Connecticut Accounts Receivable - Assignment

Description

How to fill out Accounts Receivable - Assignment?

Are you currently in a scenario where you will require documents for various business or specific purposes almost every working day.

There are numerous legal document templates available online, but locating ones you can trust is not simple.

US Legal Forms offers a vast array of form templates, such as the Connecticut Accounts Receivable - Assignment, designed to comply with federal and state regulations.

Once you find the correct form, click Acquire now.

Choose the pricing plan you want, fill in the required information to create your account, and complete the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Connecticut Accounts Receivable - Assignment template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

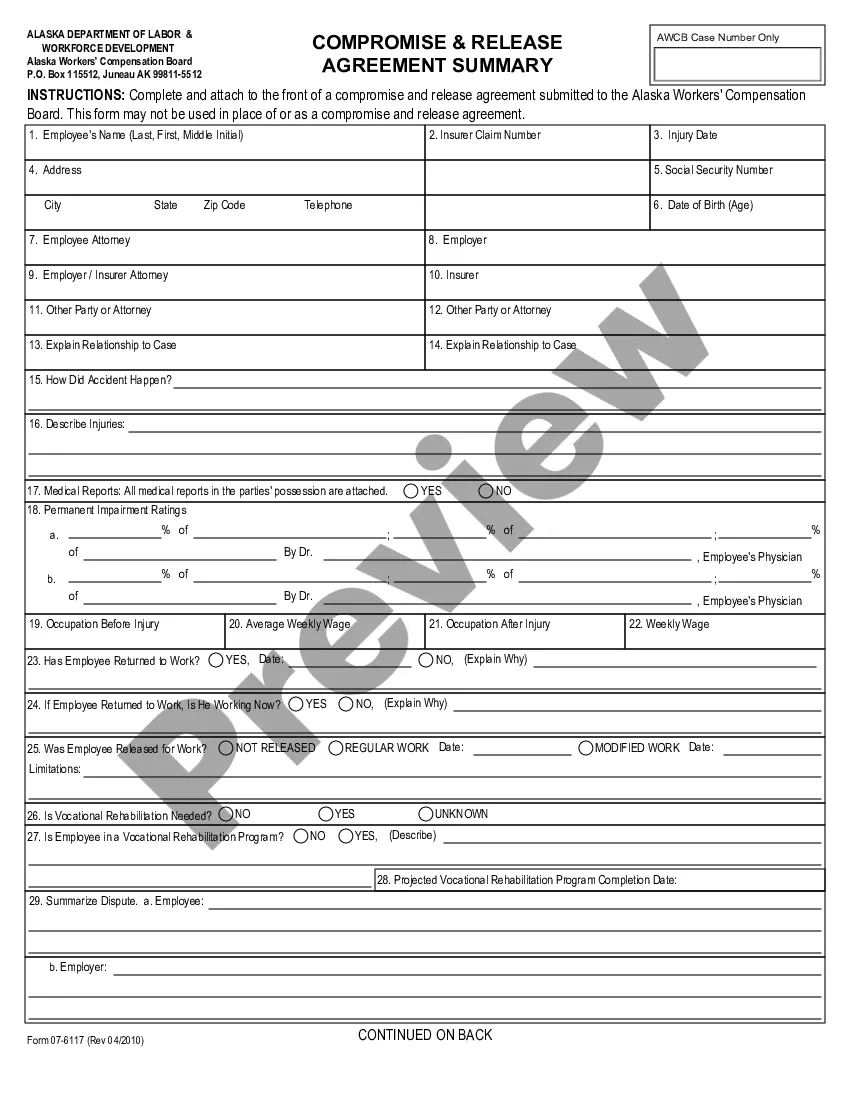

- Locate the form you need and ensure it is for the correct city/state.

- Use the Review button to examine the form.

- Check the description to confirm you have selected the right form.

- If the form is not what you are seeking, use the Search field to find the form that satisfies your needs and requirements.

Form popularity

FAQ

Generally Accepted Accounting Principles (GAAP) set standards for reporting accounts receivable, ensuring transparency and consistency. Under GAAP, receivables should be recorded at their net realizable value, reflecting expected collections. Familiarizing yourself with these rules can enhance your Connecticut Accounts Receivable - Assignment processes, helping maintain compliance and trust with stakeholders.

The 5 C's of accounts receivable management include Character, Capacity, Capital, Conditions, and Collateral. Understanding these elements helps businesses assess the creditworthiness of customers. By focusing on these factors, you can improve your Connecticut Accounts Receivable - Assignment strategies, ensuring timely payments and reducing risks.

To find accounts receivable in accounting, you can review the balance sheet, where it is typically listed as a current asset. Additionally, businesses can track outstanding invoices and payment records to manage their receivables effectively. Utilizing tools from platforms like UsLegalForms can simplify this process, making it easier for you to monitor Connecticut Accounts Receivable - Assignment and improve your financial management.

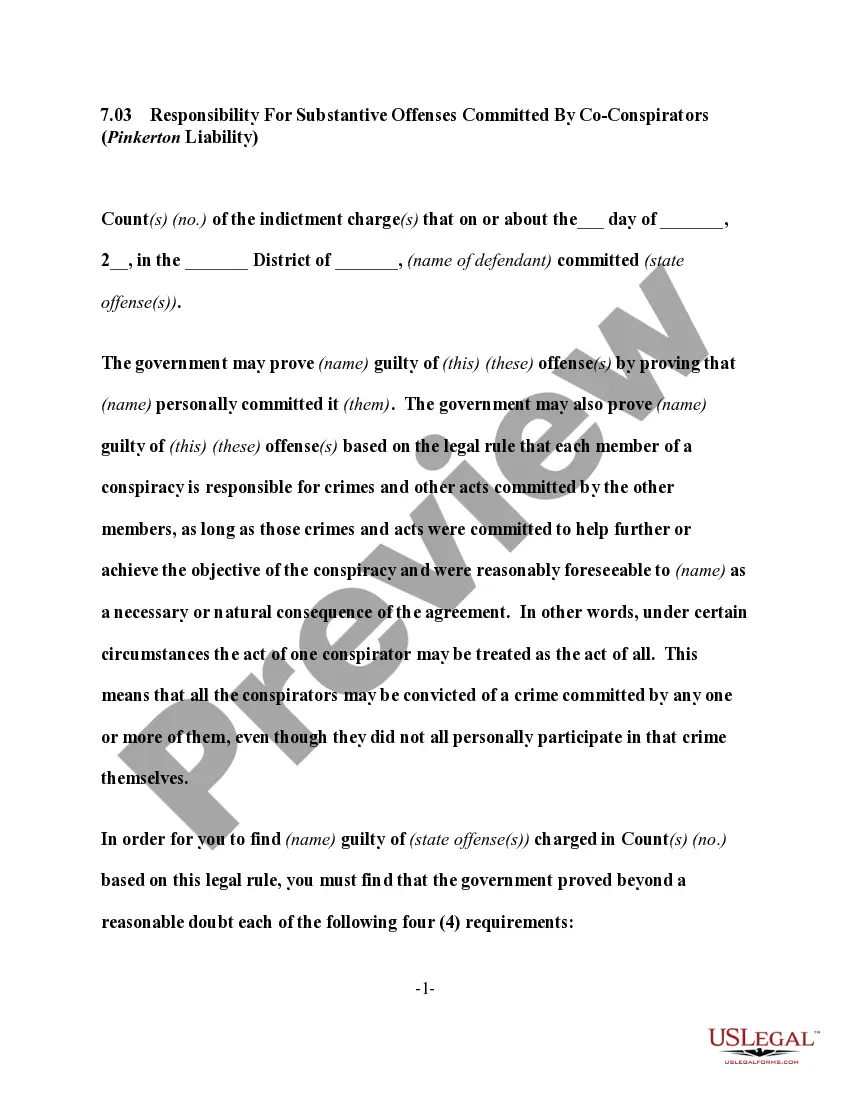

Consent to assignment of receivables is an agreement in which the original creditor allows a third party to collect debts owed by their customers. This consent is crucial because it enables the assignee to pursue collections legally. For businesses in Connecticut Accounts Receivable - Assignment, obtaining this consent can ensure smoother transactions and a clearer understanding between all parties involved.

Firstly, factoring is a financial service of selling and purchasing, which implies consideration, unlike assignment, which may take place either with or without consideration. In addition, non-matured or future accounts receivable can be subject to factoring.

In the accounts receivable assignment process, a company assigns receivables to a lending institution to borrow money. The borrower pays interest plus additional fees. The borrowing company retains ownership of the accounts receivable and collects payment from its customers.

What are the benefits of Assigning Receivables? Assigning receivables turns unpaid invoices into immediate working capital. The borrowing business can then cover day-to-day expenses like payroll or rent. The borrowing company still owns the accounts, but the assigned receivables serve as collateral.

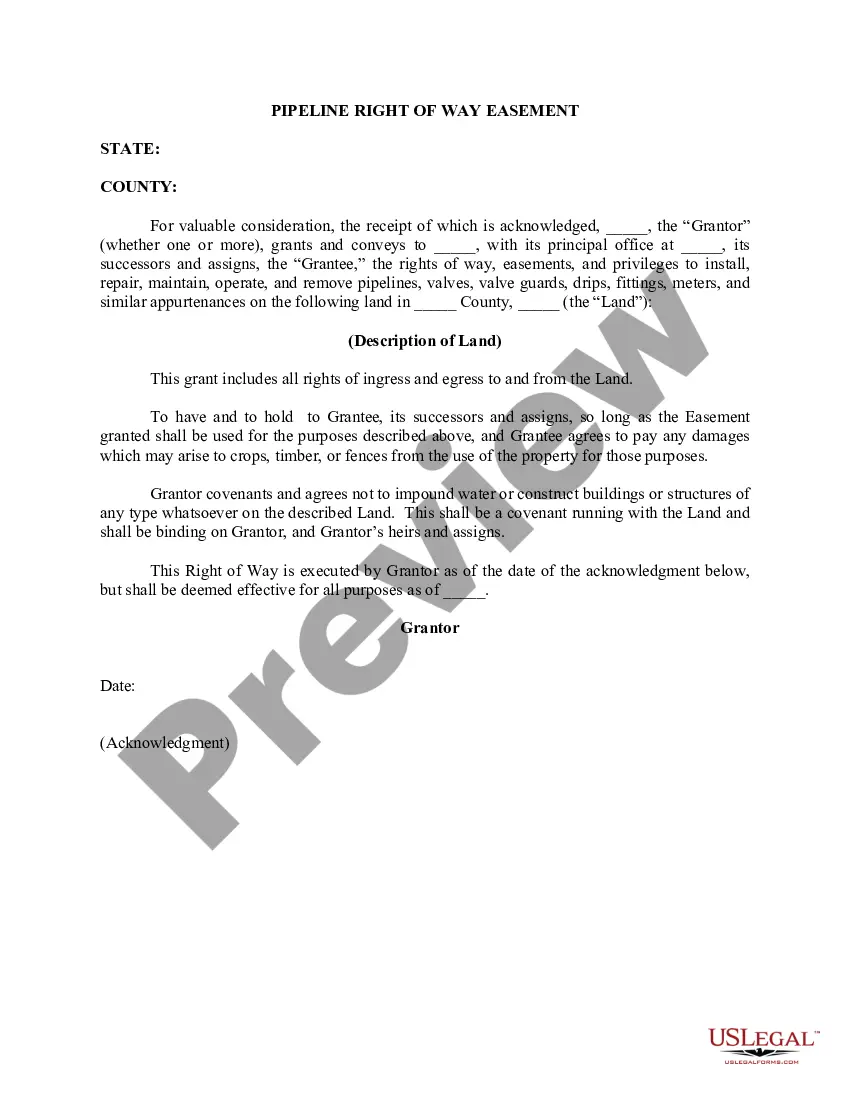

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

Example of the Assignment of Accounts Receivable ABC Corp. approaches XYZ Bank to obtain financing using its accounts receivable as collateral. XYZ Bank agrees to provide a loan of 85% of the total accounts receivable value, which amounts to $170,000 (85% of $200,000).

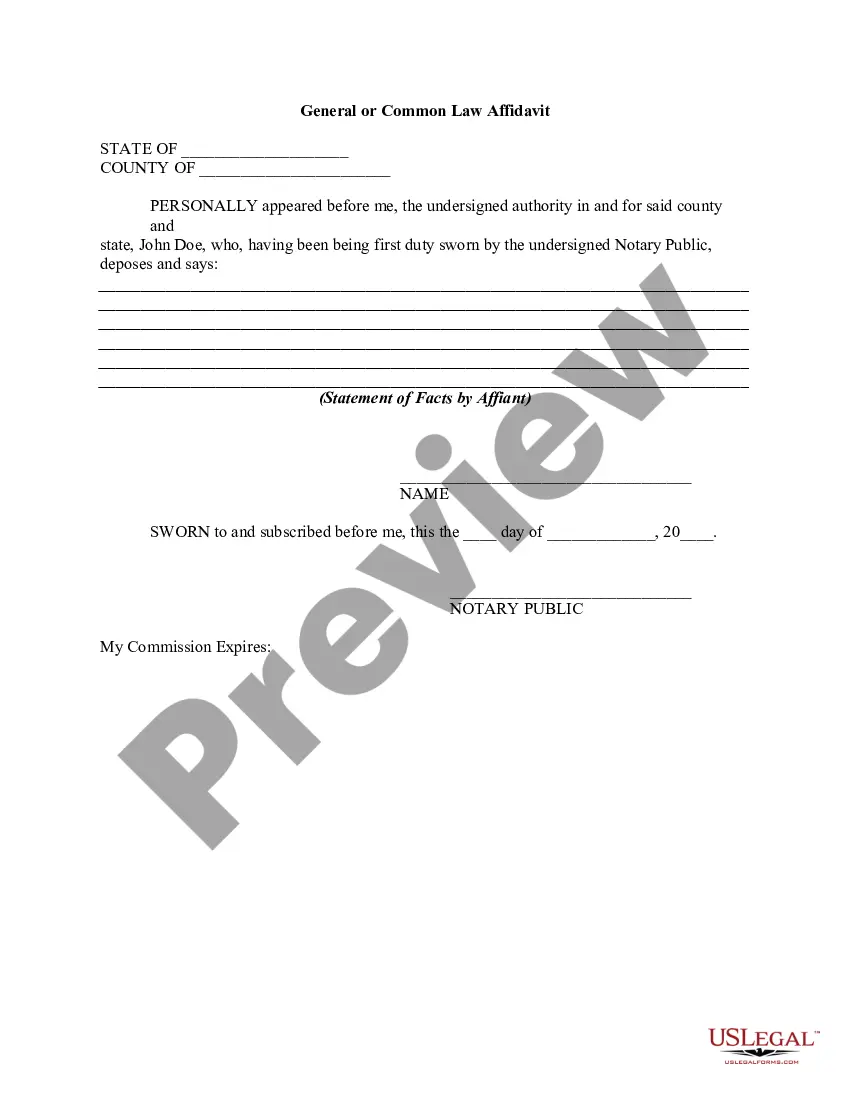

What are the journal entries for assigning Accounts Receivable as collateral for a loan? The entry to record assignment of Accounts Receivable as collateral would be a credit to cash, and a debit to assign Accounts Receivable. The cash account is debited because the company gave up the assigned receivables.