Connecticut Agreement between General Sales Agent and Manufacturer

Description

How to fill out Agreement Between General Sales Agent And Manufacturer?

If you want to complete, acquire, or produce authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for your account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the Connecticut Agreement between General Sales Agent and Manufacturer in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to access the Connecticut Agreement between General Sales Agent and Manufacturer.

- You can also find forms you previously obtained within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct area/state.

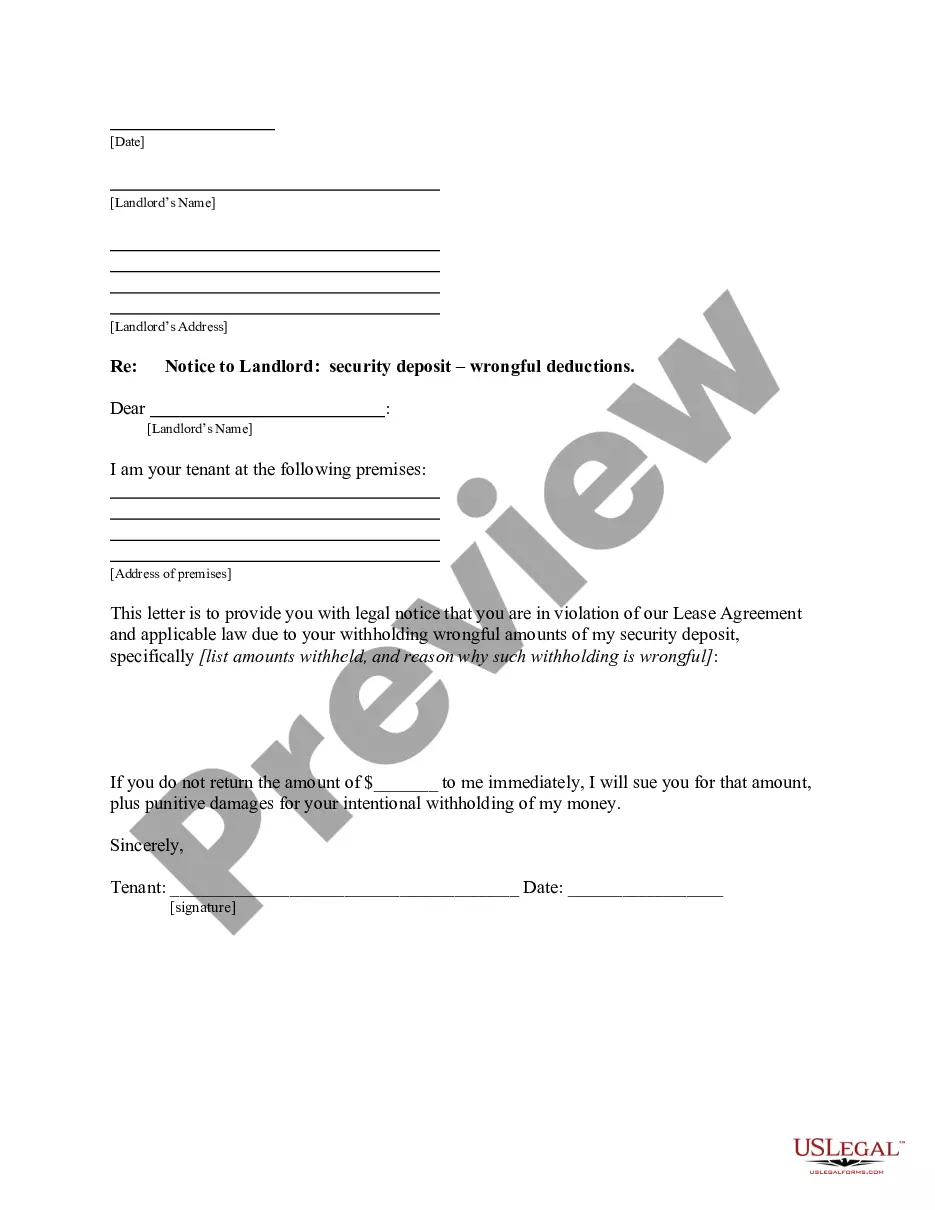

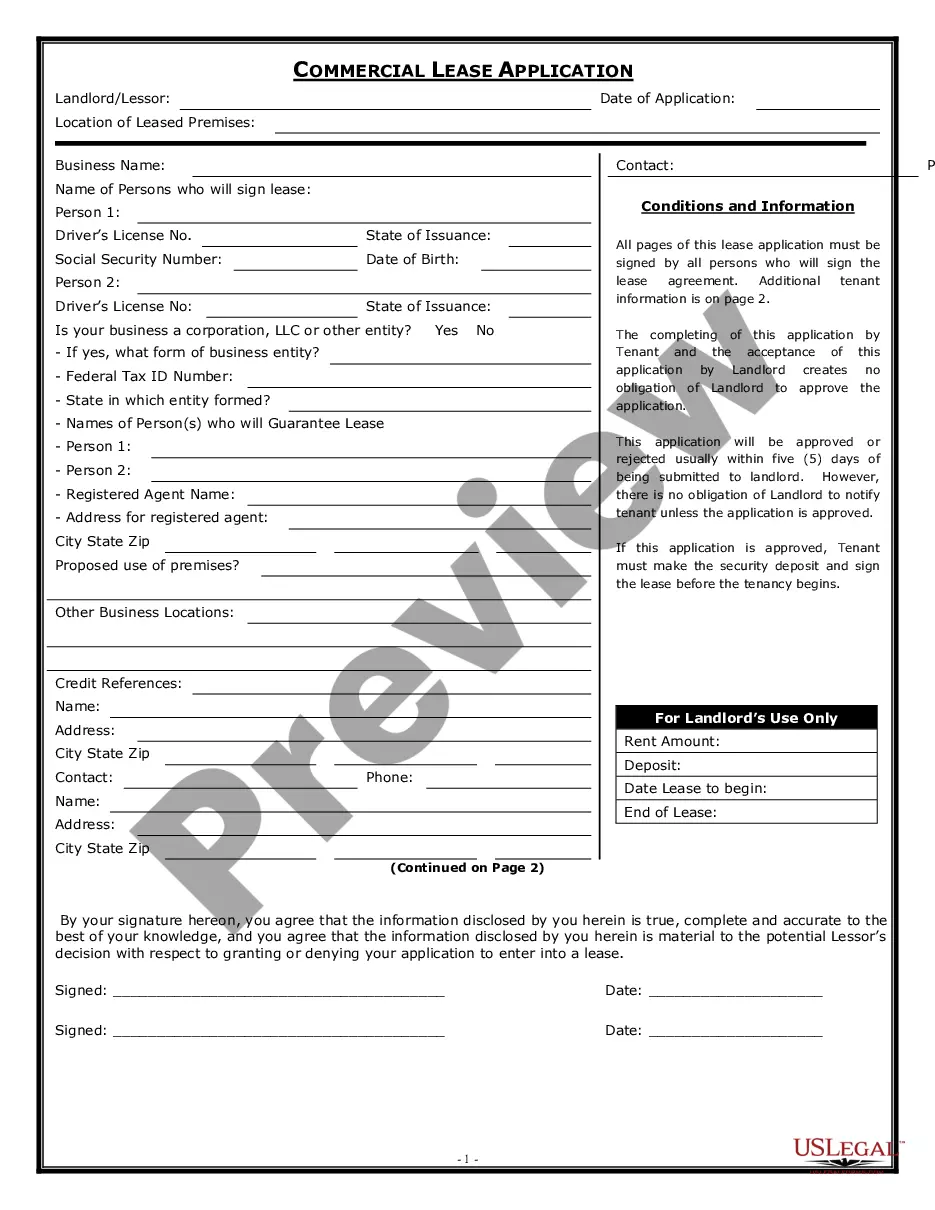

- Step 2. Use the Review option to check the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other options in the legal form template.

Form popularity

FAQ

Consulting services in Connecticut are generally exempt from sales tax, except in specific situations where a tangible product is involved. Consequently, if your business falls under this category, understanding the nuances will help you navigate agreements effectively. A Connecticut Agreement between General Sales Agent and Manufacturer allows you to detail your obligations and services while staying tax compliant.

To obtain a sales and use tax permit in Connecticut, you must register with the Connecticut Department of Revenue Services. This can be done online through their portal. If you manage transactions under a Connecticut Agreement between General Sales Agent and Manufacturer, having this permit is essential for legal operations in the state.

Certain services and select goods do not attract sales tax in Connecticut. For instance, most services related to real estate and specific health-related items are exempt. Knowing these exemptions is very beneficial when establishing agreements under a Connecticut Agreement between General Sales Agent and Manufacturer, as it aids in clear financial planning.

Taxable goods in Connecticut include items like furniture, vehicles, and prepared meals. When conducting business in the state, it’s important to recognize which goods fall into this category, especially if you are negotiating terms under a Connecticut Agreement between General Sales Agent and Manufacturer. Being informed helps avoid compliance issues and unexpected expenses.

In Connecticut, most clothing items are generally exempt from sales tax. However, certain clothing accessories and items considered luxury goods may still incur tax. Thus, if you engage in a Connecticut Agreement between General Sales Agent and Manufacturer, understanding these tax intricacies is crucial for compliance.

A general agreement contract is a foundational document that establishes the overall terms and expectations between parties without detailing every aspect. It typically covers broad parameters such as payment terms and delivery timelines. When negotiating a Connecticut Agreement between General Sales Agent and Manufacturer, a general agreement contract can set the stage for more specific terms. A strong foundation will facilitate effective and streamlined business interactions.

General sales refer to the broad category of transactions that involve the selling of products or services. This term can encompass various types of sales, including retail and wholesale. In creating a Connecticut Agreement between General Sales Agent and Manufacturer, defining what constitutes general sales is essential for clarity. Clear definitions help streamline operations and set realistic expectations.

In Connecticut, certain items such as food, prescription drugs, and specific medical devices are exempt from sales tax. Additionally, businesses should be aware of exemptions that may apply to specific industries. Understanding these exemptions can benefit sales agents when drafting a Connecticut Agreement between General Sales Agent and Manufacturer. Always stay updated on tax laws to ensure compliant sales transactions.