Connecticut Pledge of Stock for Loan

Description

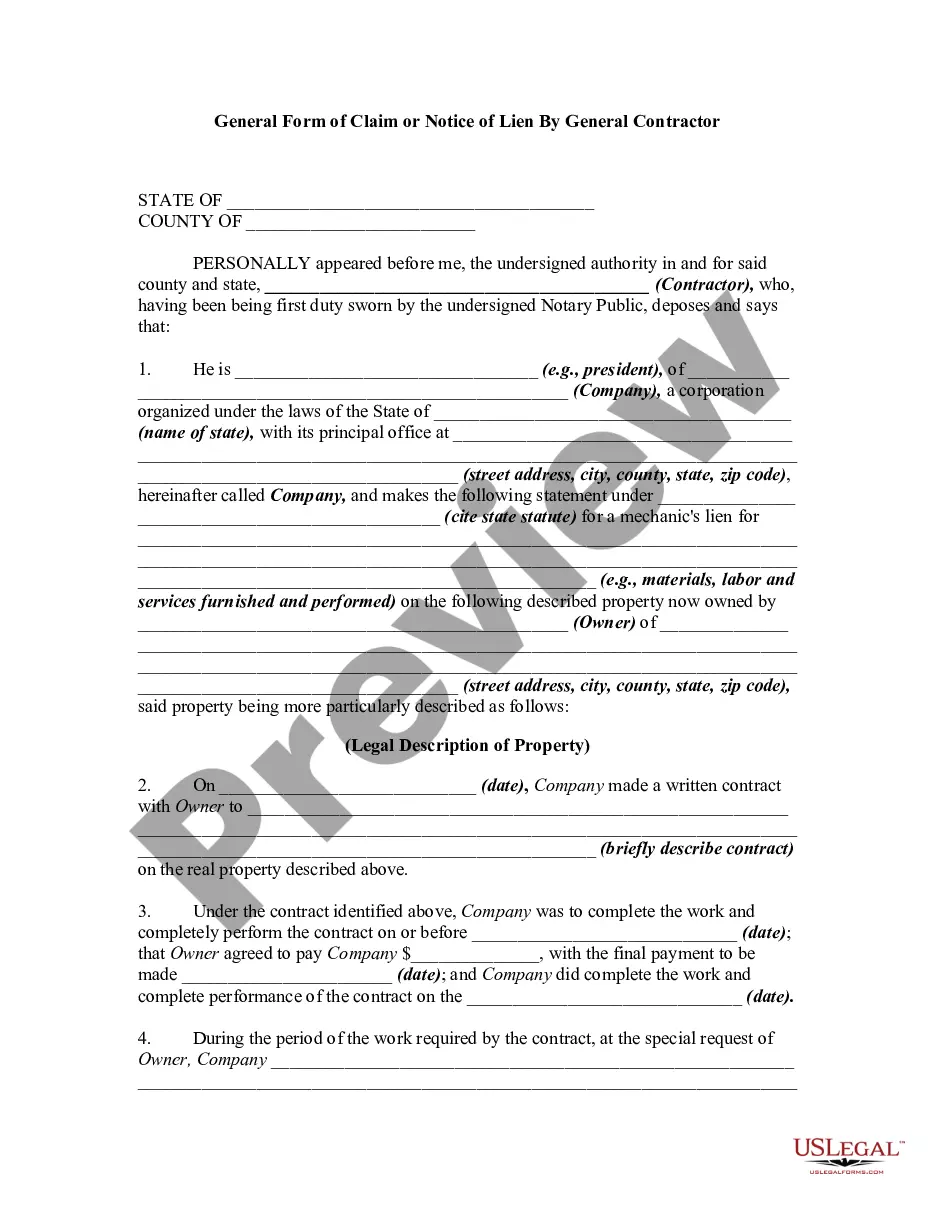

How to fill out Pledge Of Stock For Loan?

Are you currently in a situation where you require documents for either business or personal use almost every day.

There are numerous legal document templates available online, but locating reliable ones is challenging.

US Legal Forms provides a wide variety of form templates, such as the Connecticut Pledge of Stock for Loan, which are designed to comply with federal and state regulations.

Once you find the correct form, click on Get now.

Choose the pricing plan you prefer, complete the necessary details to set up your payment, and purchase your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the Connecticut Pledge of Stock for Loan template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Use the Preview feature to examine the form.

- Check the details to confirm you have selected the right form.

- If the form isn’t what you are looking for, use the Search field to locate the form that fits your needs.

Form popularity

FAQ

Collateral is an item of value pledged to secure a loan. Collateral reduces the risk for lenders. If a borrower defaults on the loan, the lender can seize the collateral and sell it to recoup its losses.

You may be able to borrow against the value of your stock portfolio to get a loan. Lenders may loan you up to 50% of your portfolio's value and hold your stock as collateral. But if you can't make your monthly payments, the lender can sell your collateral to recover what it is owed.

In simple words, a pledge is a promise to repay a loan, and collateral is what you lose if you don't keep your promise. For example, I can take a loan from a friend, pledge to return it within 30 days, and offer my bike as collateral. As long as I return the loan within 30 days, the bike is safe.

So in simple terms Loan Against shares or LAS is a loan availed against your shares. Instead of selling your shares, you can simply pledge them as collateral and avail instant funds for your unplanned expenses or for any of your personal needs.

Loan Against Securities (LAS) is a good choice when you need to raise funds in a hurry. All you need to do is pledge your shares, mutual funds, LIC policies or postal savings certificates as collateral to receive instant funds in your account.

Pledging of shares involves the transfer of ownership of shares from the shareholder to the lender, as collateral security for a loan. The bank or financial institution holds the shares until you fully repay the loan.

A pledged asset is an asset that is used by a lender to secure a debt or loan and can include cash, stocks, bonds, and other equity or securities. A pledged asset is collateral held by a lender in return for lending funds.

(Loans against shares not to exceed Rs 10 lacs if the purpose is for subscribing to IPOs.) Nature of Loan is Overdraft. You will need to provide a margin amount of 50% of the prevailing market prices of the shares being offered as security. Pledge of the demat shares against which loan is sanctioned.