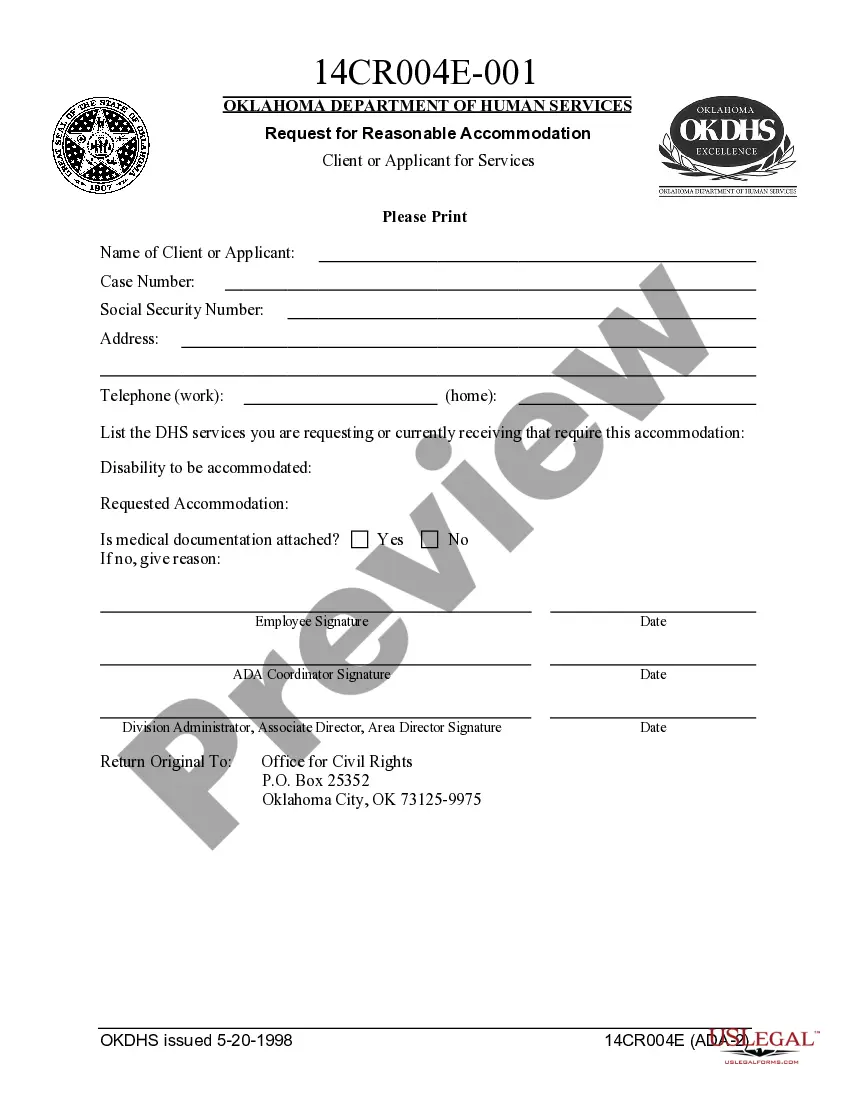

This form is a notice and claim form for income withholding. This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Notice and Claim Form - Support Income Withholding

Description

How to fill out Connecticut Notice And Claim Form - Support Income Withholding?

The greater number of documents you should make - the more stressed you are. You can find thousands of Connecticut Notice and Claim Form - Support Income Withholding blanks on the web, but you don't know those to trust. Get rid of the hassle and make getting samples easier with US Legal Forms. Get accurately drafted documents that are created to go with the state demands.

If you already have a US Legal Forms subscribing, log in to your account, and you'll see the Download button on the Connecticut Notice and Claim Form - Support Income Withholding’s page.

If you’ve never applied our service before, finish the registration process with the following steps:

- Ensure the Connecticut Notice and Claim Form - Support Income Withholding is valid in your state.

- Double-check your choice by reading through the description or by using the Preview mode if they are provided for the chosen file.

- Click on Buy Now to get started on the sign up process and choose a costs program that meets your needs.

- Provide the requested info to create your profile and pay for your order with your PayPal or bank card.

- Choose a practical document structure and acquire your example.

Find each template you obtain in the My Forms menu. Simply go there to fill in new duplicate of the Connecticut Notice and Claim Form - Support Income Withholding. Even when having expertly drafted forms, it’s nevertheless crucial that you think about asking your local legal representative to twice-check filled in form to make certain that your record is correctly filled in. Do much more for less with US Legal Forms!

Form popularity

FAQ

The process for income tax refunds to be applied towards child support can vary, but it generally occurs within a few weeks after taxes are filed. If a parent owes child support, the state can intercept tax refunds to satisfy these obligations. This means that if you have pending child support payments, your refund may contribute to those dues. To understand how this might affect your financial planning, consult uslegalforms for comprehensive guidance tailored to your situation.

Once an employer receives the Connecticut Notice and Claim Form - Support Income Withholding, they typically have two business days to remit the withheld child support payments to the appropriate agency. It is vital for the employer to adhere to this timeline to ensure that payments are made on time. Delays in remitting payments can cause financial difficulties for the receiving parent. For more information on employer obligations, uslegalforms offers valuable resources to assist.

The Income Withholding Order (Iwo) typically goes into effect within a week after your employer receives the Connecticut Notice and Claim Form - Support Income Withholding. Once implemented, the employer is required to start withholding the specified amount from your paycheck. This process ensures that child support payments are made consistently and timely. If you have questions about the Iwo process, consider reaching out to uslegalforms for detailed guidance.

You may be exempt from income tax withholding if you had no tax liability in the previous year and expect none in the current year. Certain categories, such as students with low income, may also qualify for exemption. To ensure you meet these criteria, refer to the Connecticut Notice and Claim Form - Support Income Withholding, which provides information on what constitutes an exemption.

Income withholding involves deducting a specified amount from an employee's wages to cover obligations, such as child support. The Connecticut Notice and Claim Form - Support Income Withholding provides a structured approach to facilitate this deduction. By following this form's guidelines, employers can easily comply with the withholding order and ensure timely payments.

The income withholding process begins when a court issues an order that mandates a portion of your earnings be withheld from your paycheck. This process often involves filling out the Connecticut Notice and Claim Form - Support Income Withholding, which notifies your employer of the required withholding. Once submitted, your employer will deduct the specified amount from your paycheck and send it to the appropriate agency.

For most individuals in the U.S., a common guideline is to withhold 10% to 20% of your income for federal taxes. However, when it comes to the Connecticut Notice and Claim Form - Support Income Withholding, your specific situation may warrant adjustments. Always consider consulting a tax professional to determine the exact amount appropriate for your financial circumstances.