Annual Minutes document any changes or other organizational activities of a Professional Corporation during a given year.

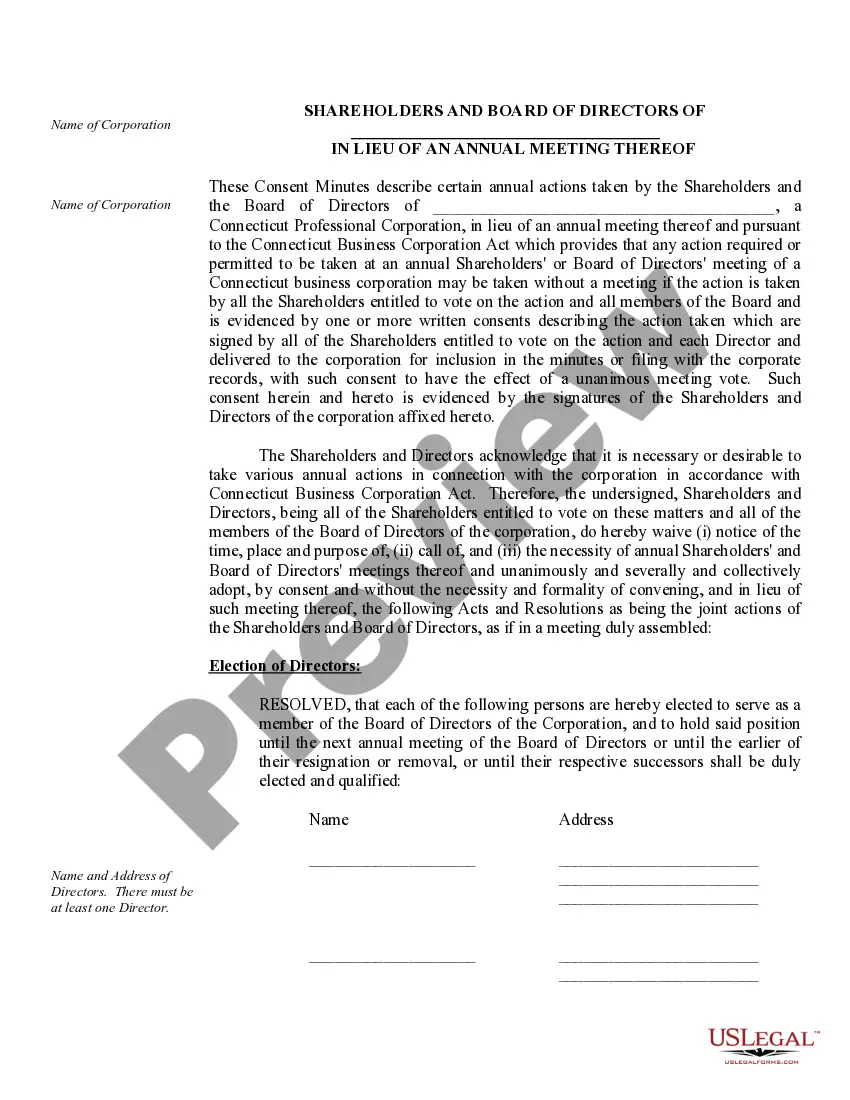

Annual Minutes for a Connecticut Professional Corporation

Description

How to fill out Annual Minutes For A Connecticut Professional Corporation?

The larger quantity of documents you are required to complete - the more anxious you become.

You can discover numerous Annual Minutes for a Connecticut Professional Corporation templates online, yet you are uncertain which ones to trust.

Eliminate the inconvenience of finding examples by using US Legal Forms.

Click Buy Now to initiate the registration process and select a pricing plan that suits your requirements. Provide the required information to create your profile and pay for the order via PayPal or credit card. Choose a convenient document format and download your copy. Locate each template you acquire in the My documents section. Simply go there to generate a new version of the Annual Minutes for a Connecticut Professional Corporation. Even when using well-prepared forms, it is still crucial to consider consulting a local attorney to verify that your form is filled out correctly. Achieve more for less with US Legal Forms!

- Obtain precisely crafted documents that comply with state requirements.

- If you're already a subscriber of US Legal Forms, Log In to your account, and you will find the Download button on the Annual Minutes for a Connecticut Professional Corporation’s webpage.

- If you haven't used our site before, complete the registration process by following these guidelines.

- Check to ensure that the Annual Minutes for a Connecticut Professional Corporation is applicable in your state.

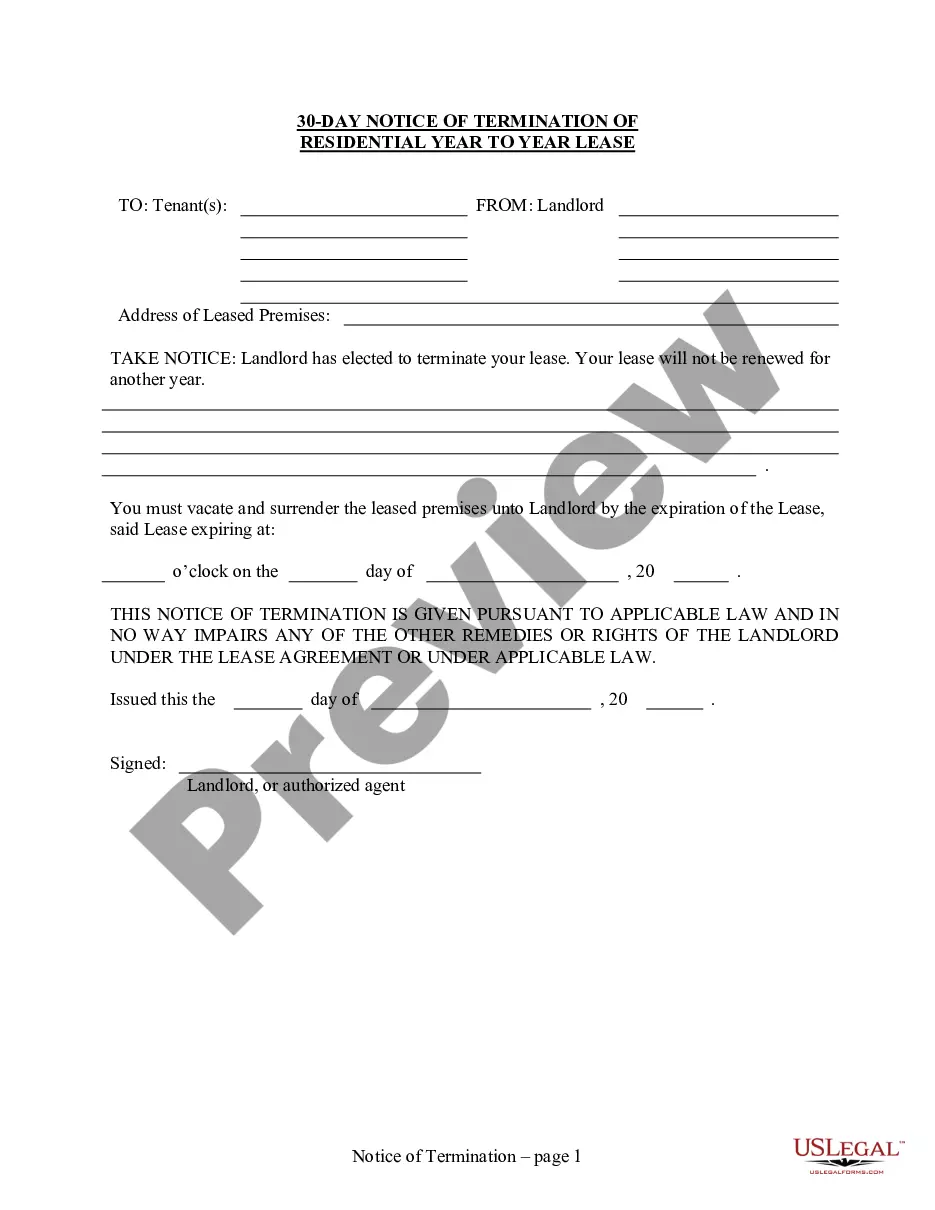

- Verify your selection by reviewing the description or utilizing the Preview feature if available for the chosen document.

Form popularity

FAQ

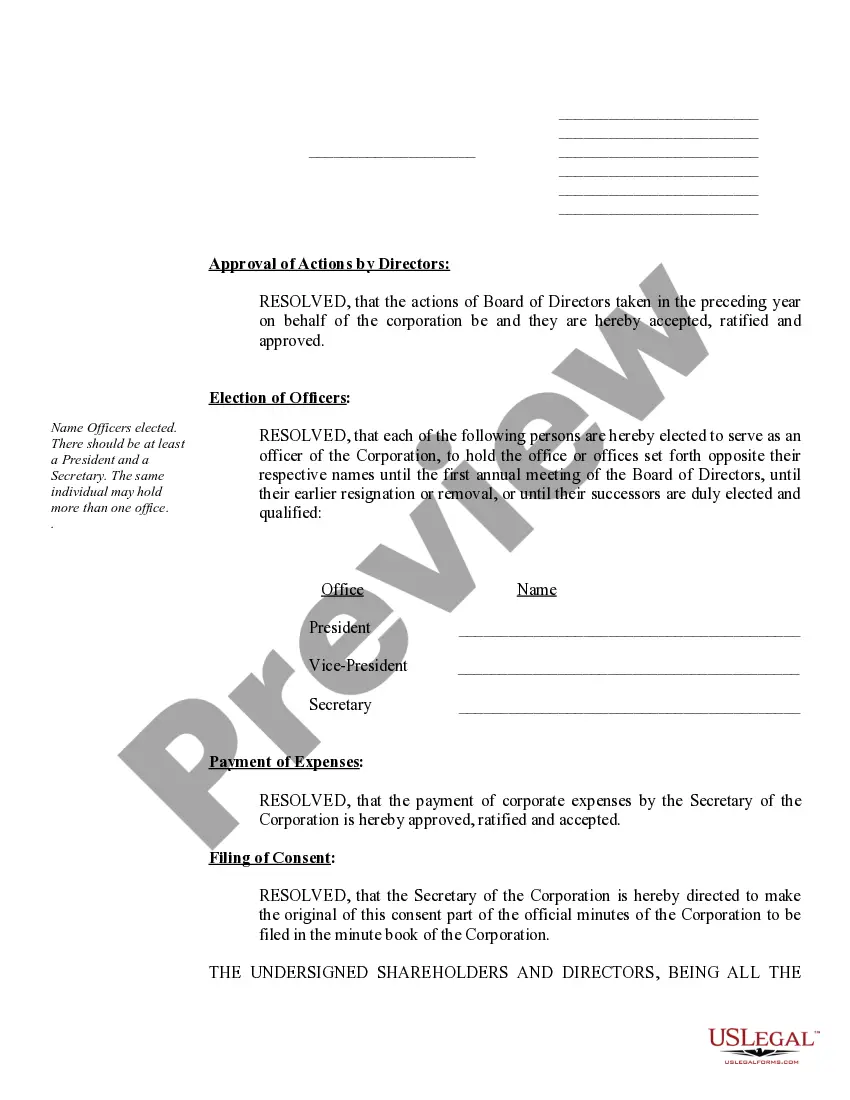

To do annual corporate minutes for a Connecticut Professional Corporation, compile records of all meetings held throughout the year. Document key decisions and actions taken to maintain a clear history of your corporation. Using a structured format helps ensure compliance and makes future reference easier, and you can utilize uslegalforms for templates and guidance in this process.

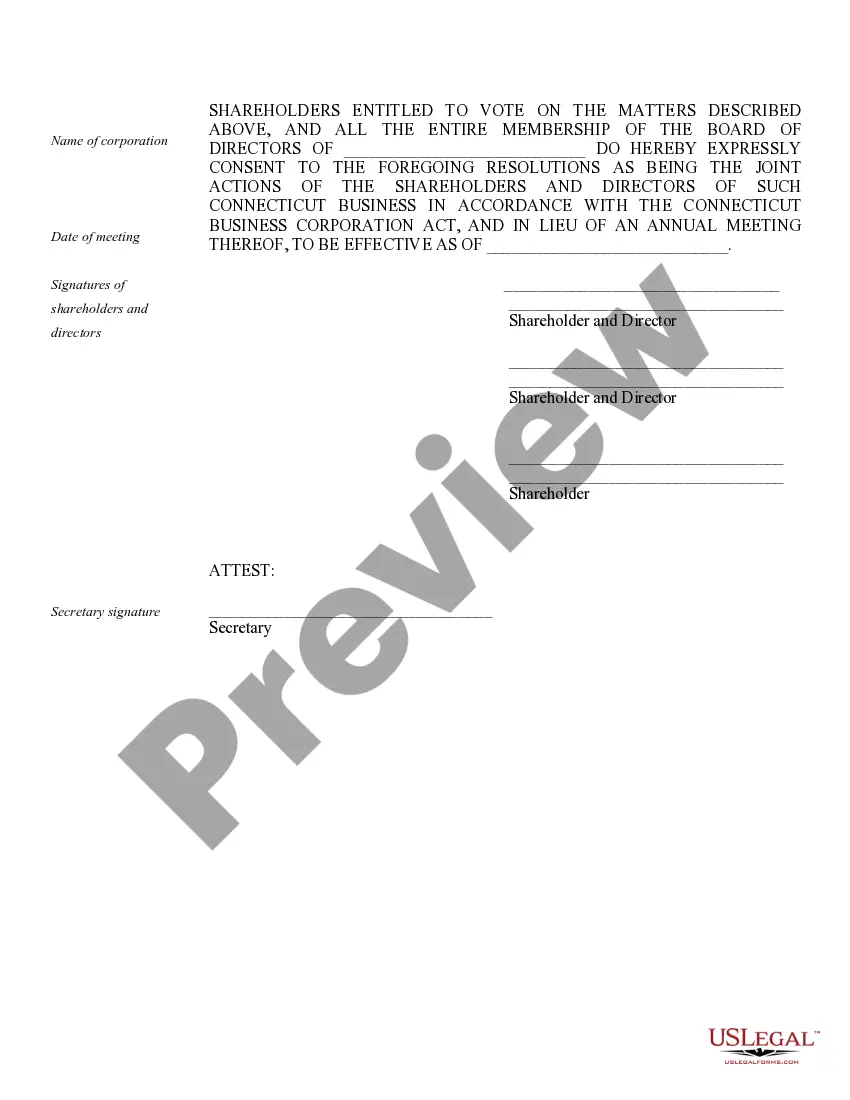

Under Robert's Rules, annual meeting minutes for a Connecticut Professional Corporation must be reviewed for accuracy by attendees before approval. Once reviewed, a motion is made to accept the minutes, which requires a second and a majority vote to be officially approved. This process ensures accountability and transparency in your corporation.

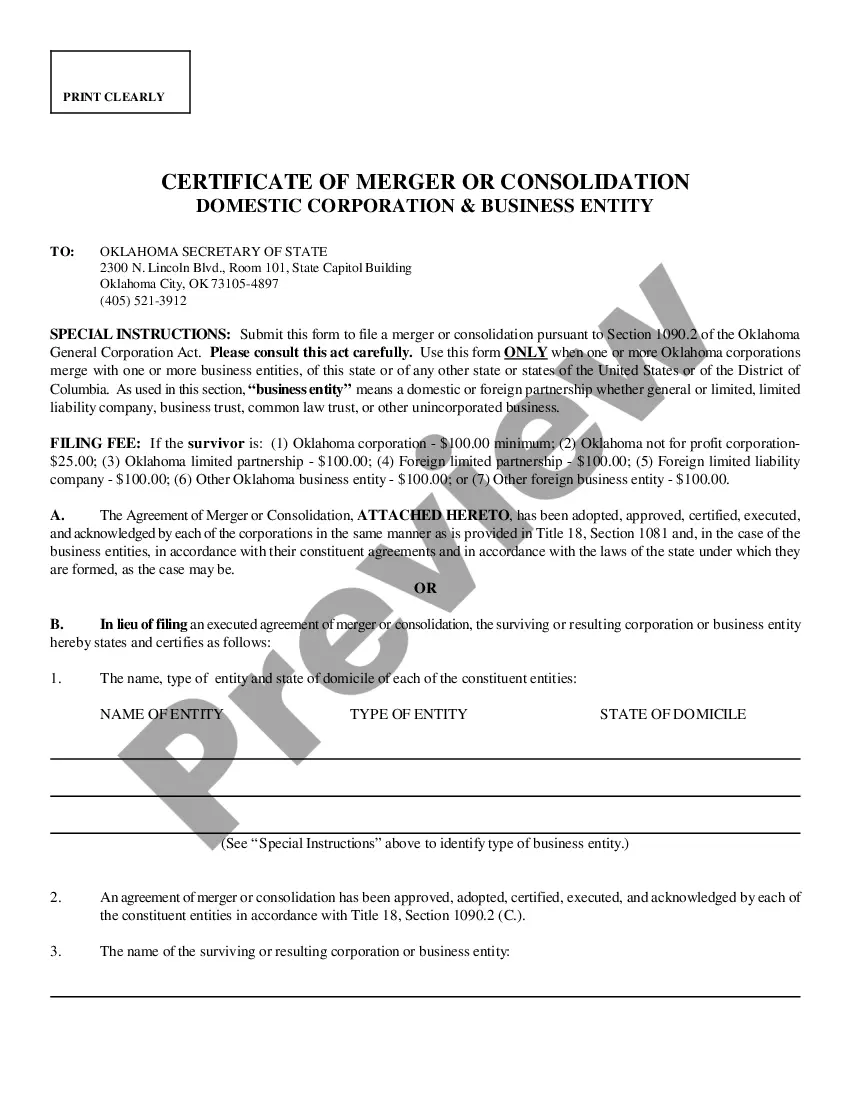

Yes, Connecticut requires professional corporations to file an annual report with the Secretary of State. This report helps maintain your corporation's good standing and provides vital updates on its activities. Ensure your report aligns with the corporate minutes, as they reflect your corporation's decisions and operations over the year.

Doing corporate minutes for a Connecticut Professional Corporation requires attention to detail and organization. Begin with identifying the meeting's key details, then summarize discussions and decisions made. Make sure to keep these minutes updated after each meeting to keep a thorough record of your corporation’s activities.

To create minutes of the Annual General Meeting (AGM) for a Connecticut Professional Corporation, start by greeting attendees and noting their presence. Record the key discussions, resolutions passed, and any votes taken during the meeting. Ensure the minutes are signed by the secretary or the chairperson, confirming their accuracy for future reference.

Keeping corporate minutes for a Connecticut Professional Corporation involves maintaining a dedicated record book or digital file. Safeguard these minutes as they serve as legal documentation of your corporation's actions and decisions. Regularly update the minutes after each meeting, ensuring all records remain accurate and accessible for future reference.

To write annual meeting minutes for a Connecticut Professional Corporation, start by documenting key details like the date, time, and location of the meeting. Include a list of attendees and summarize discussions on each agenda item. Use clear language to communicate decisions made or actions taken, ensuring an accurate record of the meeting.

To fill out corporate minutes correctly, start by noting the date, time, and location of the meeting. Then, record the names of participants and outline the principal topics discussed, including any decisions made. Ensure that you clearly document votes and outcomes. Using a structured template can help streamline this process and make sure your annual minutes for a Connecticut professional corporation are accurate and compliant.

The recommended retention period for corporate minutes is at least three years. Keeping them longer may benefit your corporation, as they provide a historical account of decisions and actions taken. Archive these records systematically so that you can retrieve them easily for audits or internal reviews. Maintaining this documentation reflects well on your corporation's commitment to good governance.

Robert's Rules of Order provide guidelines for writing meeting minutes in a clear and organized manner. According to these rules, minutes should summarize essential motions, discussions, and votes taken during the meeting. This format helps ensure that annual minutes for a Connecticut professional corporation accurately reflect the meeting's outcomes. Following these guidelines contributes to better communication and compliance within your corporation.