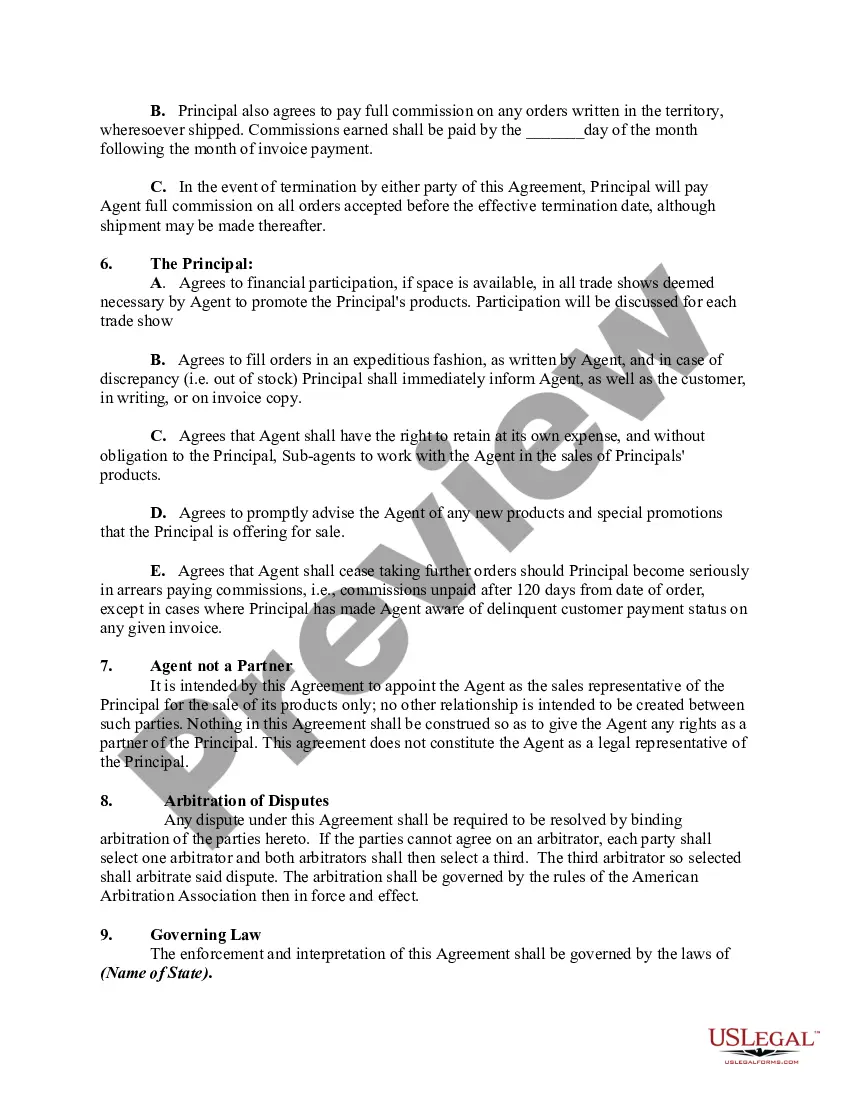

Connecticut Agreement between Sales Agent and Manufacturer — Distributor is a legally binding contract that outlines the terms and conditions of the business relationship between a sales agent and a manufacturer-distributor in the state of Connecticut. This agreement ensures the smooth and mutually beneficial functioning of the two parties involved in the distribution and sale of products. The Connecticut Agreement between Sales Agent and Manufacturer — Distributor typically includes key provisions such as: 1. Parties involved: Clearly identifies the sales agent and the manufacturer-distributor, along with their legal names and addresses. 2. Term of the agreement: Specifies the duration of the agreement, including the start and end dates. It may also include provisions for renewal and termination. 3. Territory: Defines the geographic area where the sales agent is authorized to promote, market, and sell the manufacturer-distributor's products. This allows for allocation of specific regions or territories to avoid conflicts between agents. 4. Product details: Describes the products that the sales agent will be authorized to sell. This includes specifications, pricing, and any limitations or restrictions imposed by the manufacturer-distributor. 5. Responsibilities: Outlines the duties and responsibilities of both the sales agent and the manufacturer-distributor. This may include obligations such as product promotion, order processing, inventory management, customer service, and marketing activities. 6. Commission and payment terms: Specifies the commission structure or payment terms that the sales agent will receive for the sales generated. This includes the rate or percentage of commission, payment frequency, and any conditions for commission adjustments. 7. Intellectual property rights: Addresses the ownership and protection of intellectual property, such as trademarks, patents, or copyrights associated with the products being sold. 8. Confidentiality and non-disclosure: Imposes obligations on both parties to maintain the confidentiality of any trade secrets, proprietary information, or customer data shared during the course of the business relationship. 9. Termination: Details the conditions and procedures for terminating the agreement, including any notice period and the consequences of termination. 10. Dispute resolution: Specifies the preferred method of resolving disputes, such as negotiation, mediation, or arbitration, to avoid costly litigation. Different types of Connecticut Agreements between Sales Agent and Manufacturer — Distributor may include variations in terms and conditions based on the nature of the business or industry involved. For example: — Exclusive Distribution Agreement: Grants the sales agent exclusive rights to sell and distribute the manufacturer-distributor's products within a specific territory or market segment. — Non-Exclusive Distribution Agreement: Allows multiple sales agents to sell and distribute the products of the manufacturer-distributor within a particular area or industry. — Commission-Based Agreement: Provides the sales agent with a commission or percentage of the sales made, whereas the manufacturer-distributor retains ownership of the products. — Stocking Agreement: Requires the sales agent to maintain a certain level of inventory or stock the products to meet customer demands promptly. In conclusion, the Connecticut Agreement between Sales Agent and Manufacturer — Distributor is a vital document that establishes the rights, responsibilities, and obligations of both parties involved. It ensures a fair and mutually beneficial working relationship, ultimately contributing to the success and growth of the business.

Connecticut Agreement between Sales Agent and Manufacturer - Distributor

Description

How to fill out Agreement Between Sales Agent And Manufacturer - Distributor?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Connecticut Agreement between Sales Agent and Manufacturer - Distributor in just minutes.

If you possess a membership, Log In and download the Connecticut Agreement between Sales Agent and Manufacturer - Distributor from the US Legal Forms library. The Download button will appear on every document you view.

If you are satisfied with the form, finalize your selection by clicking the Buy now button. Then, select the pricing plan you prefer and provide your credentials to register for the account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase. Choose the format and download the document to your device.

- You gain access to all your previously saved forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your locality/region.

- Click the Review button to evaluate the form's details.

- Check the form summary to confirm you have chosen the proper form.

- If the form does not meet your needs, utilize the Search box at the top of the page to find one that does.

Form popularity

FAQ

In Connecticut, most retail sales are taxed at a rate of 7.35%, which includes most goods. This rate applies to items like electronics, furniture, and prepared meals from restaurants. When discussing a Connecticut Agreement between Sales Agent and Manufacturer - Distributor, being aware of this tax rate can help you calculate costs accurately and ensure compliance in all sales transactions.

In Connecticut, common exempt items include certain groceries, prescription drugs, and medical devices. Other exemptions may apply to specific services or products, so it's important to check the latest regulations. If you are engaging in a Connecticut Agreement between Sales Agent and Manufacturer - Distributor, knowing about these exemptions can help you avoid unnecessary costs and streamline transactions.

To obtain a sales and use tax permit in Connecticut, you must complete an application through the state's Department of Revenue Services. This process involves providing information about your business and its operations. If you are entering a Connecticut Agreement between Sales Agent and Manufacturer - Distributor, having this permit is essential for conducting sales legally and managing taxes effectively.

Yes, Connecticut typically requires businesses to obtain a license before operating, depending on their specific industry. This requirement can vary based on local regulations and business type. If you are considering a Connecticut Agreement between Sales Agent and Manufacturer - Distributor, ensure compliance with licensing requirements to protect your investment.

Connecticut offers a business help line that provides resources and guidance for entrepreneurs and business owners. They can assist you with permits, regulations, and local business practices. For those exploring a Connecticut Agreement between Sales Agent and Manufacturer - Distributor, utilizing this help line can ensure you have the necessary support to navigate the complexities of business operations.

The concept of business opportunity refers to a situation where an individual can start a business with a potential for profit. This typically includes components such as the sale of goods or services and training or support from an established company. A clear understanding of a Connecticut Agreement between Sales Agent and Manufacturer - Distributor can open doors to lucrative business opportunities.

In Connecticut, the taxation of consulting services depends on the nature of the services offered. Generally, if the service relates to a tangible good or involves selling an item, it may be taxable. For those involved in a Connecticut Agreement between Sales Agent and Manufacturer - Distributor, consulting services that support the sale of a product might fall under tax regulations, so it's wise to verify specifics.

The business opportunity law in Connecticut establishes regulations for agreements between sales agents and manufacturers or distributors. This law protects both parties by ensuring transparency and fairness in the agreement process. When entering a Connecticut Agreement between Sales Agent and Manufacturer - Distributor, understanding these regulations is crucial for compliance and success.

Yes, Connecticut law mandates that businesses, including those entering into a Connecticut Agreement between Sales Agent and Manufacturer - Distributor, must designate a registered agent. This agent serves as a point of contact for legal documents and official communications. It's essential to ensure compliance with this requirement to avoid penalties and maintain good standing.

Connecticut does not tax a variety of services, including professional services such as legal, accounting, and medical. Furthermore, many services provided under a Connecticut Agreement between Sales Agent and Manufacturer - Distributor, like certain promotional activities, also remain untaxed. Always stay updated on the current tax codes to determine which services apply.