Connecticut Simple Partnership Agreement

Description

How to fill out Simple Partnership Agreement?

You can dedicate multiple hours online trying to locate the legal document template that meets the federal and state requirements you require.

US Legal Forms provides an extensive array of legal documents that are reviewed by professionals.

It is easy to download or print the Connecticut Simple Partnership Agreement from my services.

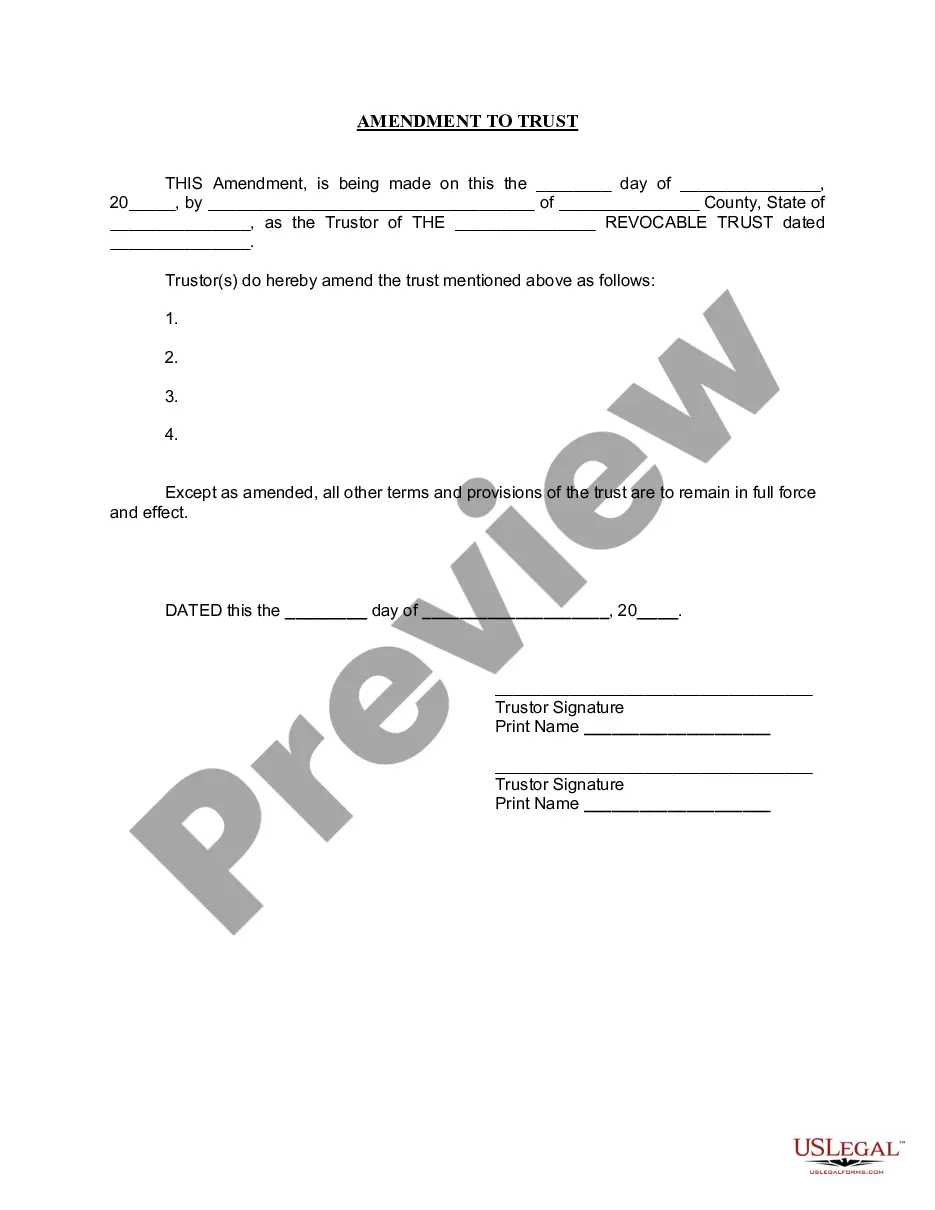

If available, use the Review button to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you may fill out, modify, print, or sign the Connecticut Simple Partnership Agreement.

- Every legal document template you acquire is yours perpetually.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your preference.

- Review the document description to confirm you have chosen the correct form.

Form popularity

FAQ

A comprehensive partnership agreement usually consists of four key contents: identification of partners, purpose of the partnership, contribution details, and profit-sharing arrangements. It also often includes terms for decision-making processes and dispute resolution. By addressing these areas, you lay a solid foundation for your business. Accessing resources from US Legal Forms can provide you with guidelines and templates essential for creating your Connecticut Simple Partnership Agreement.

A typical partnership agreement details the roles and responsibilities of each partner in the business. It typically includes sections about profit sharing, capital contributions, and procedures for adding new partners or resolving disputes. This essential document ensures clarity and prevents misunderstandings. For residents of Connecticut, using US Legal Forms can help you draft a compliant and effective Simple Partnership Agreement.

Creating a partnership agreement example involves outlining a clear structure. Begin by stating the names and addresses of the partners, followed by the business name and purpose. Ensure to include sections for capital contributions and management roles. Using a sample from US Legal Forms gives a practical framework for your own Connecticut Simple Partnership Agreement.

To write a Connecticut Simple Partnership Agreement, start by defining the partners involved and the business purpose. Next, outline each partner's contributions, responsibilities, and profit-sharing ratios. Additionally, include terms for decision-making and how disputes will be resolved. Using a platform like US Legal Forms can simplify this process by providing templates tailored to Connecticut partnership laws.

To form a simple partnership, individuals should first discuss their shared goals and contributions. Next, drafting a Connecticut Simple Partnership Agreement is crucial, as it outlines the partnership’s terms, roles, and profit-sharing arrangements. By formalizing these details, partners can ensure clarity and avoid potential disputes in the future.

A simple partnership involves partners who share equal responsibility and liability for the business, while a limited partnership includes both general and limited partners. General partners have full control and liability, whereas limited partners contribute capital but have limited involvement and liability. A Connecticut Simple Partnership Agreement is tailored for those seeking to create a straightforward partnership without the complications of a limited partnership structure.

While both simple and general partnerships involve multiple partners sharing business decisions and financial outcomes, a general partnership can include more complex arrangements and responsibilities. In a general partnership, all partners typically have unlimited personal liability. Conversely, a Connecticut Simple Partnership Agreement focuses on defining each partner’s roles, making it easier to manage day-to-day operations and responsibilities.

A simple partnership is a business arrangement where two or more individuals work together to achieve a common goal, sharing profits and losses. This type of partnership typically requires fewer formalities compared to other business structures. A Connecticut Simple Partnership Agreement can help partners clarify their responsibilities and streamline decision-making processes.

The Connecticut Uniform Partnership Act is a set of laws that governs partnerships in the state of Connecticut. It establishes guidelines for the formation, operation, and dissolution of partnerships. Understanding this act is important for individuals entering into a Connecticut Simple Partnership Agreement, as it dictates the legal obligations of partners and provides essential protections.

A simple partnership involves two or more individuals who agree to conduct business together. In contrast, a compound partnership includes multiple partners who have varying levels of involvement and responsibility. The Connecticut Simple Partnership Agreement serves as a clear framework for simple partnerships, outlining the roles and contributions of each partner, ensuring smooth operation and compliance.