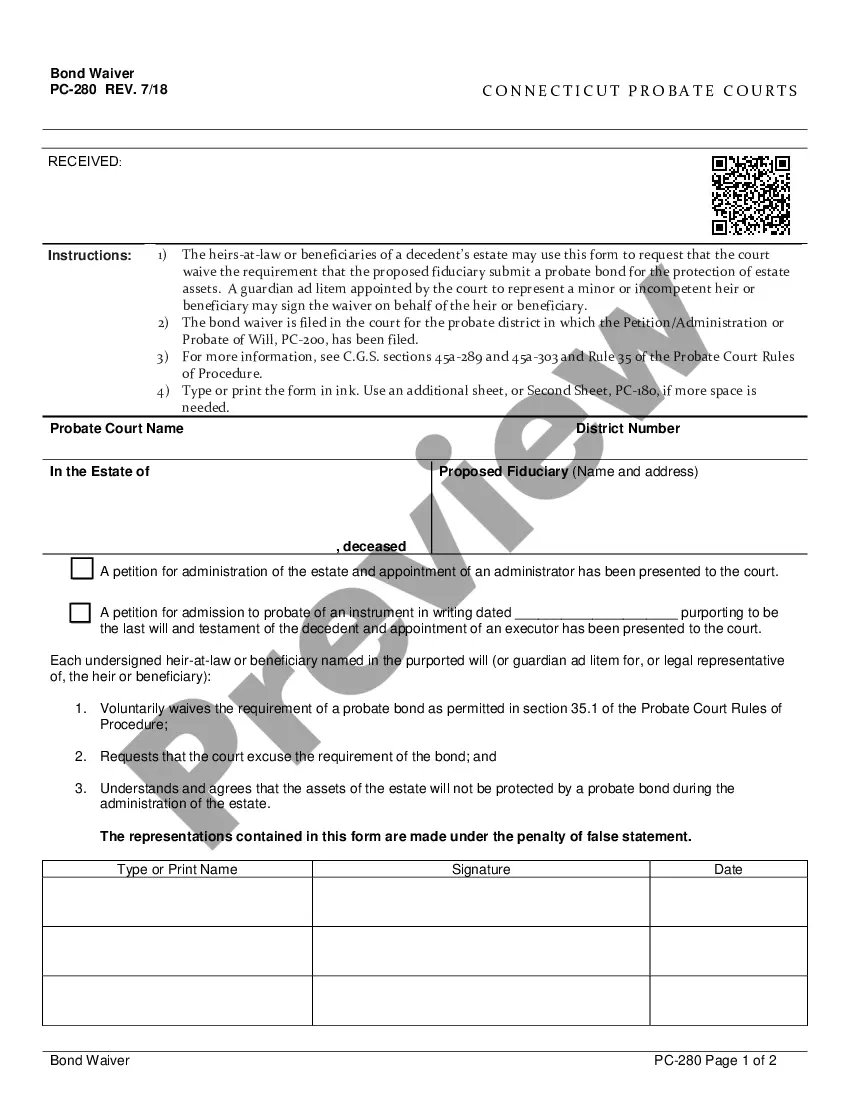

This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Probate Bond

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Probate Bond?

The higher the quantity of documents you need to create - the more anxious you get.

You can discover numerous Connecticut Probate - Bond templates online, however, you aren't sure which ones to trust.

Eliminate the frustration and simplify finding samples with US Legal Forms. Obtain expertly crafted papers that adhere to state requirements.

Locate each document you receive in the My documents section. Simply go there to generate a new copy of the Connecticut Probate - Bond. Even when utilizing properly drafted templates, it's still crucial to consider consulting a local attorney to verify that your completed form is accurate. Achieve more for less with US Legal Forms!

- Verify that the Connecticut Probate - Bond is applicable in your state.

- Double-check your selection by reviewing the description or using the Preview feature if it's available for the selected document.

- Click Buy Now to initiate the enrollment process and select a pricing plan that meets your needs.

- Input the required information to create your account and pay for your order using PayPal or credit card.

- Choose a convenient document format and obtain your sample.

Form popularity

FAQ

To fill out form CT 706 NT, start by collecting all relevant information about the estate and the beneficiaries. Ensure you include the estate's value and any deductions you're claiming. It’s important to follow the form's instructions closely for accuracy. For assistance, you might find resources from US Legal Forms helpful, especially for understanding Connecticut Probate Bond obligations.

Certain assets do not need to go through probate, including life insurance payouts, retirement accounts with named beneficiaries, and jointly owned property. These assets can transfer directly to the designated beneficiaries without court involvement. Understanding which of these assets apply to your situation can expedite the process for your loved ones. Consider secure solutions like a Connecticut Probate Bond to facilitate the transfer of assets seamlessly.

During a probate hearing, the court will typically inquire about the validity of the will, the deceased’s assets, and the identity of the heirs or beneficiaries. Additionally, the judge may ask about any outstanding debts or claims against the estate. Understanding these topics helps you prepare effectively. Utilizing a Connecticut Probate Bond can also provide security throughout this process.

Filling out a probate form involves gathering necessary information about the deceased's assets, debts, and heirs. You will typically need details such as the full name, date of death, and a list of all estate assets. It’s essential to carefully follow the instructions provided with the form to ensure accuracy. If you're unsure, consider using resources like US Legal Forms to help with Connecticut Probate Bond requirements.

To close an estate in Connecticut, you must complete various steps, including notifying beneficiaries and settling all outstanding debts. Filing the final accounting with the probate court is essential, along with obtaining a Connecticut Probate Bond if required. Engaging a knowledgeable professional can help navigate these procedures smoothly. Resources like uslegalforms can be beneficial in preparing the necessary documents.

Closing an estate account typically takes several weeks to a few months once you initiate the process. This timeline depends on factors such as settling debts and distributing assets to beneficiaries. Having a Connecticut Probate Bond can help ensure smooth management of the estate’s funds during this period. Utilizing legal services can also accelerate this process.

In Connecticut, the probate process must begin within 30 days of the death. Failing to file within this timeframe can lead to complications and potential legal issues for the estate. A Connecticut Probate Bond may also be required during probate proceedings to protect the estate's assets. Timeliness is key, so acting quickly is essential.

To close a deceased estate, you should first gather all necessary documents, including the will and financial records. Then, file a probate petition to begin the legal process. After addressing all debts and taxes, distribute the remaining assets with the aid of a Connecticut Probate Bond to safeguard against errors. Many find it helpful to use platforms like uslegalforms to simplify the paperwork involved.

An estate concludes through a final accounting and distribution of assets to heirs or beneficiaries. Once all debts and taxes are settled, the remaining assets can be distributed. The estate closure process often requires a Connecticut Probate Bond, ensuring proper management of the estate until its completion. Involving legal assistance can streamline this process.

Closing an estate in Connecticut typically takes around six months to a year, depending on various factors. The complexity of the estate and whether there are disputes among heirs can impact this timeline. To manage the process efficiently, engaging a professional who understands requirements like the Connecticut Probate Bond is advisable. This bond ensures that the executor fulfills their duties responsibly.