecticut, it is quite difficult to back out of the agreement. However, there may be specific circumstances where a buyer could challenge the sale, particularly if there was misconduct or fraud involved. It is wise to consult a legal expert who understands Connecticut Sales Agreement - Foreclosure to explore your options. Taking informed actions can safeguard your interests during this complex process.

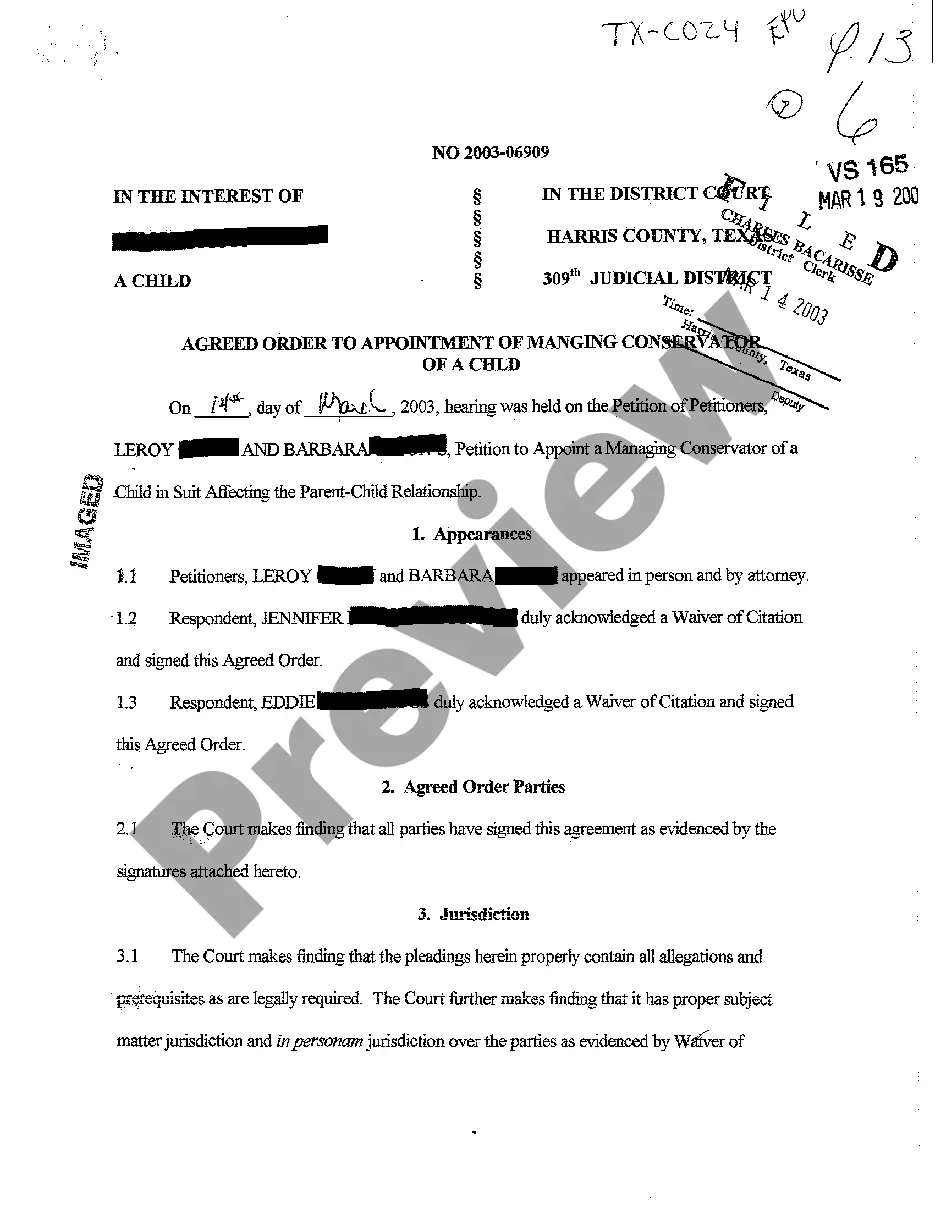

In the context of foreclosure, a judgment refers to the court's official decision confirming the lender's right to take ownership of the property due to the borrower's default. This judgment is crucial as it allows the lender to pursue the foreclosure process legally. Understanding this judgement can help you navigate your rights and protect your interests during a foreclosure. With a Connecticut Sales Agreement - Foreclosure, you can gain clarity on the implications of a judgment.

In Connecticut, foreclosure proceedings typically begin after a borrower misses three consecutive payments. Lenders are required to provide notice before initiating legal action, giving borrowers time to address their financial situation. Therefore, it's essential to communicate with your lender when facing financial difficulties. Using a Connecticut Sales Agreement - Foreclosure can offer insight into your options during this challenging time.

A judgment of foreclosure by sale in Connecticut authorizes the sale of a property to satisfy a mortgage debt. It comes after the court confirms the lender's right to foreclose, indicating that the borrower has not met their payment obligations. This judgment does not automatically lead to the borrower's eviction, as they may still have options to reclaim the property. Understanding how this plays into a Connecticut Sales Agreement - Foreclosure can clarify your rights and responsibilities.

The foreclosure process in Connecticut can take several months to over a year, depending on various factors, including court schedules and any objections from homeowners. After the lender files a foreclosure complaint, the homeowner has a specified period to respond. If unresolved, the court eventually issues a judgment, leading to an auction or property sale. For more accurate timelines tailored to your situation, consulting with professionals and utilizing resources like USLegalForms can streamline the process.

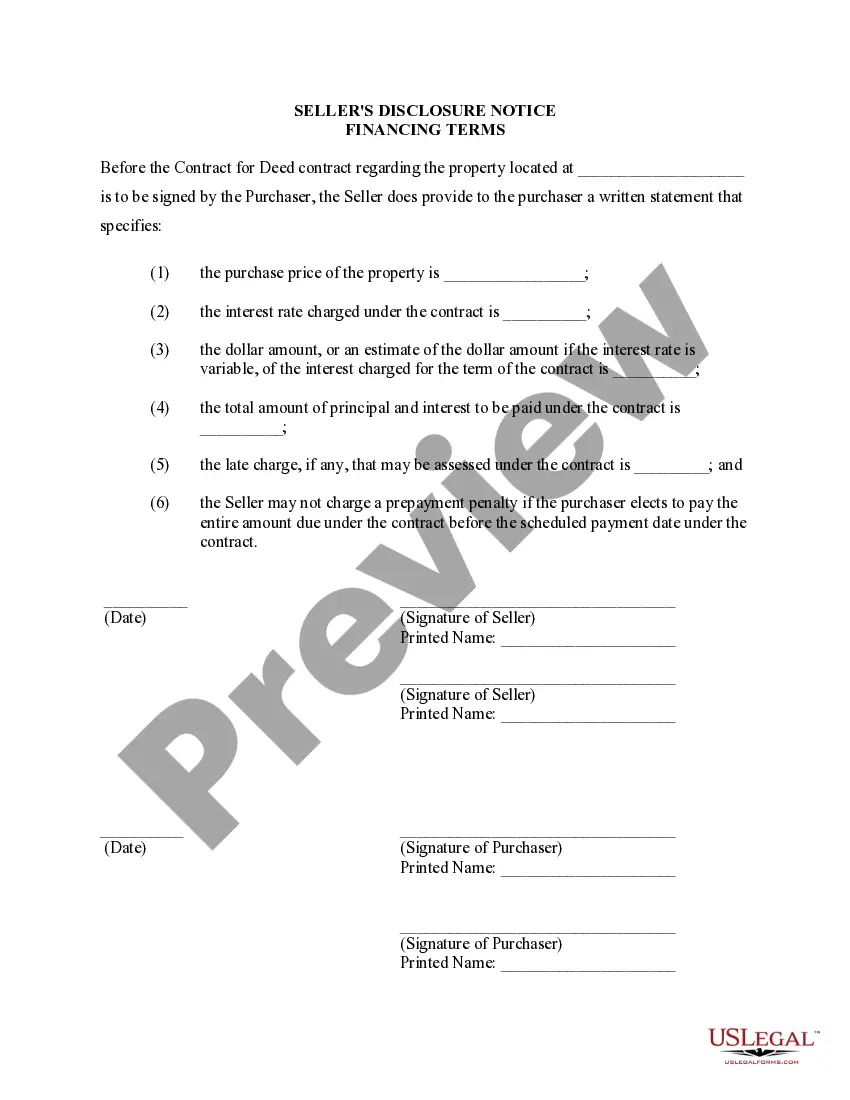

In Connecticut, buying a foreclosure involves several steps, starting with finding properties listed for sale by the bank or auction. You must conduct a title search and evaluate the property’s condition before placing a bid. Once you secure the property, you will execute a Connecticut Sales Agreement - Foreclosure, which serves as a legally binding document. Throughout the process, working with a real estate professional can help you navigate the complexities of buying a foreclosure.