Satisfaction, Release or Cancellation of Mortgage by Individual

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

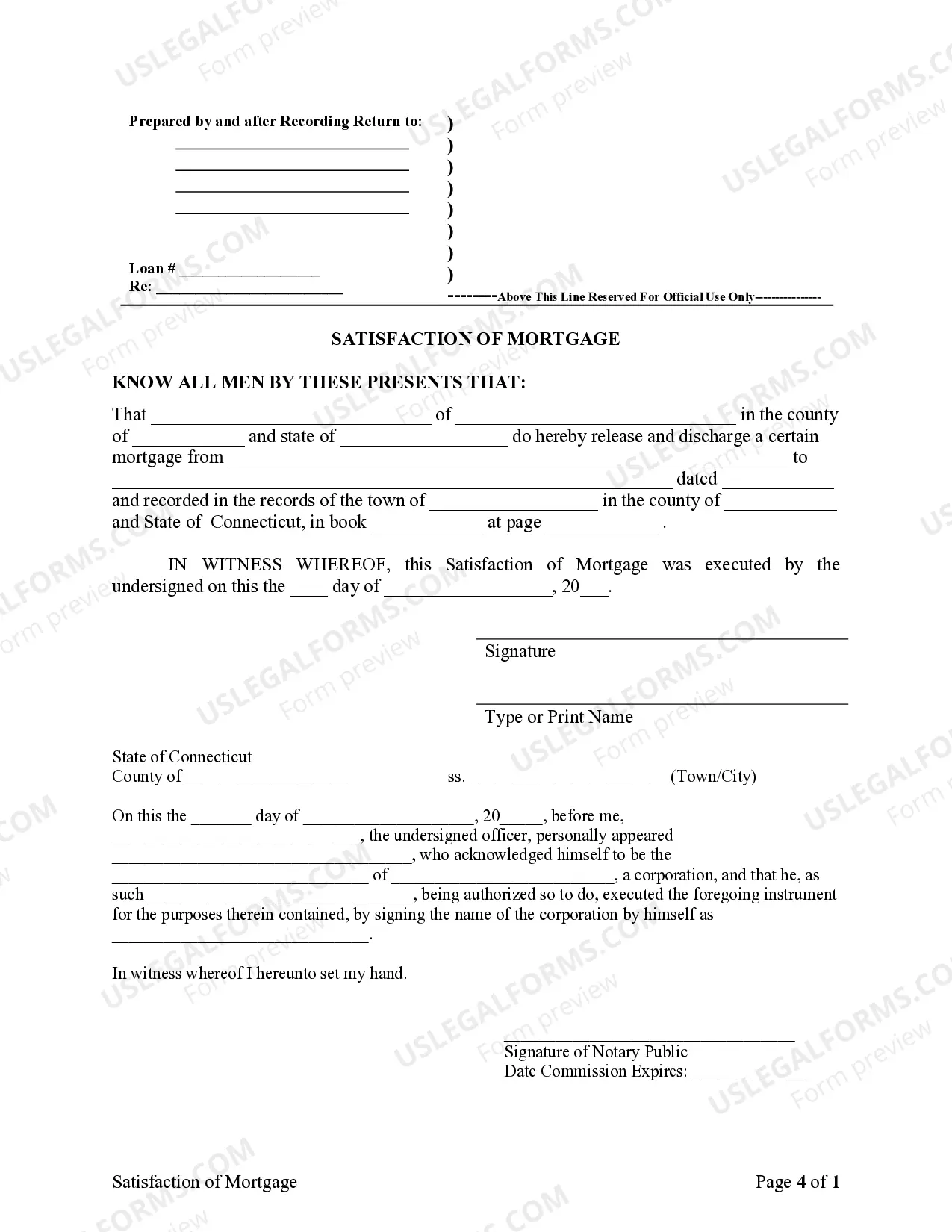

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Connecticut Law

Assignment: It is not necessary that an assignment be recorded. When the assignment instrument is executed, attested and acknowledged as required by law, it vests in the assignee. However, it is recommended that the assignment be recorded to avoid complications that might arise.

Demand to Satisfy: Following payoff, the demand to satisfy should be by registered or certified mail to the mortgagee, who then has 60 days to record satisfaction.

Recording Satisfaction: A mortgage may be released by an instrument in writing executed, attested and acknowledged, setting forth that the mortgage is discharged.

Penalty: If mortgagee fails to record satisfaction of mortgage within 60 days of receipt of demand from mortgagor, mortgagee shall be liable for damages at the rate of two hundred dollars for each week after the expiration of such sixty days up to a maximum of five thousand dollars or in an amount equal to the loss sustained, plus costs and reasonable attorney's fees.

Acknowledgment: An assignment or satisfaction must contain a proper Connecticut acknowledgment, or other acknowledgment approved by Statute.

Connecticut Statutes

Sec. 49-8. Release of satisfied or partially satisfied mortgage or ineffective attachment, lis pendens or lien.

Damages.

(a) The mortgagee or a person authorized by law to release the mortgage shall execute and deliver a release to the extent of the satisfaction tendered before or against receipt of the release: (1) Upon the satisfaction of the mortgage; (2) upon a bona fide offer to satisfy the mortgage in accordance with the terms of the mortgage deed upon the execution of a release; (3) when the parties in interest have agreed in writing to a partial release of the mortgage where that part of the property securing the partially satisfied mortgage is sufficiently definite and certain; or (4) when the mortgagor has made a bona fide offer in accordance with the terms of the mortgage deed for such partial satisfaction on the execution of such partial release.

(b) The plaintiff or the plaintiff's attorney shall execute and deliver a release when an attachment has become of no effect pursuant to section 52-322 or section 52-324 or when a lis pendens or other lien has become of no effect pursuant to section 52-326.

(c) The mortgagee or plaintiff or the plaintiff's attorney, as the case may be, shall execute and deliver a release within sixty days from the date a written request for a release of such encumbrance (1) was sent to such mortgagee, plaintiff or plaintiff's attorney at the person's last-known address by registered or certified mail, postage prepaid, return receipt requested, or (2) was received by such mortgagee, plaintiff or plaintiff's attorney from a private messenger or courier service or through any means of communication, including electronic communication, reasonably calculated to give the person the written request or a copy of it. The mortgagee or plaintiff shall be liable for damages to any person aggrieved at the rate of two hundred dollars for each week after the expiration of such sixty days up to a maximum of five thousand dollars or in an amount equal to the loss sustained by such aggrieved person as a result of the failure of the mortgagee or plaintiff or the plaintiff's attorney to execute and deliver a release, whichever is greater, plus costs and reasonable attorney's fees.

Sec. 49-8a. Release of mortgage. Affidavit. Recording of affidavit with town clerk. Penalty for recording false information.

(a) For the purposes of this section and section 49-10a:

(1) Mortgage loan means a loan secured by a mortgage on one, two, three or four family residential real property located in this state, including, but not limited to, a residential unit in any common interest community, as defined in section 47-202.

(2) Person means an individual, corporation, limited liability company, business trust, estate, trust, partnership, association, joint venture, government, governmental subdivision or agency, or other legal or commercial entity.

(3) Mortgagor means the grantor of a mortgage.

(4) Mortgagee means the grantee of a mortgage; provided, if the mortgage has been assigned of record, mortgagee means the last person to whom the mortgage has been assigned of record; and provided further, if the mortgage has been serviced by a mortgage servicer, mortgagee means the mortgage servicer.

(5) Mortgage servicer means the last person to whom the mortgagor has been instructed by the mortgagee to send payments of the mortgage loan. The person who has transmitted a payoff statement shall be deemed to be the mortgage servicer with respect to the mortgage loan described in that payoff statement.

(6) Attorney-at-law means any person admitted to practice law in this state and in good standing.

(7) Title insurance company means any corporation or other business entity authorized and licensed to transact the business of insuring titles to interests in real property in this state.

(8) Institutional payor means any bank or lending institution that, as part of making a new mortgage loan, pays off the previous mortgage loan.

(9) Payoff statement” means a statement of the amount of the unpaid balance on a mortgage loan, including principal, interest and other charges properly assessed pursuant to the loan documentation of such mortgage and a statement of the interest on a per diem basis with respect to the unpaid principal balance of the mortgage loan.

(b) If a mortgagee fails to execute and deliver a release of mortgage to the mortgagor or to the mortgagor's designated agent within sixty days from receipt by the mortgagee of payment of the mortgage loan (1) in accordance with the payoff statement furnished by the mortgagee, or (2) if no payoff statement was provided pursuant to a request made under section 49-10a, in accordance with a good faith estimate by the mortgagor of the amount of the unpaid balance on the mortgage loan using (A) a statement from the mortgagee indicating the outstanding balance due as of a date certain, and (B) a reasonable estimate of the per diem interest and other charges due, any attorney-at-law or duly authorized officer of either a title insurance company or an institutional payor may, on behalf of the mortgagor or any successor in interest to the mortgagor who has acquired title to the premises described in the mortgage or any portion thereof, execute and cause to be recorded in the land records of each town where the mortgage was recorded, an affidavit which complies with the requirements of this section.

(c) An affidavit pursuant to this section shall state that:

(1) The affiant is an attorney-at-law or the authorized officer of a title insurance company, and that the affidavit is made on behalf of and at the request of the mortgagor or the current owner of the interest encumbered by the mortgage;

(2) The mortgagee has provided a payoff statement with respect to the mortgage loan or the mortgagee has failed to provide a payoff statement requested pursuant to section 49-10a;

(3) The affiant has ascertained that the mortgagee has received payment of the mortgage loan (A) in accordance with the payoff statement, or (B) in the absence of a payoff statement requested pursuant to section 49-10a, in accordance with a good faith estimate by the mortgagor of the amount of the unpaid balance on the mortgage loan calculated in accordance with subdivision (2) of subsection (b) of this section, as evidenced by a bank check, certified check, attorney's clients' funds account check or title insurance company check, which has been negotiated by the mortgagee or by other documentary evidence of such receipt of payment by the mortgagee, including a confirmation of a wire transfer;

(4) More than sixty days have elapsed since payment was received by the mortgagee; and

(5) At least fifteen days prior to the date of the affidavit, the affiant has given the mortgagee written notice by registered or certified mail, postage prepaid, return receipt requested, of intention to execute and cause to be recorded an affidavit in accordance with this section, with a copy of the proposed affidavit attached to such written notice; and that the mortgagee has not responded in writing to such notification, or that any request for additional payment made by the mortgagee has been complied with at least fifteen days prior to the date of the affidavit.

(d) Such affidavit shall state the names of the mortgagor and the mortgagee, the date of the mortgage, and the volume and page of the land records where the mortgage is recorded. The affidavit shall provide similar information with respect to every recorded assignment of the mortgage.

(e) The affiant shall attach to the affidavit (1) photostatic copies of the documentary evidence that payment has been received by the mortgagee, including the mortgagee's endorsement of any bank check, certified check, attorney's clients' funds account check, title insurance company check, or confirmation of a wire transfer, and (2) (A) a photostatic copy of the payoff statement, or (B) in the absence of a payoff statement requested pursuant to section 49-10a, a copy of a statement from the mortgagee that is in the possession of the mortgagor indicating the outstanding balance due on the mortgage loan as of a date certain and a statement setting out the mortgagor's basis for the estimate of the amount due, and shall certify on each that it is a true copy of the original document.

(f) Such affidavit, when recorded, shall constitute a release of the lien of such mortgage or the property described therein.

(g) The town clerk shall index the affidavit in the name of the original mortgagee and the last assignee of the mortgage appearing of record as the grantors, and in the name of the mortgagors and the current record owner of the property as grantees.

(h) Any person who causes an affidavit to be recorded in the land records of any town in accordance with this section having actual knowledge that the information and statements therein contained are false shall be guilty of a class D felony.

Sec. 49-9. Release of mortgage, mechanic's lien or power of attorney. Form of instrument. Index. Operation of executed release.

(a) A mortgage of real or personal property, a mechanic's lien or a power of attorney for the conveyance of land may be released by an instrument in writing executed, attested and acknowledged in the same manner as deeds of land, setting forth that the mortgage, mechanic's lien or power of attorney for the conveyance of land is discharged or that the indebtedness or other obligation secured thereby has been satisfied. That instrument vests in the person or persons entitled thereto such legal title as is held by virtue of the mortgage, or mechanic's lien. An instrument in substantially the form following is sufficient for the release:

Know all Men by these Presents, That of in the county of and state of do hereby release and discharge a certain (mortgage, mechanic's lien or power of attorney for the conveyance of land) from to dated and recorded in the records of the town of in the county of and state of Connecticut, in book at page .

In Witness Whereof have hereunto set hand and seal, this day of ., A.D. .

Signed, sealed and delivered

in the presence of

(Seal)

(Acknowledgment)

(b) In the case of partial releases of mortgages as provided for in section 49-8, the instrument shall state the extent to which the mortgage is partially released and a sufficiently definite and certain description of that part of the property securing the mortgage which is being released therefrom.

(c) Town clerks shall note the discharge or partial release as by law provided and shall index the record of each such instrument under the name of the releasor and of the mortgagor.

(d) A release of mortgage executed in accordance with this section shall operate to release the interest of the releasor in the mortgage which is the subject of the release, even if such interest is, in fact, acquired by the releasor after executing such release or does not appear of record until after the execution of such release. Nothing in this subsection shall be construed to limit the effect of any release of mortgage recorded before, on or after October 1, 2006.

Sec. 49-10. Assignment of mortgage debt. Form of instrument. Requirements. Sufficient notice of assignment. Allocation of recording fees paid by a nominee of a mortgagee. Operation of executed assignment.

(a) As used in this section, mortgage debt” means a debt or other obligation secured by mortgage, assignment of rent or assignment of interest in a lease.

(b) Whenever any mortgage debt is assigned by an instrument in writing containing a sufficient description to identify the mortgage, assignment of rent or assignment of interest in a lease, given as security for the mortgage debt, and that assignment has been executed, attested and acknowledged in the manner prescribed by law for the execution, attestation and acknowledgment of deeds of land, the title held by virtue of the mortgage, assignment of rent or assignment of interest in a lease, shall vest in the assignee. An instrument substantially in the following form is sufficient for such assignment:

Know all Men by these Presents, That of in the county of and state of does hereby grant, bargain, sell, assign, transfer and set over a certain (mortgage, assignment of rent or assignment of interest in a lease) from to dated and recorded in the records of the town of county of and state of Connecticut, in book at page .

In Witness Whereof have hereunto set hand and seal, this day of A.D. .

Signed, sealed and delivered

in the presence of

(SEAL)

(Acknowledged)

(c) In addition to the requirements of subsection (b) of this section, whenever an assignment of any residential mortgage loan (1) made by a lending institution organized under the laws of or having its principal office in any other state, and (2) secured by mortgage on residential real estate located in this state is made in writing, the instrument shall contain the name and business or mailing address of all parties to such assignment.

(d) If a mortgage debt is assigned, a party obliged to pay such mortgage debt may discharge it, to the extent of the payment, by paying the assignor until the party obliged to pay receives sufficient notice in accordance with subsection (f) of this section that the mortgage debt has been assigned and that payment is to be made to the assignee. In addition to such notice, if requested by the party obliged to pay, the assignee shall furnish reasonable proof that the assignment has been made, and until the assignee does so, the party obliged to pay may pay the assignor. For purposes of this subsection, reasonable proof” means (1) written notice of assignment signed by both the assignor and the assignee, (2) a copy of the assignment instrument, or (3) other proof of the assignment as agreed to by the party obliged to pay such mortgage debt.

(e) If a mortgage debt is assigned, a party obliged to pay such mortgage debt who, in good faith and without sufficient notice of the assignment in accordance with subsection (f) of this section, executes with the assignor a modification or extension of the mortgage, assignment of rent or assignment of interest in a lease, shall have the benefit of such modification or extension, provided, the assignee shall acquire corresponding rights under the modified or extended mortgage, assignment of rent or assignment of interest in a lease. The assignment may provide that modification or extension of the mortgage, assignment of rent or assignment of interest in a lease, signed by the assignor after execution of the assignment, is a breach by the assignor of the assignor's contract with the assignee.

(f) Notice of assignment is sufficient for purposes of subsections (d) and (e) of this section if the assignee notifies a party obliged to pay the mortgage debt (1) by mailing to the party obliged to pay, at the party's last billing address, a notice of the assignment identifying the instrument and mortgage debt assigned, the party obliged to pay such debt, the names of the assignor and assignee, the date of the assignment, and the name and address of the person to whom payments should be made, (2) by giving notice of the assignment pursuant to 12 USC Section 2605, Section 6 of the federal Real Estate Settlement Procedures Act of 1974 and the regulations promulgated pursuant to said section, as from time to time amended, or (3) by giving actual notice of the assignment, reasonably identifying the rights assigned, in any other manner. No signature on any such notice is necessary to give sufficient notice of the assignment under this subsection and such notice may include any other information.

(g) Recordation of an assignment of mortgage debt is not sufficient notice of the assignment to the party obliged to pay for purposes of subsection (d) or (e) of this section.

(h) Notwithstanding the provisions concerning remittance and retention of fees set forth in section 7-34a, the recording fees paid in accordance with subsections (a), (d) and (e) of said section 7-34a by a nominee of a mortgagee, as defined in subdivision (2) of subsection (a) of said section 7-34a, shall be allocated as follows: (1) For fees collected upon a recording by a nominee of a mortgagee, except for the recording of (A) an assignment of mortgage in which the nominee of a mortgagee appears as assignor, and (B) a release of mortgage, as described in section 49-8, by a nominee of a mortgagee, the town clerk shall remit one hundred ten dollars of such fees to the state, such fees shall be deposited into the General Fund and, upon deposit in the General Fund, thirty-six dollars of such fees shall be credited to the community investment account established pursuant to section 4-66aa; the town clerk shall retain forty-nine dollars of such fees, thirty-nine dollars of which shall become part of the general revenue of such municipality and ten dollars of which shall be deposited into the town clerk fund; and the town clerk shall retain any fees for additional pages beyond the first page in accordance with the provisions of subdivision (2) of subsection (a) of said section 7-34a; and (2) for the fee collected upon a recording of (A) an assignment of mortgage in which the nominee appears as assignor, or (B) a release of mortgage by a nominee of a mortgagee, the town clerk shall remit one hundred twenty-seven dollars of such fee to the state, such fee shall be deposited into the General Fund and, upon deposit in the General Fund, thirty-six dollars of such fee shall be credited to the community investment account, and, until October 1, 2014, sixty dollars of such fee shall be credited to the State Banking Fund for purposes of funding the foreclosure mediation program established by section 49-31m; and the town clerk shall retain thirty-two dollars of such fee, which shall become part of the general revenue of such municipality.

(i) An assignment executed in accordance with this section shall operate to assign the interest of the assignor in the mortgage which is the subject of the assignment, even if such interest is, in fact, acquired by the assignor after executing such assignment or does not appear of record until after the execution of such assignment. Nothing in this subsection shall be construed to limit the effect of any assignment of mortgage debt recorded before, on or after October 1, 2006.