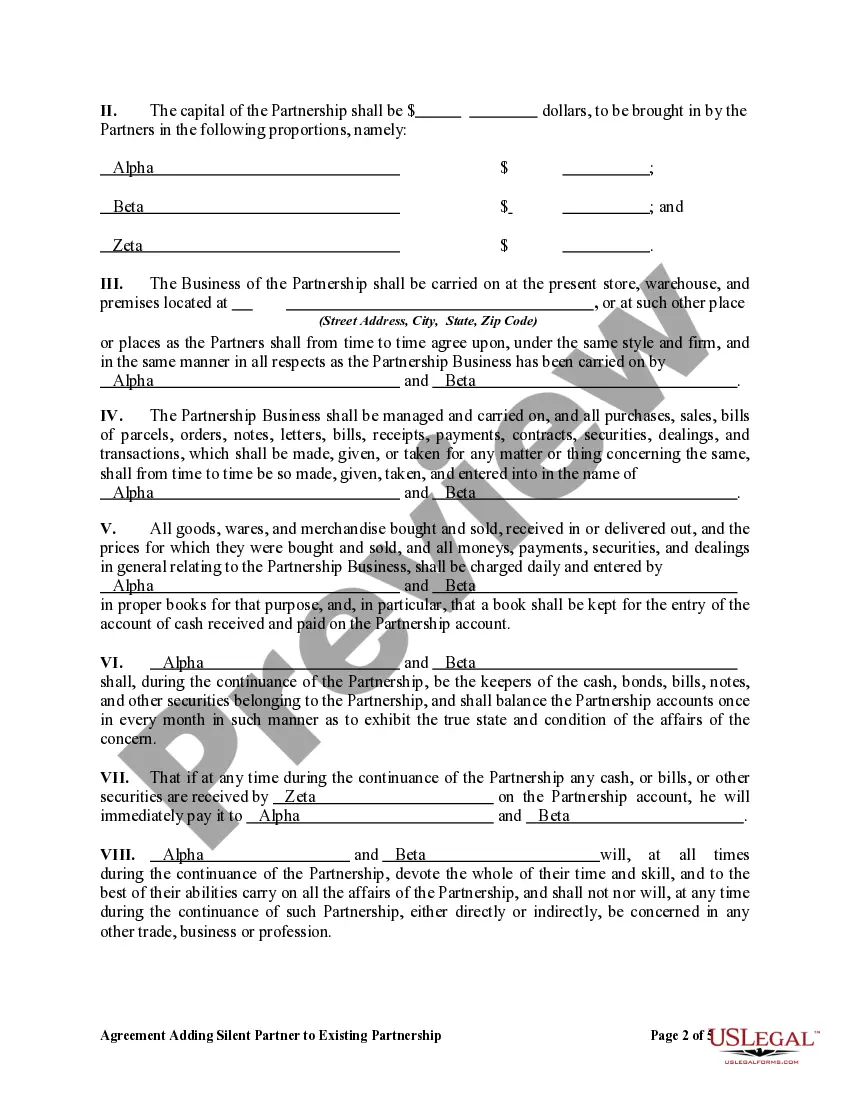

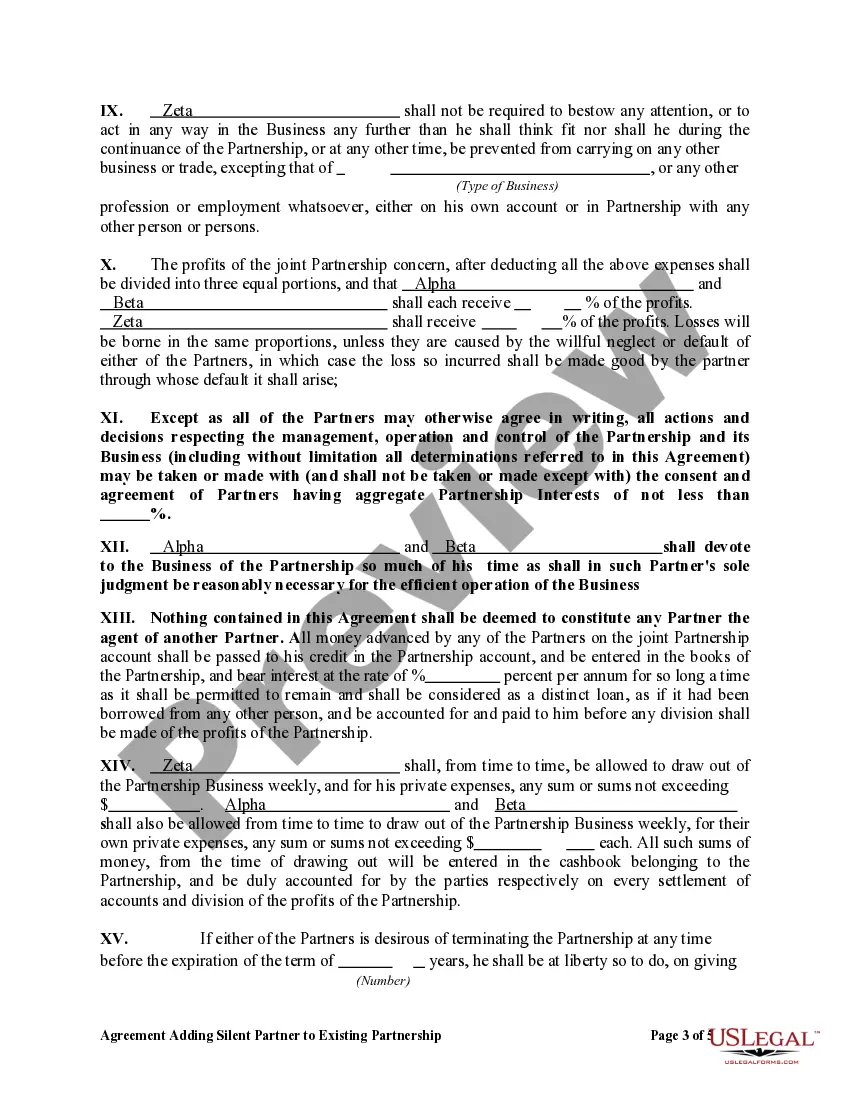

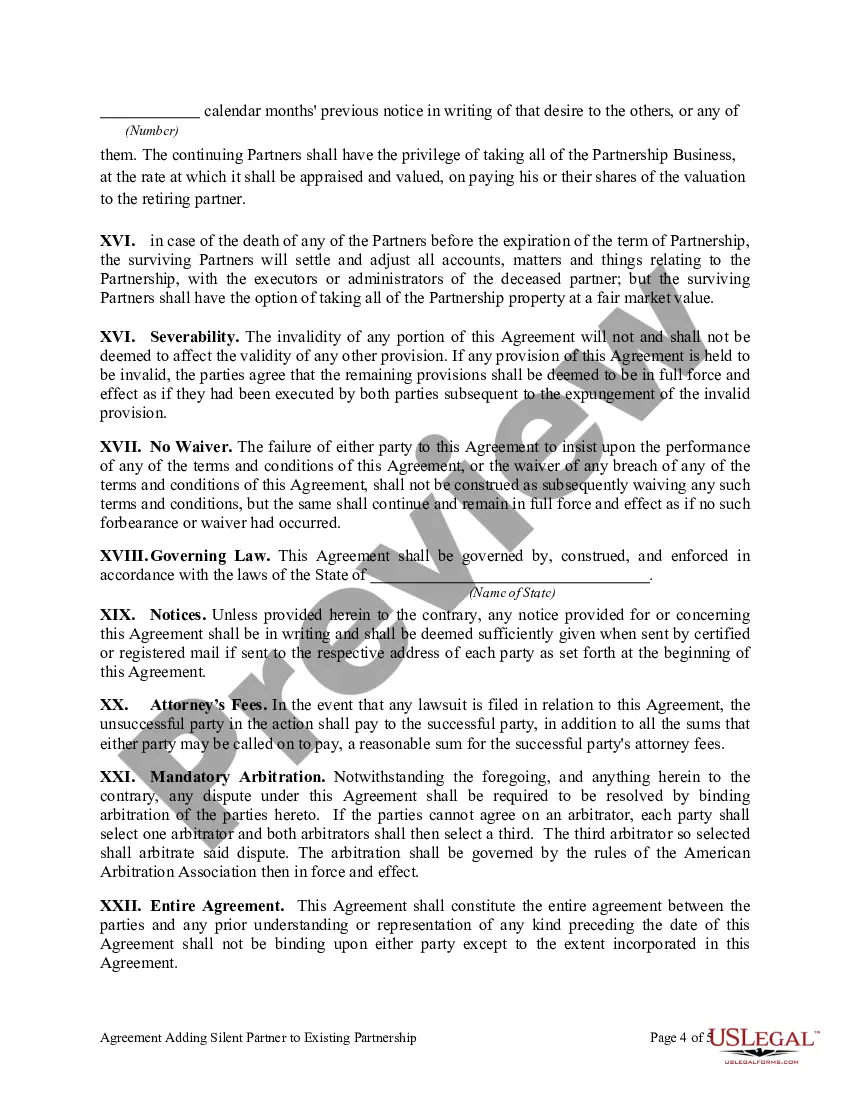

Connecticut Agreement Adding Silent Partner to Existing Partnership is a legal document that is used when a partnership wants to introduce a silent partner into the existing business structure. A silent partner is an individual or entity that contributes capital to a partnership but does not participate in the day-to-day operations or decision-making processes of the business. This agreement outlines the terms and conditions under which the silent partner will join the partnership, ensuring clarity and legal protection for all parties involved. It typically includes details such as the name and address of the existing partnership, the name of the new silent partner, and the effective date of the agreement. The agreement specifies the percentage or amount of capital that the silent partner will contribute to the partnership, as well as the specific rights, responsibilities, and limitations the silent partner will have within the partnership. It may also address issues such as profit-sharing arrangements, liability protection for the silent partner, and mechanisms for dispute resolution or buyout provisions. There are two main types of Connecticut Agreement Adding Silent Partner to Existing Partnership: 1. General Partnership Agreement: This type of agreement is used when the partnership is formed with the intent to share profits, losses, and liability among all partners, including the silent partner. In this scenario, the silent partner may have a say in the business operations but is not actively involved in the day-to-day management. 2. Limited Partnership Agreement: This agreement is more suitable when the silent partner desires to limit their liability within the partnership. In this arrangement, the silent partner will have no involvement in the management or decision-making processes, and their liability will be limited to the amount of their investment in the partnership. It is crucial for all parties involved to carefully review and understand the legal implications of the Connecticut Agreement Adding Silent Partner to Existing Partnership before signing. Consulting with a qualified attorney is highly recommended ensuring that the agreement aligns with the specific needs and goals of the partnership and that all legal requirements are met.

Connecticut Agreement Adding Silent Partner to Existing Partnership

Description

How to fill out Connecticut Agreement Adding Silent Partner To Existing Partnership?

Discovering the right legitimate papers design could be a have a problem. Needless to say, there are tons of layouts accessible on the Internet, but how will you obtain the legitimate kind you require? Use the US Legal Forms internet site. The services delivers thousands of layouts, such as the Connecticut Agreement Adding Silent Partner to Existing Partnership, which you can use for enterprise and private demands. Every one of the kinds are inspected by professionals and satisfy federal and state needs.

When you are currently signed up, log in in your account and click on the Acquire switch to have the Connecticut Agreement Adding Silent Partner to Existing Partnership. Make use of your account to check through the legitimate kinds you have ordered previously. Check out the My Forms tab of the account and acquire an additional duplicate from the papers you require.

When you are a whole new customer of US Legal Forms, listed here are simple recommendations for you to comply with:

- Very first, be sure you have chosen the appropriate kind for the town/state. You are able to look over the shape making use of the Review switch and browse the shape information to ensure this is basically the right one for you.

- In the event the kind will not satisfy your preferences, utilize the Seach discipline to find the appropriate kind.

- When you are positive that the shape would work, select the Acquire now switch to have the kind.

- Select the pricing prepare you desire and type in the necessary information and facts. Create your account and pay money for an order with your PayPal account or Visa or Mastercard.

- Choose the document structure and down load the legitimate papers design in your system.

- Complete, change and print out and indicator the attained Connecticut Agreement Adding Silent Partner to Existing Partnership.

US Legal Forms is definitely the largest catalogue of legitimate kinds where you can discover various papers layouts. Use the service to down load expertly-made files that comply with express needs.