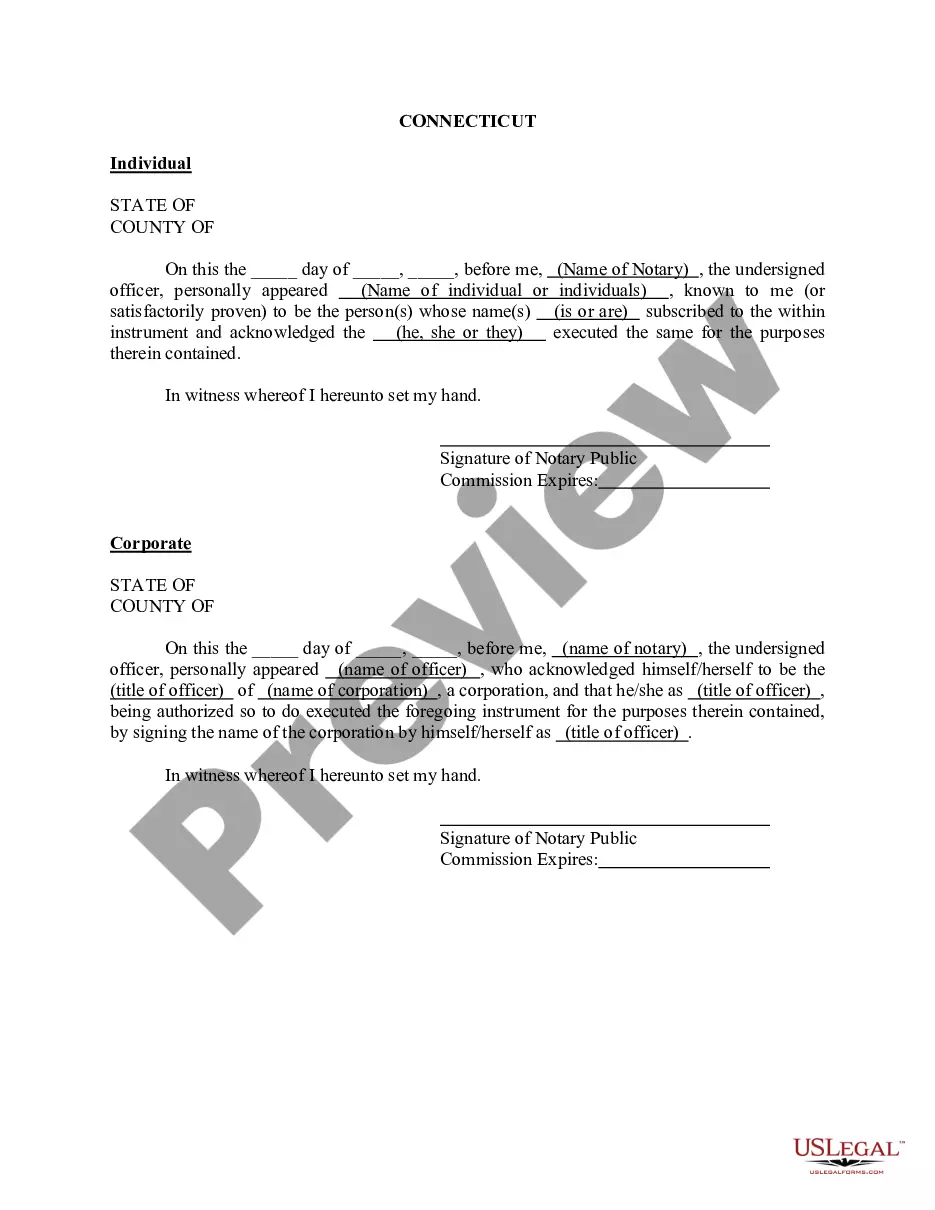

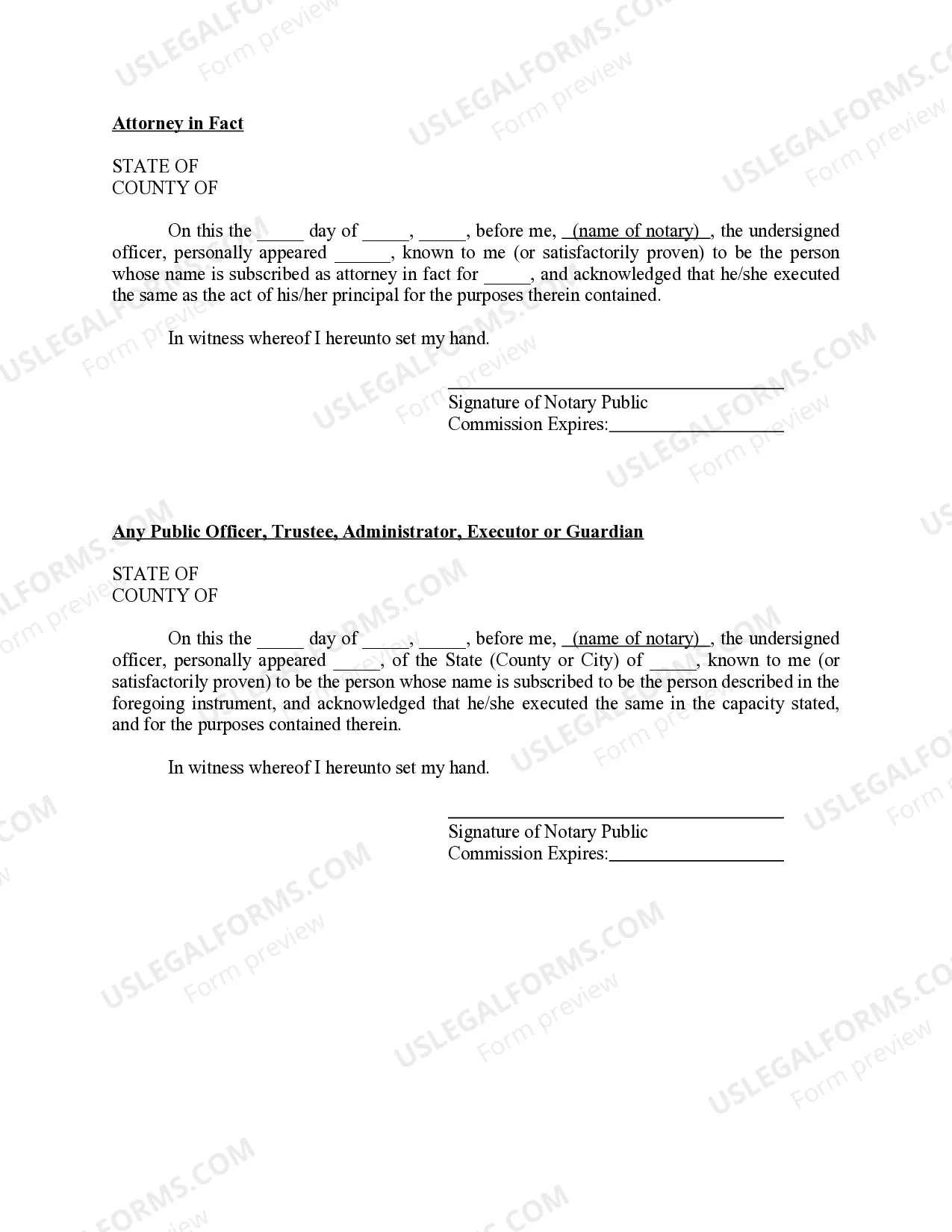

Connecticut Oil and Gas Acknowledgement

Description

How to fill out Connecticut Oil And Gas Acknowledgement?

The more extensive paperwork you need to complete - the more stressed you become.

You can discover numerous Connecticut Oil and Gas Acknowledgment templates online, yet you’re uncertain which ones to depend on.

Remove the trouble to make obtaining samples much easier using US Legal Forms.

Find all templates you obtain in the My documents menu. Just visit there to generate a new copy of the Connecticut Oil and Gas Acknowledgment. Even when utilizing professionally crafted templates, it's still crucial to consider consulting your local attorney to verify the completed form to ensure that your document is accurately filled out. Achieve more for less with US Legal Forms!

- Ensure the Connecticut Oil and Gas Acknowledgment is valid in your state.

- Reconfirm your choice by reviewing the description or by using the Preview option if available for the chosen document.

- Click on Buy Now to initiate the registration process and select a pricing plan that suits your needs.

- Provide the required details to create your account and pay for the transaction with PayPal or credit card.

- Select a convenient file format and obtain your template.

Form popularity

FAQ

The 7.35% tax in Connecticut typically refers to the tax rate applied to certain income and business sectors. If you operate in the oil and gas industry, understanding this tax rate is essential for completing your Connecticut Oil and Gas Acknowledgement accurately. Make sure to familiarize yourself with any applicable exemptions or deductions that may lower your burden. Consulting with tax professionals can provide clarity on its implications for your business.

Yes, Connecticut provides an e-file form for submitting taxes electronically. This is a useful feature that can simplify your tax filing, particularly if you need to include your Connecticut Oil and Gas Acknowledgement. Online filing reduces paperwork and ensures you can submit your forms quickly. Make sure to follow the instructions closely to ensure proper submission.

Yes, Connecticut does impose a gross receipts tax. This tax affects various sectors, particularly the oil and gas industry, which must manage their tax obligations carefully. Your Connecticut Oil and Gas Acknowledgement plays a vital role in accurately reporting your tax liabilities. Understanding this tax is crucial for maintaining compliance and optimizing your business expenses.

Absolutely, you can file Connecticut state taxes online. This option streamlines the submission process, especially for businesses needing to manage their Connecticut Oil and Gas Acknowledgement efficiently. Using reputable online tax platforms can simplify your filing experience, ensuring you meet all deadlines without hassle. Look for tools that provide support and guidance throughout the process.

Yes, you can file your taxes electronically yourself in Connecticut. This method provides a swift and convenient way to submit your Connecticut Oil and Gas Acknowledgement. Ensure you have all your documents ready and follow the guidelines to achieve successful e-filing. Online tools simplify the process and allow for real-time confirmation of your submission.

Yes, Connecticut is currently accepting tax returns. If you need to file your Connecticut Oil and Gas Acknowledgement this tax season, make sure to gather all necessary documents. Filing early can help you avoid any potential delays. You can use online platforms for an efficient filing process.

Several states implement a gross receipts tax, which is based on total revenue rather than profit. Notably, states like Delaware, New Mexico, and Texas have such taxes in place. If you operate in Connecticut, it's essential to understand how the Connecticut Oil and Gas Acknowledgement intersects with gross receipts taxation. This knowledge could impact your business strategy and compliance efforts.

As of recent data, California holds the record for the highest fuel tax in the United States. This tax can significantly affect fuel prices, influencing consumer behavior. Understanding how fuel tax works in different states, including Connecticut, can help you navigate costs associated with oil and gas. The Connecticut Oil and Gas Acknowledgement can guide you through fuel tax regulations specific to the state.

Yes, heating oil in Connecticut is subject to sales tax, impacting both residential and commercial consumers. The current rate is aligned with the state's overall sales tax. When navigating heating oil purchases, the Connecticut Oil and Gas Acknowledgement becomes important to understand potential tax implications. Being aware of these taxes helps you avoid unexpected expenses.

Connecticut imposes a tax on petroleum products, which can vary based on the product type and market conditions. This tax plays a significant role in funding various state programs. When considering oil transactions, the Connecticut Oil and Gas Acknowledgement can provide details on how these taxes apply to your business operations. Understanding these taxes can help in budgeting and financial planning.