Connecticut Restricted Endowment to Religious Institution is a specific type of financial fund established to support religious organizations and institutions in the state of Connecticut. Endowments are generally funds or assets that are donated to an organization, such as a church or religious institution, with the intention that they be invested and the generated income used for specific purposes. In Connecticut, the term "restricted endowment" refers to funds that are subject to certain limitations or restrictions on their use. These restrictions are typically outlined by the donors or the governing body of the religious institution and may come with specific criteria, such as only being used for specific projects or programs. It is important to note that there may be various types or categories of restricted endowments for religious institutions in Connecticut. These types can be based on the purpose of the endowment, the source of the donation, or other relevant factors. Here are a few possible categories of Connecticut Restricted Endowment to Religious Institution: 1. Program-Specific Endowment: This type of endowment is dedicated to supporting a particular program or initiative within the religious institution. Donors may choose to create endowments specifically for education programs, community outreach, maintenance of facilities, or any other specific purpose within the religious organization. 2. Scholarship Endowment: Some restricted endowments may be established to provide scholarships or financial assistance to individuals seeking education, training, or religious studies within the religious institution. These endowments can support students pursuing ministry, religious education, or related fields of study. 3. Building or Property Endowment: Religious institutions often require funds for building maintenance, renovation, or expansion. A restricted endowment within this category could be designated solely for these purposes, ensuring that the religious institution's infrastructure remains well-maintained and functional. 4. Clergy Support Endowment: Certain endowments may be created to provide ongoing support for the clergy members within the religious institution. These funds can help cover salaries, housing allowances, continuing education, health benefits, or retirement plans. It's important to consult with legal and financial advisors to ensure compliance with any regulations or laws governing the establishment and management of Connecticut Restricted Endowment to Religious Institution. Religious organizations should also clearly define the terms and conditions of the endowment to maximize the impact and align with the intentions of the donors.

Connecticut Restricted Endowment to Religious Institution

Description

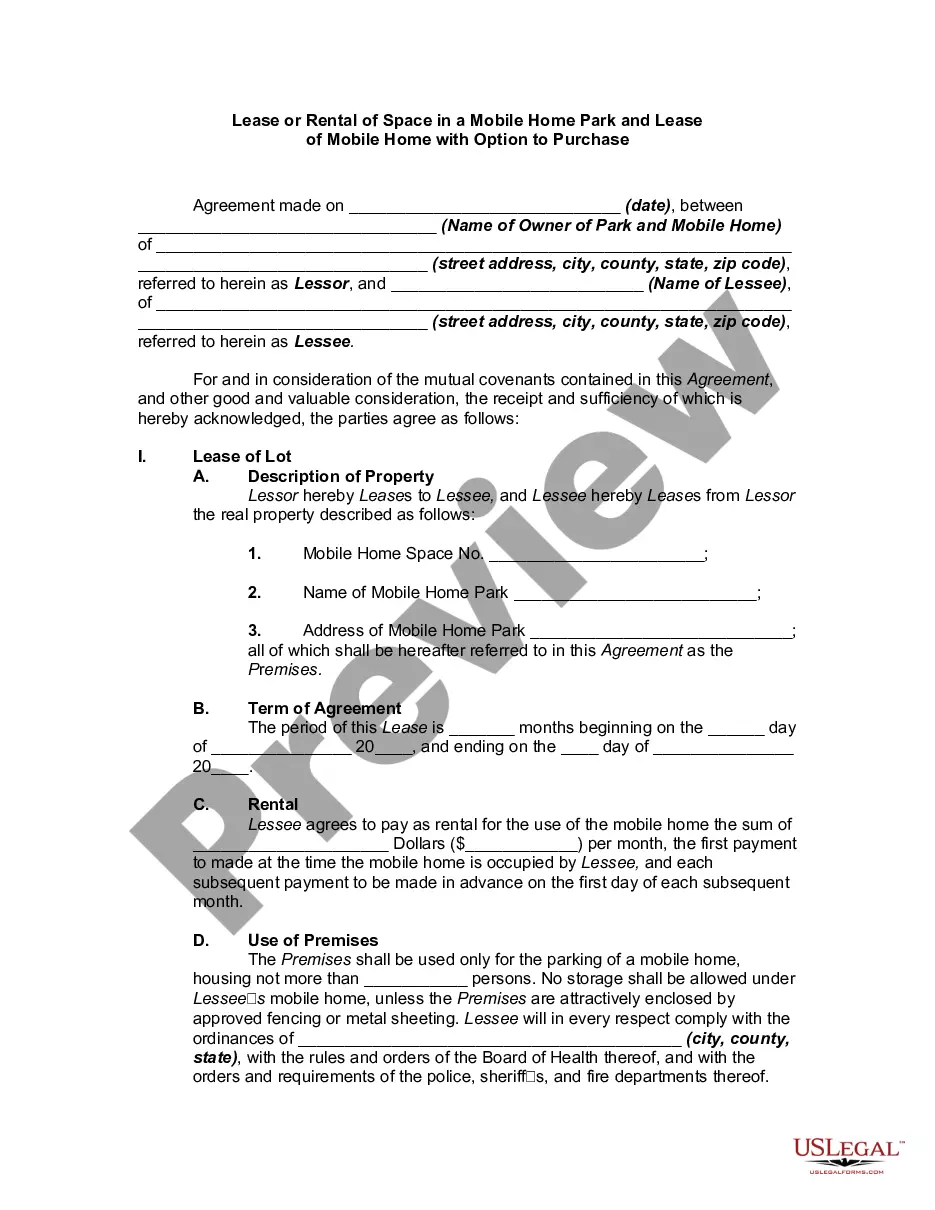

How to fill out Connecticut Restricted Endowment To Religious Institution?

If you want to finalize, download, or create legal document templates, utilize US Legal Forms, the most extensive collection of legal forms, available online.

Take advantage of the website's straightforward and convenient search to find the documents you need.

A range of templates for business and personal purposes are categorized by groups and states, or keywords.

Every legal document template you obtain is yours indefinitely. You have access to every type you downloaded within your account. Select the My documents section and choose a form to print or download again.

Compete and download, and print the Connecticut Restricted Endowment to Religious Institution with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your personal or business needs.

- Utilize US Legal Forms to find the Connecticut Restricted Endowment to Religious Institution with a few clicks.

- If you are currently a US Legal Forms user, Log Into your account and click on the Download button to obtain the Connecticut Restricted Endowment to Religious Institution.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate region/state.

- Step 2. Use the Review option to check the form's details. Always remember to read the description.

- Step 3. If you are dissatisfied with the form, take advantage of the Search field at the top of the screen to find other models of the legal form template.

- Step 4. After locating the form you require, click on the Purchase now button. Choose the pricing plan you prefer and input your details to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the deal.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Connecticut Restricted Endowment to Religious Institution.

Form popularity

FAQ

The UPMIFA endowment pertains to the guidelines set by the Uniform Prudent Management of Institutional Funds Act for managing endowment funds. This act aims to provide clarity on how to invest and utilize these funds prudently. It is particularly relevant for institutions dealing with a Connecticut Restricted Endowment to Religious Institution, as it establishes a framework for effective fund management and compliance.

As of recent reports, the UCLA endowment stands at approximately $5 billion, which supports various programs, scholarships, and initiatives. This substantial fund demonstrates how successful endowment management can provide a wealth of resources for educational institutions. For institutions exploring their own Connecticut Restricted Endowment to Religious Institution, learning from examples like UCLA can provide valuable insights.

Under the Uniform Prudent Management of Institutional Funds Act (UPMIFA), an endowment refers to a fund that is held by an institution for a specific purpose, typically with restrictions. UPMIFA provides guidelines on how these funds should be invested and spent to maintain their value. Knowing the laws associated with the Connecticut Restricted Endowment to Religious Institution can help organizations adhere to these guidelines and ensure compliance.

An endowment fund is a financial asset that is invested to generate income for a specific purpose over time. These funds ensure financial stability for organizations, often supporting education or charitable purposes. For those involved with a Connecticut Restricted Endowment to Religious Institution, understanding how to properly manage and utilize these funds is essential for long-term success.

To receive endowment funds, you generally need to apply to the institution managing the endowment. They often require a clear proposal outlining your purpose for requesting funds. You might also consider collaborating with legal experts who can assist in navigating the complexities related to Connecticut Restricted Endowment to Religious Institution. Always ensure your application aligns with the goals of the endowment.

The four types of endowments are permanent, term, quasi, and operating endowments. A permanent endowment is typically restricted to maintain principal while generating income. Term endowments have restrictions that last for a set period before becoming available for use. Understanding these types is crucial for managing funds such as a Connecticut Restricted Endowment to Religious Institution.

While each state has its advantages, many consider Delaware, California, and New York as strong contenders for starting a 501(c)(3). However, Connecticut offers unique benefits especially if you are establishing a Connecticut Restricted Endowment to Religious Institution, providing access to state-specific resources and community support that can enhance your nonprofit’s mission.

Starting a nonprofit in Connecticut typically costs around $500 to $1,000, depending on various factors, including filing fees and legal expenses. These costs may include the initial incorporation fees and expenses related to applying for 501(c)(3) status. Keep in mind that establishing a Connecticut Restricted Endowment to Religious Institution could require additional funds for ongoing compliance and operations.

To start a 501(c)(3) in Connecticut, begin by incorporating your nonprofit at the state level. Afterward, apply for federal tax-exempt status using Form 1023. You might find that understanding the process can be easier with resources from platforms like US Legal Forms, which can assist you in ensuring compliance with regulations for a Connecticut Restricted Endowment to Religious Institution.

Becoming a 501(c)(3) in Connecticut starts with forming a nonprofit organization. After organizing your board and drafting bylaws, you’ll need to file Form 1023 with the IRS to apply for tax-exempt status. Securing 501(c)(3) status can be vital for a Connecticut Restricted Endowment to Religious Institution as it provides financial benefits and credibility.

Interesting Questions

More info

Can the application of this provision effectuate any of the purposes of this provision?