Connecticut Charitable Remainder Inter Vivos Annuity Trust (also known as CRT IVAN) is a type of trust established in accordance with the laws and regulations of the state of Connecticut. The trust is primarily aimed at providing financial benefits to both charitable organizations and individuals who contribute to the trust. By creating a CRT IVAN, contributors can receive certain tax advantages while also supporting a charitable cause. A Charitable Remainder Inter Vivos Annuity Trust in Connecticut operates on the principle of receiving and managing the contributed assets, usually cash or property, and then distributing a fixed annual income to the designated beneficiaries, often the trust creator or specified individuals. This income is determined by a predetermined fixed percentage of the trust's initial fair market value at the time of its creation. Connecticut offers different types of Charitable Remainder Inter Vivos Annuity Trusts, including: 1. Charitable Remainder Unit rust (CUT): This type of trust allows for variable income payouts to beneficiaries based on a fixed percentage of the trust's annual fair market value. The income is typically reevaluated annually and can increase or decrease based on the trust's performance. 2. Flip Charitable Remainder Unit rust (Flip CUT): This trust starts as a Charitable Remainder Annuity Trust (CAT) and later converts to a unit rust once a predetermined triggering event occurs, such as the sale of a specific asset or reaching a certain date. The conversion allows for more flexibility in income distribution. 3. Net Income Charitable Remainder Unit rust (NICEST): In this type of trust, the income distributed to beneficiaries is typically based on the trust's net income for the year. If the trust's net income is lower than the specified amount, the distribution may be less than expected, but it can later be supplemented in years with higher income. In conclusion, Connecticut Charitable Remainder Inter Vivos Annuity Trusts provide individuals with the opportunity to support charitable causes while also receiving financial benefits. With different types of trusts available, contributors can choose the one that best fits their financial goals and philanthropic intentions.

Connecticut Charitable Remainder Inter Vivos Annuity Trust

Description

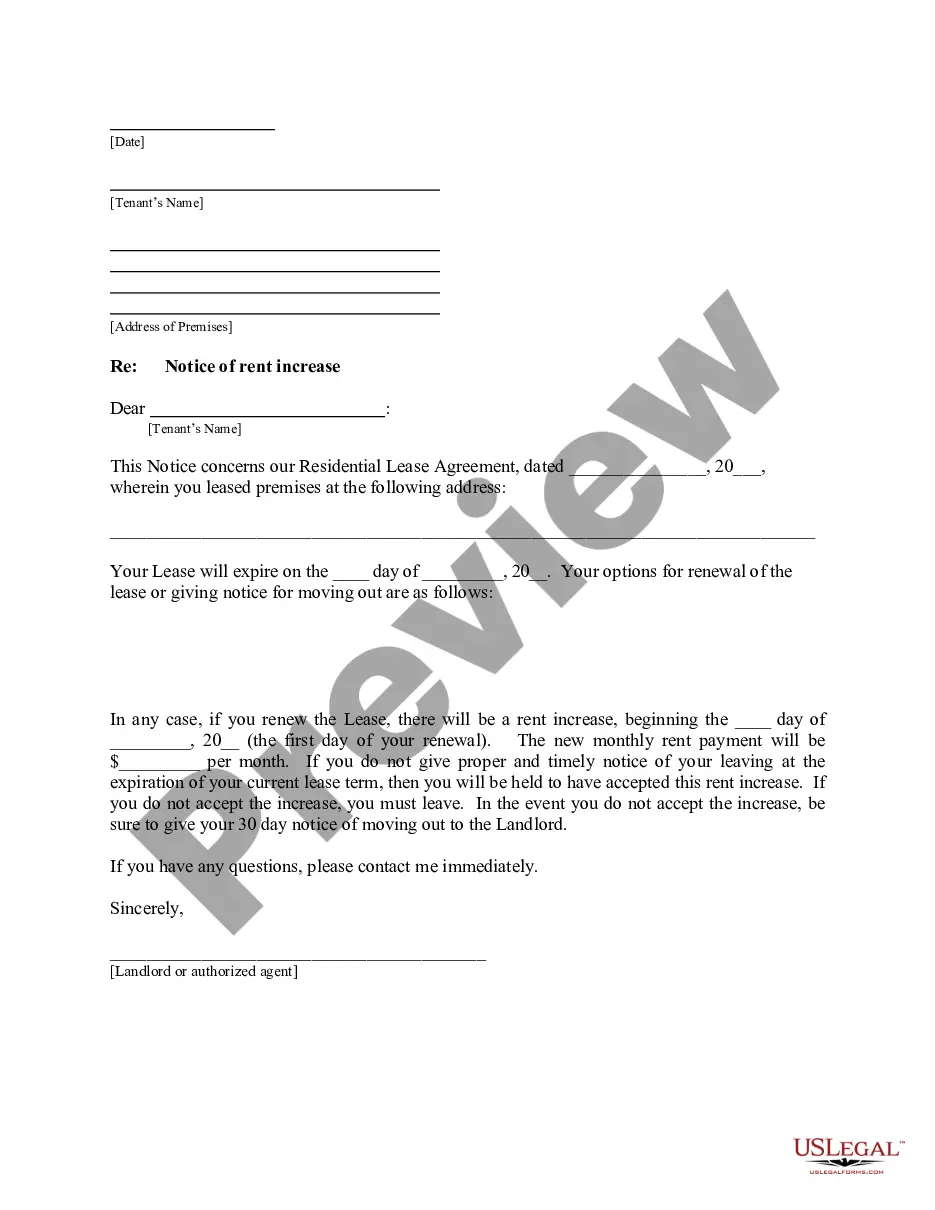

How to fill out Connecticut Charitable Remainder Inter Vivos Annuity Trust?

Are you currently in a place where you need papers for either organization or personal reasons virtually every working day? There are a lot of legal file templates available on the Internet, but finding types you can rely on isn`t straightforward. US Legal Forms delivers thousands of develop templates, much like the Connecticut Charitable Remainder Inter Vivos Annuity Trust, that are published to fulfill federal and state specifications.

When you are currently acquainted with US Legal Forms website and possess a free account, simply log in. Following that, you may download the Connecticut Charitable Remainder Inter Vivos Annuity Trust design.

Unless you offer an account and wish to start using US Legal Forms, abide by these steps:

- Find the develop you want and make sure it is to the proper town/area.

- Make use of the Preview key to check the shape.

- See the explanation to ensure that you have chosen the proper develop.

- In case the develop isn`t what you`re looking for, take advantage of the Search discipline to obtain the develop that suits you and specifications.

- Once you find the proper develop, click Purchase now.

- Select the rates prepare you want, complete the specified info to produce your money, and pay money for an order with your PayPal or Visa or Mastercard.

- Choose a practical file file format and download your backup.

Find all of the file templates you possess purchased in the My Forms menus. You can obtain a further backup of Connecticut Charitable Remainder Inter Vivos Annuity Trust at any time, if required. Just click on the required develop to download or print out the file design.

Use US Legal Forms, probably the most substantial assortment of legal types, to save time and steer clear of mistakes. The assistance delivers appropriately manufactured legal file templates which you can use for an array of reasons. Make a free account on US Legal Forms and commence generating your way of life easier.