Connecticut Charitable Remainder Inter Vivos Annuity Trust (also known as CRT IVAN) is a type of trust established in accordance with the laws and regulations of the state of Connecticut. The trust is primarily aimed at providing financial benefits to both charitable organizations and individuals who contribute to the trust. By creating a CRT IVAN, contributors can receive certain tax advantages while also supporting a charitable cause. A Charitable Remainder Inter Vivos Annuity Trust in Connecticut operates on the principle of receiving and managing the contributed assets, usually cash or property, and then distributing a fixed annual income to the designated beneficiaries, often the trust creator or specified individuals. This income is determined by a predetermined fixed percentage of the trust's initial fair market value at the time of its creation. Connecticut offers different types of Charitable Remainder Inter Vivos Annuity Trusts, including: 1. Charitable Remainder Unit rust (CUT): This type of trust allows for variable income payouts to beneficiaries based on a fixed percentage of the trust's annual fair market value. The income is typically reevaluated annually and can increase or decrease based on the trust's performance. 2. Flip Charitable Remainder Unit rust (Flip CUT): This trust starts as a Charitable Remainder Annuity Trust (CAT) and later converts to a unit rust once a predetermined triggering event occurs, such as the sale of a specific asset or reaching a certain date. The conversion allows for more flexibility in income distribution. 3. Net Income Charitable Remainder Unit rust (NICEST): In this type of trust, the income distributed to beneficiaries is typically based on the trust's net income for the year. If the trust's net income is lower than the specified amount, the distribution may be less than expected, but it can later be supplemented in years with higher income. In conclusion, Connecticut Charitable Remainder Inter Vivos Annuity Trusts provide individuals with the opportunity to support charitable causes while also receiving financial benefits. With different types of trusts available, contributors can choose the one that best fits their financial goals and philanthropic intentions.

Connecticut Charitable Remainder Inter Vivos Annuity Trust

Description

How to fill out Charitable Remainder Inter Vivos Annuity Trust?

Are you presently in a situation where you require documents for either organizational or personal purposes almost every business day.

There are numerous legal form templates accessible online, but locating reliable versions can be challenging.

US Legal Forms offers a vast collection of template forms, including the Connecticut Charitable Remainder Inter Vivos Annuity Trust, that are designed to meet federal and state requirements.

Choose a convenient file format and download your copy.

Access all of the form templates you have purchased in the My documents section. You can retrieve another copy of the Connecticut Charitable Remainder Inter Vivos Annuity Trust whenever needed. Just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Afterward, you can download the Connecticut Charitable Remainder Inter Vivos Annuity Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/region.

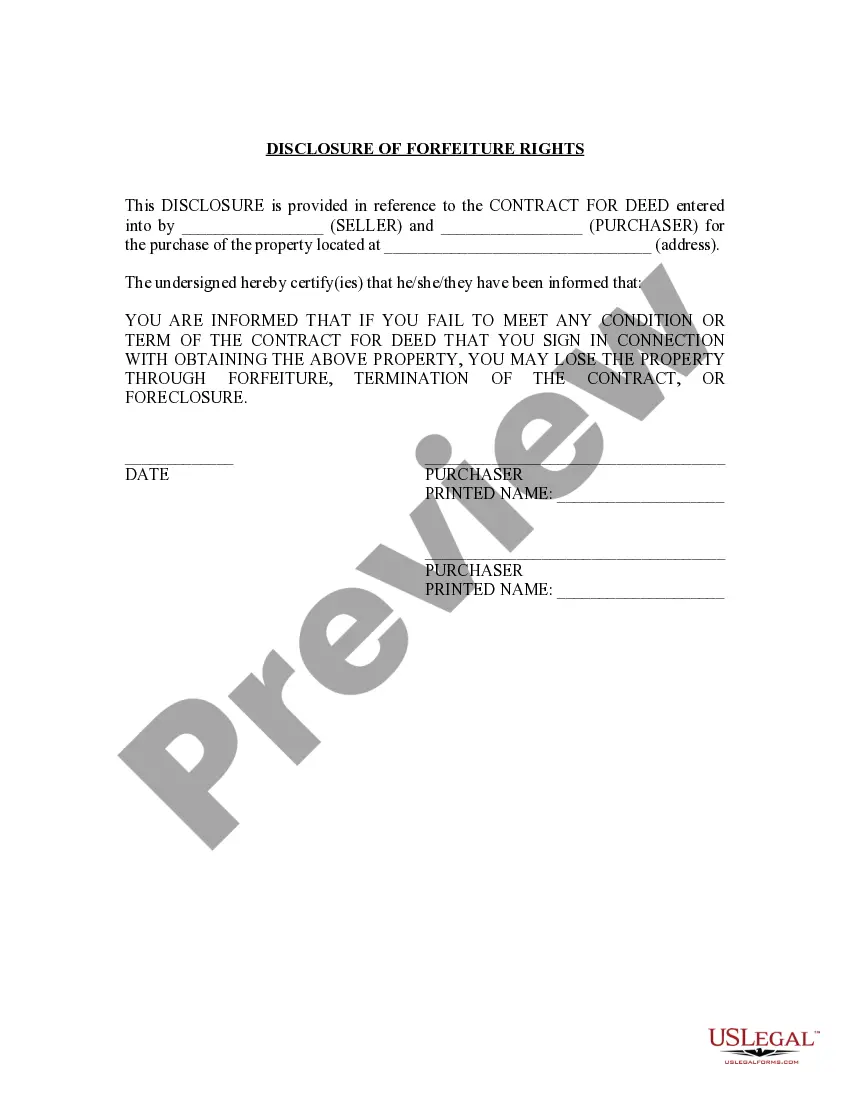

- Use the Preview button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form is not what you seek, use the Search box to find the form that meets your needs and specifications.

- Once you find the correct form, click Purchase now.

- Select the pricing plan you desire, fill out the required information to create your account, and pay for your order using PayPal or a credit card.

Form popularity

FAQ

While a Connecticut Charitable Remainder Inter Vivos Annuity Trust offers many benefits, there are some downsides to consider. Once you fund the trust, you relinquish control over the assets which may be challenging if your financial needs change. Additionally, the initial setup and management costs can be significant, so it's essential to weigh these factors before establishing the trust.

Advised Fund (DAF) and a Charitable Remainder Trust (CRT) serve different purposes. While both support charitable giving, a Connecticut Charitable Remainder Inter Vivos Annuity Trust provides income to the beneficiary and distributes remaining assets to charity after a specified term. In contrast, a DAF acts as an intermediary for your charitable donations, allowing you to manage when and how to distribute funds to charitable organizations.

The assets in a Connecticut Charitable Remainder Inter Vivos Annuity Trust are usually managed by a trustee. This trustee can be an individual or an institution, and they are responsible for making investment decisions and ensuring that the trust adheres to its terms. Choosing a competent trustee is crucial, as they directly impact the trust's performance and the beneficiaries' benefits.

A Connecticut Charitable Remainder Inter Vivos Annuity Trust typically files IRS Form 5227. This form is important because it reports the trust's income, expenses, and distributions. By accurately completing this form, you help ensure compliance with IRS regulations and maintain the trust's favorable tax status.

Trusts in Connecticut, including the Connecticut Charitable Remainder Inter Vivos Annuity Trust, are generally subject to income tax based on the income they generate. This tax applies to both irrevocable and revocable trusts, with specific rules governing the distribution to beneficiaries. Understanding the tax implications can help you make informed decisions about your trust structure, ensuring that you maximize benefits for your charitable goals while remaining compliant with state laws.

The new trust law in Connecticut modernizes the rules surrounding trusts, including the Connecticut Charitable Remainder Inter Vivos Annuity Trust. This law provides more flexibility and clarity for trust participants, enabling better management of assets during the trustor's lifetime. Additionally, the changes aim to enhance the benefits for both the grantor and the beneficiaries, making it easier to implement charitable giving strategies.

The main difference between a Charitable Remainder Trust (CRT) and a Charitable Lead Trust (CLT) lies in the distribution of income. A CRT, such as a Connecticut Charitable Remainder Inter Vivos Annuity Trust, pays income to the donor or beneficiaries for a specific period, after which the remaining assets go to charity. On the other hand, a CLT provides income to charity for a set period, and the remaining assets go to the beneficiaries. Understanding these differences can help you choose the right trust for your financial and philanthropic goals.

To create a Connecticut Charitable Remainder Inter Vivos Annuity Trust, start by selecting a reputable trustee who will manage the trust's assets. Next, outline your intent for the trust, including your beneficiaries and the charitable organization you wish to support. You will need to draft a trust document that complies with Connecticut laws, and it is advisable to consult with a legal expert to ensure everything is in order. Finally, fund the trust with assets, and ensure the setup aligns with your financial and charitable goals.

A charitable gift annuity provides fixed payments to the donor or a beneficiary for life, while a Connecticut Charitable Remainder Inter Vivos Annuity Trust offers a fixed annuity payment based on the trust's assets. The key distinction lies in the structure: one is a simple contract, while the other is a complex legal trust that allows for more significant control and tax advantages.

Setting up a Connecticut Charitable Remainder Inter Vivos Annuity Trust involves several steps. First, consult a legal expert experienced in trust formation and tax implications. From there, you'll define the terms of the trust, select charitable beneficiaries, and fund the trust with your chosen assets.

Interesting Questions

More info

Away.