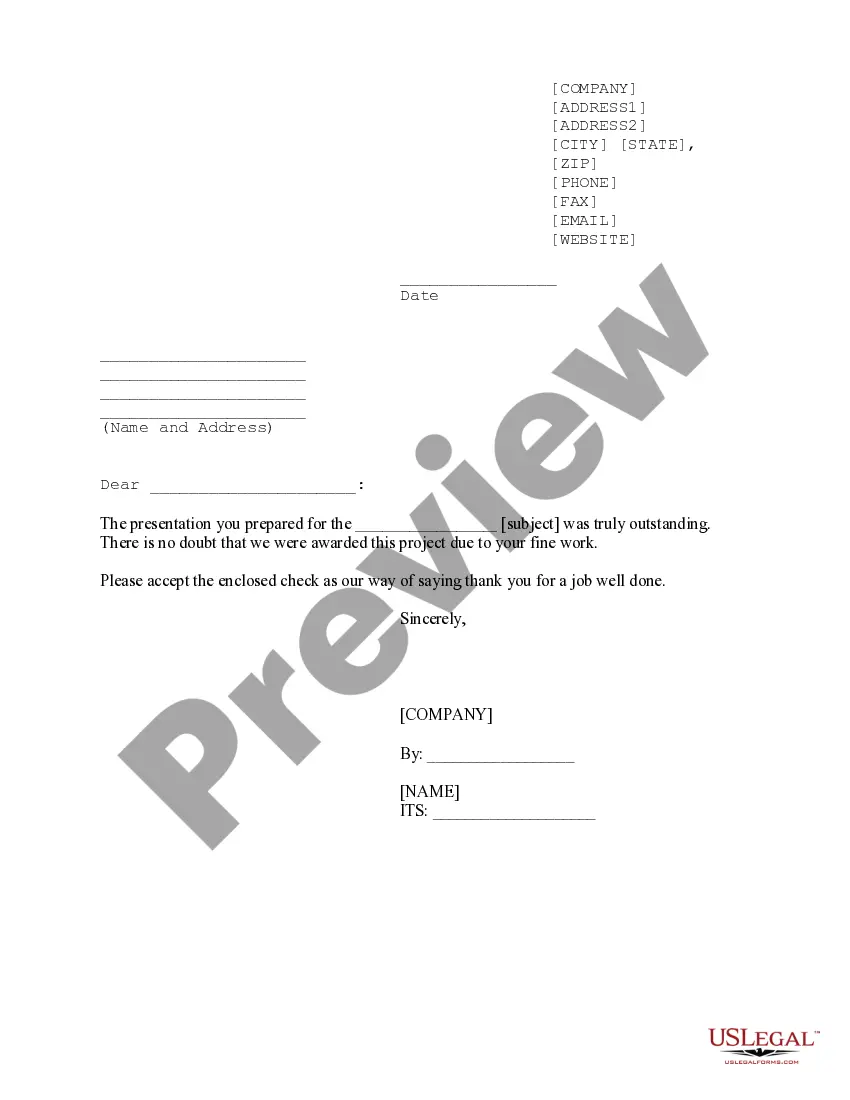

This form is a sample letter in Word format covering the subject matter of the title of the form.

Connecticut Sample Letter for Bonus

Description

How to fill out Sample Letter For Bonus?

It is feasible to spend hours online attempting to locate the legal document template that meets the state and federal requirements you have.

US Legal Forms provides thousands of legal forms that have been reviewed by experts.

You can easily download or print the Connecticut Sample Letter for Bonus from our platform.

If available, use the Review button to take a look through the document template as well.

- If you already have a US Legal Forms account, you may Log In and click on the Obtain button.

- After that, you can complete, modify, print, or sign the Connecticut Sample Letter for Bonus.

- Every legal document template you purchase is yours indefinitely.

- To retrieve another copy of any purchased form, navigate to the My documents tab and click on the corresponding button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate document template for the county/region of your choice.

- Review the document description to confirm you have chosen the correct form.

Form popularity

FAQ

I am writing this letter with immense pleasure and respect. I would like to inform you that I have been working hard and sincerely to present my dedication towards the growth of our company. I have worked overtime and worked as and when required by the company. I believe that I deserve some bonus for the same.

Dear Employee Name, We are pleased to present you with your year award in the amount of $. This bonus award reflects your excellent performance, the contributions you made and the goals achieved on behalf of Company Name during the past year.

Respected Sir, It is strongly request you to kindly allocate me annual bonus as per company policy. I am serving your esteem organization since last one & half year ( joining date) and, It is company policy to give annual bonus to every employee who has worked at least one year.

Dear Employee Name, We are pleased to present you with your year award in the amount of $. This bonus award reflects your excellent performance, the contributions you made and the goals achieved on behalf of Company Name during the past year.

Thank you so much for my performance bonus. I really appreciate your generosity and having my hard work acknowledged. I feel so fortunate to work for a company that encourages its employees to keep meeting new goals and gives them the support and tools to do so.

Here are some ways to inquire about the extra money you were promised without making your boss angry.Wait an appropriate amount of time.Don't assume your boss remembers.Don't say you need the money.Master the timing.Catch your boss in a good mood.Come prepared.Don't slack off.Don't appear desperate, demanding or pushy.

I would like to take some time to discuss a bonus payment for my performance this year and I wanted to request a meeting at a time that is convenient for you, so that I can present my achievements to you in more detail. I know that you highly value my contribution and I thank you for your recognition of this.

I am writing this letter with immense pleasure and respect. I would like to inform you that I have been working hard and sincerely to present my dedication towards the growth of our company. I have worked overtime and worked as and when required by the company. I believe that I deserve some bonus for the same.

To: All Employees or Dear Name of Employee: I am pleased to announce that the numbers are now in for year, and we have not only met all our goals but exceeded them for sales and customer service! All of you have my congratulations and personal appreciation for this achievement!