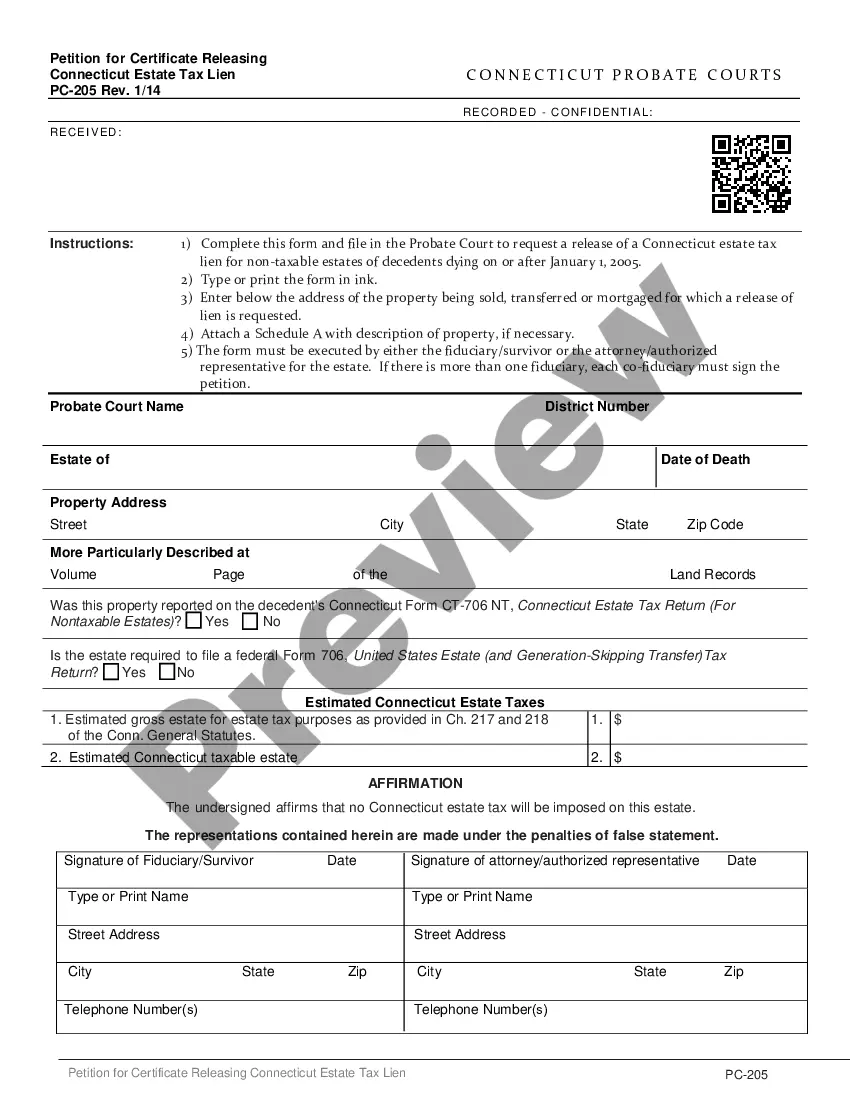

This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Application for Certificate Releasing Connecticut Estate Tax Lien

Description

How to fill out Application For Certificate Releasing Connecticut Estate Tax Lien?

The more papers you should create - the more anxious you feel. You can find a huge number of Application for Certificate Releasing Connecticut Estate Tax Lien templates on the internet, still, you don't know which ones to rely on. Eliminate the hassle to make detecting samples less complicated using US Legal Forms. Get expertly drafted documents that are published to meet state demands.

If you already possess a US Legal Forms subscription, log in to the profile, and you'll see the Download key on the Application for Certificate Releasing Connecticut Estate Tax Lien’s page.

If you’ve never used our website earlier, finish the sign up procedure with the following steps:

- Ensure the Application for Certificate Releasing Connecticut Estate Tax Lien is valid in the state you live.

- Re-check your choice by reading the description or by using the Preview mode if they’re available for the chosen document.

- Click Buy Now to begin the registration process and choose a rates program that fits your expectations.

- Insert the asked for information to make your profile and pay for your order with the PayPal or credit card.

- Select a practical file structure and have your example.

Find every template you get in the My Forms menu. Simply go there to fill in fresh version of the Application for Certificate Releasing Connecticut Estate Tax Lien. Even when preparing professionally drafted forms, it’s still vital that you think about requesting your local legal professional to double-check filled out sample to make sure that your record is correctly filled in. Do much more for less with US Legal Forms!

Form popularity

FAQ

No, Connecticut is not a no tax state. It has state income tax, sales tax, and various local taxes that contribute to its revenue. If you face difficulties with estate taxes, utilizing the Application for Certificate Releasing Connecticut Estate Tax Lien can be beneficial. It enables you to address estate tax liens efficiently, giving you peace of mind regarding your financial obligations.

Yes, Connecticut is a tax lien state where local municipalities can put liens on properties for unpaid taxes. When you submit the Application for Certificate Releasing Connecticut Estate Tax Lien, you can initiate the process to remove these liens. This process is crucial for homeowners who wish to sell or refinance their property without tax encumbrances.

With a tax lien certificate, you have the opportunity to collect the owed tax amount along with interest, or in some cases, acquire the property if debts remain unpaid. This investment can be lucrative, but it also requires a clear understanding of local tax laws and strategies. If you ever need to address any estate tax lien needs, consider using the Application for Certificate Releasing Connecticut Estate Tax Lien for better clarity and process efficiency.

A released tax lien means that the taxing authority no longer has a claim against your property due to unpaid taxes. This release allows you to freely sell, transfer, or refinance your property without encumbrances. It's important to ensure this status is properly documented, possibly through the Application for Certificate Releasing Connecticut Estate Tax Lien, to avoid future complications.

To apply for a certificate of discharge from a federal tax lien, you must submit Form 12277 to the IRS along with supporting documentation. This form provides details about the property and your circumstances that warrant the release. Effective management of this process can simplify your financial situation, especially if you are also dealing with state requirements like the Application for Certificate Releasing Connecticut Estate Tax Lien.

A certificate of release of tax lien is an official document that confirms the removal of a tax lien from your property records. It verifies that any outstanding tax obligations have been satisfied and legally restores clear title to the property. Obtaining this certificate is essential for homeowners looking to sell or refinance and can be processed through the Application for Certificate Releasing Connecticut Estate Tax Lien.

According to Ted Thomas, an authority on tax lien certificates and tax deeds, 21 states and the District of Columbia are tax lien states: Alabama, Arizona, Colorado, Florida, Illinois, Indiana, Iowa, Kentucky, Maryland, Mississippi, Missouri, Montana, Nebraska, New Jersey, North Dakota, Ohio, Oklahoma, South Carolina,

The winner of a tax lien certificate is typically the investor willing to accept the lowest interest rate.But that rarely happens: The taxes are generally paid before the redemption date. The interest rates make tax liens an attractive investment.

Connecticut is a redeemable tax deed state. In a redeemable tax deed state the actual property is sold after tax foreclosure and then the former owner has one last opportunity to redeem the property (pay the delinquent taxes). If the taxes aren't paid the investor becomes the owner.

Purchasing a tax lien does not obligate you to pay any future property taxes that become delinquent or pay for other property liabilities.Unlike an investment in a tax lien, an investment in a tax deed requires that your adequately maintain the property until you are able to sell it.