Connecticut Contract for the Sale and Purchase of Real Estate - No Broker - Commercial Lot or Land

Description

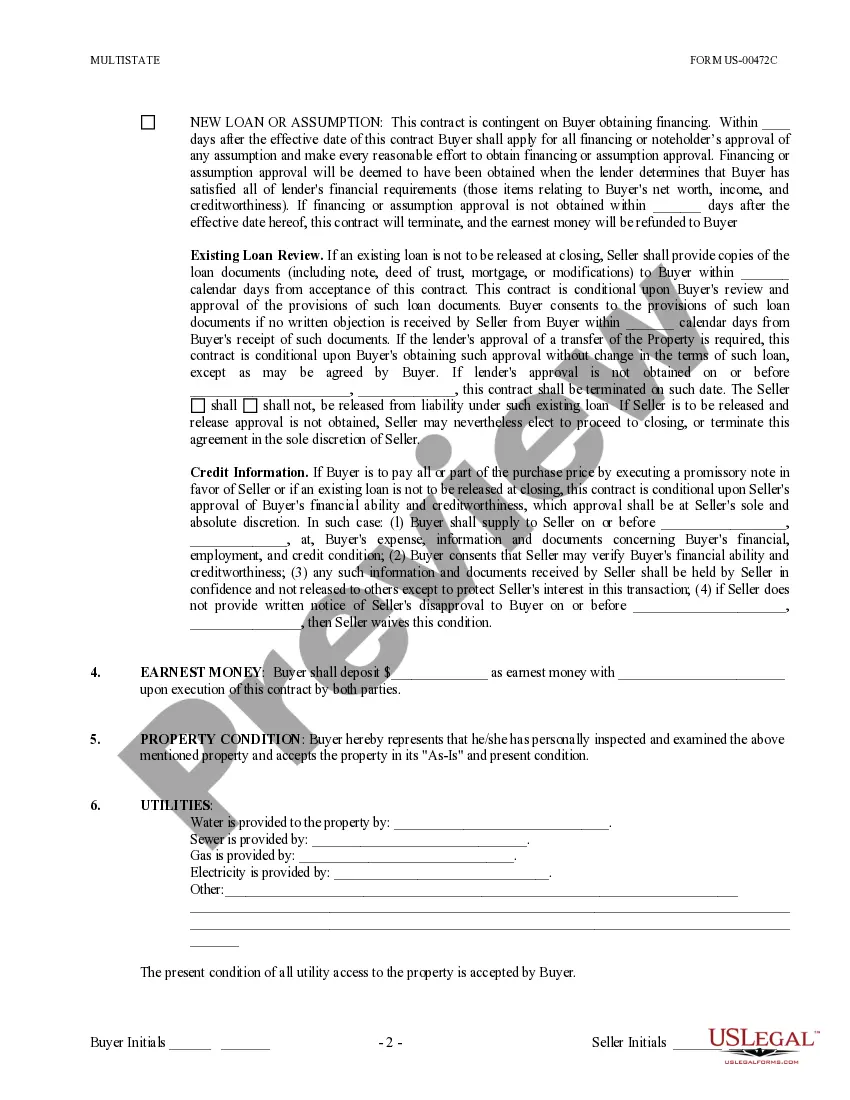

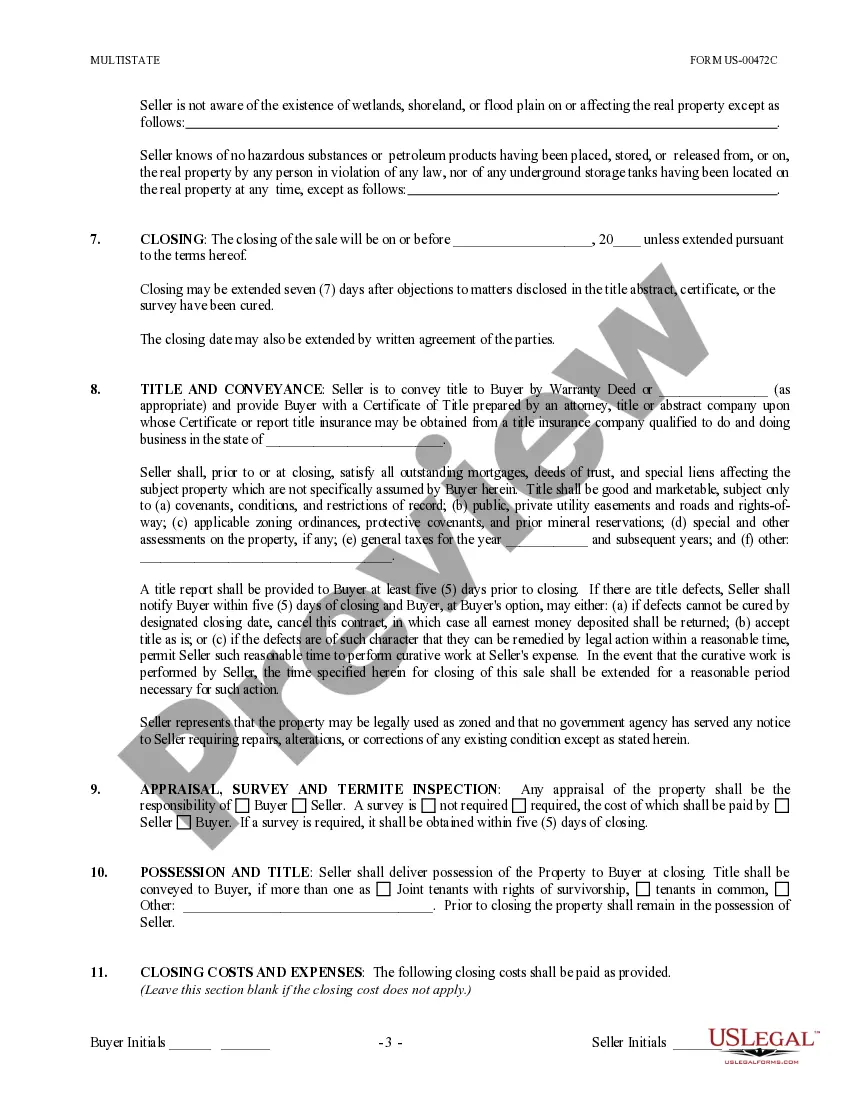

How to fill out Contract For The Sale And Purchase Of Real Estate - No Broker - Commercial Lot Or Land?

Are you presently in a situation where you require documentation for either business or specific purposes nearly every day.

There is a plethora of legal document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms offers numerous form templates, including the Connecticut Contract for the Sale and Purchase of Real Estate - No Broker - Commercial Lot or Land, designed to comply with federal and state requirements.

Once you find the appropriate form, simply click Purchase now.

Choose the payment plan you prefer, fill in the necessary information to create your account, and complete your purchase with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Connecticut Contract for the Sale and Purchase of Real Estate - No Broker - Commercial Lot or Land template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific city/state.

- Use the Preview button to review the form.

- Read the description to confirm you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

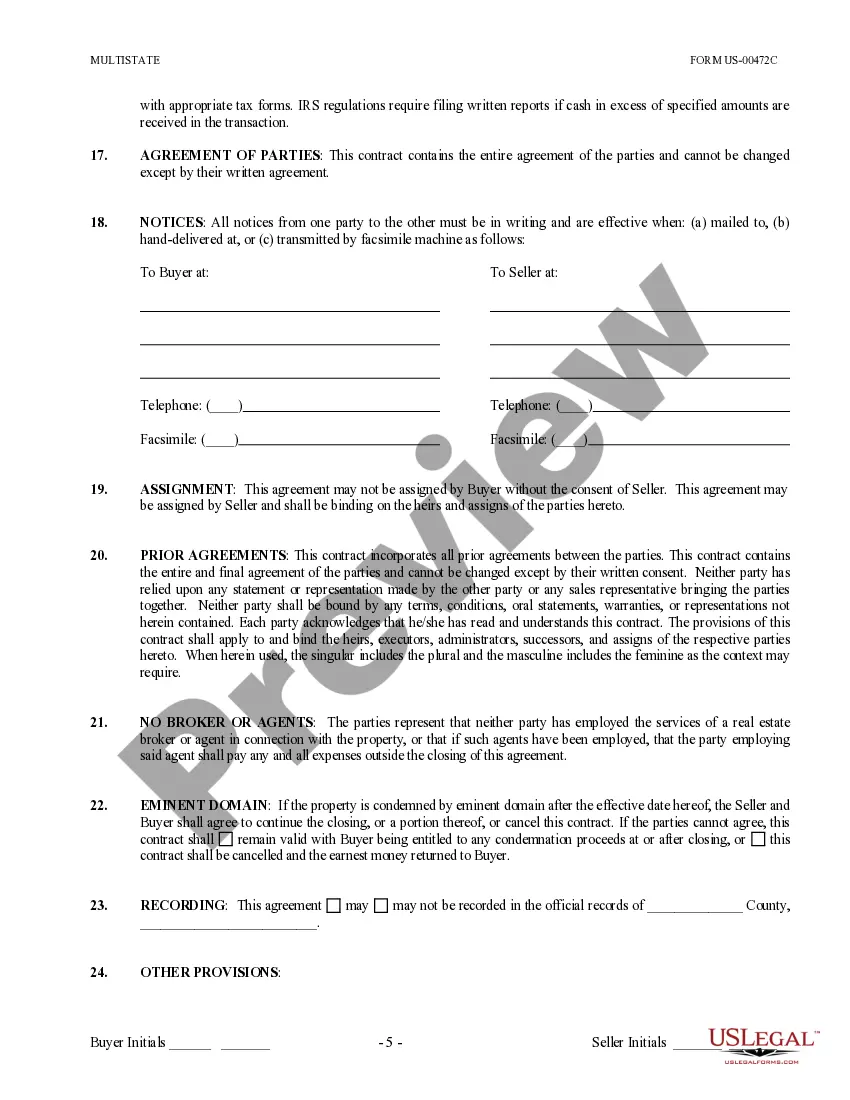

Follow these steps to write an LOI for an intended commercial real estate transaction:Structure it like a letter.Write the opening paragraph.State the parties involved.Draft a property description.Outline the terms of the offer.Include disclaimers.Conclude with a closing statement.

How to Fill Out a Residential Purchase AgreementPlace the name(s) of the seller(s) on the contract.Write the date of the offer on the agreement.Add the purchase price to the contract.Include a request for the seller to provide a clear title and deed for the property.More items...

6 Things Every Commercial Lease Letter of Intent Should IncludeA Statement Declaring Your Interest in Leasing the Space.A Description of Your Company.An Outline of On-Site Employees, Equipment, and Machinery.Your Business Hours.An Overview of Your Current Space.Contact Details.

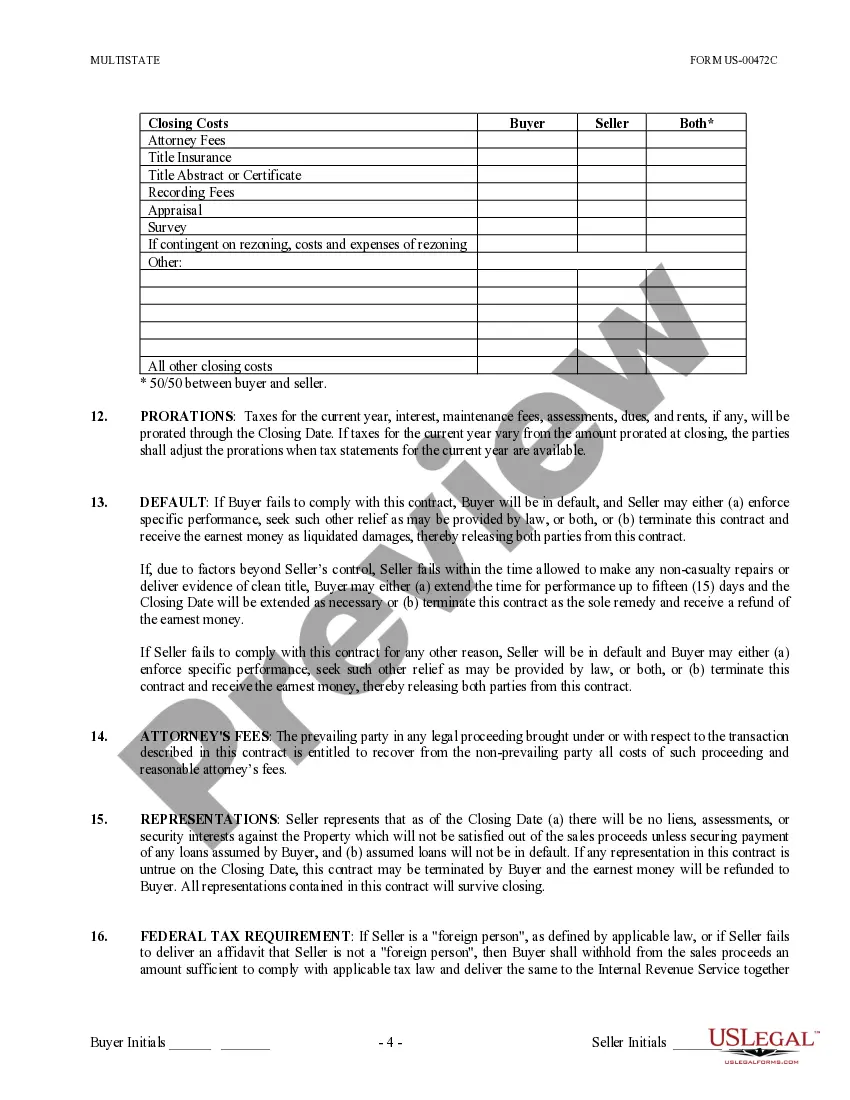

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...?

(Rupees ), will be received by the FIRST PARTY from the SECOND PARTY, at the time of registration of the Sale Deed, the FIRST PARTY doth hereby agree to grant, convey, sell, transfer and assign all his rights, titles and interests in the said portion of the said property, fully

In commercial real estate, a Letter of Intent is a preliminary agreement that is negotiated between a tenant and landlord or buyer and seller. The LOI or Letter of Intent states the primary economics and deal points with proposed terms.

How to create winning commercial real estate proposals: a step-by-step guideStart with an executive summary.Define the property.Provide location information.Summarize the existing property market.Make specific marketing recommendations.Give some details about you and your team.Don't forget to use visuals.

The LOI should be in writing; it should be signed by the parties; it should state all needed terms of a property sale agreement or lease, like price or rent, party names and descriptions of the property and the interest conveyed and finally, it should state clearly that the parties may (or will) prepare a final written

Connecticut has a law that requires agents and buyers to sign an agreement in order to show a home that is not listed by the agent's brokerage. Agents who do not have buyers sign a representation agreement are breaking the law!

How to write a real estate purchase agreement.Identify the address of the property being purchased, including all required legal descriptions.Identify the names and addresses of both the buyer and the seller.Detail the price of the property and the terms of the purchase.Set the closing date and closing costs.More items...