Connecticut Corporation - Consent by Shareholders

Description

How to fill out Corporation - Consent By Shareholders?

It is feasible to spend hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that have been reviewed by experts.

You can easily obtain or print the Connecticut Corporation - Consent by Shareholders from the service.

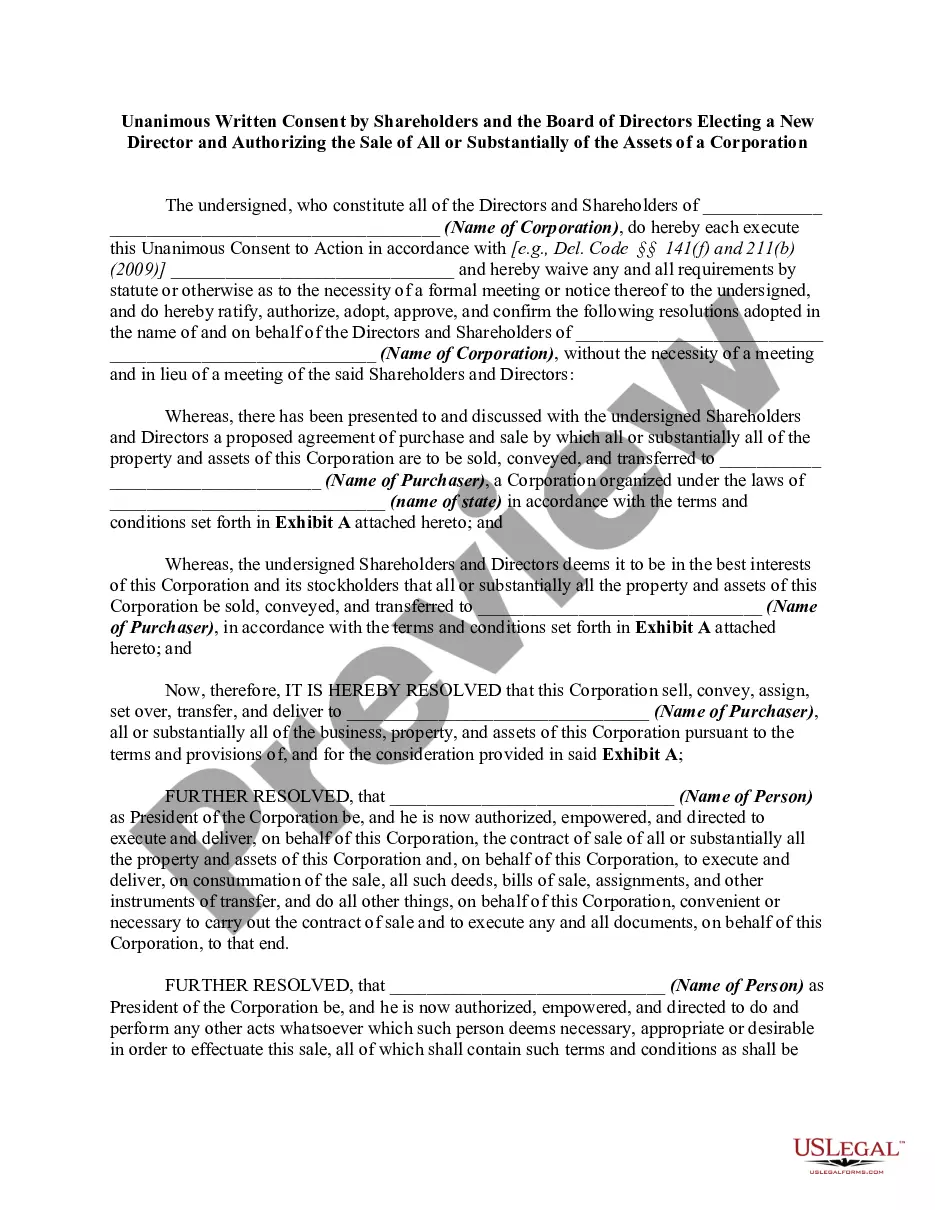

If available, utilize the Preview option to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download option.

- After that, you can complete, modify, print, or sign the Connecticut Corporation - Consent by Shareholders.

- Each legal document template you receive is yours permanently.

- To obtain another copy of the purchased form, navigate to the My documents tab and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/town of your choice.

- Review the form description to verify you have chosen the right form.

Form popularity

FAQ

Adding shareholders to your Connecticut Corporation typically involves issuing new shares or transferring existing shares. It's essential to follow the procedures outlined in your corporation's bylaws and maintain accurate records of all transactions. Ensure that these changes comply with the Connecticut Corporation - Consent by Shareholders rules to protect the interests of all current and future shareholders.

To write a simple bylaw, focus on clarity and purpose. Include key elements such as the corporation's name, the number of directors, and procedures for meetings and voting. Ensure that your simple bylaw adheres to the Connecticut Corporation - Consent by Shareholders regulations and appropriately reflects your company's governance structure, making it easier for shareholders to understand.

Forming a corporation in Connecticut requires several steps. First, you need to choose a unique name for your corporation and appoint a registered agent. Then, file the Certificate of Incorporation with the Connecticut Secretary of State and create corporate bylaws that comply with state laws, including Connecticut Corporation - Consent by Shareholders requirements. Resources like US Legal Forms can simplify this process.

Yes, Connecticut requires businesses that wish to be taxed as an S Corporation to file Form 2553 with the IRS. This election should be made soon after forming your Connecticut Corporation to ensure that the business enjoys the tax benefits associated with an S Corp. Additionally, understanding Connecticut Corporation - Consent by Shareholders implications can help streamline your decision-making process for the S Corp election.

An example of S Corp bylaws might include provisions about shareholder agreements, the election of directors, and the frequency of meetings. Bylaws for a Connecticut Corporation must address the specific requirements for S Corporations, including limits on the number of shareholders. Be sure to tailor these bylaws to reflect the unique aspects of your business while adhering to Connecticut Corporation - Consent by Shareholders guidelines.

Writing corporate bylaws involves clearly defining the rules for managing your Connecticut Corporation. Begin by establishing the company's name, objectives, and governing structure. After that, include procedures for meetings, voting, and shareholder rights. Make sure the bylaws align with Connecticut Corporation - Consent by Shareholders standards, and consider using US Legal Forms for templates and guidance.

To fill out corporate bylaws for your Connecticut Corporation, start by gathering essential information, such as the company's name, address, and purpose. Next, outline the governing structure, including the roles and powers of officers and directors. Once you have compiled the necessary information, you can use online resources, like the US Legal Forms platform, to ensure compliance with Connecticut Corporation - Consent by Shareholders requirements.

The Connecticut Entity Transaction Act governs mergers, consolidations, and sales of assets in Connecticut. This act sets clear rules for how these transactions should be conducted to ensure fairness and transparency. For a Connecticut Corporation - Consent by Shareholders, understanding this act is essential when considering significant operational changes. It provides a legal framework that facilitates smooth transactions and protects shareholder rights.

In Connecticut, every corporation, including S Corporations and C Corporations, must file a CT corporate tax return if they conduct business in the state. This also applies to domestic and foreign corporations. Understanding your filing obligations is important for compliance and reflecting your Connecticut Corporation - Consent by Shareholders accurately. Failing to file may lead to penalties and additional taxes.

Section 33-749 outlines the procedures for shareholder consent to corporate actions in Connecticut. This section details how shareholders can express their consent or dissent regarding significant corporate decisions. Knowing this section is crucial for maintaining transparency within your Connecticut Corporation - Consent by Shareholders. This ensures all shareholders are appropriately informed and engaged in governance.