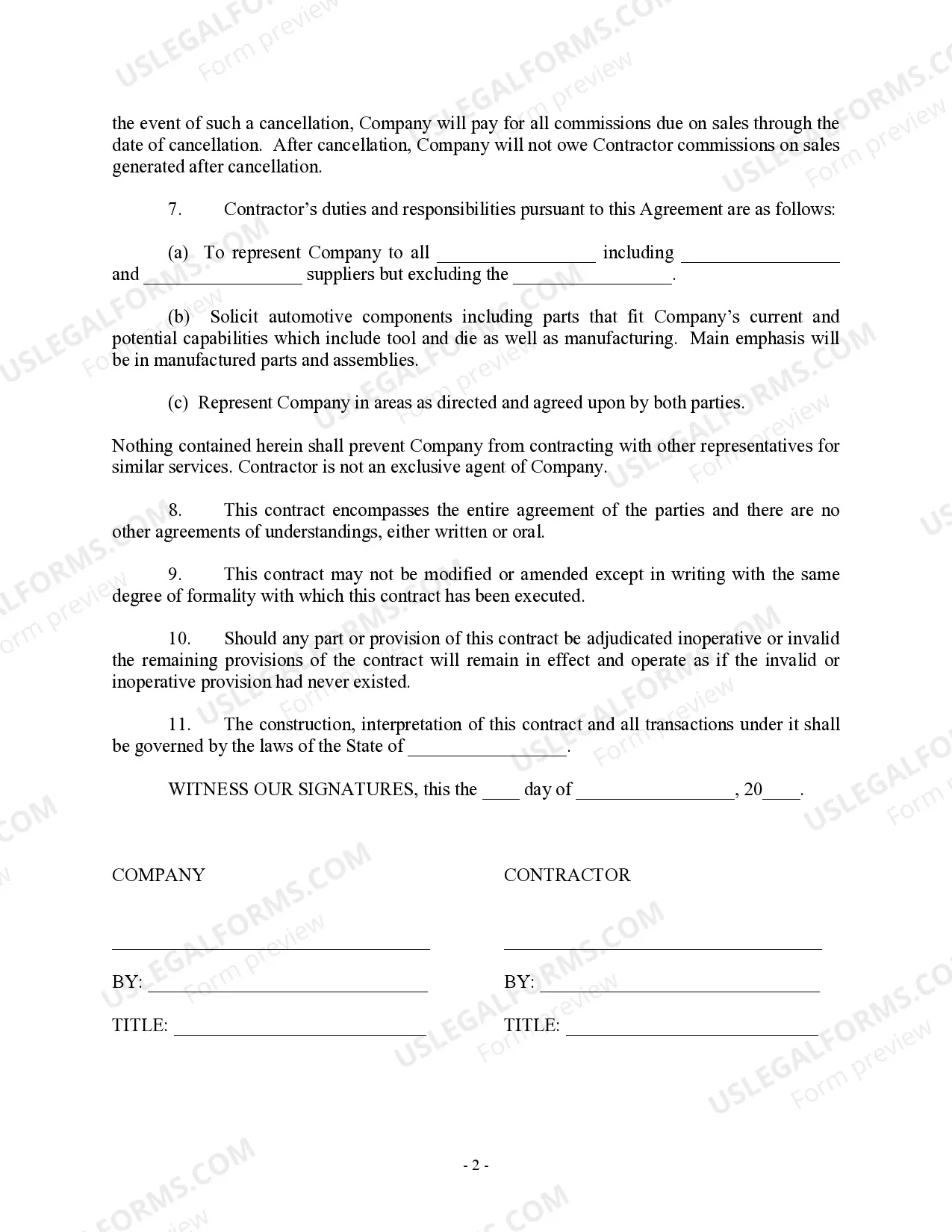

Connecticut Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor A Connecticut Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor is a legally binding document that outlines the terms and conditions of the working relationship between a self-employed individual and a company or client in Connecticut. This type of agreement is specifically designed for independent contractors whose compensation is based directly on a percentage of the sales they generate. In this agreement, various key elements and provisions are included to protect the rights and interests of both parties involved. The agreement typically covers the following: 1. Parties: Clearly identifies and provides contact information for both the independent contractor and the client or company engaging their services. 2. Engagement: States the nature of the contractor's services and the specific activities they will perform to generate sales for the client or company. 3. Term: Outlines the duration of the agreement, specifying whether it is a fixed-term contract or an ongoing relationship. 4. Compensation: Details the payment structure and the percentage of sales the independent contractor will receive as remuneration. It may also include any commission tiers or bonuses based on performance targets achieved. 5. Sales Reporting: Specifies the methodology and frequency of sales reporting, ensuring transparency and accountability between both parties. 6. Expenses: Defines which party will be responsible for covering certain business-related expenses, such as travel costs, advertising, or supplies. 7. Intellectual Property: Addresses the ownership and usage rights of any intellectual property, trademarks, or proprietary information related to the sales activities. 8. Confidentiality: Incorporates clauses to ensure the contractor maintains the confidentiality of sensitive business information throughout the engagement. 9. Independent Contractor Status: Emphasizes that the contractor is an independent business entity and not an employee of the client or company. It clarifies that no employment benefits or tax obligations are associated with the agreement. 10. Termination: Outlines the conditions that permit either party to terminate the contract and the notice period required for termination. Types of Connecticut Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor: 1. Sales Representative Agreement: Specifically designed for individuals engaged in direct sales activities on behalf of a company or client, focusing on generating revenue through product or service sales. 2. Marketing Affiliate Agreement: Geared towards independent contractors who generate sales through online marketing efforts, such as affiliate advertising, website promotions, or social media campaigns. 3. Commission-Based Contractor Agreement: Primarily used by companies or clients who engage independent contractors to secure sales contracts or leads on a commission basis. 4. Real Estate Salesperson Agreement: Tailored for self-employed real estate agents who earn a percentage of the sales they facilitate in the Connecticut housing market. It is important to consult with legal professionals or seek appropriate advice to ensure compliance with Connecticut state laws and regulations when drafting or entering into this type of employment agreement.

Connecticut Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor

Description

How to fill out Connecticut Employment Agreement - Percentage Of Sales - Self-Employed Independent Contractor?

Are you presently in the position in which you will need paperwork for sometimes organization or personal purposes almost every working day? There are a lot of lawful papers themes available on the Internet, but finding kinds you can depend on isn`t straightforward. US Legal Forms provides thousands of type themes, such as the Connecticut Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, that are published in order to meet state and federal requirements.

In case you are currently acquainted with US Legal Forms web site and have an account, basically log in. After that, you are able to obtain the Connecticut Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor format.

Should you not have an bank account and need to begin using US Legal Forms, abide by these steps:

- Obtain the type you will need and ensure it is for the proper area/area.

- Take advantage of the Review switch to examine the shape.

- Look at the outline to actually have chosen the right type.

- When the type isn`t what you are seeking, use the Search discipline to discover the type that suits you and requirements.

- Whenever you find the proper type, just click Purchase now.

- Opt for the prices strategy you desire, submit the specified information and facts to create your money, and purchase the transaction making use of your PayPal or credit card.

- Decide on a handy data file structure and obtain your version.

Locate each of the papers themes you might have purchased in the My Forms food selection. You may get a additional version of Connecticut Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor any time, if required. Just go through the essential type to obtain or printing the papers format.

Use US Legal Forms, probably the most comprehensive collection of lawful varieties, in order to save time as well as prevent faults. The services provides expertly created lawful papers themes which can be used for a variety of purposes. Produce an account on US Legal Forms and commence generating your daily life a little easier.