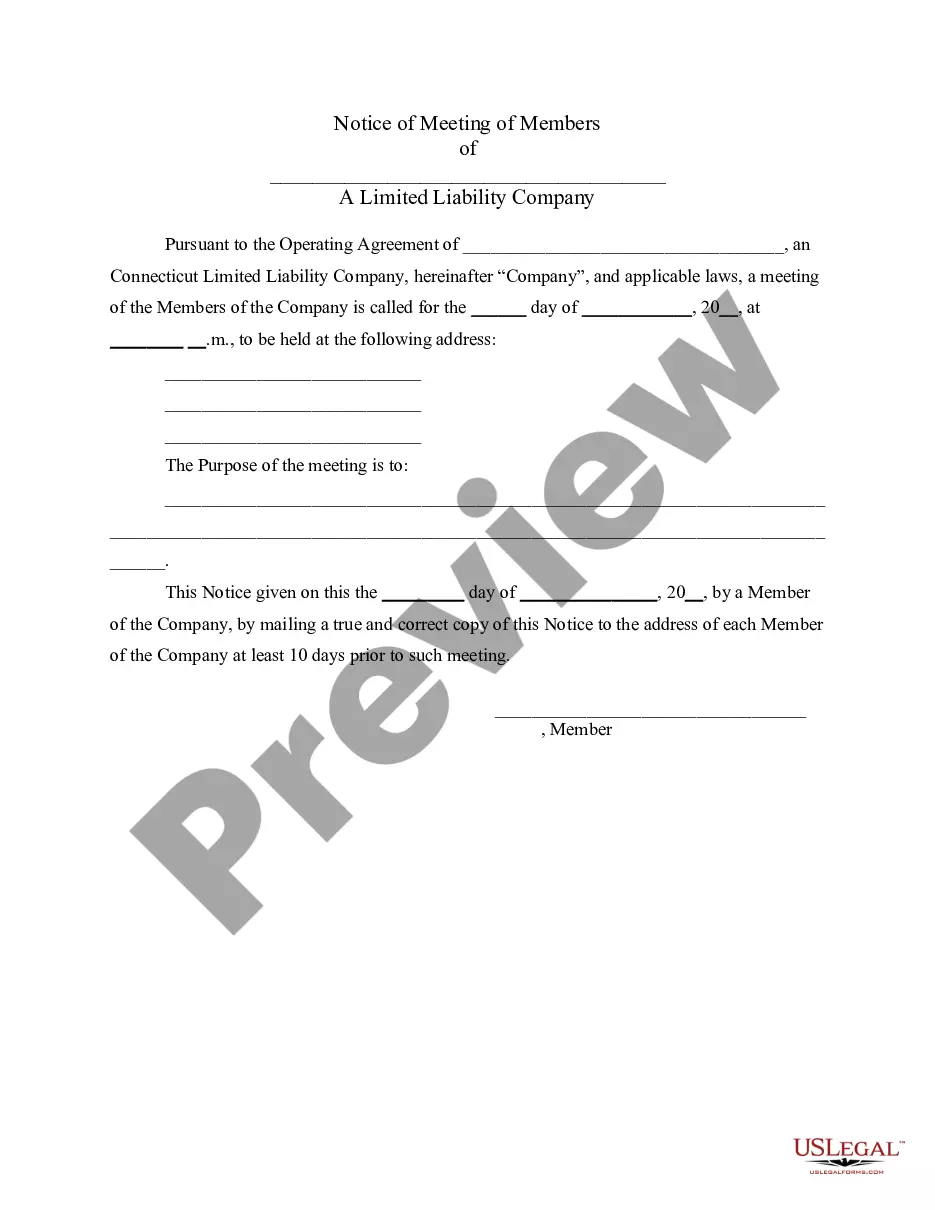

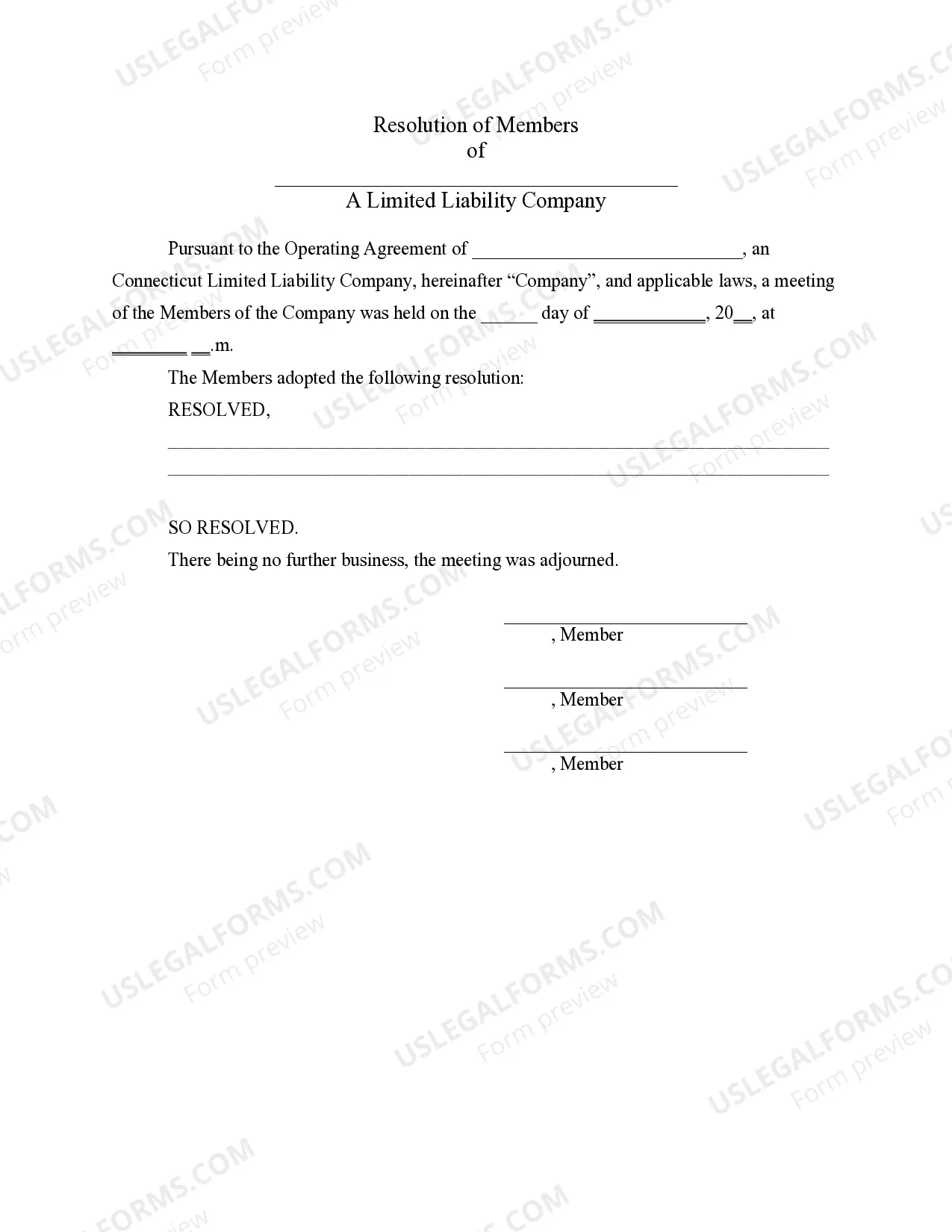

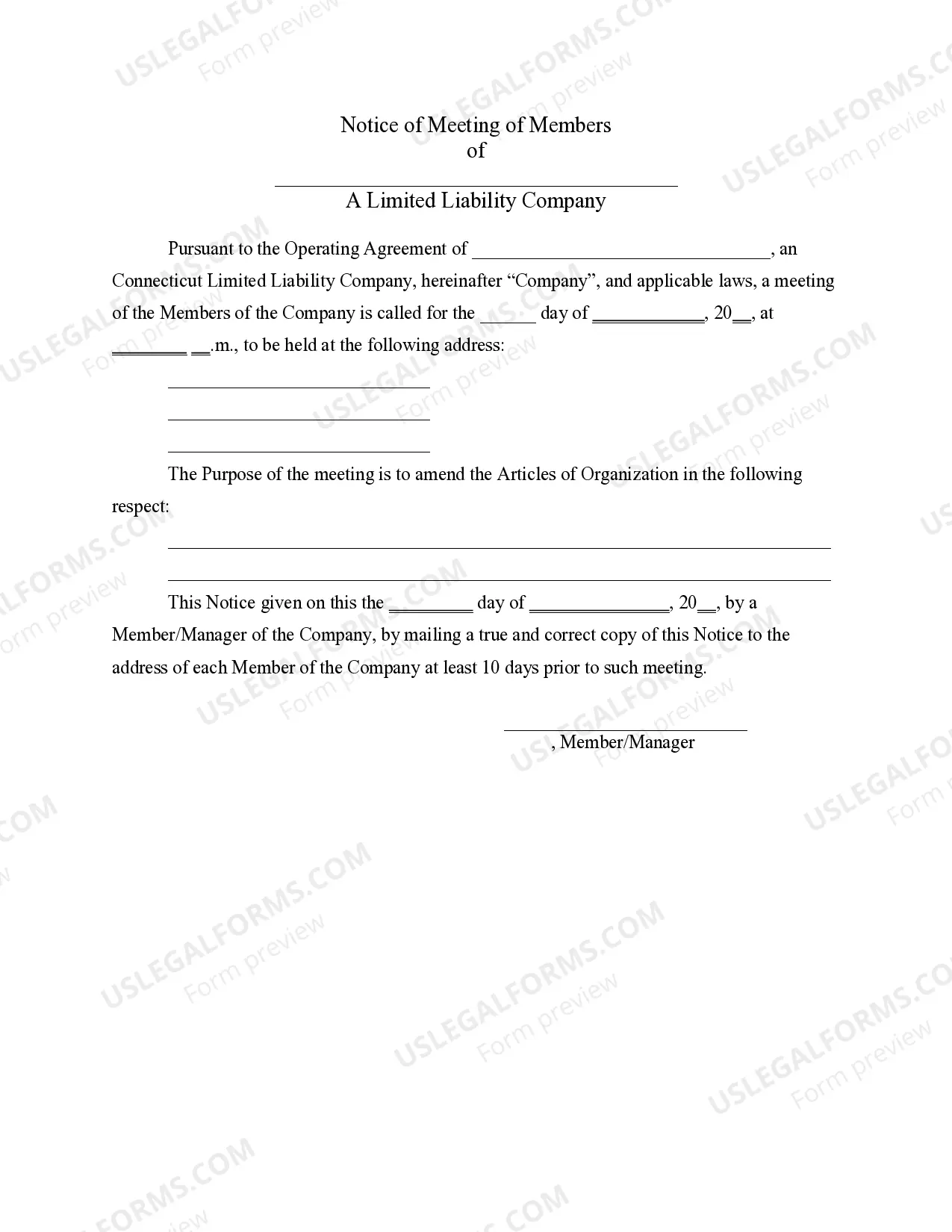

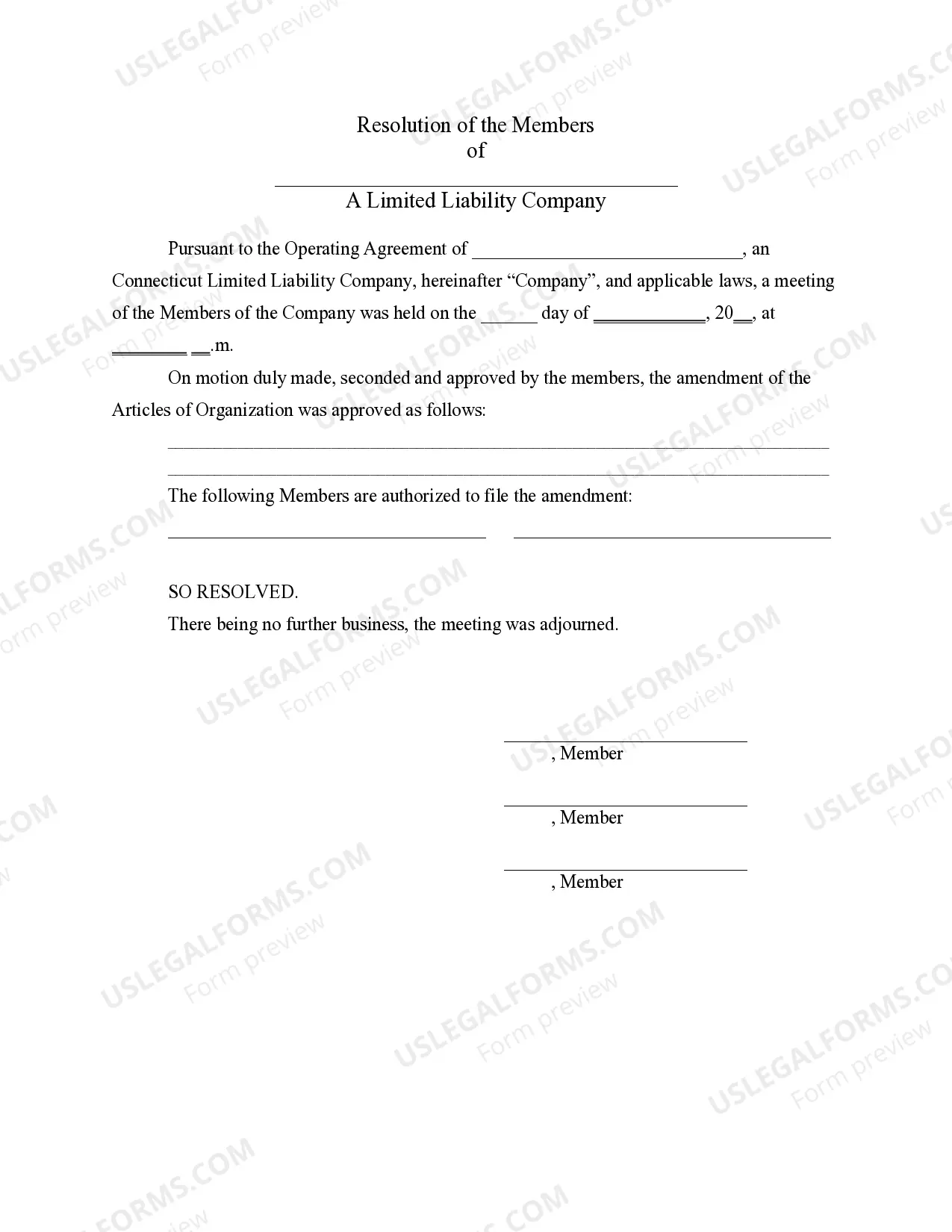

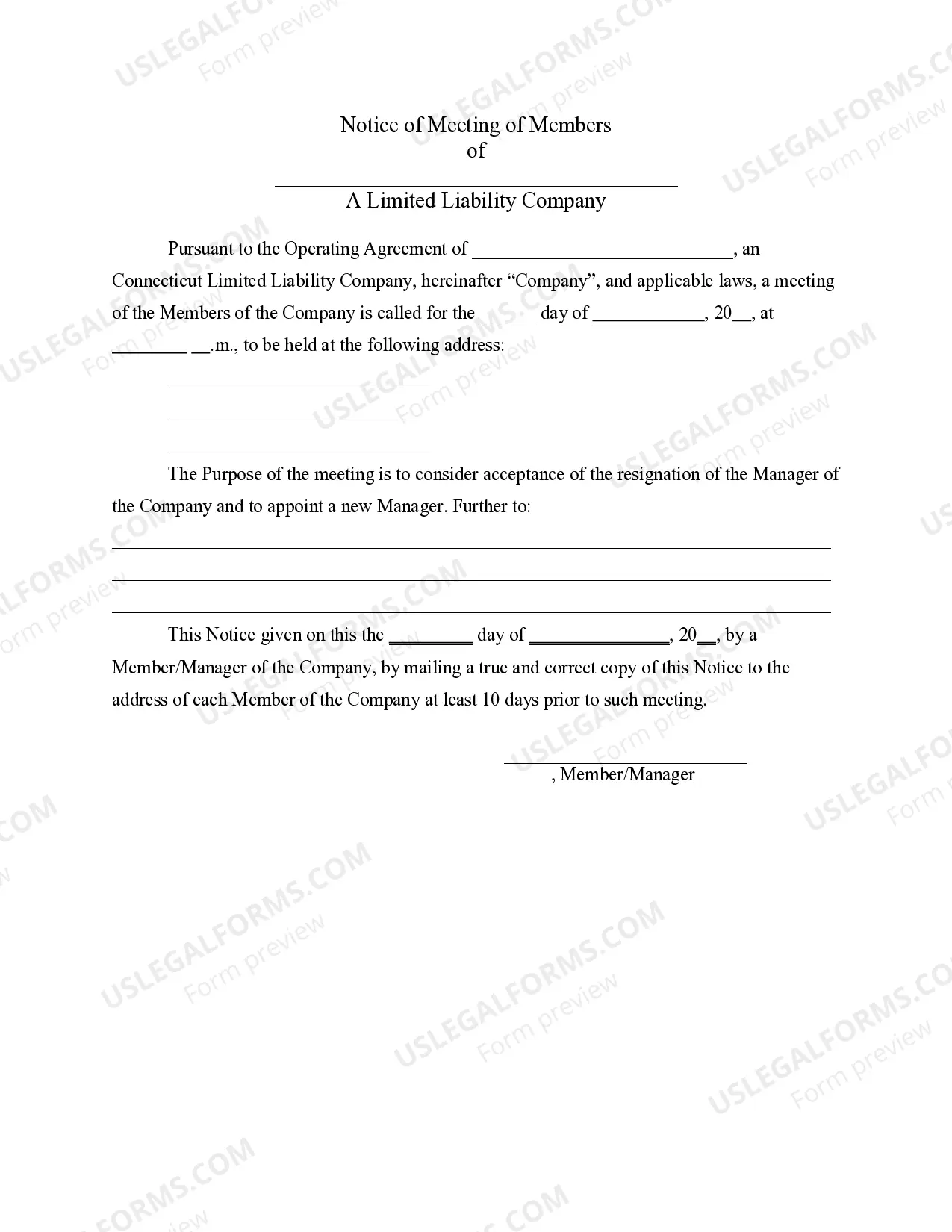

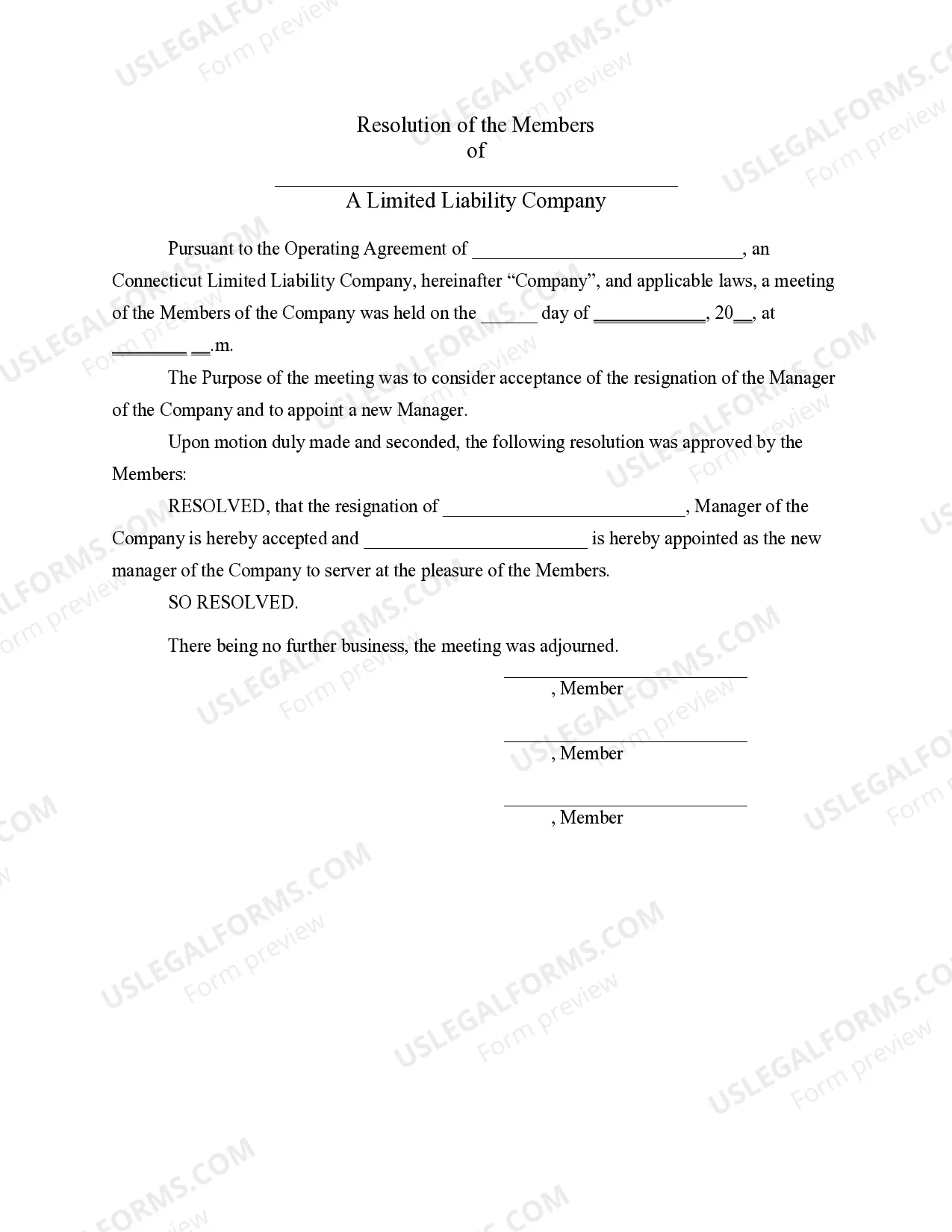

These Notices & Resolutions collection contains over 15 forms for use in connection with the operation of the company, including the following: (1) Notice of Meeting for General Purpose, (2) Resolution of Meeting for General Purpose, (3) Notice of Meeting to Amend Articles of Organization, (4) Resolution to Amend Articles of Organization, (5) Notice of Meeting to Consider Dissolution, (6) Resolution Regarding Dissolution, (7) Notice to Admit New Members, (8) Resolution Concerning Admitting New Members, (9) Notice of Meeting Concerning Accepting Resignation of Manager, (10) Resolution Accepting Resignation of Manager, (11) Notice of Meeting to Remove Manager, (12) Resolution Concerning Removal of Manager, (13) Notice of Meeting to Consider Disbursements to Members, (14) Resolution Concerning Disbursements, (15) Assignment of Member Interest, and (16) Demand for Indemnity by Member/Manager.

Connecticut PLLC Notices and Resolutions

Description

How to fill out Connecticut PLLC Notices And Resolutions?

The greater number of documents you need to make - the more worried you get. You can get thousands of Connecticut PLLC Notices and Resolutions blanks on the internet, but you don't know which of them to rely on. Get rid of the hassle and make getting samples more convenient with US Legal Forms. Get skillfully drafted documents that are published to satisfy state specifications.

If you already possess a US Legal Forms subscribing, log in to your account, and you'll find the Download option on the Connecticut PLLC Notices and Resolutions’s webpage.

If you have never applied our platform earlier, finish the registration procedure using these recommendations:

- Make sure the Connecticut PLLC Notices and Resolutions is valid in the state you live.

- Double-check your option by reading the description or by using the Preview functionality if they are available for the chosen file.

- Click on Buy Now to start the sign up process and select a rates plan that fits your needs.

- Insert the requested information to make your profile and pay for your order with your PayPal or credit card.

- Select a prefered file type and get your duplicate.

Find each document you obtain in the My Forms menu. Simply go there to produce a new copy of your Connecticut PLLC Notices and Resolutions. Even when using professionally drafted web templates, it’s still essential that you think about asking your local legal professional to re-check filled out sample to be sure that your record is accurately completed. Do much more for less with US Legal Forms!

Form popularity

FAQ

Many states across the U.S. recognize Professional Limited Liability Companies (PLLCs), but regulations vary from state to state. States such as New York, Texas, and Florida have established provisions for PLLCs, allowing licensed professionals to take advantage of this business structure. If you're considering forming a PLLC, make sure to consult your state's laws and consider using resources like US Legal Forms for guidance on Connecticut PLLC Notices and Resolutions.

While Connecticut does not legally require an operating agreement for LLCs, having one is highly recommended for clarity and legal protection. An operating agreement outlines the management structure and operating procedures of the LLC, including aspects relevant to Connecticut PLLC Notices and Resolutions. By establishing a clear agreement, you can avoid potential disputes and ensure all professionals are aligned with business goals.

Yes, Connecticut allows the formation and operation of PLLCs. The state provides specific regulations that govern professional entities, ensuring compliance with relevant professional standards. By structuring your business as a PLLC, you can manage Connecticut PLLC Notices and Resolutions efficiently while focusing on your core professional services.

Connecticut does recognize Professional Limited Liability Companies (PLLCs). This recognition means that licensed professionals in Connecticut can form a PLLC and benefit from the protections and flexibility offered by this structure. When you manage your Connecticut PLLC Notices and Resolutions, you can confidently operate within the legal framework established by the state.

Yes, a Professional Limited Liability Company (PLLC) is a specific type of Limited Liability Company (LLC) designed for licensed professionals. In the context of Connecticut PLLC Notices and Resolutions, PLLCs provide the same liability protection as standard LLCs while accommodating the regulatory requirements for certain professions. This distinction is essential for professionals who seek to limit personal liability while adhering to state laws.

The minimum tax for corporations in Connecticut is $250, regardless of your company's income. This tax applies annually and is due even if your corporation is not profitable. Staying informed about Connecticut PLLC Notices and Resolutions can help you manage tax responsibilities effectively and ensure your corporation meets all financial obligations.

To look up a business in Connecticut, you can visit the Secretary of State’s website, where you can access the Business Entity Search tool. This tool allows you to find any registered business by name or business identification number. Additionally, reviewing Connecticut PLLC Notices and Resolutions can help you understand the status and compliance of the business you are investigating.

Connecticut does not require an S Corp election if you choose to incorporate. However, if you want your corporation to be taxed under Subchapter S, you need to file Form 2553 with the IRS. Understanding this process is vital, as it relates to Connecticut PLLC Notices and Resolutions that provide detailed insights into tax obligations and benefits.

Yes, you can start a corporation by yourself in Connecticut. As a sole incorporator, you can file the necessary documents solely in your name. While it's possible, consider consulting resources like Connecticut PLLC Notices and Resolutions for crucial information on structure, governance, and compliance to support your new business.

Incorporating in Connecticut involves several key steps. Start by selecting a unique name for your corporation and then submit your Certificate of Incorporation to the Secretary of State. Don't forget to familiarize yourself with Connecticut PLLC Notices and Resolutions to ensure your incorporation meets state requirements and governance.