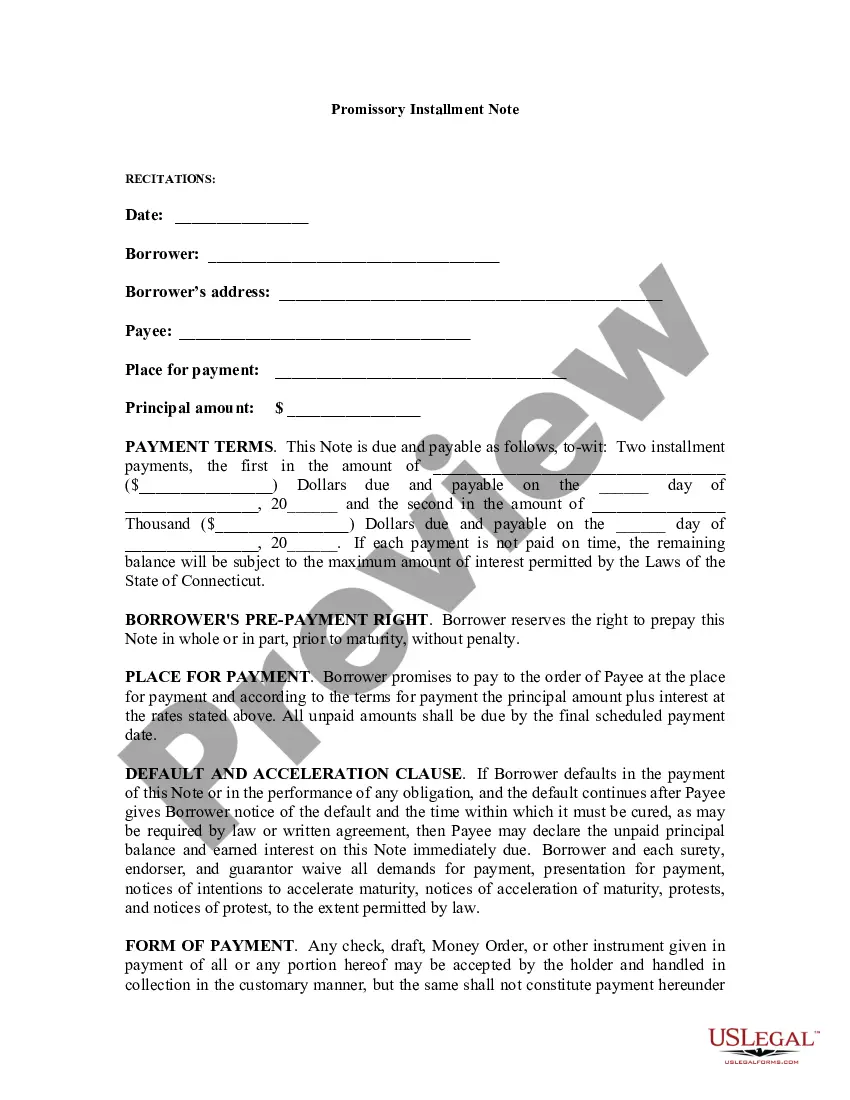

Connecticut Promissory Installment Note is a legal document that outlines the terms of a loan between two parties, the lender and the borrower. It is a written agreement that identifies the amount of the loan, the interest rate, the payment schedule, and other important information. The Connecticut Promissory Installment Note is governed by the Connecticut General Statutes Section 49-3. There are two types of Connecticut Promissory Installment Note: Simple and Secured. A Simple Promissory Installment Note is an unsecured loan and does not require collateral. A Secured Promissory Installment Note requires collateral, such as a car or home, to guarantee repayment of the loan. Both types of Connecticut Promissory Installment Note are subject to all applicable laws and statutes.

Connecticut Promissory Installment Note

Description

How to fill out Connecticut Promissory Installment Note?

US Legal Forms is the most easy and affordable way to locate suitable legal templates. It’s the most extensive web-based library of business and personal legal paperwork drafted and checked by attorneys. Here, you can find printable and fillable templates that comply with national and local regulations - just like your Connecticut Promissory Installment Note.

Getting your template requires just a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted Connecticut Promissory Installment Note if you are using US Legal Forms for the first time:

- Read the form description or preview the document to ensure you’ve found the one meeting your requirements, or find another one using the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and choose the subscription plan you like most.

- Create an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Decide on the preferred file format for your Connecticut Promissory Installment Note and save it on your device with the appropriate button.

Once you save a template, you can reaccess it at any time - simply find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more effectively.

Benefit from US Legal Forms, your reliable assistant in obtaining the required official paperwork. Try it out!

Form popularity

FAQ

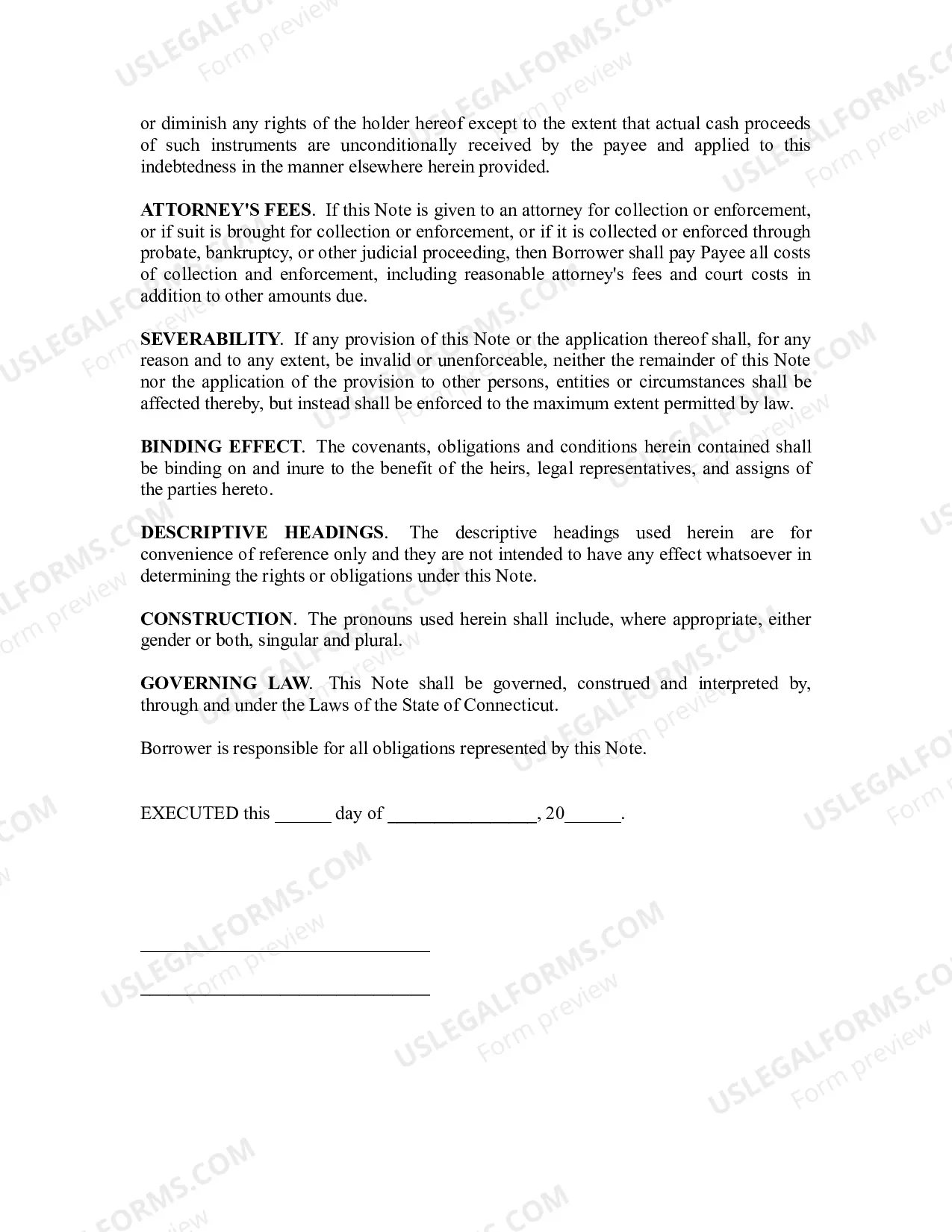

Yes, a well-drafted Connecticut Promissory Installment Note can hold up in court if necessary. The note serves as a legally binding agreement between parties, provided it meets state requirements. Courts typically enforce these notes when they include essential details, such as payment terms and signatures. If you want a reliable template, consider using uslegalforms for a professional and compliant document.

To create a valid Connecticut Promissory Installment Note, you must include specific elements. First, the note should clearly state the amount borrowed, the interest rate, and the repayment schedule. Additionally, both the borrower and the lender must sign the document, ensuring mutual consent. It's essential to acknowledge Connecticut laws regarding signatures and notary requirements to make the note enforceable.

drafted Connecticut Promissory Installment Note should be neatly organized, featuring clear headings and structured sections for all essential information. It should visually represent the borrower’s obligations and the lender’s rights in a readerfriendly format. When complete, the document should clearly represent an enforceable agreement.

The format of a Connecticut Promissory Installment Note generally begins with the title at the top, followed by the date, borrower and lender details. It includes sections for the principal amount, interest rate, repayment terms, and signatures. Ensuring that each part is clear and organized helps prevent misunderstandings.

An example of a Connecticut Promissory Installment Note might include a borrower agreeing to repay $10,000 in installments of $500 per month with an interest rate of 5% per annum. The note outlines the payment dates and any consequences for late payments. Such examples help clarify terms and ensure all parties understand their obligations.

To fill out a Connecticut Promissory Installment Note sample, start by entering your information such as the borrower’s name and the lender’s name. Next, clearly state the principal amount and interest rate. Finally, set the repayment schedule, which specifies due dates and amounts, and sign the document to make it legally binding.

A Connecticut Promissory Installment Note can be drafted by individuals, lenders, or financial institutions. Typically, private lenders and businesses offer these documents when financing arrangements are made. If you prefer convenience, consider using USLegalForms, which offers professionally designed templates. This allows you to easily create a legally binding document without confusion.

You can obtain a Connecticut Promissory Installment Note through various avenues. Many online platforms, such as USLegalForms, provide customizable templates for promissory notes that comply with state laws. This ensures that your document is both legal and tailored to your specific needs. By using a reliable source, you can save time and avoid potential legal issues.

A promissory note, including a Connecticut Promissory Installment Note, should be stored securely. It is advisable to keep a physical copy in a safe place, and consider digital backups for extra security. Having quick access to the document can be crucial for clarity in payment situations.

The primary difference lies in the repayment terms. An installment note specifies scheduled payments over a period, while a promissory note may not. Understanding the features of a Connecticut Promissory Installment Note can help you choose the right option for your financial needs.