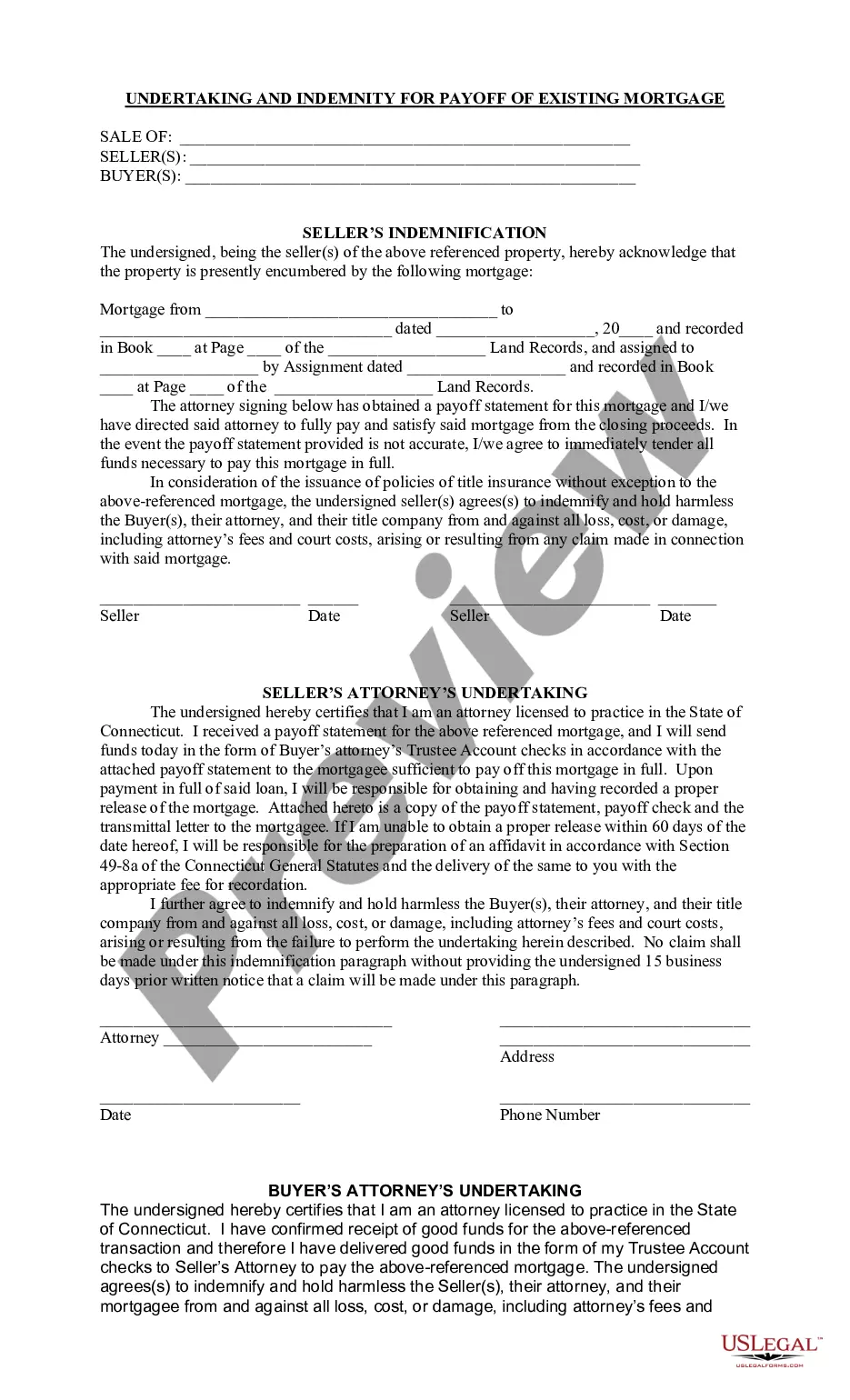

Connecticut Undertaking and Indemnity for Payoff of Existing Mortgage is a legal document that is used when the borrower of a mortgage loan is refinancing and pays off the existing mortgage. This document provides a guarantee that the borrower will pay the mortgage they are refinancing in full, and also provides protection for the lender in the event of default. It also requires the borrower to indemnify the lender for any losses or damages that may occur in the event of a default. There are two main types of Connecticut Undertaking and Indemnity for Payoff of Existing Mortgage: limited and unlimited. The limited version provides protection to the lender only in the event of a default, whereas the unlimited version offers a broader range of protection for the lender.

Connecticut Undertaking and Indemnity for Payoff of Existing Mortgage is a legal document that is used when the borrower of a mortgage loan is refinancing and pays off the existing mortgage. This document provides a guarantee that the borrower will pay the mortgage they are refinancing in full, and also provides protection for the lender in the event of default. It also requires the borrower to indemnify the lender for any losses or damages that may occur in the event of a default. There are two main types of Connecticut Undertaking and Indemnity for Payoff of Existing Mortgage: limited and unlimited. The limited version provides protection to the lender only in the event of a default, whereas the unlimited version offers a broader range of protection for the lender.