Working with legal documentation requires attention, precision, and using properly-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Connecticut Refund Claim For Overpaid Fees template from our library, you can be sure it complies with federal and state regulations.

Working with our service is easy and fast. To get the required document, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to obtain your Connecticut Refund Claim For Overpaid Fees within minutes:

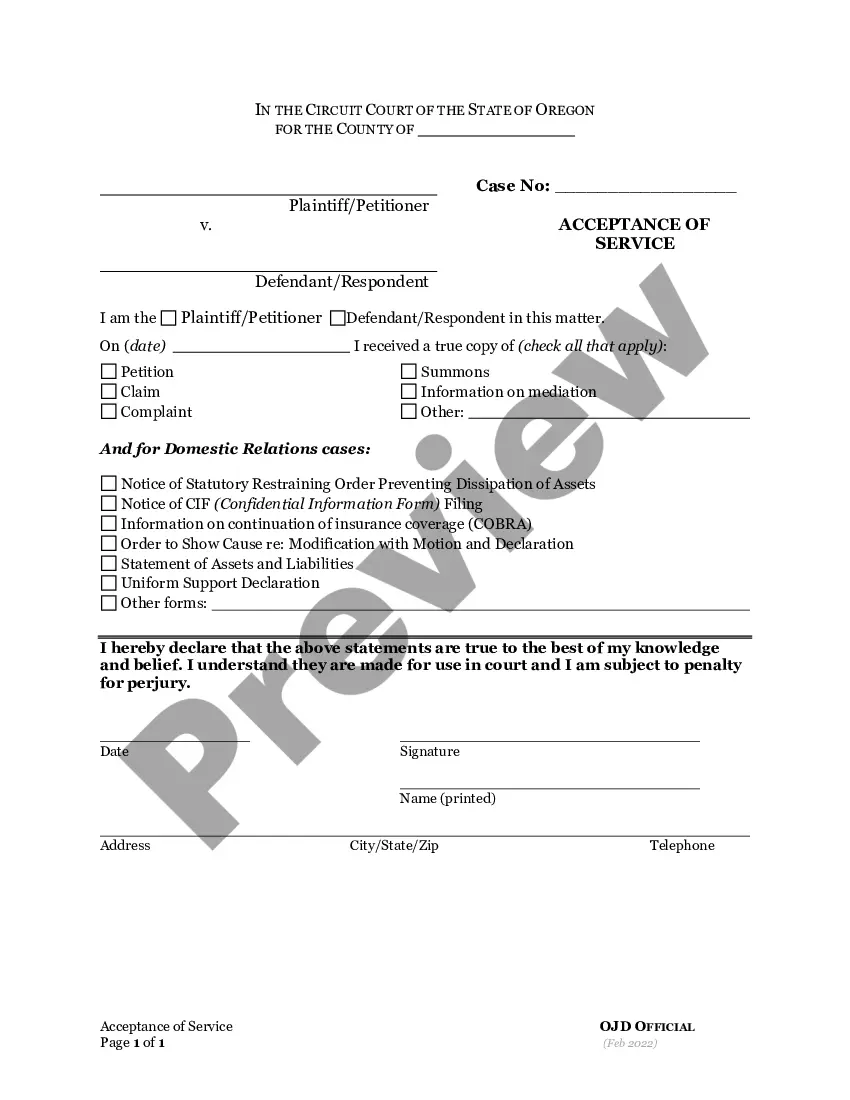

- Remember to attentively examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for an alternative formal template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Connecticut Refund Claim For Overpaid Fees in the format you prefer. If it’s your first time with our service, click Buy now to continue.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Connecticut Refund Claim For Overpaid Fees you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in full legal compliance!

Attached you will find a refund form to complete to obtain the refund of your overpaid fees. It is preferred you submit this form to us via email.Following find the Refund Claim Form you will need to complete in order to obtain a refund of your overpaid fees. To request a refund after making a duplicate or erroneous overpayment, the payor should, complete an Application for Refund form, which is available under the. Use Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. If the fee we withheld and paid exceeds the authorized fee, refund the excess fee withholding to the claimant. Supporting documentation, including but not limited to: A letter explaining the reason for the refund. A copy of your Explanation of Benefits (EOB) statement. A claim for refund is a request for reimbursement of amounts previously paid. Generally, if you have paid your balance in full you will file a formal claim.