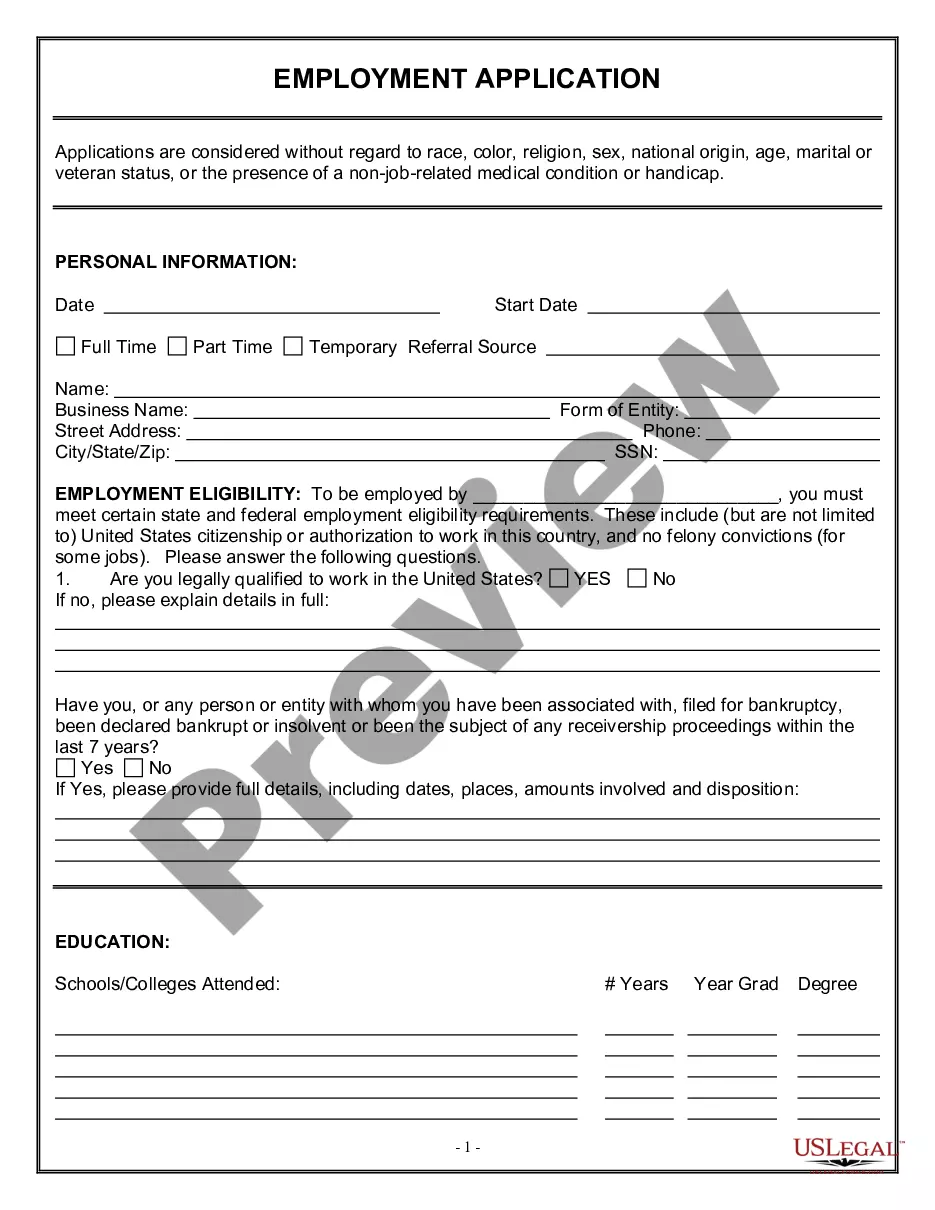

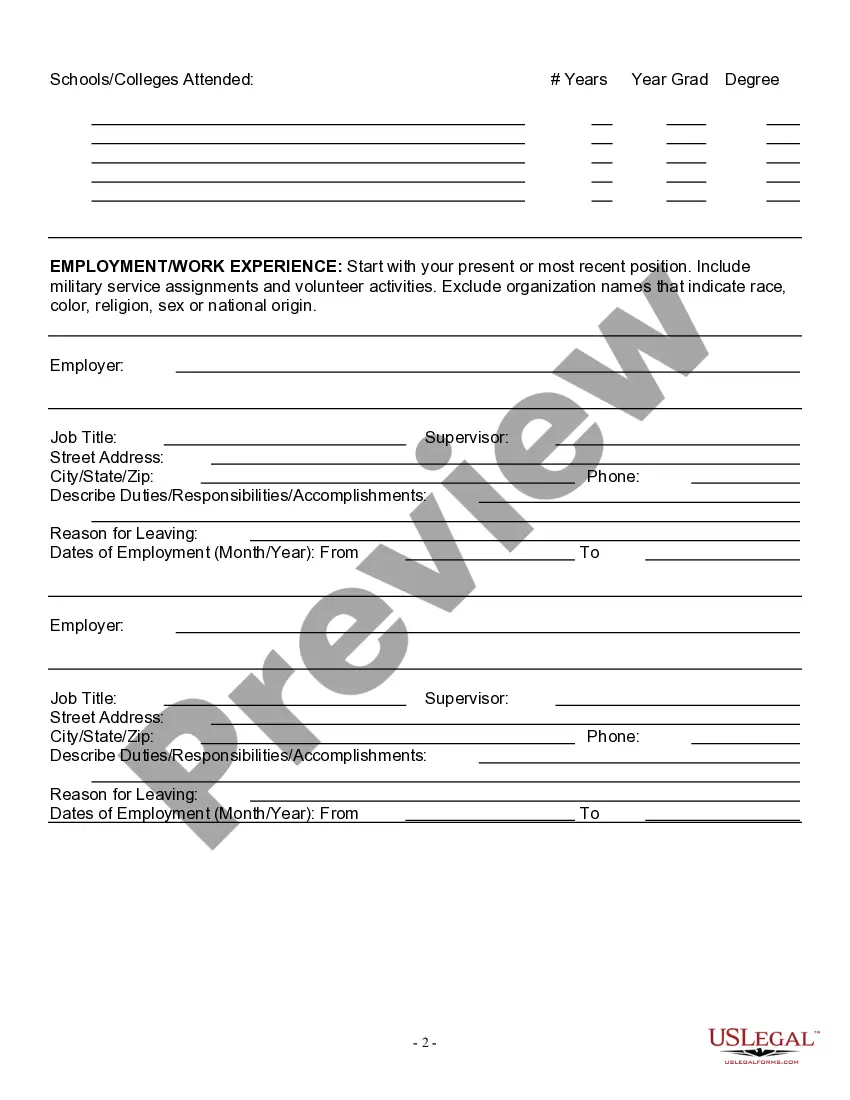

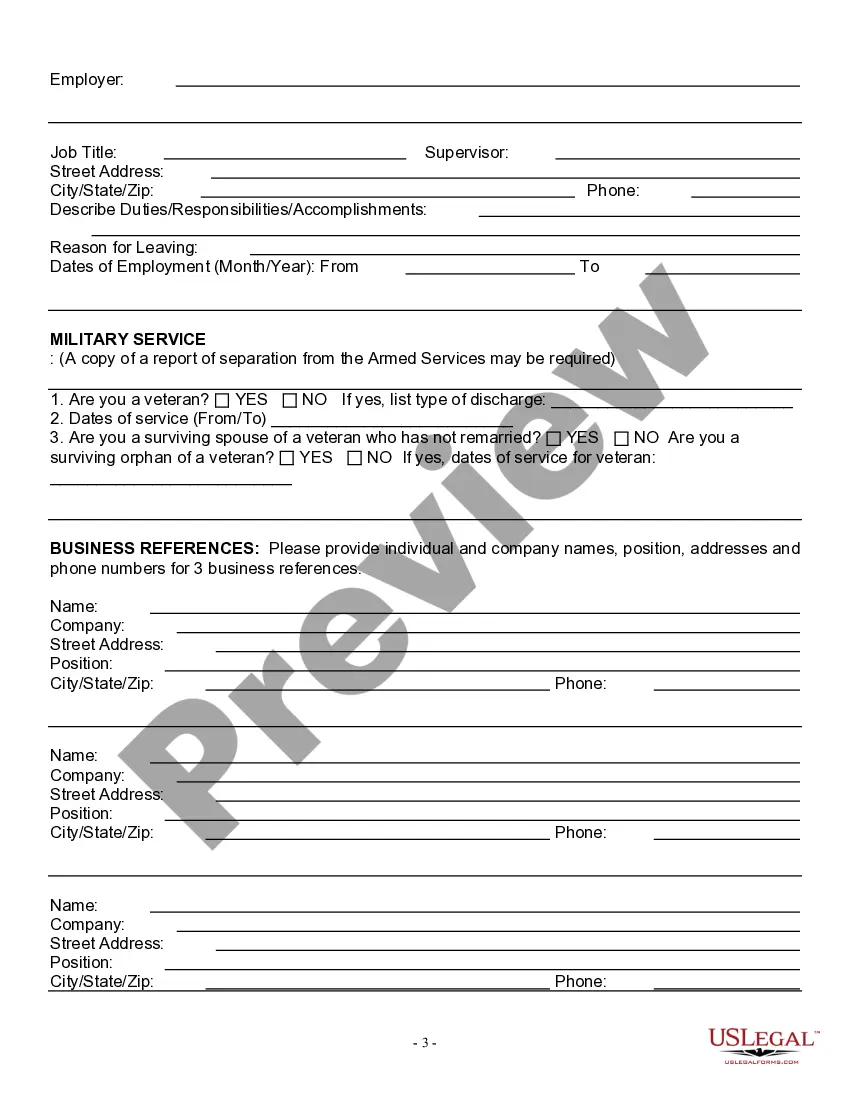

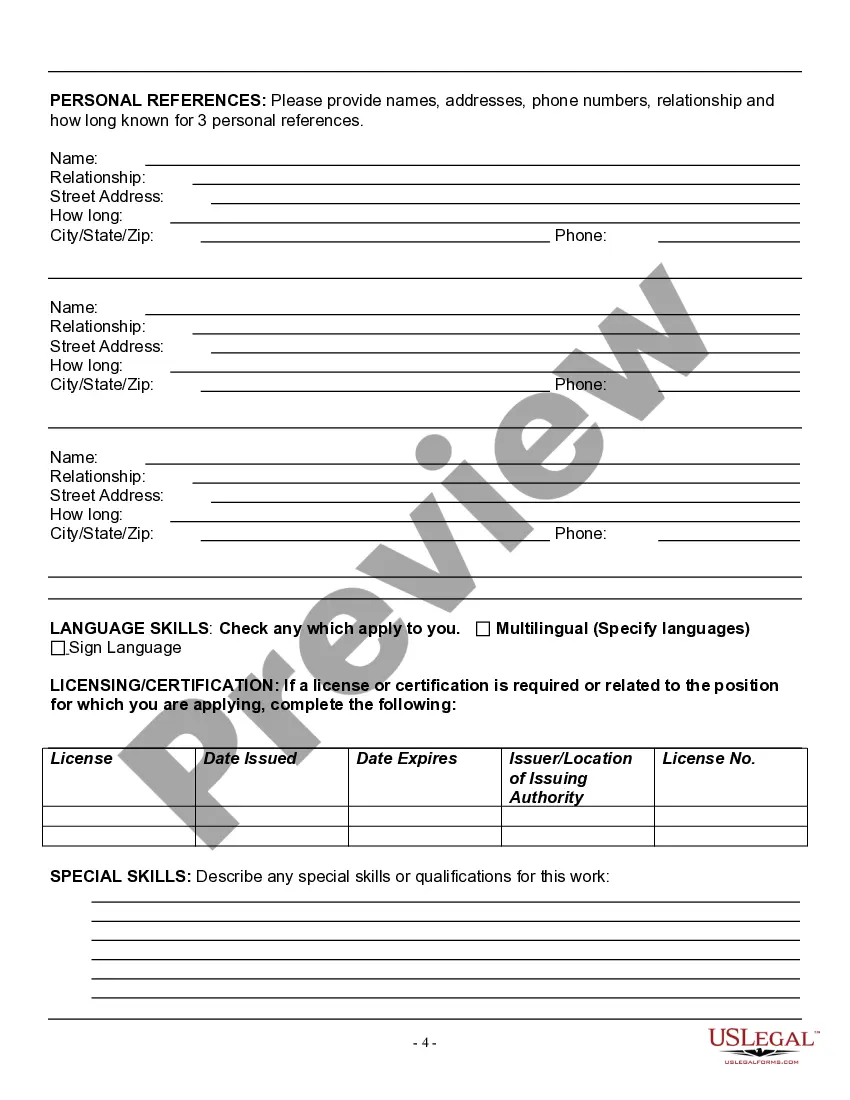

Connecticut Employment Application for Accountant

Description

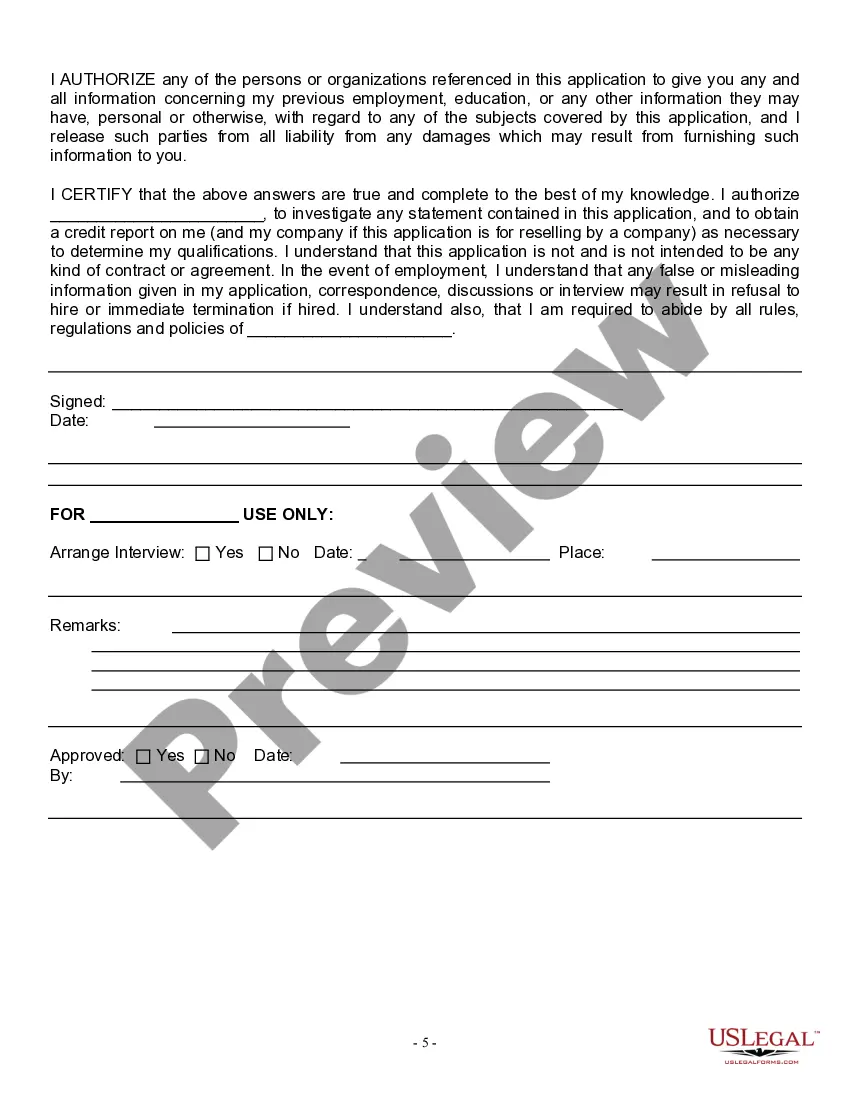

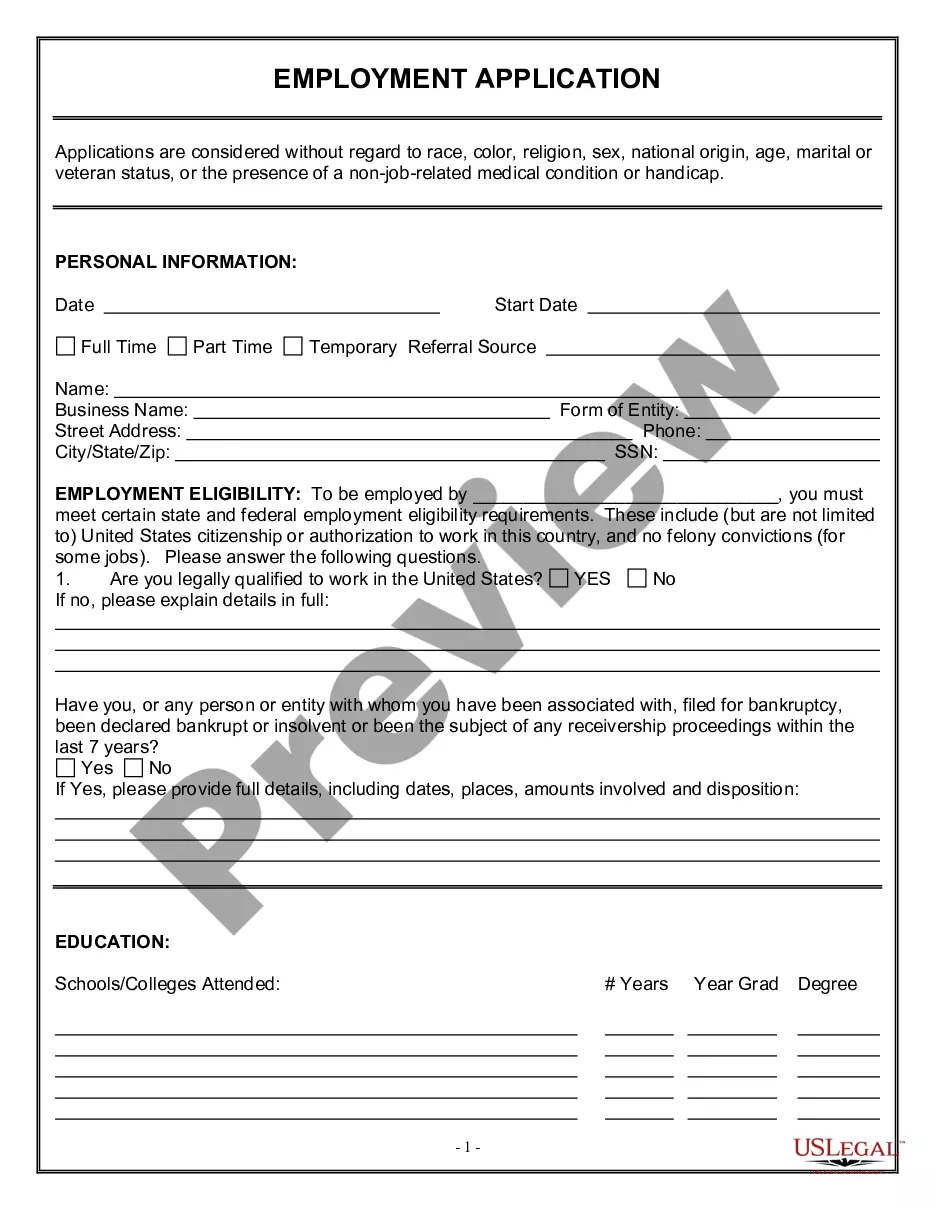

How to fill out Employment Application For Accountant?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal form templates that you can download or print.

By utilizing the website, you can discover thousands of forms for business and personal uses, organized by categories, states, or keywords. You can obtain the most recent versions of forms such as the Connecticut Employment Application for Accountant within minutes.

If you already have a membership, Log In to download the Connecticut Employment Application for Accountant from the US Legal Forms repository. The Download option will be visible on every form you view. You can access all previously downloaded forms from the My documents tab in your account.

Process the transaction. Use your credit card or PayPal account to complete the purchase.

Select the format and download the form to your device.Make edits. Fill out, modify, print, and sign the downloaded Connecticut Employment Application for Accountant.Every template you add to your account does not expire and is yours permanently. Therefore, if you would like to download or print another copy, simply navigate to the My documents section and click on the form you wish.

- Ensure you have selected the correct form for your city/state.

- Click on the Review option to examine the form`s content.

- Check the form details to confirm that you have chosen the right one.

- If the form does not fit your needs, use the Lookup field at the top of the screen to find one that does.

- If you are pleased with the form, validate your choice by clicking the Purchase now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.