Connecticut Mutual Release of Claims based on Real Estate Purchase Contract

Description

How to fill out Mutual Release Of Claims Based On Real Estate Purchase Contract?

Should you require to compile, acquire, or generate legal document templates, utilize US Legal Forms, the premier assortment of legal documents available online.

Utilize the site's convenient and accessible search feature to locate the forms you require.

Various templates for corporate and individual applications are categorized by classifications and jurisdictions, or keywords.

Step 4. Once you find the form you require, click the Acquire now option. Choose your desired pricing plan and enter your information to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account for the payment. Step 6. Select the format of your legal document and download it to your device. Step 7. Complete, revise, and print or sign the Connecticut Mutual Release of Claims derived from Real Estate Purchase Contract.

- Utilize US Legal Forms to find the Connecticut Mutual Release of Claims derived from Real Estate Purchase Contract in just a few clicks.

- If you are a current US Legal Forms user, sign in to your account and select the Download option to obtain the Connecticut Mutual Release of Claims derived from Real Estate Purchase Contract.

- You can also access forms you have previously secured from the My documents section of your account.

- If you are new to US Legal Forms, please follow the steps below.

- Step 1. Ensure you have chosen the document for the correct region/state.

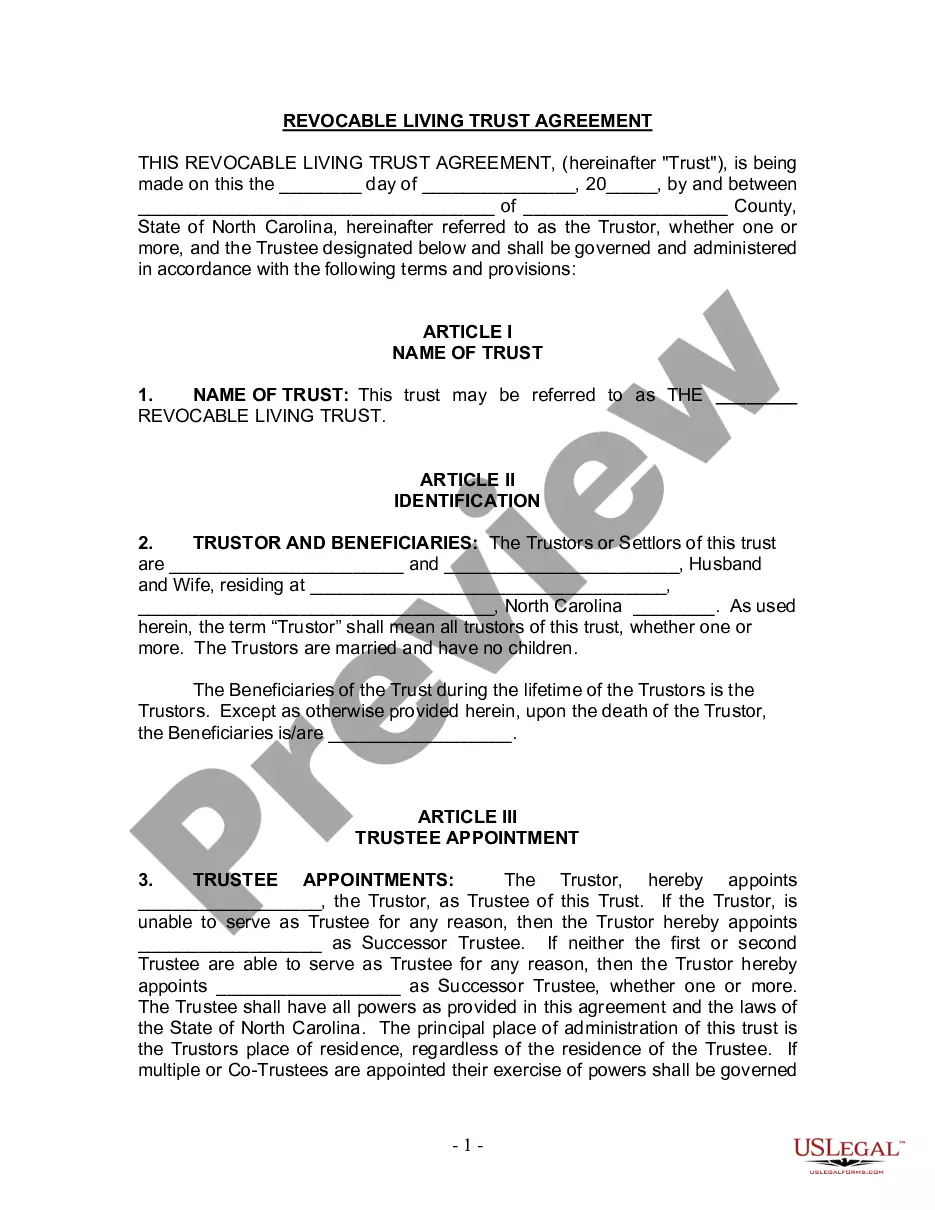

- Step 2. Utilize the Review option to examine the document's content. Do not forget to review the description.

- Step 3. If you are unsatisfied with the document, use the Search section at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

The Court of Appeal's holding establishes that, despite the prohibition against the release of unknown claims set forth in section 1524 and the protections provided to homeowners by the Right to Repair Act, California homeowners can, in fact, release or waive claims against homebuilders for future, latent construction

A generic form of release agreement for use when parties to a commercial contract are terminating or have terminated the contract (or a portion of it) and have agreed to deliver a mutual release of claims. This Standard Document has integrated notes with important explanations and drafting tips.

Can seller back out? Yes, it is possible. That is, if the seller can offer compensation to the buyer or if the buyer regrets his purchase. Timing is also of essence things will be much easier before the purchase agreement is signed.

Can a seller cancel their agreement by refusing to close? The answer is no. The buyer can sue the seller if this happens.

If both parties agree to waive the right to hold each other legally responsible for injuries, losses, and damages, it is a mutual release agreement. A Release of Liability Form is also known as a: Liability waiver form. Release of liability waiver.

A Mutual Release Agreement is a straightforward document that allows you to settle disputes quickly and professionally. No matter what your dispute, a Mutual Release Agreement allows both parties to agree to drop all claims and get out of the contract.

A rescission is also referred to as an unmaking of a contract. When a mutual release agreement and rescission are drafted well, they represent a definitive ending point for the commitments of each party. These documents can also help the involved parties avoid any disputes or misunderstandings in the future.

A mutual release is a document designed to be signed by both the buyers and sellers to cancel an agreement of purchase and sale. When executed, this document cancels the agreement and releases all parties from any future liabilities or claims.

In Connecticut, a seller can get out of a real estate contract if the buyer's contingencies are not metthese include financial, appraisal, inspection, insurance, or home sale contingencies agreed to in the contract. Sellers might have additional exit opportunities with unique situations also such as an estate sale.

A mutual release is a document designed to be signed by both the buyers and sellers to cancel an agreement of purchase and sale. When executed, this document cancels the agreement and releases all parties from any future liabilities or claims.