Connecticut Employment Application for Sole Trader

Description

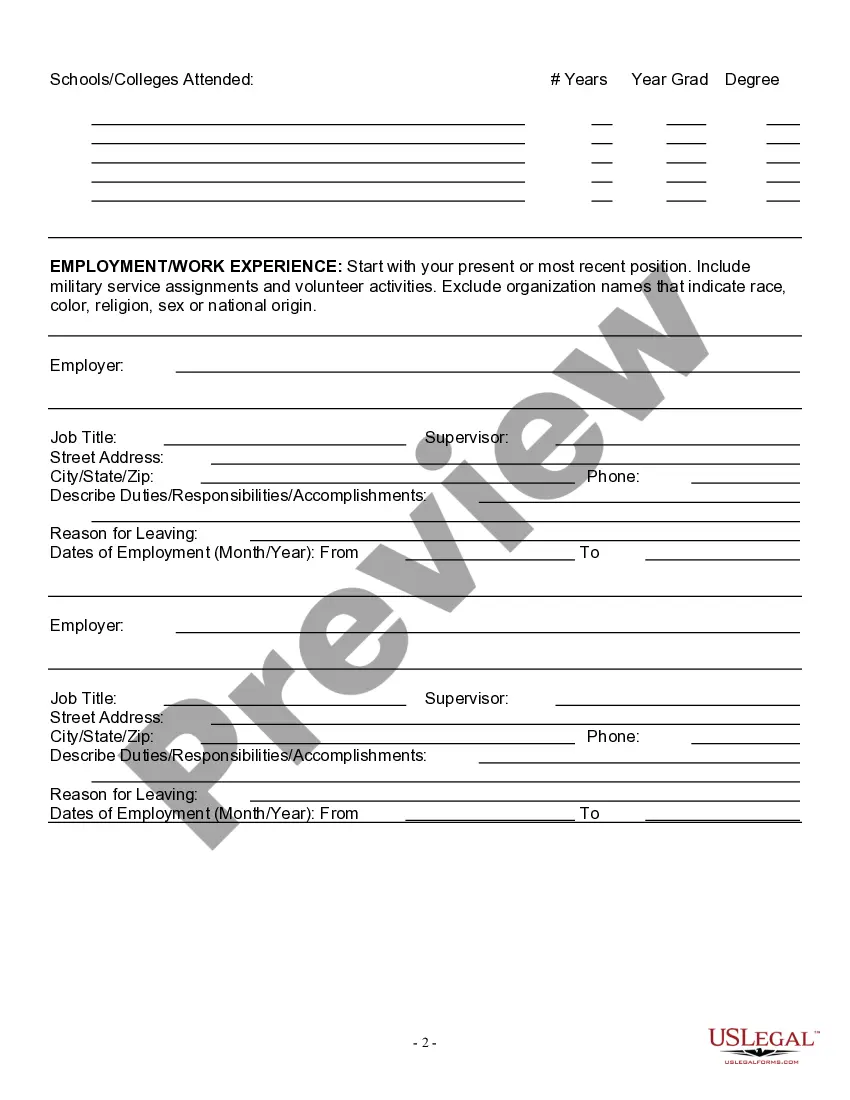

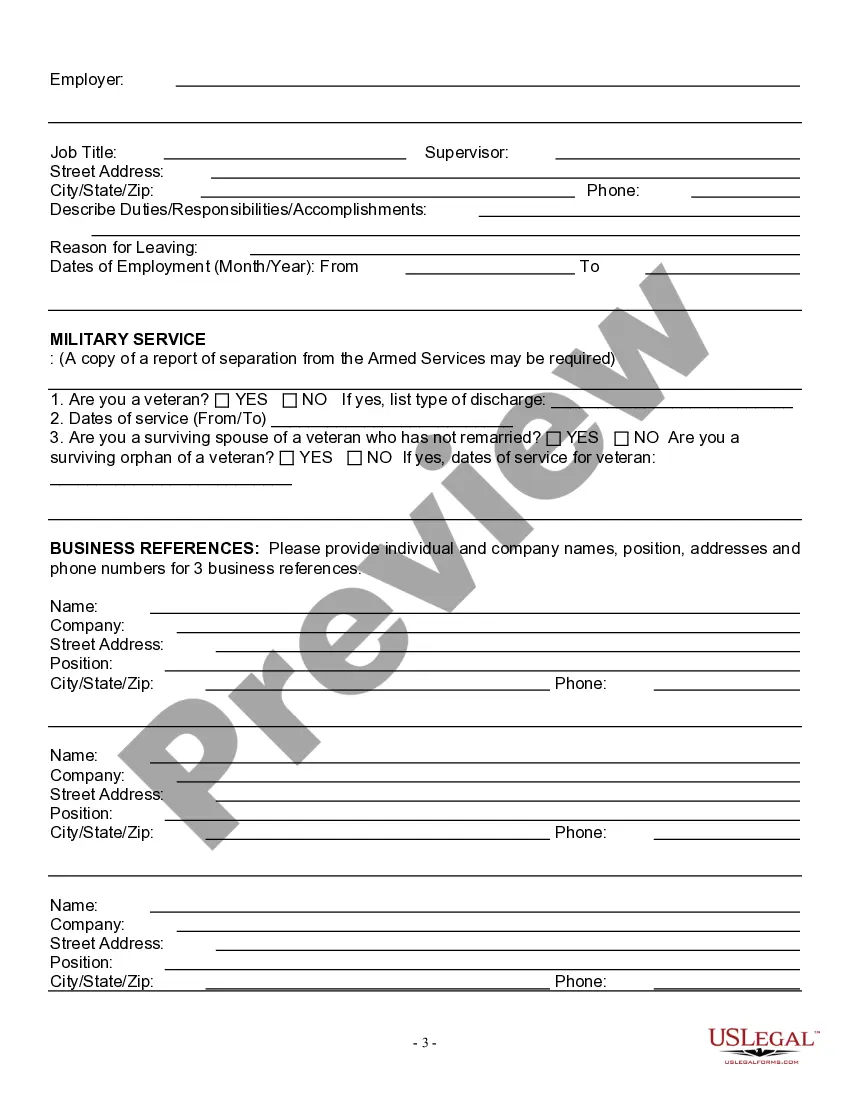

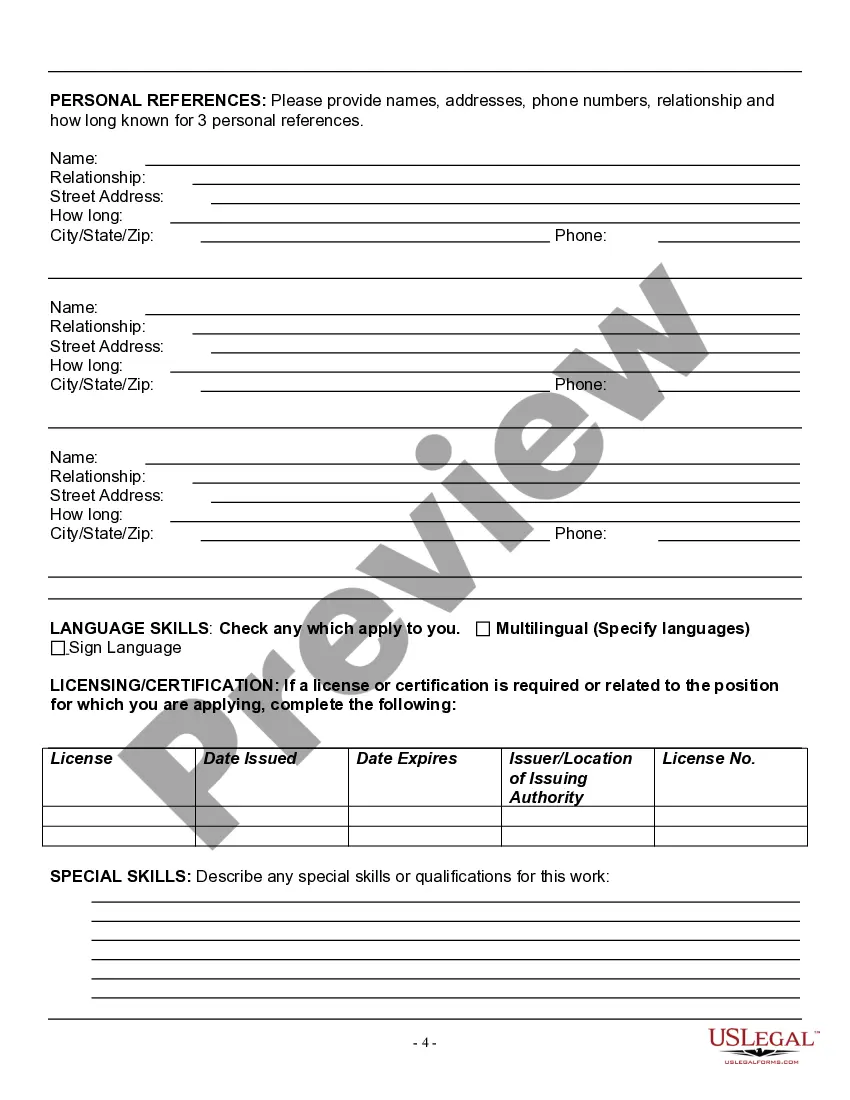

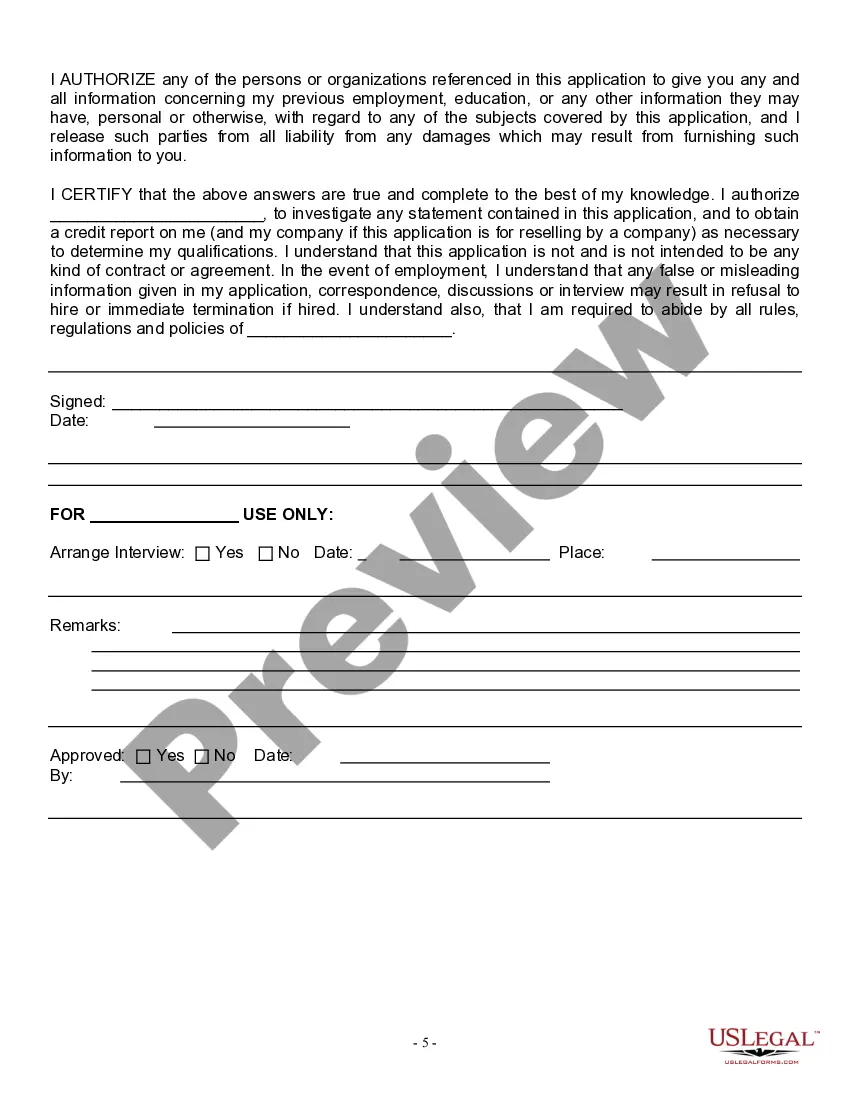

How to fill out Employment Application For Sole Trader?

It is feasible to spend numerous hours online trying to locate the authentic document template that fulfills the regional and national requirements you will need.

US Legal Forms offers thousands of valid templates that are reviewed by experts.

You can easily obtain or print the Connecticut Employment Application for Sole Trader from this service.

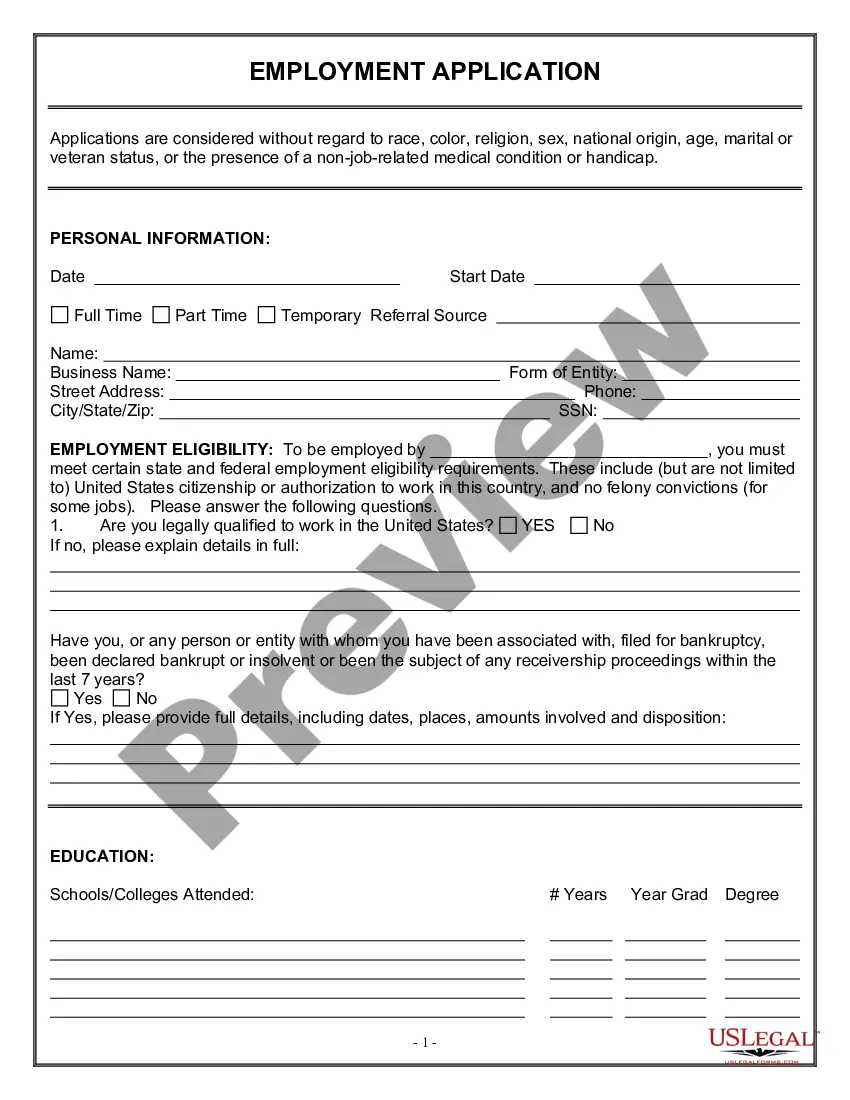

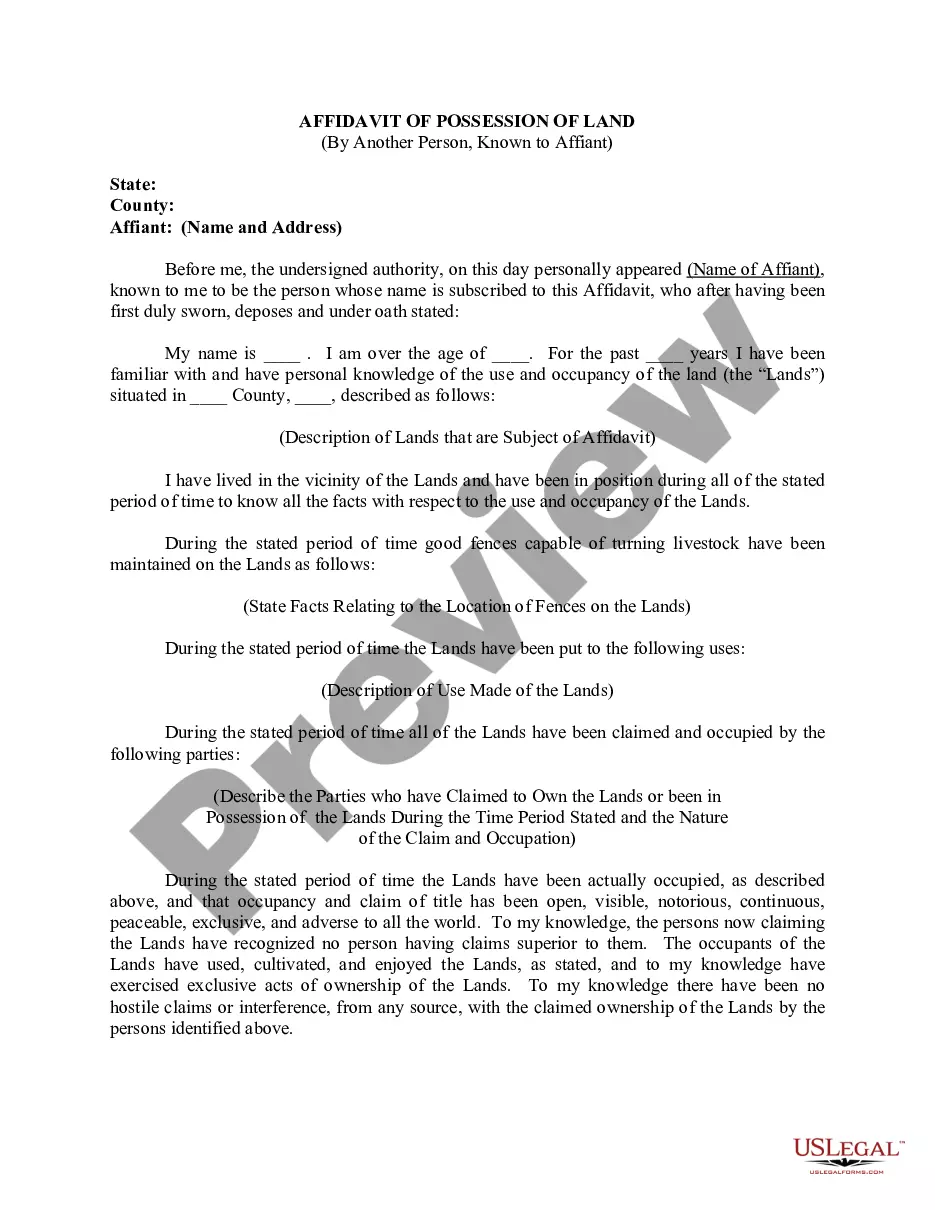

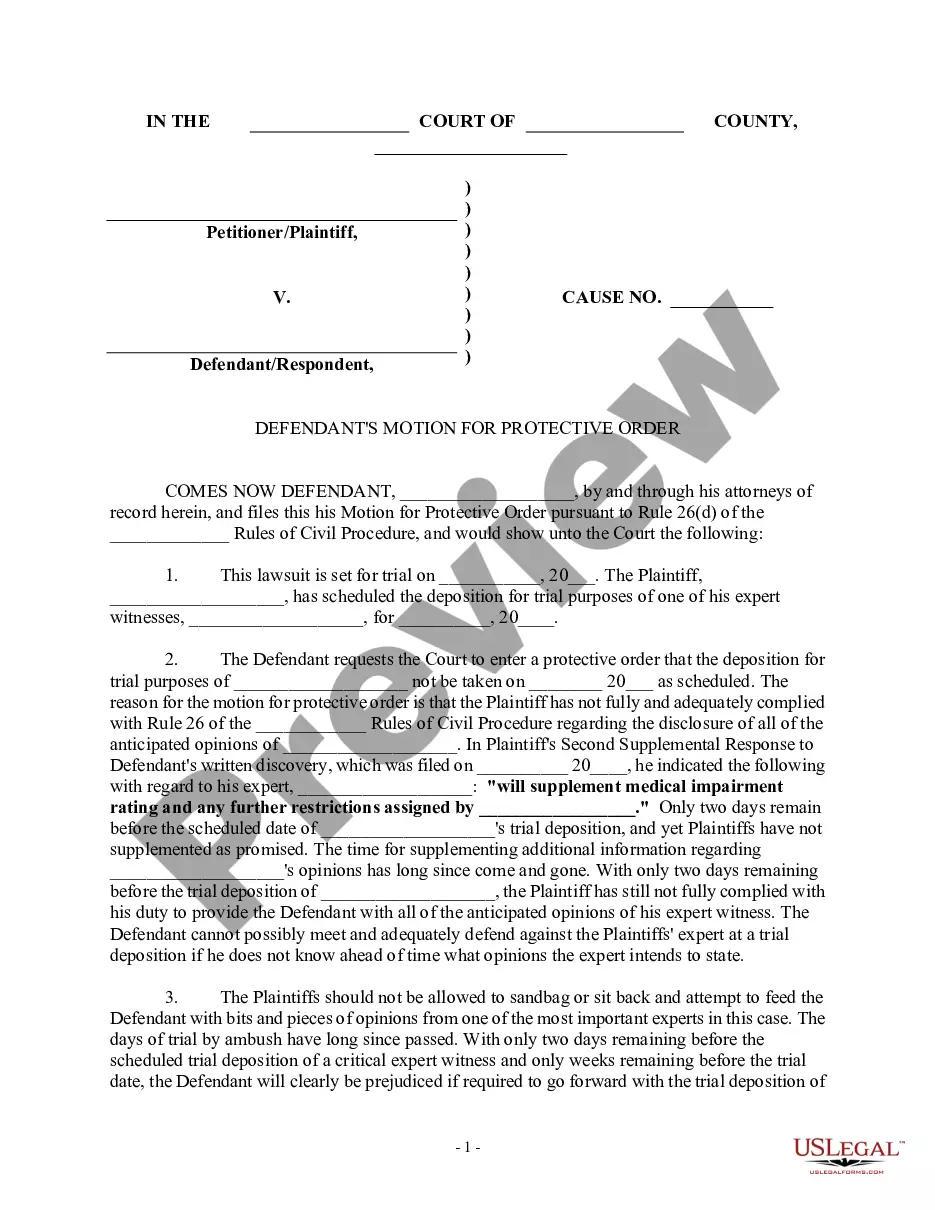

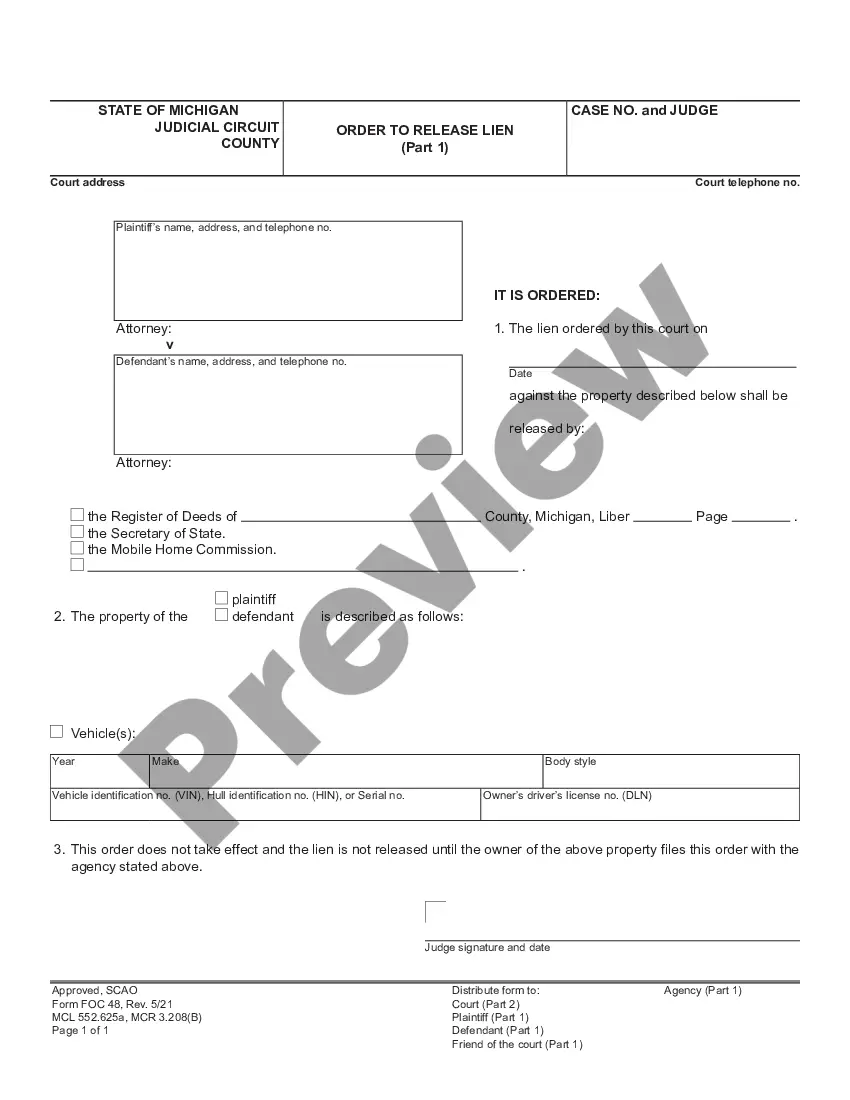

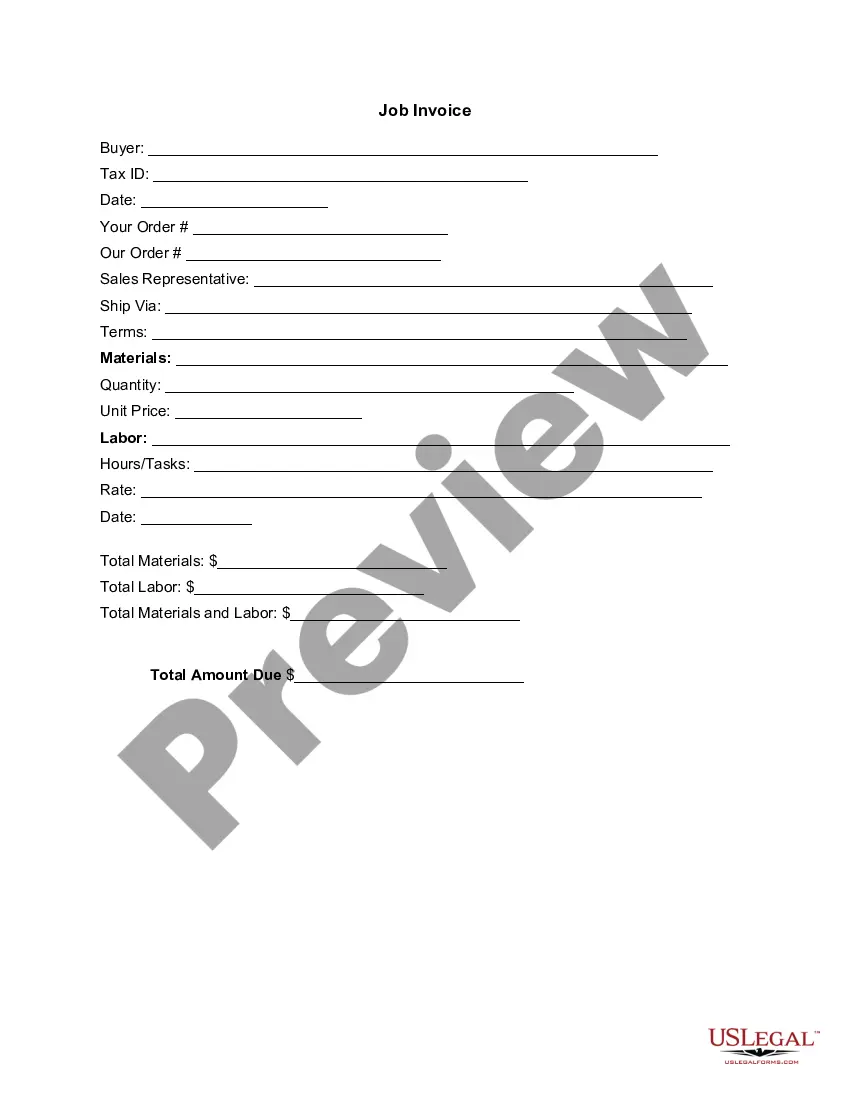

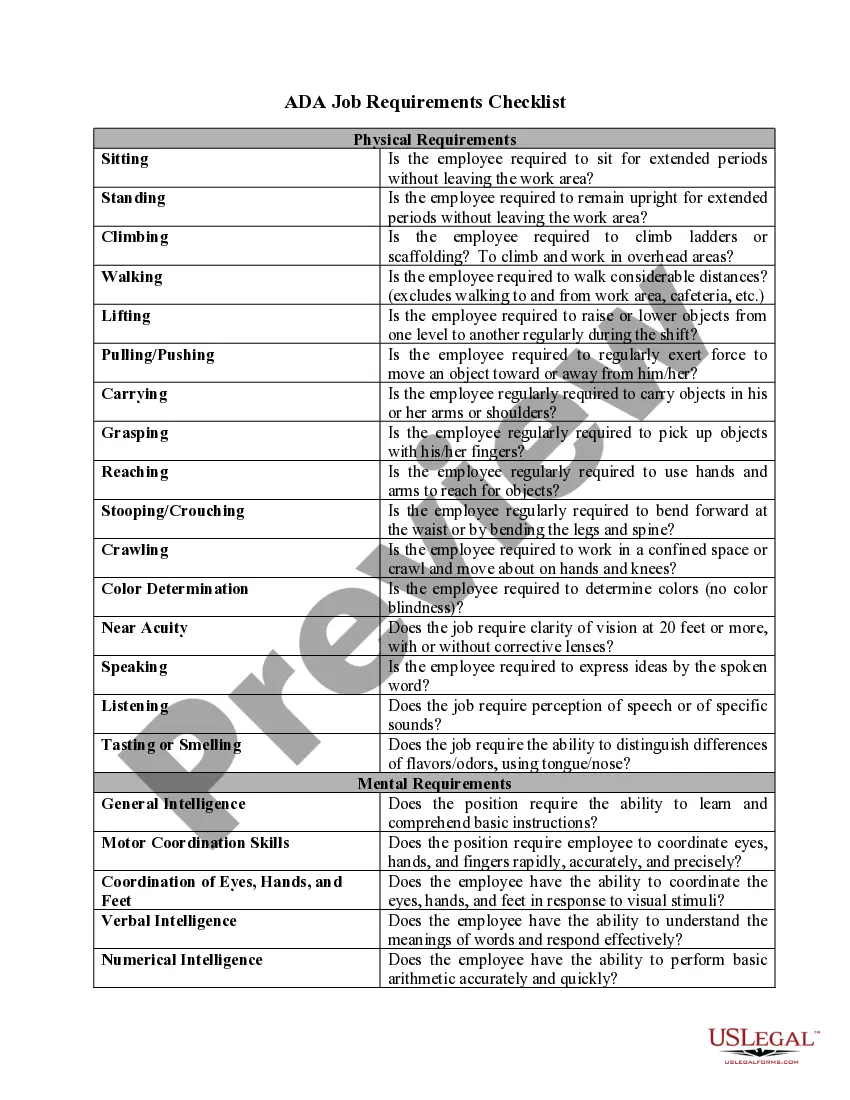

If available, utilize the Preview button to review the document template simultaneously.

- If you already possess a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Connecticut Employment Application for Sole Trader.

- Every legal document template you buy is yours to keep forever.

- To get an additional copy of any purchased form, go to the My documents section and click the relevant button.

- If this is your first time using the US Legal Forms website, follow the straightforward instructions outlined below.

- First, ensure that you have chosen the correct document template for your area/town.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

Self-employed individuals must follow this two-step application process:STEP ONE: Beginning April 30. File a regular state claim application with the Connecticut Department of Labor at using the BLUE button to file.STEP TWO: Once the UC-58 has been received via US mail.

As a sole proprietor you must report all business income or losses on your personal income tax return; the business itself is not taxed separately. (The IRS calls this "pass-through" taxation, because business profits pass through the business to be taxed on your personal tax return.)

To establish a sole proprietorship in Connecticut, here's everything you need to know.Choose a business name.File a trade name with the town clerk (mandatory).Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number from the IRS.

Documents Required For A Sole ProprietorshipAadhar Card. Aadhar number is now a necessity for applying for any registration in India.PAN Card. You can't file your income tax return until you get a PAN.Bank Account.Registered Office Proof.Registering as SME.Shop and Establishment Act License.GST Registration.

Employers can register their business on-line by using our Internet Employer Registration System or by downloading the application, which will then need to be completed, printed and mailed or faxed to us. For either option, please visit .

A Sole Proprietorship form of business organisation is where a business is managed by a single person. Generally, it does not require any registration as such. Any individual who wants to start a business with less investment can choose this type of business form.

While the sole proprietor is such a simple business classification that Connecticut doesn't even require a business registration process or any type of fees, depending on how you use your sole proprietorship and what industry you operate in, you still might have some important steps that need to be taken.

A CT business license is required if your company plans to do business in the state. You need to apply for a business license with the Secretary of State. The business entities that need to apply for a CT Business License are: Every corporation.