Connecticut Loan Form Corporation is a prominent financial institution that specializes in providing loans to individuals and businesses in the state of Connecticut. With a strong presence in the market, this corporation offers a range of loan services and solutions to meet the diverse needs of its clients. One of the key aspects of Connecticut Loan Form Corporation is its expertise in handling corporate resolutions. Corporate resolutions play a crucial role in the decision-making process of a company, outlining the goals, policies, and actions to be taken by its board of directors and shareholders. Connecticut Loan Form Corporation assists businesses in preparing and executing these resolutions effectively, ensuring compliance with legal requirements and maximizing the efficiency of corporate governance. Different types of Connecticut Loan Form Corporation — Corporate Resolutions include: 1. Loan Resolutions: These resolutions are aimed at establishing guidelines for the corporation's lending portfolio. They outline the types of loans the corporation is authorized to provide, the interest rates, repayment terms, and other important factors. Loan resolutions help ensure that the corporation offers suitable loan options to its clients while mitigating risk. 2. Board of Directors Resolutions: These resolutions document the decisions made by the board of directors pertaining to various aspects of the corporation's operation. They cover areas such as mergers and acquisitions, investments, partnerships, and major policy decisions. Board of Directors Resolutions serve as a formal record of the board's actions and demonstrate their commitment to fulfilling their fiduciary duties. 3. Shareholder Resolutions: These resolutions are put forward by shareholders during annual or extraordinary general meetings. They involve matters such as dividend distribution, appointment or removal of directors, amendments to the corporation's bylaws, and other significant shareholder-related decisions. Shareholder resolutions provide an opportunity for shareholders to express their opinions and influence the corporation's direction. 4. Financial Resolutions: These resolutions pertain to crucial financial matters, such as budget approvals, capital investments, debt issuance, and financial reporting. They outline the corporation's financial goals, strategies, and guidelines for prudent financial management. Financial resolutions ensure transparency, accountability, and stability in the corporation's financial operations. In summary, Connecticut Loan Form Corporation is a leading financial institution in Connecticut, providing a wide range of loan services. It specializes in assisting businesses with corporate resolutions, including loan resolutions, board of directors resolutions, shareholder resolutions, and financial resolutions. By offering comprehensive solutions in corporate governance, Connecticut Loan Form Corporation aids in the smooth functioning and success of businesses in the state.

Connecticut Loan Form Corporation - Corporate Resolutions

Description

How to fill out Connecticut Loan Form Corporation - Corporate Resolutions?

Are you in the place that you will need papers for either company or personal functions virtually every day? There are a lot of authorized file web templates accessible on the Internet, but discovering types you can trust isn`t effortless. US Legal Forms delivers thousands of kind web templates, such as the Connecticut Loan Form Corporation - Corporate Resolutions, that are created to meet federal and state needs.

When you are already acquainted with US Legal Forms website and also have your account, basically log in. After that, you are able to obtain the Connecticut Loan Form Corporation - Corporate Resolutions template.

Unless you provide an accounts and want to begin using US Legal Forms, follow these steps:

- Discover the kind you require and ensure it is for your right town/area.

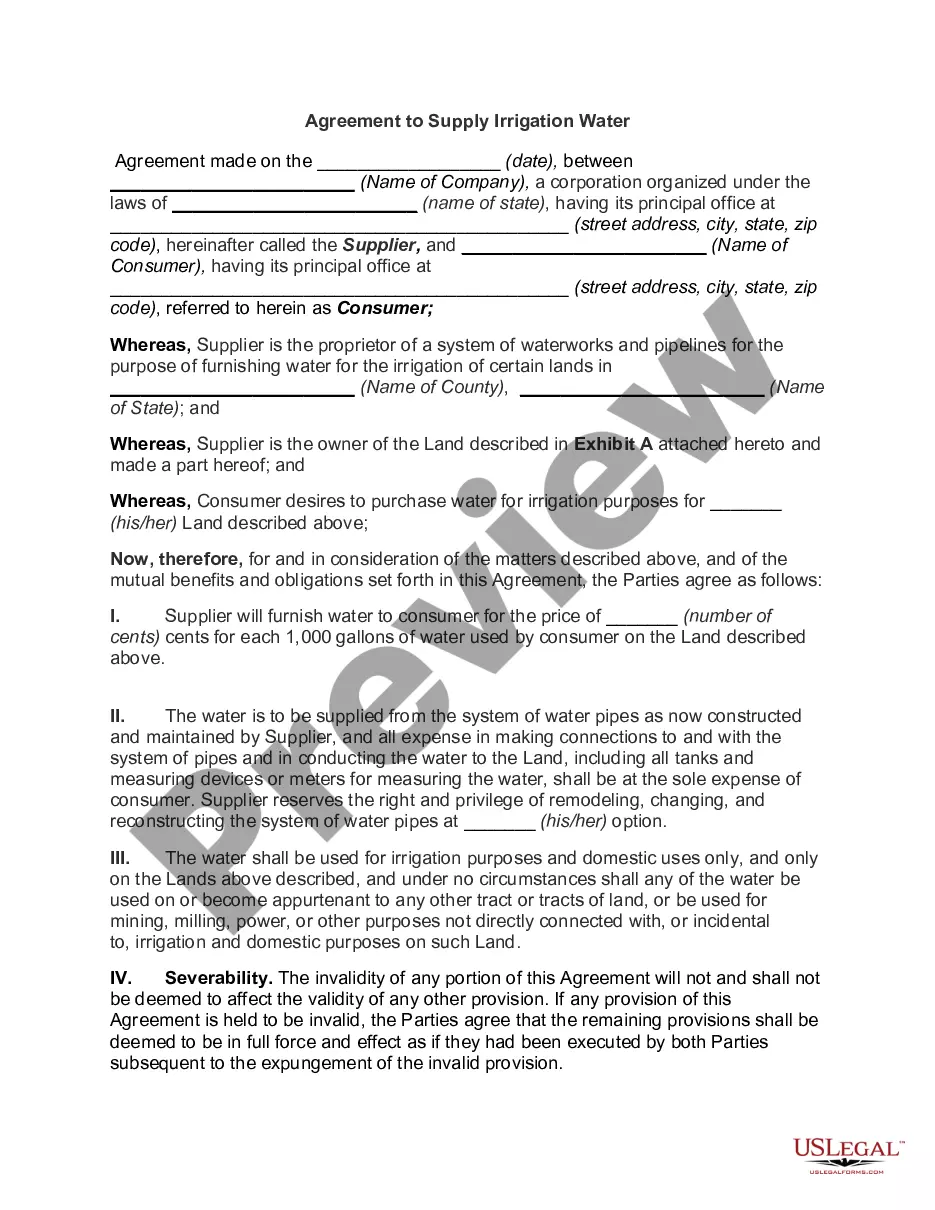

- Utilize the Review key to examine the shape.

- Browse the description to ensure that you have selected the right kind.

- In case the kind isn`t what you`re seeking, take advantage of the Research field to get the kind that suits you and needs.

- Whenever you obtain the right kind, click Acquire now.

- Opt for the prices strategy you need, complete the necessary information and facts to create your money, and pay money for the order making use of your PayPal or credit card.

- Decide on a convenient file file format and obtain your copy.

Get every one of the file web templates you might have bought in the My Forms menu. You can get a more copy of Connecticut Loan Form Corporation - Corporate Resolutions whenever, if required. Just click the needed kind to obtain or printing the file template.

Use US Legal Forms, one of the most substantial assortment of authorized kinds, to save time as well as prevent blunders. The assistance delivers skillfully manufactured authorized file web templates which can be used for a range of functions. Make your account on US Legal Forms and commence creating your way of life easier.