A Connecticut Buy Sell or Stock Purchase Agreement covering common stock in a closely held corporation with an option to fund the purchase through life insurance is a legal contract that outlines the terms and conditions of buying and selling shares of common stock in a privately held company. This type of agreement is commonly used among shareholders or business partners in closely held corporations to provide a mechanism for the orderly transfer of ownership interests in case of certain triggering events. The agreement typically includes key provisions such as the purchase price and terms, the methods of valuation for the shares, the rights and obligations of the parties involved, the circumstances triggering a buy-sell event (e.g., death, disability, retirement, or voluntary transfer), and the process for resolving disputes or disagreements. One specific aspect of this type of agreement is the option to fund the purchase through life insurance. This means that the agreement may allow the remaining shareholders or partners to use the proceeds from a life insurance policy on the life of an exiting or deceased owner to buy out their shares. This mechanism ensures that the necessary funds are readily available to complete the purchase, thereby avoiding potential financial strain on the surviving shareholders or partners. There may be different variations or types of Connecticut Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance, such as: 1. Cross-Purchase Agreement: In this arrangement, each shareholder or partner agrees to purchase the shares of the exiting or deceased owner directly from them or their estate. In the event of a triggering event, the surviving shareholders or partners use the life insurance proceeds to buy the shares proportionately based on their ownership interests. 2. Stock Redemption Agreement: In this structure, the corporation itself agrees to redeem the shares of the exiting or deceased owner. The corporation is usually the purchaser of the life insurance policy on the lives of the shareholders or partners. Upon a triggering event, the corporation receives the insurance proceeds and uses them to buy the stock from the affected shareholder or partner. 3. Wait-and-See Agreement: This agreement offers flexibility by allowing the surviving shareholders or partners to decide whether they will use the cross-purchase or stock redemption arrangement at the time of the triggering event. The decision is typically made based on the most tax-efficient or financially advantageous method. It is important to note that specific details and provisions in a Connecticut Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance may vary based on the preferences and needs of the parties involved and the specific requirements under Connecticut state law. Seeking legal counsel is essential to ensure compliance with applicable regulations and the appropriate customization of the agreement to meet the unique circumstances of the closely held corporation and its shareholders or partners.

Connecticut Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance

Description

How to fill out Connecticut Buy Sell Or Stock Purchase Agreement Covering Common Stock In Closely Held Corporation With Option To Fund Purchase Through Life Insurance?

Are you currently in a location where you often need documents for either business or personal purposes.

There are numerous authentic document templates accessible online, yet finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Connecticut Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with the Option to Fund Purchase via Life Insurance, designed to comply with federal and state regulations.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Connecticut Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with the Option to Fund Purchase via Life Insurance anytime, if necessary. Just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Connecticut Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with the Option to Fund Purchase through Life Insurance template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is suitable for your city/region.

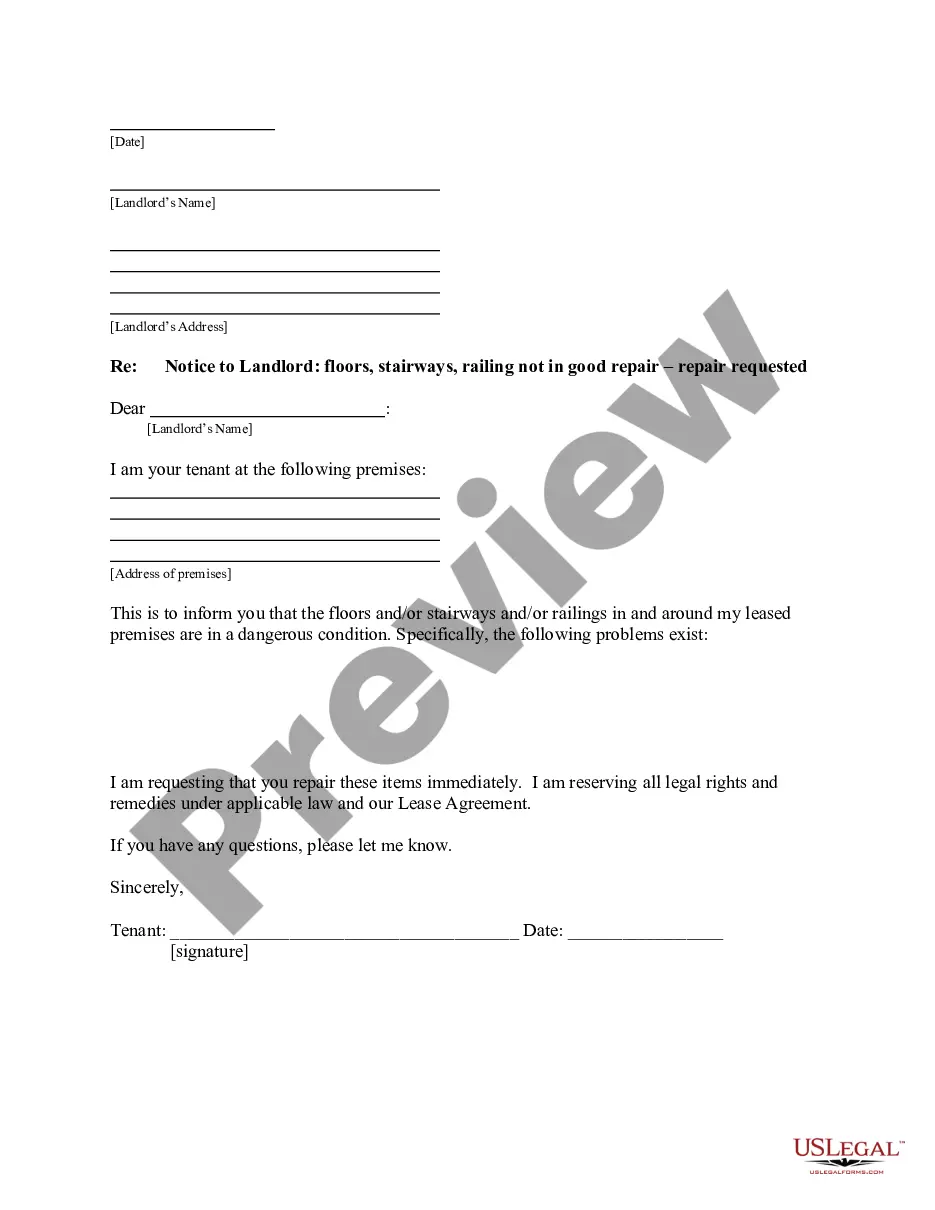

- Use the Review button to examine the form.

- Read the overview to confirm that you have selected the correct form.

- If the form is not what you are looking for, utilize the Lookup section to find a form that meets your preferences and requirements.

- Once you find the appropriate form, click on Get now.

- Choose the pricing plan you prefer, complete the required information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

The number of policies required for a buy-sell agreement primarily hinges on the ownership structure of the corporation. Typically, each owner should have a separate policy to cover their share of the business. This approach ensures that, in the event of a triggering event, the funds are readily available to buy out the departing owner's shares, thereby maintaining stability in the closely held corporation.

purchase agreement is a document that allows a company's partners or other shareholders to purchase the interest or shares of a partner who dies, becomes incapacitated or retires. The mechanism often relies on a life insurance policy in the event of a death to facilitate that exchange of value.

A stock purchase agreement is an agreement that two parties sign when shares of a company are being bought or sold. These agreements are often used by small corporations who sell stock. Either the company or shareholders in the organization can sell stock to buyers.

A buy and sell agreement is a legally binding contract that stipulates how a partner's share of a business may be reassigned if that partner dies or otherwise leaves the business. Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership.

Common Stock Agreement means an agreement between the Company and a Grantee evidencing the terms and conditions of an individual Common Stock grant. The Stock Grant agreement is subject to the terms and conditions of the Plan.

Stock purchase agreements are legal documents that lay out the terms and conditions for a sale of company stocks. They are legally binding contracts that create obligations and rights for all the parties involved.

The purpose of a buy-and-sell agreement is to provide the surviving co-owners with cash to purchase the interest of a deceased co-owner. According to the agreement, each co-owner takes out life cover on the other co-owners' lives.

Stock Purchase AgreementName of company. Par value of shares. Name of purchaser. Warranties and representations made by the seller and purchaser.

A stock purchase agreement (SPA) is the contract that two parties, the buyers and the company or shareholders, written consent is required by law when shares of the company are being bought or sold for any dollar amount. In a stock deal, the buyer purchases shares directly from the shareholder.

In a cross purchase buy-sell agreement, each business owner buys a life insurance policy on the other owner(s). With multiple owners, this can get very complex and complicated. Instead, try a trusteed cross purchase buy-sell, in which a third-party (acting as trustee) takes care of the buy-sell arrangement.

Interesting Questions

More info

DEI Acknowledgements.