Certificate Releasing Connecticut Succession And Estate Tax Liens is a document issued by the Connecticut Department of Revenue Services (DRS) that provides proof that the estate tax lien on a deceased person's assets has been released. The Certificate Releasing Connecticut Succession And Estate Tax Liens is required when transferring the ownership of real or personal property owned by the deceased. There are two types of Certificate Releasing Connecticut Succession And Estate Tax Liens: a Certificate of Tax Lien Release and a Certificate of Tax Lien Satisfaction. The Certificate of Tax Lien Release is issued when the Connecticut estate taxes have been paid in full and the lien is released. The Certificate of Tax Lien Satisfaction is issued when the lien is satisfied by other means, such as the sale of the assets or the transfer of the assets to a trust. The Certificate Releasing Connecticut Succession And Estate Tax Liens must be submitted to the DRS for approval before the transfer of ownership of the deceased's assets can be completed.

Certificate Releasing Connecticut Succession And Estate Tax Liens

Description

How to fill out Certificate Releasing Connecticut Succession And Estate Tax Liens?

How much time and resources do you frequently dedicate to composing official documentation.

There’s a more efficient alternative to obtaining such forms than employing legal professionals or spending hours searching online for a fitting template. US Legal Forms is the foremost online repository that provides expertly drafted and validated state-specific legal documents for any purpose, such as the Certificate Releasing Connecticut Succession And Estate Tax Liens.

Another advantage of our library is that you can access previously acquired documents that you securely maintain in your profile under the My documents tab. Retrieve them anytime and re-complete your paperwork as often as necessary.

Conserve time and effort in completing legal documents with US Legal Forms, one of the most reliable online solutions. Register with us now!

- Examine the form content to confirm it meets your state regulations. To achieve this, review the form description or use the Preview option.

- If your legal template does not fulfill your requirements, locate another one using the search bar at the top of the page.

- If you already possess an account with us, Log In and download the Certificate Releasing Connecticut Succession And Estate Tax Liens. Otherwise, move on to the next steps.

- Click on Buy now once you identify the correct document. Select the subscription plan that best fits you to access our library’s complete service.

- Sign up for an account and complete the payment for your subscription. You can pay using your credit card or via PayPal - our service is completely secure for that.

- Download your Certificate Releasing Connecticut Succession And Estate Tax Liens onto your device and fill it out on a printed hard copy or electronically.

Form popularity

FAQ

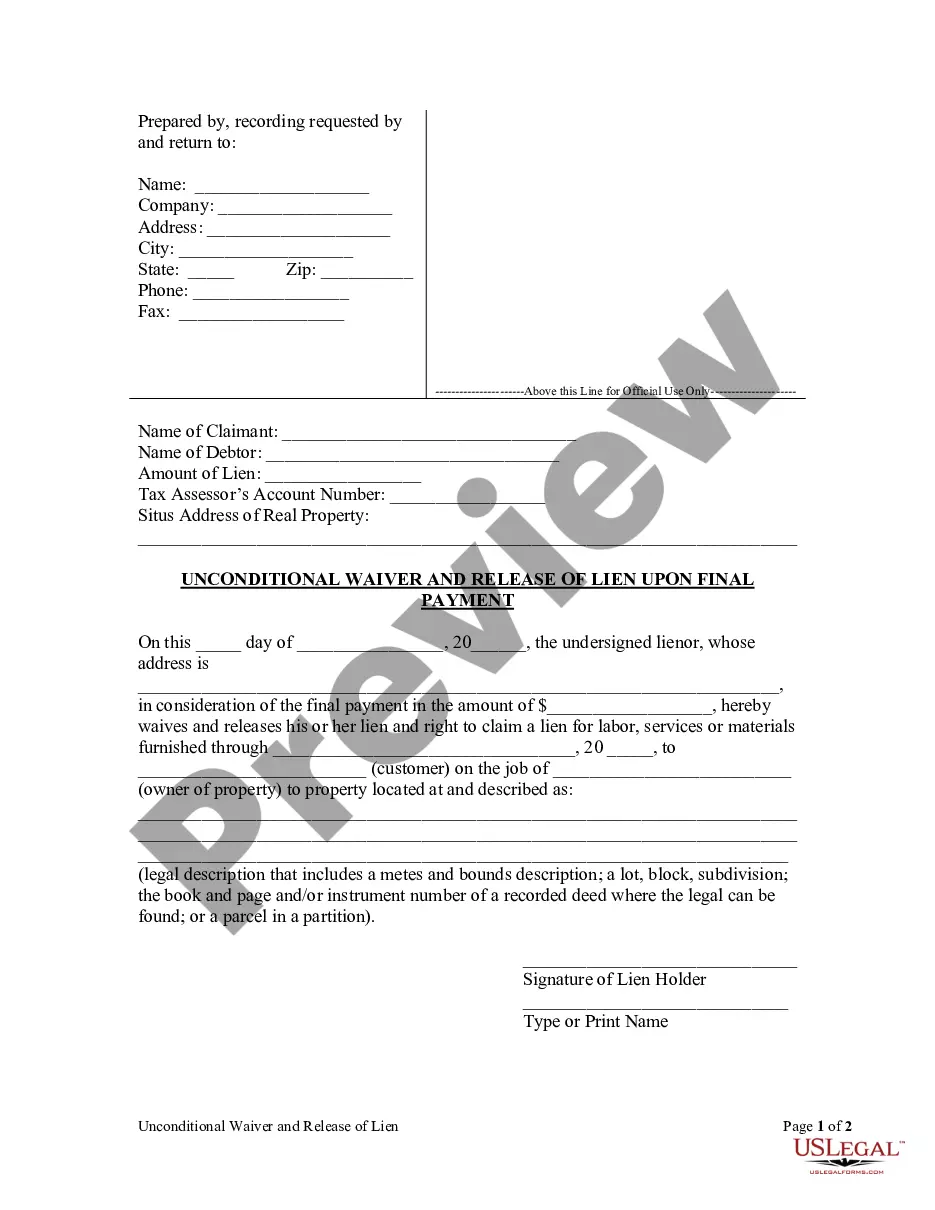

You can obtain a lien release form from your local Connecticut town clerk's office, or you can access it online through various legal forms platforms. Platforms like USLegalForms simplify this process by providing easy access to necessary documentation. This resource ensures you can efficiently manage and resolve any tax lien issues related to succession and estate matters.

A lien release statement is a document that declares a lien on a property is no longer valid. This statement is crucial when you have resolved your tax obligations, allowing for a smooth transfer of ownership. It plays a significant role in handling Connecticut succession and estate tax liens and is essential for potential buyers.

To release a lien in Connecticut, you must complete the appropriate form, such as the Certificate of Release of Tax Lien, and submit it to the local town clerk’s office. Once filed, this document officially indicates the resolution of any outstanding estate tax liens. Ensuring you handle this process properly will help you maintain clear property titles.

Yes, Connecticut operates as a tax lien state, meaning that the state can place a lien on your property if taxes remain unpaid. This ensures that the government can recover owed taxes through the property ownership. Understanding how this works will help you navigate any tax issues, especially related to succession and estate matters.

In Connecticut, the form for releasing a lien includes the CT Certificate of Release of Tax Lien. This document officially removes any recorded tax liens associated with the property, ensuring clarity in the ownership status. Utilizing this form is essential for clearing any estate tax liens before a property can be transferred or sold.

CT 1041 must be filed by the fiduciary of the estate. This fiduciary is responsible for the management of estate finances and reporting income generated during the administration. If the estate generates sufficient income, timely filing is essential. Utilizing platforms that assist with estate tax compliance can ease the journey to obtaining a Certificate Releasing Connecticut Succession And Estate Tax Liens.

Not everyone is required to file an estate tax return. Only estates that exceed the $2.6 million threshold in Connecticut must file. However, even smaller estates might benefit from filing under certain circumstances. Engaging with a service that specializes in estate matters can streamline your process and secure a Certificate Releasing Connecticut Succession And Estate Tax Liens.

In Connecticut, you can inherit up to $2.6 million without triggering estate taxes. This exemption is vital for estate planning and helps reduce financial burdens on heirs. To navigate this law effectively, many turn to services that provide guidance on securing a Certificate Releasing Connecticut Succession And Estate Tax Liens after tax obligations have been settled.

Estate tax return 1041 must be filed by the personal representative of the estate, which may be an executor or administrator. This representative manages the estate's financial matters and must ensure compliance with tax obligations. If the estate has income exceeding $600 during its administration, a 1041 needs to be filed. Obtaining a Certificate Releasing Connecticut Succession And Estate Tax Liens often follows this filing.

An estate tax return is generally triggered when a deceased individual’s estate exceeds a certain value. In Connecticut, this threshold is currently set at $2.6 million. If your loved one's estate is above this amount, you will likely need to file. This process plays a crucial role in obtaining a Certificate Releasing Connecticut Succession And Estate Tax Liens.