Subject: Connecticut Sample Letter to State Tax Commission regarding Decedent's Estate Dear [State Tax Commission], I am writing to provide you with the necessary details concerning the estate of [Decedent's Name], who recently passed away. As the designated executor of the estate, it is my responsibility to address any outstanding tax matters that may have arisen. The purpose of this letter is to request guidance and clarification on the tax-related obligations associated with managing the decedent's estate in Connecticut. I kindly ask for your assistance in understanding the steps that need to be taken to ensure the proper handling of tax matters in accordance with state regulations. Key details pertaining to the estate are as follows: 1. Identification and Contact Information: — Full legal name of the decedent: [Decedent's Full Name] — Executor's full name: [Executor's Full Name] — Executor's address: [Executor's Address] — Executor's contact number: [Executor's Contact Number] — Executor's email address: [Executor's Email Address] 2. Estate Information: — Date of death: [Date of Death— - Social Security Number of the decedent: [Decedent's Social Security Number] — EIN or taxpayer identification number (if applicable): [EIN/Tax ID Number] 3. Assets and Liabilities: — A brief overview of the estate's assets, including bank accounts, investments, real estate, vehicles, and valuable personal property. — Details of any outstanding debts, loans, or mortgages held by the decedent. 4. Probate Court Details: — Probate court handling the decedent's estate: [Probate Court Name] — Probate court docket/tracking number (if available): [Docket/Tracking Number] Based on the above information, I kindly request your guidance on the following matters related to the decedent's estate tax obligations in Connecticut: 1. Estate Tax Filings: — Do I need to file a Connecticut Estate Tax Return? If so, what is the required form and deadline? — Is there a minimum threshold for estates that must file, and if so, what is the current threshold? — Are there any deductions or exemptions available for the estate? If yes, please provide guidance on how to claim them. 2. Income Tax Obligations: — Are there any outstanding income tax obligations for the decedent that need to be addressed? If yes, what are the filing requirements and deadlines? — How do I report income earned by the estate during the probate process? Are there specific forms or guidelines that need to be followed? 3. Inheritance Tax: — Are there any inheritance taxes in Connecticut? If yes, please advise on the filing requirements and deadlines, along with any potential exclusions or exemptions that may apply. 4. Additional Resources: — Could you direct me towards any state-specific resources, forms, or publications that would be helpful for managing the decedent's tax obligations? I appreciate your attention to this matter and acknowledge the importance of fulfilling all the necessary tax obligations associated with the decedent's estate in Connecticut. Thank you in advance for your support and guidance in clarifying the required steps to ensure compliance with state tax regulations. Please find attached copies of relevant documents, such as the death certificate, probate court documentation, and any other pertinent details that may assist in addressing this matter effectively. I look forward to your prompt response and cooperation. Sincerely, [Your Name] [Executor's Title/Position] [Contact Information: Address, Phone Number, Email Address] [Additional Documents Attached: List the documents enclosed in the letter]

Connecticut Sample Letter to State Tax Commission concerning Decedent's Estate

Description

How to fill out Connecticut Sample Letter To State Tax Commission Concerning Decedent's Estate?

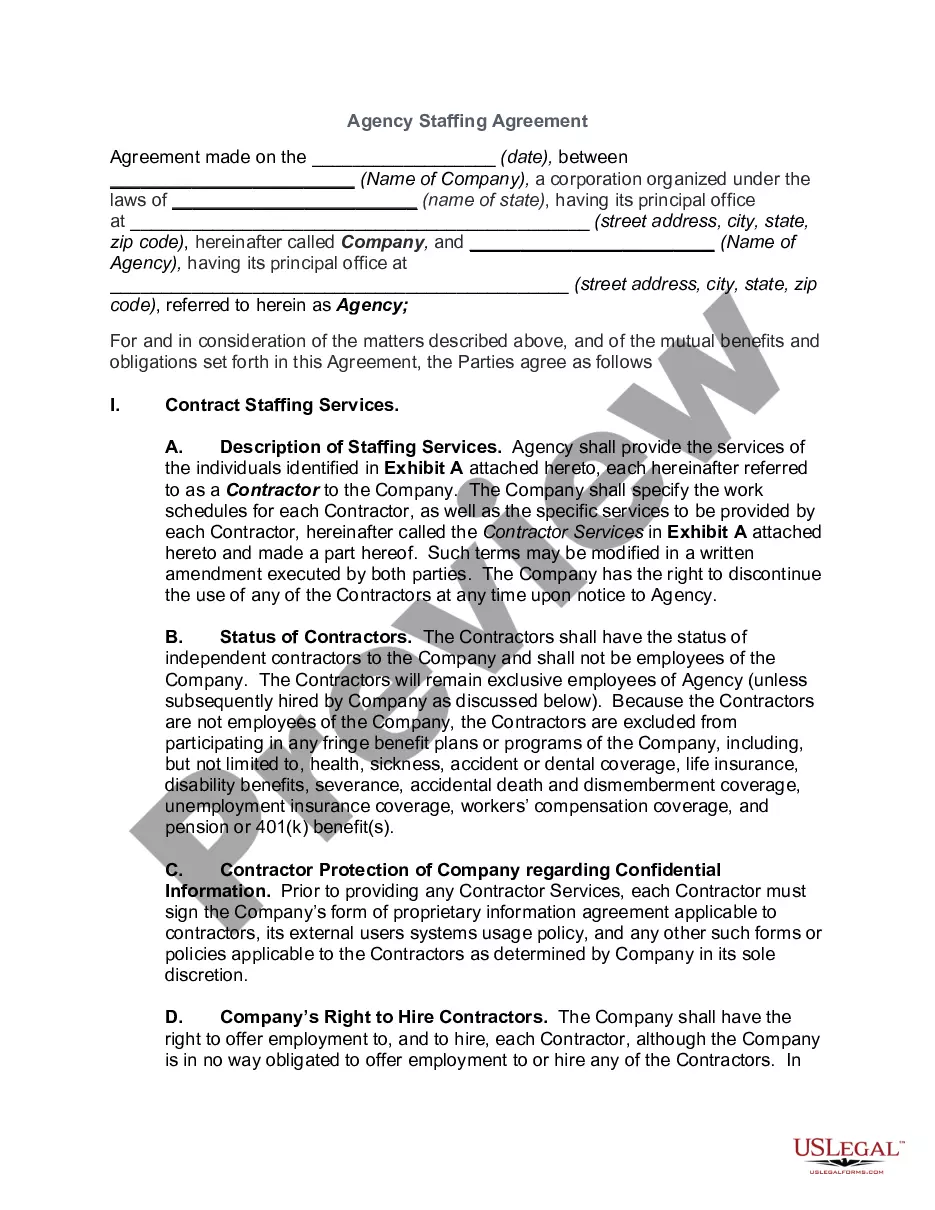

You are able to invest several hours on-line trying to find the lawful document template which fits the state and federal demands you will need. US Legal Forms supplies 1000s of lawful kinds that are analyzed by experts. You can actually acquire or print out the Connecticut Sample Letter to State Tax Commission concerning Decedent's Estate from your support.

If you have a US Legal Forms account, you are able to log in and click on the Acquire switch. Afterward, you are able to full, modify, print out, or signal the Connecticut Sample Letter to State Tax Commission concerning Decedent's Estate. Every lawful document template you buy is your own permanently. To have another copy for any purchased form, check out the My Forms tab and click on the corresponding switch.

If you use the US Legal Forms website the first time, adhere to the basic directions under:

- Very first, be sure that you have chosen the best document template to the region/metropolis of your liking. See the form explanation to ensure you have picked the right form. If readily available, take advantage of the Review switch to check from the document template also.

- If you want to get another model of your form, take advantage of the Research discipline to get the template that fits your needs and demands.

- Once you have found the template you would like, simply click Purchase now to continue.

- Pick the prices prepare you would like, type in your accreditations, and register for an account on US Legal Forms.

- Comprehensive the deal. You should use your charge card or PayPal account to fund the lawful form.

- Pick the formatting of your document and acquire it in your product.

- Make modifications in your document if possible. You are able to full, modify and signal and print out Connecticut Sample Letter to State Tax Commission concerning Decedent's Estate.

Acquire and print out 1000s of document web templates utilizing the US Legal Forms Internet site, that offers the largest variety of lawful kinds. Use skilled and express-particular web templates to take on your small business or personal demands.